Keeping Digital Money Going When Things Break Down

Input

Modified

Digital cash resilience pairs fast digital payments with a cash fallback for shocks A privacy-safe, offline-capable digital euro can scale without draining deposits Schools should drill multi-rail payments, keep cash buffers, and pilot only cost-winning rails

In 2025, the Dutch central bank advised people to have enough cash at home to cover three days of expenses, around €70 for adults and €30 for kids, in case of emergencies. This wasn't just about old habits; it was about dealing with real risks. Cyberattacks and power outages can disrupt the flow of money. When the power is out, cards, apps, and QR codes don't work. Cash allows shops and pharmacies to keep running. Later, the European Commission said something like: every home should have a 72-hour kit with food, water, medicine, power banks, and cash. The idea is simple: digital payments are quick but not foolproof. Staying prepared with digital cash is essential for when the lights go out.

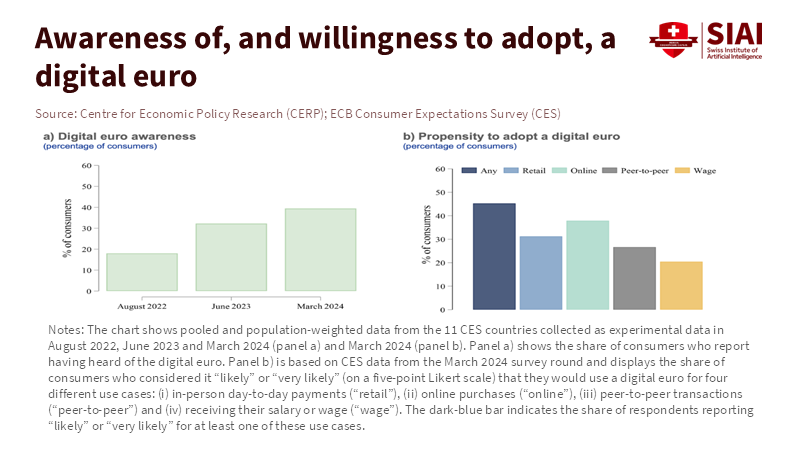

This sets the stage for a discussion that often gets stuck on choosing between cash and digital methods. We should aim for a system that allows digital cash to work both online and offline. Recent stats show people are open to this idea. Awareness of the digital euro has grown from under 10% in 2021 to about 40% by March 2024. Around 45% of consumers say they’d likely use it for everyday purchases. At the same time, cash remains the most common way to pay in person in the euro area, though its use is declining. In 2024, it was used in just over half of in-person payments, down from 59% in 2022 and 79% in 2016. It's clear that people want digital money, but they also need a backup plan that works.

Knowing Isn't Doing: What the Digital Euro Must Prove

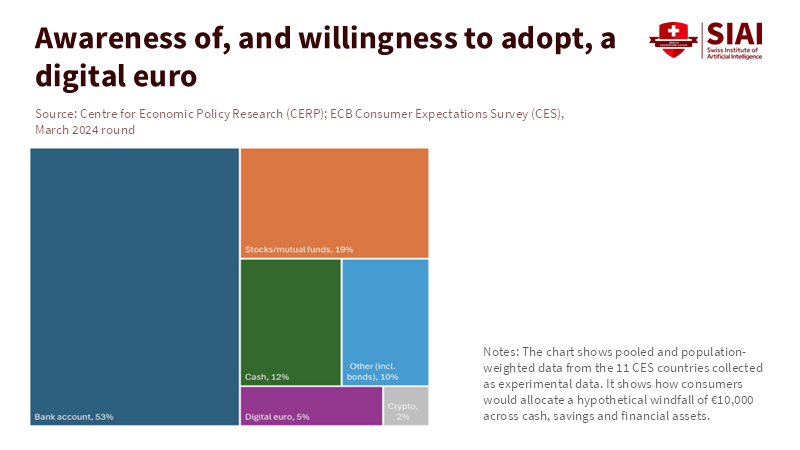

The main question is not just whether people know about a central bank digital currency, but whether they'll actually use it daily. In fact, surveys in the largest euro-area countries indicate a general willingness to use a digital euro. In particular, younger, wealthier, and educated people are more inclined to adopt it. Specifically, they would likely use it for shopping and online payments, but are less interested in using it as a savings account. Importantly, this fits with the intended purpose: a digital euro should be for payments, not for storing large amounts of wealth that could take money away from banks. Furthermore, early signs suggest that imposing limits on how much digital euro someone can hold would move only a small amount of funds from bank accounts. Overall, this is beneficial for financial stability and allows for a gradual introduction that can build trust.

