Dollar Gravity and the Limits of Local Ambition: Why Asian Stablecoins Will Struggle to Dethrone the Dollar

Input

Modified

Dollar stablecoins dominate liquidity; Asian rivals will struggle Europe’s MiCA and Korea’s stalemate show rules don’t build networks Win small: target local corridors with instant bank redemption and dollar swaps

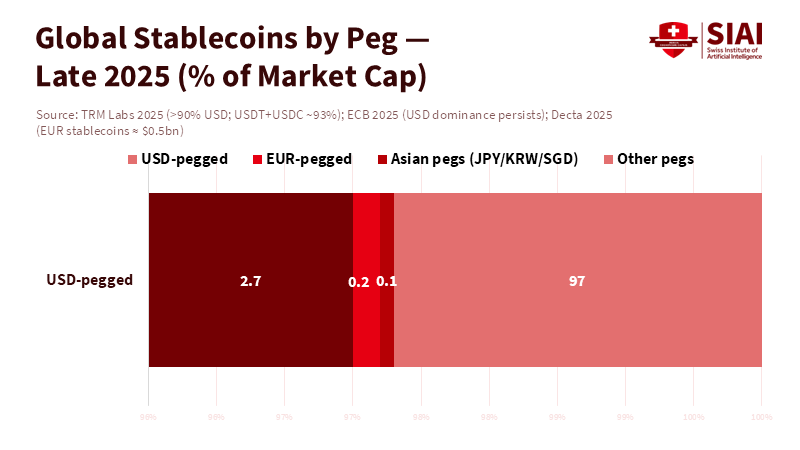

In cryptocurrency markets, dollar-pegged stablecoins like USDT and USDC dominate, accounting for over two-thirds of total stablecoin value. They control a huge portion of trading pairs and on-chain activity. This large scale creates more chances for itself. More liquidity attracts market makers, which in turn attracts merchants and users, bringing in even more liquidity. Asian stablecoins aim to give options for local currency and policy control; their growth faces a big challenge to the current trend.

Europe's situation is worth noting. Even with complete rules, euro stablecoins account for only a small share of the total market, while dollar-based options strengthen their hold. Asian regulators can make good laws and test new ideas, but can't force network effects. The main lesson from 2025 is that most local stablecoins will compete for specific uses, not whole markets, if they don't have strong dollar support. The likely result in 2026 is divided activity on the edges and stronger control at the center. That center is based on the dollar.

Asian stablecoins: The Network Effect You Can't Buy

The plan for Asian stablecoins starts with clear goals: keeping value in local currency, linking digital payments to local banks, and supporting trade that reflects local conditions. The issue is that the core of the crypto business doesn't run on yen, won, or the Singapore dollar. It runs on dollar systems, where USDT and USDC offer fast conversions, tight spreads, and deep order books across exchanges. In 2025, USDT alone handled hundreds of billions of dollars on-chain each month and continued to grow its supply. These activities draw more attention. Every new currency pair against USDT strengthens that draw. Volume doesn't come from having regulatory approval, but from knowing that your counterparty will offer good rates in the asset you hold.

Europe’s results after MiCA give Asian decision-makers a look ahead. Legal rules didn't bring more market share. Euro stablecoins grew slightly and were sometimes removed or limited in some markets, while dollar tokens continued to grow and remained the main choice for trading and DeFi. This pattern is important because crypto isn't limited by borders, and liquidity depends on what happened before. When an asset controls global currency pairs, others must offer safety, obedience, and better support and use. This is tough for any local currency token to do. It's hard to accept: network effects aren't neutral. They lock in the winner, and in stablecoins, that's the dollar.

Asian stablecoins: Lessons from Europe’s Lost Lead

Europe created the most detailed rulebook first. Yet, euro stablecoins account for only a small share of the global market. Even those who support them say their market is small, fragmented, and largely reliant on a few companies. Reports from late 2025 show that EUR-based tokens gained in some situations, but the broader market remained focused on the dollar. Following the rules protected users but didn't create liquidity. Exchanges and wallets choose which pairs to support based on the assets that are active. Those assets are dollar-based. The euro shows that following the rules without having enough activity isn't enough. Asian plans risk the same problem if they think rules alone create size.

