Quiet Coup: Why Dethroning the Dollar Is No Longer Theoretical

Input

Modified

The dollar’s strength is increasingly driven by funding stress, not stable safe-haven confidence China’s shift from U.S. Treasuries toward gold reflects rising concern over U.S. political risk Dethroning the dollar is likely to be gradual, shaped by institutional erosion rather than market panic

China's holdings of U.S. Treasury bonds have decreased from $1.317 trillion in November 2013 to $689 billion by October 2025 – a nearly 48% drop. At the same time, Beijing's official gold reserves increased to about 2,306 tons by the end of 2025. This single fact shows a significant change that affects how global finance is taught and managed. A currency's status as a reserve currency is as important politically as it is economically. When a major currency issuer loses its reputation for stable institutions and policies, those who manage reserves respond as any other risk manager would. They diversify their holdings. They buy assets that aren't tied to any one country. They consider other options. This analysis reconsiders the factors that make a currency a haven, suggesting that political stability now plays a key role in the dollar's future. The result isn't a sudden collapse, but a gradual and expensive process of seeking insurance and diversification, which weakens the dollar's unique position over time.

Why Dethroning the Dollar Is Now a Real Possibility

To understand this shift, we need to rethink the factors that make a currency a haven. Usually, these include how easily it can be bought and sold, the size of the market, and how widely it is used. These things are still important, but they aren't enough on their own. Political stability is a key factor. Political stability means that the rules don't change drastically with each new government. It means that courts, regulators, and central banks operate clearly and that contracts are upheld even during difficult times. When stability declines, the value of a currency's assets decreases in ways that measures of market size can't fully show. Investors don't just look at interest rates and market depth. They consider the risk that policies might be used against them or that trade restrictions or sanctions could limit their access to the currency. This is a genuine concern. It alters the currency's risk profile and affects reserve management.

Also, the credibility of a country's monetary policy depends on institutions that seem independent and consistent. If a central bank's independence is questioned or if emergency rules are changed without clear guidelines, it may lead to higher risk premiums on the country's debt. Considering that political stability is essential makes diversification more logical and makes dethroning the dollar a serious policy consideration.

Data since 2023 supports this idea. According to the International Monetary Fund, the US dollar's share of global foreign exchange reserves declined from 57.79 percent to 56.32 percent in 2025, mainly due to other reserve currencies strengthening against the dollar. Global gold demand reached new highs in 2025, driven by central bank purchases. This analysis examined U.S. Treasury data on country holdings through late 2025, IMF data on currency shares, and World Gold Council reports on official purchases. The concurrence among these sources suggests that this isn't just random data. Instead, it suggests a clear pattern: keep access to dollar markets while diversifying into assets that aren't easily controlled by political decisions. This strategy is why shifting away from the dollar, as a gradual adjustment, is now a valid and vital issue.

China's Portfolio Shift: How Dethroning the Dollar Works in Practice

China's portfolio provides a clear example of this strategy. Data shows an apparent decrease in China's holdings of U.S. Treasuries, from a high of nearly $1.317 trillion after the 2008 financial crisis to about $689 billion in late 2025. This is a significant reduction. At the same time, the People's Bank of China announced frequent additions to its official gold reserves throughout 2025, bringing its total holdings to about 2,306 tons by the end of 2025.

This pattern is intentional and gradual. Through reducing its direct exposure to dollar-denominated assets and increasing its gold reserves, China is creating a defense against legal changes in other countries. Gold can't be readily re-denominated, frozen by domestic law, or altered through rapid legislative action. For those planning long-term, legal stability is essential. These actions suggest a strategy that maintains access to U.S. assets for market participation while building a reserve of assets not tied to any one country. This reduces the influence that a single currency can have in global politics.

These portfolio moves are essential but not revolutionary. U.S. Treasuries are still the largest and most easily traded government bonds in the world. The markets for short-term borrowing, central clearinghouses, and banking regulation rely heavily on these bonds. Replacing Treasuries on a large scale would reduce global cash flows and could adversely affect all major holders. Gold, on the other hand, is a good long-term store of value but doesn't replace Treasuries for short-term cash needs. It's less easily used for short-term loans and can be more volatile in dollar terms.

The practical conclusion is a balanced strategy: reduce, but not eliminate, Treasuries, add gold, and create additional credit and payment instruments to reduce dependence on a single currency. This moderate approach makes a gradual shift more likely than a sudden change. This is precisely what current financial flows and reserve decisions suggest.

How Dethroning the Dollar Speeds Up with Political Shocks

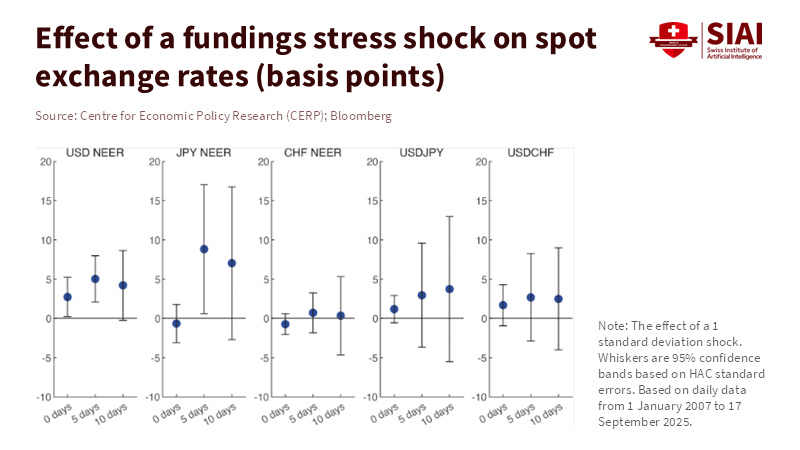

Political shocks affect reserve calculations more quickly than regular economic cycles. Markets can absorb a predictable economic expansion or a well-signaled change in monetary policy over time. Political instability – for example, sudden tariffs, changes to sanctions, or challenges to institutional independence – creates a different type of cost. When a lender believes there's a real chance that policies could be used against foreign holders, the premium on government bonds increases, and investment decisions change.