But if the digital euro isn’t designed to handle common problems, people won't use it. They need to be sure it will work when the network is slow, a server fails, or a major service goes down. While Europe’s payment system is strong, it is not perfect. For example, a study for the European Parliament found that it relies on external cloud services and faces other weaknesses. To address these challenges, the study suggested carefully managing risks and maintaining backup systems at all levels. Thus, the key is to make offline functionality a main feature, not an afterthought. This means terminals and digital wallets should process small payments locally and sync the data later. Furthermore, keeping the rules clear and the process simple is vital. Otherwise, digital cash will remain just a concept, not a practical solution when there's a citywide power outage.

How We Pay: Stablecoins, Cards, and Payment Systems

People don’t care about infrastructure when paying. They use what’s fastest and most reliable: for years, cards; now, phones; in some places, QR codes linked to fast payment systems. In the UK, 12% of payments are cash, with debit cards accounting for the majority. Digital wallets are surging. This trend will likely grow as costs fall and habits shift. But cash won't vanish. Even as card and wallet use rises, European data shows that cash remains important for in-person payments. Digital cash readiness lets us capture digital speed without losing cash’s safety.

Adding another layer to these payment choices, stablecoins offer quick payments and, in theory, lower fees for businesses and international transactions. They can move money quickly at all times. Some think stablecoins could compete with card networks, especially for online shopping and remittances. Big banks are testing how to use tokenized money for payments while following regulations. The trend is clear: the ways we move money are changing. But let's be realistic about limitations. Most stablecoin use is within crypto markets, not everyday shopping. Also, consumer protection, transparency, and reserve levels vary among issuers. There's also little compatibility across different systems. These issues need to be resolved before stablecoins can be used for mainstream retail, not just specialized payments. For now, they enhance cards and bank systems rather than replace them.

From Ideas to Action: Making Digital Cash Preparedness a Reality in Education

Education leaders should consider digital cash preparedness a key part of their planning. A school is like a small town. It provides food, handles money, and needs to keep functioning under pressure. A simple rule to start with is to avoid having a single point of failure for important payments. This means having multiple payment options for fees, cafeteria purchases, and transport passes, as well as offline backups for small transactions. Staff should also be trained to use cash or manual vouchers when systems fail. The EU’s new emphasis on preparedness should encourage this approach. Emergency kits should include plans for how the school will purchase fuel for generators and food for students when the network is down, and card terminals aren't working. Having cash available can make the difference between a normal day and worried parents.

Policy makers should make sure the digital euro aligns with these practical needs. First, they should guarantee offline payments up to a certain limit per transaction and per day. People should be able to make payments even if their phone has no signal or the store’s internet is down. Second, they should create rules that treat cash and the digital euro as equal forms of public money, ensuring everyone has access. Third, they should clearly state the limits and privacy protections. People need to trust the system. A person buying lunch should not be tracked more than necessary to prevent fraud or to comply with the law. Surveys show that confidence in the central bank affects willingness to use a digital euro. This is something policymakers can influence with clear plans and open communication.

Fourth, make the system affordable for businesses. Small businesses already face slim card profits. If the digital euro adds costs, use will lag. If it lowers costs and cuts fraud, adoption will rise. Make sign-up easy. Software updates should enable current terminals to accept the digital euro with minimal effort. Work with payment processors to make changes routine. Fifth, test thoroughly with simulated attacks such as cloud outages and cyberattacks. Ensure safe switch to offline mode. Urge providers and device makers to meet recovery-time and transaction-success goals. Publish results. Public money needs public trust.

