Rule vs. Discretion: A New Public Debt Strategy for Advanced Economies

Input

Modified

Public debt is now a core risk for advanced economies, not just poorer ones Rule-based fiscal policy preserves market trust better than discretion Without credible debt strategies, education and growth spending will be crowded out

In 2024, global public debt reached an estimated $102 trillion, a level that could significantly alter the financial landscapes of treasuries, central banks, and other public institutions. This substantial amount reveals a critical issue: escalating debt is not confined to developing countries. Within the Organisation for Economic Co-operation and Development (OECD), the average general government debt by the close of 2024 surpassed 110% of Gross Domestic Product (GDP), with numerous major economies continuing to borrow extensively. Interest payments are now consuming a larger share of national income, creating a direct trade-off in which routine expenditures on essential services such as education, healthcare, and scientific research are forced to compete with debt servicing. This dynamic shapes managers' and organisational leaders' everyday decisions, underscoring the need for a well-defined public debt strategy. Such a strategy is vital for safeguarding long-term investments in human capital and economic expansion.

The Current Significance of Public Debt Strategies

The discourse surrounding public finances has changed, bringing the risks and benefits into sharper focus. The increase in emergency borrowing in response to various crises, coupled with slower economic growth, has elevated baseline debt levels across many nations. Simultaneously, interest rates and term premia now respond more sensitively to fiscal announcements than in previous years. By implementing a structured public debt strategy, countries can re-establish stability and decrease borrowing expenses. This stability is crucial, as markets and managers respond to future expectations. When governments establish a clear, medium-term plan, investors are more inclined to accept longer maturities and lower premiums. Conversely, the absence of such a plan can lead to increased yields, necessitating quicker debt rollovers and heightening rollover risks. The tangible outcome is straightforward: increased debt service diminishes discretionary spending, potentially leading to more drastic adjustments in the future. For educational institutions, this can manifest as delayed construction projects, hiring limitations, and inconsistent upkeep, thereby reducing the quality of education.

