Selling Our Sickness: Why Health Data Monetization Is a Dead End

Published

Modified

Health data monetization is failing because patients do not trust technology firms with sensitive medical records Turning health data into a commodity ignores consent, governance, and healthcare’s real economics Without strong safeguards and public oversight, most health data projects will keep breaking down

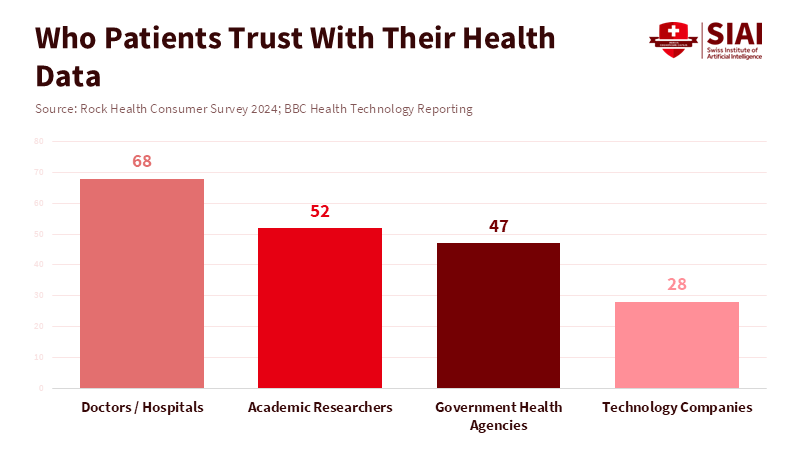

In the last five years, the health sector has generated more information than in the previous fifty. Every day, billions of data points are collected from electronic medical records, wearable devices, imaging systems, and pharmacy systems. Still, less than half of patients in developed countries are willing to share their medical records with private tech companies, even if the data is anonymized. This gap between the amount of data available and public trust is the real barrier to monetizing health data. Companies may have the tools to collect information at scale, but they lack the public’s permission to use it. This matters because health data is different from clicks, location, or shopping habits. It is personal, permanent, and tied to future risks. When trust disappears, participation drops. The success of monetized medical insights depends on whether people believe their data will be used for care, not profit, not just on better algorithms.

Health data monetization and the myth of voluntary scale

Many believe that patients will share health data as easily as they share information in other online markets, especially if it is useful or personalized. But this is not the case. People see medical information as part of their personal control, not something to trade. Patients share sensitive data with doctors because it happens within a trusted relationship with clear boundaries. Once the data leaves that setting, things change. Tech companies are mainly responsible to their shareholders, not patients, and their promises to protect data are based on company policies, not universal rules. This leads to understandable hesitation.

This hesitation is tangible. It appears in the form of low engagement rates, opt-outs, and incomplete datasets. Health data monetization needs scale to create value, but scale depends on trust. Without significant involvement, data sets are more likely to include early adopters, healthier people, or individuals less concerned about privacy. That prejudice lowers the quality of insights and limits their benefits for serious medical or policy uses. Businesses frequently find themselves with considerable fragmented, low-signal data that’s expensive to clean and validate. The economics of promotion don’t translate to medicine, where accuracy, representativeness, and responsibility are more important than volume.

There’s additionally a misunderstanding of what drives patients. Patients don’t see a clear personal benefit from communicating data with business platforms. In comparison to the perceived long-term risks of exposure, abuse, or resale, small improvements in suggestions or summaries aren’t enough. The risks seem permanent, while the benefits are unclear and dispersed. Health data monetization systems rarely handle this imbalance. Instead, they rely on vague claims about privacy and security, even though data breaches and secondary uses remain common across the digital world. It is logical to be doubtful under such conditions.

The reason health startups are always failing is health data monetization

Digital health is full of big ideas that often fail to deliver real value. There is a common pattern behind these failures. First, there is a payment gap: health systems and insurers, not patients, pay for care. Products based on data insights often have no clear way to get paid. Workflow is another issue. Doctors are already busy, so tools that add extra steps or alerts without making their jobs easier are quickly ignored. Regulations are also tough. Following health data rules is expensive, slow, and strict. Many startups underestimate these challenges and run out of money before they gain traction.

Health data monetization exacerbates these problems. When patients are treated as data sources, things get even more complicated. If companies do not solve the basic adoption issues, they face ethical risks and long-term responsibility. Even if businesses say they will not sell personal information, they often make money by licensing data, training models, or selling business insights to others. For patients, these differences do not matter. What matters is control. Once their data is uploaded, patients lose much of their say in how it is used.