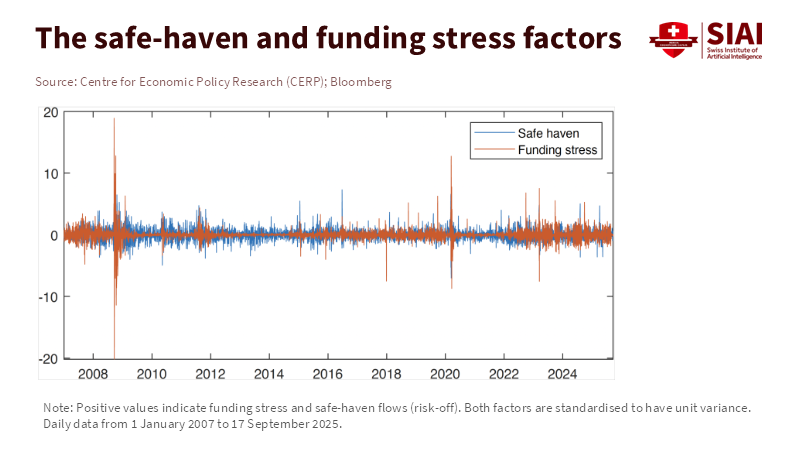

In 2025, several such events occurred. Sudden tariff announcements and trade statements coincided with short-term market volatility and downward pressure on the dollar. These swings are essential for reserve managers because they show that political risk has become a market factor that requires absolute protection.

The market reactions are subtle but persistent. According to a Time report, market volatility increased around major policy announcements in 2025, and the U.S. dollar declined to a three-year low despite some economic factors remaining steady. However, this decline does not mean the dollar’s status as the world’s leading reserve currency is likely to end soon. Instead, they show how political signals can influence the factors that affect reserve decisions. Reserve managers plan for the long term and value stability. If politically driven disruption becomes a constant factor in risk models, investment decisions will reflect this over time. That's why teaching finance now requires incorporating simulations of political events. It's also why administrative frameworks for funds and banks must include scenarios about policy-driven shocks, not just interest rate and economic cycles. Ignoring political risks no longer aligns with the behavior of official holders.

Policy Consequences for Education, Government, and Financial Management

If reserve diversification is a logical response to political risk, then education and governance must adapt quickly. Education must stop presenting reserve status as based solely on market size and currency usage. Curricula should emphasize political risk, legal stability, and how alternative reserves, such as gold and non-U.S. government debt, work. Practical exercises should require students to simulate scenarios: how does a payment system respond if a cash flow is blocked? How do currency exchange agreements work when dollar availability decreases? These aren't specialized topics. They are essential skills for those who will manage portfolios and policies in a world with multiple reserve currencies. Training should also emphasize how to measure and assess political risk through scenario planning, rather than relying solely on historical patterns.

Governments must update governance standards now. Boards of endowments, pension funds, and sovereign wealth funds should expand their scenario analyses to include political risks, such as asset freezes, sanctions, and tariff policies that alter revenue flows. Stress tests should estimate how quickly cash availability could decline and how reserve funds would be used in such scenarios.

For decision-makers, the priority remains institutional stability. This means definite legal protections for foreign lenders, transparent emergency powers with pre-defined conditions and expiration dates, and strong guarantees of central bank independence. These steps won't eliminate global political competition. They will reduce the likelihood that market players feel forced to seek alternatives en masse – the gradual path to a world with multiple reserve currencies.

The near-halving of China’s Treasury holdings alongside steady gold accumulation shows that reserve managers view political risk as a key factor. The idea of dethroning the dollar can be misleading if it's interpreted as a sudden collapse. But as a long-term shift in risk, it is worth considering. The policy response is clear. Education must teach about political risk and how to respond to it. Governments must expand stress tests to account for government factors. Officials must strengthen institutions to ensure market trust is grounded in stable, rule-based authority rather than political advantages. With focused education, stronger governance, and fundamental institutional reforms, the financial system can manage a gradual shift without systemic disruption. The immediate call to action is evident: teach political stability as a key component of reserve value, test for political risks, and make stable institutions the primary defense.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

IMF. Currency Composition of Official Foreign Exchange Reserves (COFER), Third Quarter 2025.

Reuters. Global gold demand hits record high in 2025, WGC says, Jan 29, 2026.

The Guardian. 'The damage is done': Trump's tariffs put the dollar's safe haven status at risk, Apr 11, 2025.

U.S. Department of the Treasury. Treasury International Capital (TIC) System, Major Foreign Holders table, Oct–Nov 2025.

World Gold Council. Gold Demand Trends and central bank data, 2025–2026.

Comment