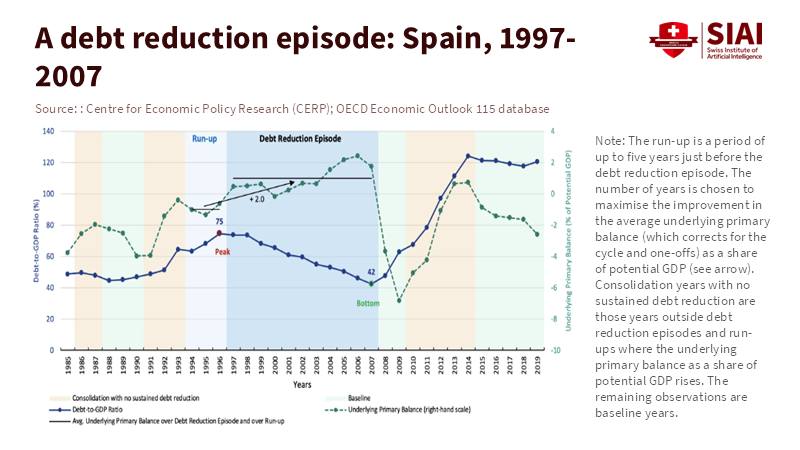

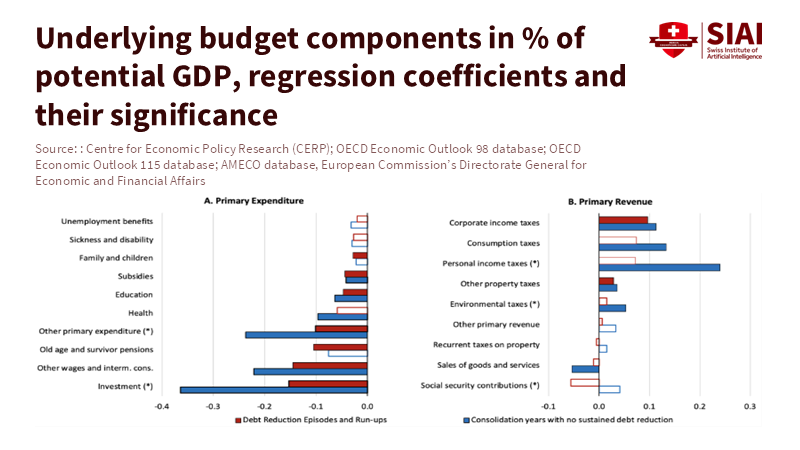

The fundamental tension between rules and flexibility helps explain these financial models. Rule-based systems, such as explicit debt targets, budgetary regulations, or multi-year expenditure plans, make economic policy more predictable. Alternatively, flexibility allows policymakers some leeway to respond to unexpected economic shocks. While flexibility can be essential, reliance on it could undermine market confidence. Historical data from OECD countries reveal that periods of significant debt reduction typically involve a combination of continuous primary surpluses with structural changes in budget allocation. Though these factors are quantitative, their implications are profoundly political. Governments that pair clear fiscal rules with viable exceptions can avert abrupt budget cuts later, preserving the state’s capacity to finance essential public services, including long-term educational strategies and vocational training programs.

The Influence of Rules and Discretion on Markets and Educational Budgets

Financial markets value predictability and penalise inconsistency. When governments manage debt credibly, investors are more inclined to accept longer maturities and lower term premia. Conversely, a lack of credibility leads to higher yields and an increased fiscal burden. Current currency and yield fluctuations confirm this dynamic. For instance, in mid-January 2026, Sterling's exchange rate against the Euro hovered around €1.15 amid market reactions to fiscal signals, underscoring the market's sensitivity to perceived ambiguity in fiscal policy. The increase in interest payments is already evident in national financial statements and proposed budgets. Public services are directly and immediately affected, as increasing debt service reduces the availability of non-mandatory funds, which, in turn, forces difficult decisions about the scheduling of building projects, employee compensation, and research grants. The relationship between market changes and the funding available to schools is therefore direct and significant.

In other words, the strain of debt is already influencing routine decision-making. As interest rates rise, nations that permit deficits to grow without intervention often experience even more rapid increases in their interest expenses, requiring stricter adjustments later. For school districts and education ministries, this manifests as overdue maintenance, constrained contracting budgets, and reduced long-term planning. A dependable public debt strategy mitigates these adverse effects by reducing borrowing costs and giving school administrators greater confidence when entering into multi-year agreements, planning curriculum changes, and undertaking capital improvements with stable funding.

Key Characteristics of a Credible Public Debt Strategy

A convincing strategy should accomplish three practical goals. First, it should define explicit, accessible objectives that align with realistic assumptions about economic growth and interest rates. Second, it should allocate revenue and spending adjustments equitably across all sectors and generations. Third, it should protect expenditures that promote future productivity—such as investments in education, early childhood development, research and development, and targeted public works—while eliminating inefficient and unnecessary expenditures. In practice, this may involve setting a medium-term debt anchor, establishing a medium-term spending plan, and including specific exception clauses designed for actual emergencies. The objective seeks to maintain the strategy's market appeal while preserving funds designated for long-term investments.

Operational details matter as much as big goals. Strong frameworks mix clear targets with escape clauses, activated only by proven emergencies. Independent reviews, public reports, and realistic plans reduce uncertainty and help meet goals. Use legal or procedural safeguards to save funds for vital projects, like multi-year school investments reviewed by neutral experts. This lets schools and contractors plan with confidence. When putting this strategy into practice, however, both technical and political sequencing must be addressed.

Executing the strategy involves careful technical decisions and strategic political sequencing. The technical aspects include combining changes to revenue streams and spending while paying close attention to financial composition. Studies of past OECD debt reductions demonstrate that consistent improvements to primary balances and better allocation choices are crucial for achieving success. The political aspects require incremental actions, precise communication, and clear protections for vulnerable populations, thus ensuring the approach is both reliable and socially acceptable. If done correctly, this strategy builds market confidence and maintains consistent public spending.