The issue is exacerbated by the company's instability. Startups pivot. They unite. They may be bought. They don’t succeed. Data does, nevertheless, continue. When a company changes hands, data sets are also transferred under circumstances that users never foresaw. Under bankruptcy or acquisition, even solid internal protections can disintegrate. This isn't just a thought. This has happened repeatedly in the health and usage tech industries. Patients understand this risk instinctively, though legal systems may not keep pace. Because of this, a number of people choose not to take part at all.

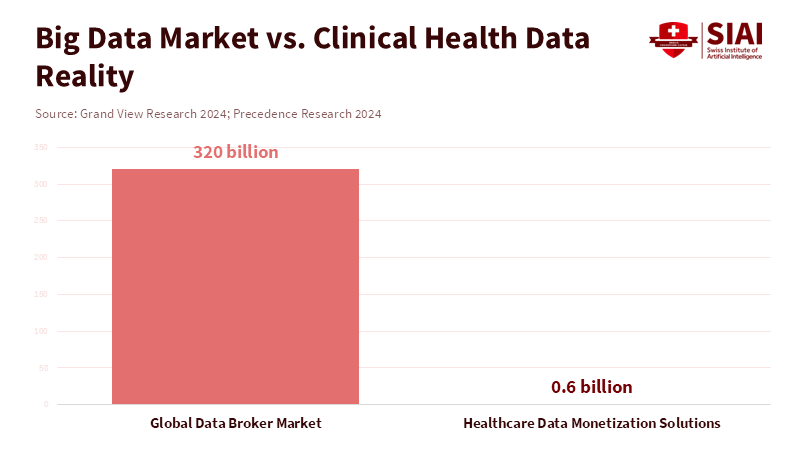

The economic argument is weaker than it seems. While the broader data brokerage economy is large, the portion that includes high-quality, clinically helpful health data is far smaller. Buyers in this market want legal verification, provenance, and certainty. They prioritize quality over volume, and meeting these standards quickly reduces margins. As a result, health data monetization struggles to deliver venture-level returns without sacrificing standards, which further fuels public mistrust. This loop explains why so many well-funded health data projects stall or quietly vanish.

Steps that the policy must now take regarding health data monetization

If market incentives cannot bring together trust and value, policy should step in. Policy should encourage innovation that protects patients and delivers real public benefits. First, consent alone is not enough. Without legal guarantees, consent has limits. Patients need strong, enforceable promises that their data will be used only for agreed-upon purposes, and that these protections will endure even if organizations change. Second, transparency should be real, not just symbolic. Platforms handling medical data should publish access logs showing who accessed the data, why, and for how long. This is common in high-security fields and could become standard in health. Consent should be clear and easy to withdraw at any time. Patients should be able to grant certain uses for set periods and revoke permission later. Users should also have true control, making it easy to move or delete their data.

Public organizations additionally have a role. Health systems, universities, and regulators can create data trusts or public-interest intermediaries that manage data sets under democratic control. These groups can grant access for approved research while shielding patients from business churn. This model treats health data as a shared resource rather than as private property. It aligns incentives toward long-term value and social benefit.

Critics say that stricter rules will slow things down. That can be true in the near term. But the other possibility is worse. Scandals, negative reactions, and strict regulations that halt entire categories of innovation stem from weak governance. Durable progress in medicine has always been deliberate, gradual, and rooted in trust. Health data monetization won't be any different. The selection is between careful constraints now or recurring failure later.

Health data monetization is commonly depicted as unavoidable. It is not. It is a policy choice motivated by incentives, rules, and values. The economics of healthcare and the attitude of trust are misunderstood when medical records are treated as a revenue source. Patients are not data mines. They're partners in providing care. Most people will decide out without reliable safeguards, leaving businesses with minimal data sets and unfulfilled promises. It is obvious what to do next. Connect data use to client control. Base innovation on public interest governance. Reward systems that produce results rather than exploitation. Health data can support research and care without becoming another failed trial in digital overreach if lawmakers and organizations act now. If they do not, the industry will keep producing expensive illusions and silent collapses. The data is already showing us what works.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

BBC News. (2026). OpenAI and health data integration coverage.

Euronews Next. (2026). ChatGPT Health feature and medical record integration.

Failory. (2025). Healthcare startup failure analysis.

Grand View Research. (2024). Global data broker market report.

Massively Better Healthcare. (2025). Why healthcare startups fail.

Precedence Research. (2024). Healthcare data monetization solutions market.

Rock Health. (2024). Consumer trust and digital health survey.

Scientific American. (2026). AI, health data, and public trust.

Comment