Lastly, inclusion should be a priority from the beginning. Data show a steady decline in cash use, but it remains important in many euro-area countries. Also, people use cash for budgeting. The digital euro should not make it harder for those who are not used to digital payments. Basic digital wallets with no fees should be available. Simple phones and cards should work without needing smartphones. Customer support should be available for those who need it. This is both the right thing to do and what makes the system stronger. A system is only as strong as its weakest link.

What Schools and Universities Can Do

The next actions are doable and cheap. Schools should check their payment systems to identify which vendors handle tuition, transport, meals, or student services. They should see which ones depend on a single cloud provider or card processor. Then, create a plan with at least two ways to pay for anything important, such as pairing a fast payment system with a card system and keeping cash available for emergencies. Staff should practice the switch-over process twice a year to make it a habit. The first practice should simulate a total network failure, and the second should simulate a payment processor outage that lasts all day. Schools should measure how long it takes to restore service at the cafeteria and bookstore and then aim to cut that time in half.

Campuses should carefully update their student payment methods. For those considering using stablecoins, they should start small, such as with on-campus vending machines, where consumer risk is low, and records are clear. They should demand that any issuer provide audited reserves and allow quick redemption. Conversion points should be set up at the campus bank to avoid student confusion. If the new system doesn’t offer lower costs and faster service than cards, it should be discontinued. The goal is an improved payment system, not just an appealing app. For most schools, the easiest thing is to use fast payment systems where possible and negotiate lower fees for small transactions.

Government agencies should also pay their vendors and staff through multiple systems. A digital euro wallet could be used for stipends and emergency aid, but it shouldn't be required until it's fully ready. They should ensure cash remains accessible across campuses by maintaining ATMs or shared cash points where students can withdraw small amounts without fees. They should also educate consumers about why being ready for digital cash disruptions is important and how to prepare for a 72-hour emergency. The main idea is civic, not just technical: a community that can continue trading during a crisis will remain stable.

Dual-Track Money Is Beneficial for Everyone

The past several years have taught us that the more we depend on digital networks, the more we need to plan for when they fail. Data shows people are more aware of the digital euro, and many are willing to use it for daily payments. Cash use is declining, but it remains important for in-person shopping. Brussels advises households to maintain a 72-hour supply of cash for public safety. These facts point to a single conclusion: a modern payment system needs to be fast under normal conditions and also needs to work during crises. This is what digital cash preparedness is all about.

The policy task is pressing but achievable. We need to develop a digital euro that can process small payments offline, protect privacy, be affordable for businesses, withstand stress testing, and be inclusive so everyone can use it. Schools and universities should turn their continuity plans into practice drills and keep some cash on hand. The purpose isn't to stop progress but to make it more dependable. If we handle this well, we can have fast digital payments and the security of a cash backup. Even if the power goes out, business will slow but will not stop. Building this resilience is something worth working toward.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Bank for International Settlements. And so we pay: more digital and faster, with cash still in play. CPMI commentary, March 25, 2025.

CEPR VoxEU (Georgarakos, D., Kenny, G., Laeven, L., Meyer, J.). The digital euro: Awareness, adoption, and household portfolios. January 6, 2026.

European Central Bank. Study on the Payment Attitudes of Consumers in the Euro Area (SPACE 2024). March 2025.

European Central Bank. SPACE 2022 report. December 20, 2022.

European Parliament (Policy Dept. for Economic, Scientific and Quality of Life Policies). Resilience of the Banking Union’s Non-Cash Payment Systems. November 21, 2025.

Euronews. Dutch citizens advised to keep emergency cash on hand amid growing cyber threats. May 21, 2025.

European Commission. EU Preparedness Union Strategy—public guidance on 72-hour emergency kits. March 26, 2025.

Financial Times. Payments using digital wallets surge in Britain. 2023 coverage cited in 2024–2025 updates.

Reuters. Even in the euro zone, king cash is about to lose its throne. December 19, 2024.

Reuters. EU Commission urges stockpiling emergency supplies for 72 hours. March 26, 2025.

UK Finance. UK Payments Markets 2024. July 23, 2024.

Yahoo Finance. Why you might one day use stablecoins in place of credit cards or bank accounts. July 26, 2025.

Comment