There is a difficulty. European authorities warned in 2025 that arrangements with different companies across borders pose dangers within the euro area. This caution reduces testing and features that helped dollar tokens grow. At the same time, global trading focuses on the current two companies, and their market share remains strong. The result is a difficult situation. Strict rules lower risk but also lower options that attract market makers and users. Asia is moving fast, but its new rules copy Europe's cautious approach. If Asian stablecoins don't solve the liquidity problem, they'll end up like Europe's local names, with the same global ranking.

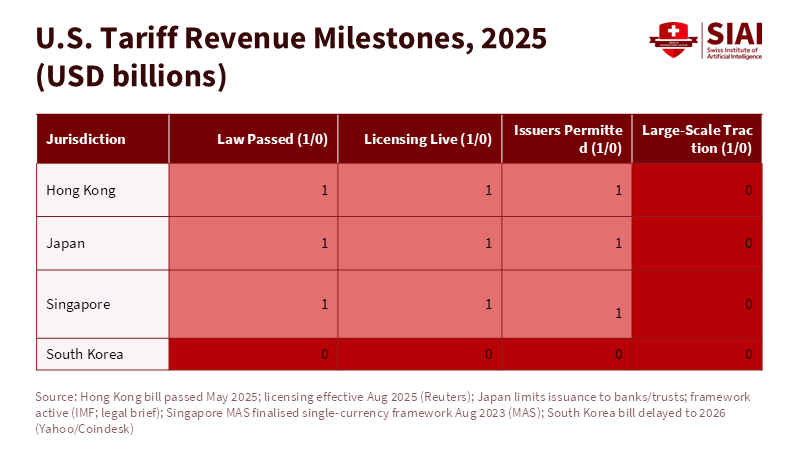

Asian stablecoins: Progress on Paper, Problems in Practice

East Asia is truly making rules. Hong Kong made a stablecoin law and started a permit system. Japan strengthened its rules, so only banks and trust companies can issue yen-based tokens. Singapore finished its system. South Korea, a major crypto market, has moved forward with plans but remains mired in debates over who should issue, how large reserves must be, and how to protect against capital leaving the country. All this shows seriousness, but it doesn't create enough activity. Traders still use the dollar as a standard. DeFi systems still refer to USDT and USDC pools. Merchants still want to settle in the currency their suppliers accept. That last part is key for real-world use beyond trading.

The problems are clear and tough. Rules on money and limits on conversion reduce the appeal of some Asian currencies outside their countries. Treasury teams want fast, sure exchange, and they want companies that already face global demand. Without that, spreads grow. The more an Asian issuer lowers those spreads through activity, the more it spends to get what dollar companies receive for free—the added benefit of size. Europe couldn't purchase that benefit, and Asia can't either. This isn't a criticism of policy. It's an observation about the market. In crypto, liquidity is both product and marketing, and the product with the support is dollar-based.

Asian stablecoins: Two Indicators and a Limited Path Forward

The start indicator is Europe. After MiCA's stablecoin rules began, the European market became safer and easier to understand, but didn't become central. Euro-based tokens remain a small part of a $280–300 billion stablecoin world led by USDT and USDC. Some euro tokens grabbed share from delisted competitors, but they didn't change the dollar core. The larger trading system, from brokers to DeFi systems, stayed tied to dollar support. This is the picture to remember as Asian programs grow in 2026. The result is regulated national tokens that are useful at home and in select areas, with limited attraction outside those areas.

