Stop the Cross-Subsidy: AI Data Center Electricity Rates Shouldn’t Raise Household Bills

Published

Modified

AI data centers are pushing grid costs onto households and schools Create a separate rate class with minimum bills, upfront upgrade payments, and full transparency Require self-supply or co-located power for very large campuses, with local community benefits

Wholesale electricity prices near major data center clusters have jumped by as much as 267% over the past 5 years. This increase affects utility bills, which in turn affect household budgets. During the same period, local transmission upgrades worth at least $4.4 billion were made in seven PJM states, costs now imposed on regular customers so that hyperscalers can connect more quickly. This practice is unfair. It creates a cross-subsidy from families and schools to some of the world's largest corporations. Suppose the demand for AI continues to rise. In that case, regular customers will bear more grid costs that would not exist without these large-scale developments. The solution is not just a catchy phrase but a thoughtful rate design. AI data center electricity rates must be independent, with clear boundaries that shield households from stranded assets, capacity charges, and local wires built just for single tenants. Anything less allows a wealth transfer to go unnoticed.

The unfair cross-subsidy is evident

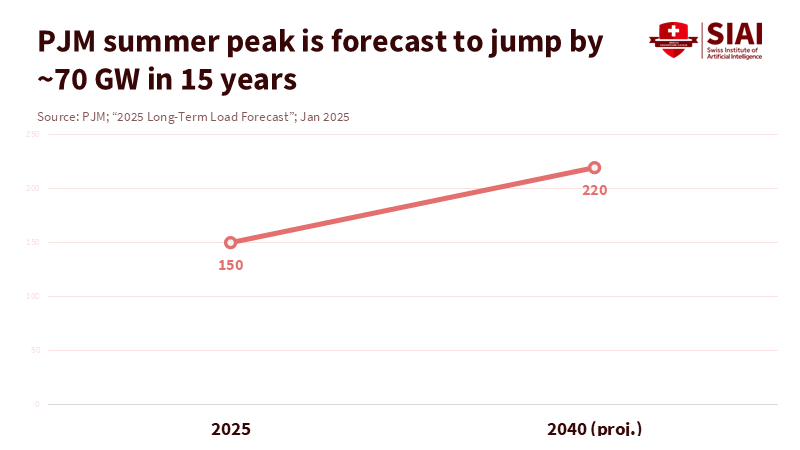

What has changed is not just the price but also the scale. Grid planners are observing a structural shift in load expectations. PJM, the largest power market in the U.S., forecasts its summer peak will grow from about 150 GW to roughly 220 GW over the next 15 years, mainly due to data-center growth. The grid’s independent market monitor estimates that data center loads contributed $9.33 billion in capacity-market revenues over one year under a scenario in which everything else remains the same. This is a clear cost signal reflected in retail bills. Residential customers cannot protect themselves from this risk; they pay for it.

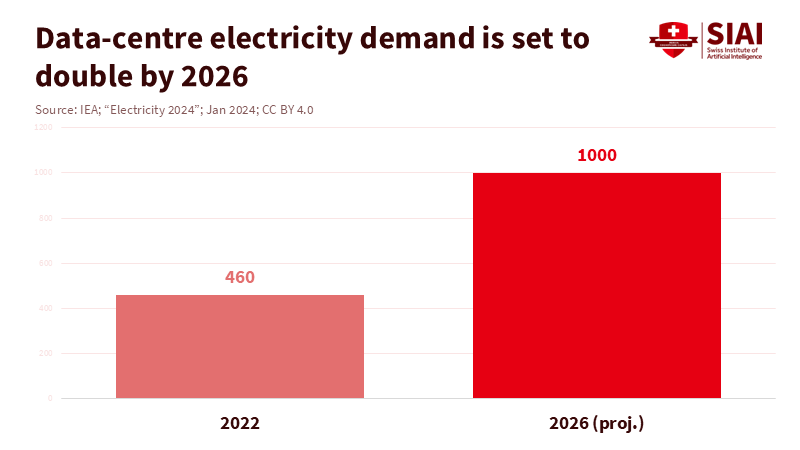

The global situation mirrors this. The International Energy Agency projects that data-center electricity use will more than double by 2030, reaching about 945 TWh, and growing nearly four times faster than overall power demand. Short-term forecasts in the U.S. indicate record electricity consumption in 2025–2026, primarily driven by data centers and AI. In the meantime, utilities in rapidly growing areas have filed resource plans and capital programs that show significant growth in large loads. These filings suggest that, unless changes are made, households will face increased rates due to higher capacity, transmission, and distribution charges. AI data center electricity rates must reflect the scale and risks of these changes rather than load costs on top of the retail base.

