AI Finance Talent Has Ended the Old Apprenticeship. Education Must Build the New One

Published

Modified

Internal AI now performs junior work, collapsing the old apprenticeship Education must build AI finance talent—aim, audit, and explain models Policy should fund governance sandboxes to grow trusted hybrid roles

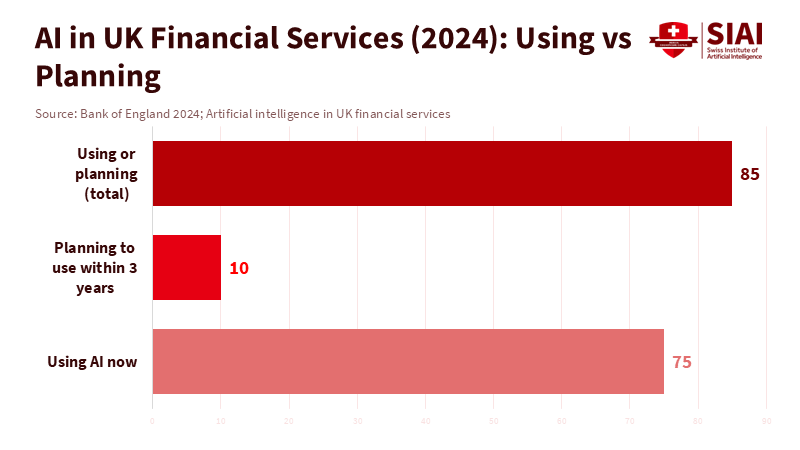

The most meaningful metric in finance this year isn’t a trading multiple. It’s that internal, company-wide AI tools have reached a point where they handle most of the entry-level work once done by interns and junior analysts. Goldman Sachs has implemented a generative-AI assistant across the company, with around 10,000 staff already using it for document synthesis and analysis. Morgan Stanley reports nearly universal adoption of an AI assistant among advisor teams. Citigroup claims its internal AI saves about 100,000 developer hours each week. In the UK, three-quarters of financial firms use AI, with the remainder planning to follow suit. In short, the foundation of financial work is now automated in-house. This change does not lead to fewer jobs. It creates a new ladder. It also compels schools, regulators, and employers to rethink how people learn and advance. At the center of this redesign is the emergence of AI finance talent — workers who can quickly aim, audit, and explain AI — highlighting the crucial role of judgment and explanation skills in the new finance landscape.

AI Finance Talent and the End of the Old Apprenticeship

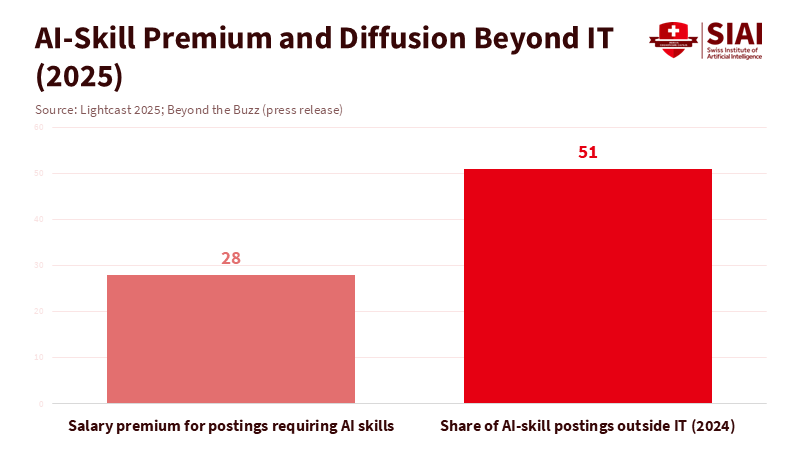

The traditional apprenticeship in banking was straightforward: new hires built models, cleaned data, drafted pitchbooks, and summarized filings until they could be trusted to make judgments. Today, internal platforms manage much of that initial work. FactSet now offers an AI Pitch Creator that saves junior bankers hours each week. UBS uses AI analyst avatars to produce research videos at scale, freeing up human resources for insights. UniCredit’s DealSync uses AI to identify hundreds of M&A leads without increasing headcount. Even when firms do not eliminate roles, the work shifts up the value chain. Entry-level tasks are decreasing; expectations are growing. The new entry-level requirement is not “clean the data” but “frame the decision.” That explains why the market premium for AI skills is real, not just talk: across different sectors, jobs that require AI skills offered a salary premium of about 28% in 2025, and over half of such postings are now outside of core IT. These roles are hybrid—finance-first, AI-savvy.