The second indicator is South Korea's discussion. Here, we see what happens when a large market meets concerns about financial stability. Decision-makers worry that small issuers could create unstable money-like tools and that dollar tokens will continue to lose value outside the country. Central banks prefer bank-issued stablecoins under tight control. The industry wants flexibility to compete. The delay delays launches and the liquidity that local tokens need to challenge dollar companies. If one of Asia's most crypto-smart countries can't align its policy stack, others will face similar problems. The dollar doesn't wait while committees argue.

Should we always be pessimistic? For the market, yes. For specific uses, no. Asian stablecoins can work if they focus on small slices where local currency is the usual unit: payroll in controlled areas, settlement for local e-commerce with bank-level APIs, or B2B areas linked to supply-chain finance where invoices, deposits, and FX hedges are combined. In these areas, the goal isn't to defeat the dollar but to lower costs and FX exposure where local currency already leads. That's a helpful business, not a global currency.

For teachers creating fintech courses, teach students that rules-first approaches are necessary but not sufficient; liquidity is a key design problem. For university finance labs, plans should start with area design and market-maker support, not just contract checks. For managers in education and health, demand settlement in assets that your vendors accept without trouble. When a local stablecoin offers rebates that don't balance wider spreads, the cost falls on your budget. For policymakers, plan to work with dollar systems rather than fight them; require bank-level exchange; and support areas with public-private market-making in select trade routes rather than pursuing general goals.

Some point to rising euro-token volumes and new bank groups as evidence that non-dollar options can grow. These efforts matter, but start from a small point and haven't shifted the center. Others say that commerce and payment standards will help everyone. Perhaps—but early adoption favors the pool, and that pool is in dollars. A final thought is that tighter U.S. rules could open the door for others. That is possible, but 2025 showed the opposite: even as shares shifted among dollar companies, total dollar support at the core continued to grow. For planners in Asia, the forecast is not replacement but being together. The goal is to make being together helpful.

Next Steps: Universities should create projects around problems: area support, exchange control, and working with dollar systems. Ministries should measure success by lower times and the basis between posted and realized FX rates. Exchanges should add local tokens where supported and release metrics as a safeguard. Plan for helpful parts, not global.

Why Most Asian Stablecoins Won't Succeed: The reason goes back to the scale, which belongs to dollar tokens. Asia will follow the rules, but credibility without liquidity isn't success. Europe couldn't do it. The exception will apply where local currency rules apply. The rest will be experiments or tickers.

In conclusion, the dollar decides. The share of dollar-based stablecoins strengthens because every trade confirms yesterday’s choice. Europe started this and found they couldn't do it. They're building pilots and frameworks. The path is targeted. If policymakers accept it, 2026 can be a year of use. If not, the dollar still owns the rails.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Chainalysis. “2025 Global Crypto Adoption Index.” September 2025.

CoinGecko. 2025 Q3 Crypto Industry Report. October 2025.

East Asia Forum. “Market Stacked Against East Asia’s Stablecoins.” January 2026.

Elliptic. “Global Crypto Regulation Landscape — 2024 Review.” November 2024.

European Central Bank. “Stablecoins: Still Small in the Euro Area, but Rising Risks.” November 2025.

European Parliament. “Digital Assets: EU Regulatory Framework, Market Uptake, Risks.” November 2025.

European Systemic Risk Board. Crypto-assets and Decentralised Finance. October 2025.

Financial News London. “Tether and Circle Continue to Dominate as Stablecoin Market Nears $300bn.” September 2025.

Forrester. “Predictions 2026: Payments Innovation Takes Root.” November 2025.

Gibson Dunn. “Hong Kong Concludes Consultations on Regulation of Virtual Asset Activities.” January 2026.

Hong Kong Monetary Authority. “Regulatory Regime for Stablecoin Issuers.” July 2024–May 2025 updates.

MEXC News. “Euro Stablecoins Face a Critical 2026 Deadline.” December 2025.

Reuters. “Hong Kong Passes Stablecoin Bill.” May 2025.

The Block. “How Crypto Changed in 2025: Five Charts.” December 2025.

Yahoo Finance. “South Korea’s Stablecoin Bill Delayed.” December 2025.

Comment