The political economy makes things more complicated. Tech companies often request power faster than permits and construction can keep up. Interconnection queues expand with requests well beyond the projects that will actually be built. When utilities prepare for maximum demand but actual demand is lower or arrives later, ratepayers end up covering the costs of unused assets. The risk is clear: we share the downside and privatize the upside. This isn't an argument against AI; it’s an argument for setting AI data center electricity rates based on the actual costs and risks of demand, before new contracts lock in poor practices for 20 years.

A firewall for AI data center electricity rates

The solution starts with creating a separate rate class and establishing a tariff structure. Some regulators and legislators are beginning to do just that. One major utility has suggested a new rate class requiring long-term commitments (around 14 years) and minimum demand charges across transmission, distribution, and generation to avoid cost shifts if data center usage falls short. Analysts and policy experts recommend similar approaches: separate AI data center electricity rates with monthly minimums linked to contracted capacity; upfront contributions for grid upgrades; extended terms; and exit fees to protect other customers from stranded costs. States like Maryland and Oregon have gone even further, requiring or allowing specific rate schedules for data centers and establishing a separate class for large users. The direction is clear: place costs on those responsible for them.

The firewall tariff should be straightforward and consistent. First, minimum monthly bills should reflect the full, long-term costs of requested capacity, including local wires. Second, require upfront payments or contributions for custom upgrades to ensure ordinary customers aren't shouldering the burden. Third, establish credit standards, contract lengths, and exit fees that align with asset lifespans. These measures are not punitive; they reflect practices in generation interconnection and industrial rate design. They also align with what grid monitors already observe: in PJM, the rise in large-load interconnections and capacity pricing has noticeable effects on consumers. The goal is to make AI data center electricity rates self-sustaining, not to stifle innovation.

Fairness also requires transparency. Utilities should provide a rolling account of data-center-driven capital—by project, substation, and cost category—and track recovery against the data-center tariff instead of general rates. Where state open records laws allow, commissions should mandate deal-level disclosures of capacity reservations and associated community protections. This will empower school districts, city councils, and small-business associations with the information they need to act before costs appear in future rate cases. The choice is between targeted AI data center electricity rates now or widespread financial pain later.

If you build it, power it yourself

Rate design alone is not sufficient. The most effective way to prevent cross-subsidies is to co-locate large loads with generation or to require self-supply for campuses above a defined threshold. Federal regulators are officially reviewing colocation issues for large loads, such as AI data centers, beginning with PJM. This approach is essential. Suppose a campus seeks hundreds of megawatts on a tight timeline. In that case, it should not trigger off-site wires and peaking plants funded by the larger community. Better models exist: merchant generation combined with long-term energy service agreements; on-site renewables and storage sized to meet load needs; or gas units near the campus priced within the private contract rather than general rates.

Market players are already making progress. Major utilities and investors are forming partnerships to build dedicated gas plants to serve data-center clusters under long-term contracts. While this doesn’t settle the climate debate, it does align incentives: those benefiting pay for the asset. These deals should include strict guidelines. The new generation should not be part of the regulated rate base unless it supports the broader system. There should be a clean-energy transition or renewable PPAs that increase with use.

Most importantly, prohibit the hidden recovery of dedicated campus assets through general riders. Suppose the business case for a 500 MW campus is sound. In that case, its owners should account for energy and capacity costs in their own financial statements. This is how we handle other large loads, and it should apply to AI as well.

Zoning and siting policy should align. Jurisdictions that accept data centers can require community benefits agreements tied to energy usage—funds designated for school energy upgrades, community solar subscriptions, and bill relief in host areas. These payments should be mandatory for projects that cause new substations or long feeders. They should scale with reserved capacity, not just square footage or headcount. Where regional reliability margins are low, local planners should insist on self-supply or co-location as conditions for approval. This prevents AI data center electricity rates from affecting everyone else's bills.

Translate fairness into rules we can enforce

What should educators, administrators, and policymakers do right now? First, engage early in rate cases and resource plans. When a utility files an integrated resource plan citing “extraordinary” growth driven by data centers, school districts, and universities, those entities should participate in the case. They should demand a separate class, minimums, and a ledger of data-center capital—not a commitment to reconcile later. Many states already have filings and press materials predicting extraordinary load and related expansions; the public record is clear enough to justify immediate action.