This does not indicate a decline in finance jobs. U.S. labor projections still predict growth for personal financial advisors and financial and investment analysts over the next decade. This aligns with broader evidence: where AI supports complex decision-making, employment and sales can increase together. The change we are facing is not a “no-jobs” future but a “new-jobs” mix with higher skill demands. Method note: these projections are decade-long baselines, not short-term forecasts; they assume ongoing cooperation and regulated use. For educators, the message is clear: curricula must abandon the notion that students learn by doing low-stakes grunt work. The grunt work is disappearing. We need to teach judgment from day one, opening up new opportunities for growth and advancement in the finance sector.

What AI Finance Talent Changes in the Labor Market

Three facts anchor the labor story. First, adoption has become mainstream. In the Bank of England’s latest survey, 75% of financial firms already use AI, and an additional 10% plan to do so within 3 years. Second, major banks have scaled internal platforms rather than outsourcing essential workflows to public tools. Goldman Sachs rolled out its assistant across the firm; Morgan Stanley’s wealth unit experienced 98% adoption; Citi has transitioned from pilots to company-wide improvements. Third, the capability frontier is specific to the industry and widening: Bloomberg trained a 50-billion-parameter model on financial data to enhance narrow tasks like sentiment and entity tagging, the same functions junior staff once performed. The result is a workplace where judgment matters more than keystrokes, and where AI finance talent earns a premium for guiding, auditing, and explaining machine outputs.

Skeptics may argue that displacement at the bottom still represents displacement. They are right to be concerned about early career opportunities. Some datasets show fewer listings for entry-level roles that generative AI most impacts. Yet when we look at the bigger picture, firms that invest in AI at scale often expand higher-value work and reassign staff. JPMorgan’s leadership has stated that AI could enhance nearly every job at the bank, and external reports have documented hundreds of use cases. Internalizing tools—rather than relying on vendors—maintains tighter compliance and speeds up improvements. The real risk isn’t mass unemployment in finance; it’s a lack of workers who can blend industry knowledge with model oversight and narrative skills. That’s what AI finance talent represents in practice.

Building the AI Finance Talent Pipeline in Education

Programs that prepare students for finance must reshape the learning sequence. If automation handles extraction and drafting, students must focus on selection and defense. Change “learn Excel shortcuts” to “run an AI-assisted model, then stress-test and explain its limits.” Change “compile comps” to “audit the source of comps and adjust for model bias.” Change “write a market update” to “create a decision brief that links model outputs to policy or fiduciary responsibility.” This isn’t theoretical. It reflects how leading firms operate now: assistants summarize policies, cluster filings, and draft code; humans decide what holds up with clients or regulators. Schools should develop AI finance talent by teaching students to align model outputs with real constraints—risk, regulations, and time—while stressing the need for a new approach to finance education in the face of these changes.

To facilitate that shift, universities can borrow ideas from medical training. Create supervised “AI rounds” where students rotate through desk-like simulations. In one week, they use a domain model to analyze an earnings call and produce a one-page risk memo, citing source documents. In another week, they will refine a draft pitch creator and write a three-paragraph rationale that a compliance officer could approve. In a third week, they assess how a prompt change affects the valuation range and justify it with a clear audit trail. These 'AI rounds' are designed to provide students with hands-on experience in using AI tools and interpreting their outputs, preparing them for the real-world challenges they will face in the finance industry. Method note: assessments can evaluate three aspects—evidence, calibration, and clarity—rather than just the final output, which AI can generate. The goal is fluency: can a student explain what the model did, why it might be wrong, and how to guide it? That’s the essence of AI finance talent.

Policy for an AI Finance Talent Economy

Policymakers should treat the redesign of apprenticeships as essential infrastructure. The aim is not to fund another coding bootcamp; it’s to support shared “explainable finance” environments where schools, supervisors, and middle-market firms can train on safe data and publish repeatable exercises. Central banks and regulators have already cautioned that explainability, bias detection, and human oversight are necessary. Public environments can standardize these practices earlier in careers, rather than as remedial training. Sector-wide adoption data highlight why timing is crucial. With 75% of firms already using AI—and major players continually pulling ahead—the window for inclusive talent pipelines is now, not later.