Further Essential Components of a Credible Public Debt Strategy

An important decision is determining how to protect educational institutions from the immediate impact of austerity measures. Simply allocating funds to specific categories often proves inadequate. An alternative approach is to guarantee multi-year funding for both capital projects and curriculum improvements within the broader fiscal plan, alongside mandating independent reviews of these funding allocations. This structure enables educational leaders to plan effectively, reduces the political difficulties associated with fiscal consolidation, and lowers project expenses by avoiding hurried bidding processes. Gradually, this protected investment, guided by thorough evaluations, reduces long-term education costs and enhances overall outcomes.

Implementation should also prioritise straightforward technical solutions such as improving procurement procedures, streamlining redundant programs, and strengthening measures against tax avoidance. These steps can increase revenue and free up funds without reducing allocations to essential functions. When cuts are needed, they should be implemented in stages, with explicit safeguards for low-income families and for investments that are expected to boost future economic growth. The principle is clear: making choices that are credible, equitable, and clearly communicated reduces the likelihood of needing emergency cuts later.

Implications for Educators, Administrators, and Policymakers

For educational leaders, the key message is operational and immediate. They should evaluate their budgets in light of the possibility of moderate increases in sovereign yields and differentiate between essential and deferrable activities. Where possible, they should pursue multi-year hiring and contracting and maintain small financial reserves to safeguard important strategic services. Clear business justifications for capital projects, supported by understandable metrics, are critical for securing protected funding. Independent audits and transparent cost-benefit analyses can prevent the reallocation of funds away from long-term educational spending in favour of short-term political considerations.

For managers and local authorities, the goal is to document plans thoroughly, prioritise projects with strong returns, and advocate for funding allocations that span more than a single year. Thorough documentation will reduce the temptation to reallocate capital mid-project when budgets are constrained. Numerous minor adjustments—such as extending procurement timelines, setting clear maintenance schedules, and creating small reserves—can accumulate over time, lowering the political costs of maintaining a reliable medium-term plan.

For policymakers, the main lesson is structural. A public debt strategy that balances precise targets with limited flexibility protects the state’s ability to invest in its citizens. This requires medium-term targets, independent monitoring, and legal protections for educational and developmental spending. Policy creation should also be equitable, incorporating progressive revenue measures and gradual efficiency improvements. Finally, coordination is essential. When global economic impacts are significant, domestic strategies are more successful when paired with international collaboration.

A common criticism is that rules prevent countries from taking needed steps during crises. While this concern is valid, a viable compromise involves a rule-based framework with narrowly defined escape rules based on verifiable shocks. Another common criticism is on the political side: maintaining long-term primary gains is difficult. The practical solution involves modest, believable strategies that unite progressive revenue practices, efficient spending, and protected investment rather than broad deductions. Financial markets focus on validity, while citizens worry about equity. The strategy must address both.

Initial statistics, highlighting an estimated $102 trillion in global public debt and an OECD average of over 110% of GDP, should prompt a reassessment of fiscal priorities. The choice between rules and flexibility is a practical one that decides whether educational institutions receive reliable funding or experience start-stop funding patterns. A well-thought-out public debt plan combines simple anchors with limited escape rules and protects essential spending. The urgent need is threefold: to adopt medium-term anchors, to create protected funding opportunities for education and development, and to establish neutral monitoring to ensure governments adhere to their fiscal plans. This conserves the government’s capacity to invest in its people while reducing the risk that debt costs will overshadow essential investments. This is pragmatic, achievable, and vital for public policy over the next decade.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

CEPR / Pina, Á., Hitschfeld, M., & Miyahara, T. (2026, January 13). What we can learn from public debt reductions in OECD countries. CEPR VoxEU.

IMF. (2024). Fiscal Monitor: Putting a Lid on Public Debt. International Monetary Fund.

OECD. (2025). Global Debt Report 2025. Organisation for Economic Co-operation and Development.

OECD. (2025). Government at a Glance 2025. Organisation for Economic Co-operation and Development.

UNCTAD. (2025). A World of Debt 2025. United Nations Conference on Trade and Development.

The Guardian. (2025, March 20). Government debt costs in richest nations at highest since 2007. The Guardian.

XE. (2026, January 14). GBP to EUR historical exchange rates. XE Currency.

Comment