Second, impose non-bypassable charges on the data-center class for local transmission upgrades. A recent review showed customers in seven PJM states were billed $4.4 billion for local data-center transmission projects approved in just one year. This illustrates the flow of costs when there's a regulatory gap. Commissions can close this by assigning specific costs to the customer responsible—just as they do for generator interconnections. If the tariff needs adjustment, make it now and prospectively.

Third, improve planning practices. Load requests are uncertain; many never materialize. Utilities should not build based on the most optimistic scenarios without solid minimum-bill protection. Require long-term commitments, strong credit support, and exit fees that cover the life of local wires. One major utility's proposal accomplishes this—offering a new class for high-energy users with 14-year commitments and minimum demand requirements—while national consultants recommend the same toolkit to protect residential customers. States are starting to legislate these directions, necessitating specific tariffs for data centers with clearly defined financial responsibilities.

Fourth, ensure consumer protection in the short term. Where bills are already rising, immediate assistance should focus on schools and low-income households most affected by increasing grid costs. Data-center hosts can provide local rate relief through impact fees and community benefits linked to reserved megawatts. Regulators can limit pass-throughs from data-center-related projects until a separate class is established. When new capacity auctions or transmission surcharges appear on bills, commissions should require a public breakdown of how much is caused by data centers. People have a right to understand the cause-and-effect relationship through precise numbers.

Finally, create a co-location pathway by default. FERC’s inquiry into rules for generator-load co-location enables PJM and other RTOs to follow suit. States can set a target from the governor’s office: any campus above a certain threshold—perhaps 100 MW—must self-supply, co-locate, or sign a full-requirements contract that shields its costs from general rates. If providers want public connections, they must agree to AI data center electricity rates that reflect all costs—without exceptions.

The numbers we started with should shape decisions for the next two years. Wholesale prices near data-center hubs are up as much as 267%. Billions in local wires have been approved and charged to customers. Capacity revenues have surged by billions as large loads have suddenly appeared. If left unchanged, this trend will continue. Families, schools, and small businesses will pay more for assets they neither wanted nor needed when nearby campuses reduce usage. We can prevent that future by changing the default. Give data centers their own AI-based electricity rates, with minimum bills reflecting contracted capacity. Require pre-payments for custom wires. Urge huge campuses to co-locate or self-supply, keeping their assets off the regulated rate base. Then ensure transparency so communities can see the accounts in detail. The message is transparent and fair: support the AI economy without making neighbors pay for it. The sooner we establish these rules, the sooner we halt the hidden transfer seen in monthly bills.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Bloomberg News. (2025, September 29). AI Data Centers Are Sending Power Bills Soaring (methodology note cites Grid Status and DC Byte). Retrieved November 5, 2025.

Brookings Institution. (2025, October 30). Boom or bust: How to protect ratepayers from the AI bubble. Retrieved November 5, 2025.

Deloitte. (2025, June 24). Can U.S. infrastructure keep up with the AI economy? (recommends separate rate class, minimum charges, exit fees).

Dominion Energy. (2025, April 1). Dominion Energy Virginia proposes new rates… (new rate class; 14-year commitments; consumer protections).

FERC. (2025, February 20). FERC orders action on co-location issues related to data centers running AI (PJM focus; reliability and fair costs).

IEA. (2025, April 10). AI is set to drive surging electricity demand from data centres… (base-case ~945 TWh by 2030; ~15% CAGR in data-center electricity).

PJM. (2025, January 30). 2025 Long-Term Load Forecast Report Predicts Significant Increase in Electricity Demand (summer peak path to ~220 GW).

PJM Independent Market Monitor. (2025, June 25). Market Monitor Report (capacity revenue impact of data-center load; $9.33 billion scenario).

Reuters. (2025, June 10). Data center demand to push U.S. power use to record highs in 2025, ’26, EIA says (STEO record consumption).

Reuters. (2025, July 15). Blackstone and U.S. utility PPL to build gas power plants in JV partnership (dedicated generation for data centers).

Utility Dive. (2025, October 1). Customers in seven PJM states paid $4.4B for data center transmission in 2024: report (UCS findings; regulatory gap).

Virginia Mercury. (2025, September 3). Dominion proposes higher utility rates, new rate class for data centers (details on minimum demand obligations; class scope).

Comment