Regulators can also promote an “internal-first” approach, where appropriate, backing firms that develop or closely manage in-house tools rather than untested external systems. This is both a precautionary measure and an educational one. Keeping model behavior and data flow visible to reviewers is better for supervision and training graduates in governance. Evidence from large institutions indicates that internal platforms enhance measurable productivity and adoption at scale. This supports wage premiums for hybrid roles and creates a more straightforward pathway from student projects to professional roles. A close connection between classroom environments and firm workflows will cultivate AI finance talent more quickly and equitably than a hands-off approach.

Educators, Administrators, and the New Ladder

Educators should eliminate outdated modules that assume entry work is manual. Replace them with three new habits that align with current practices. First, always combine generation with verification. Students must check AI-generated numbers against original documents and keep a record of the check. Second, teach translation. The best junior today turns a model’s complex outputs into clear, client-ready paragraphs with decisions and caveats. Third, integrate narrative skills with quantitative skills. Finance now involves both analytics and storytelling—quick synthesis, concise writing, and a human tone. Bloomberg’s finance-focused model and UBS’s video avatars signal this shift. The content aspect of finance is becoming more like journalism, but with fiduciary responsibilities. If we train students to report and not just repeat, their value increases in any role as they move up the ladder.

Administrators should assess success by placement into hybrid roles rather than by software certifications. Evidence from Lightcast showing an AI skills premium should inform program design: build capstones that have students practice governance, not just prompting. Track outcomes in risk, research, and client advisory, where adoption is strongest and the combination with human skills is most effective. Meanwhile, universities should enter into data-sharing agreements with employers that allow students to work with synthetic yet realistic datasets—such as policy libraries, anonymized filings, and redacted client notes—so graduates enter the workforce with a governance portfolio rather than just a degree.

Internal AI now manages much of the work that once taught newcomers how finance operates. This can serve as a warning or as a call to action. If grunt work is disappearing, we must replace it with structured judgment. The evidence is compelling: adoption is widespread; specialized models are emerging; wage premiums reward hybrid skills; and projections still indicate growth in advisory and analysis. The labor market will favor individuals who can refine and validate a model and communicate the results clearly. That defines AI finance talent. Our mission is to construct a ladder fit for this era: classrooms that link to real governance; apprenticeships that simulate rather than impose drudgery; curricula that emphasize judgment and culminate in impact. Finance has upgraded its tools. Now, education needs to upgrade its training. The quicker we act, the fairer the new ladder will be.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Bank of England. (2024, November 21). Artificial intelligence in UK financial services – 2024.

Bank for International Settlements. (2024, June 25). Artificial intelligence and the economy: implications for central banks (BIS Annual Economic Report, Chapter III).

Bloomberg. (2023, March 30). Introducing BloombergGPT, Bloomberg’s 50-billion parameter large language model, purpose-built for finance.

Brookings Institution. (2025, July 10). Hybrid jobs: How AI is rewriting work in finance.

Brookings Institution. (2025). The effects of AI on firms and workers.

FactSet. (2025, January 15). FactSet launches AI-powered Pitch Creator.

Financial News London. (2024, April 8). Jamie Dimon: AI could ‘augment virtually every job’ at JPMorgan.

Lightcast. (2025, July 24). New Lightcast report: AI skills command 28% salary premium as demand shifts beyond tech.

Morgan Stanley. (2024, June 26). AI @ Morgan Stanley Debrief – launch debrief.

Reuters. (2025, June 23). Goldman Sachs launches AI assistant firmwide, memo shows.

Reuters. (2025, May 22). Citigroup launches AI tools for Hong Kong employees.

Reuters / Breakingviews. (2024, June 27). Banks grab AI-generated tiger by the tail.

UBS. (2025, June). UBS deploys AI analyst avatars [News report]. Financial Times.

U.S. Bureau of Labor Statistics. (2025, March 11). Incorporating AI impacts in BLS employment projections.

World Economic Forum. (2023). The Future of Jobs Report 2023.

Comment