Agglomeration Won’t Save House Prices: Why Housing Price Deflation Can Hit Big Cities

Input

Modified

Real home prices are slipping—rents cooling and high costs signal housing price deflation Agglomeration can’t beat affordability limits or hybrid work Plan for gentle deflation: lock cheaper leases, support incomes, keep building

Here's the deal with the housing market right now: Even though home prices seem to be going up a little, they're actually dropping when you factor in inflation. The S&P CoreLogic Case-Shiller index rose 1.3% year over year, with consumer prices up 3.0%, for a real drop of about 2%. Rents, extremely high in many cities, are down about 1.1% since last year. Mortgage rates stay above 6%, and vacant homes are increasing. This signals a shift. Big cities are not immune to housing price drops; prices can still fall even with strong job markets and vibrant social scenes. In some areas, like Florida's pandemic boomtowns, tech hubs, and the Mountain West, prices are already falling. The bubble has burst.

So, are home prices really dropping?

Yes. Real home prices are dropping. The Case-Shiller index shows a slight increase, but inflation rose faster. The FHFA index agrees: price growth is slowing. Between 2024 and 2025, prices rose 2.2%, then stayed flat by September. When prices lag behind inflation and wages, home values decline without a dramatic crash. That’s happening now. Prices erode slowly.

Also, rents are getting cheaper, which usually means housing demand is going down. National rents are down about 1.1% from last year, and many new buildings have been completed in the past couple of years. The Census Bureau says the rental vacancy rate is 7.1%, up from 6.9% last year, indicating the market is cooling. The constructed buildings are now available, adding to the pressure in many cities. Even if people can't afford to buy houses because of interest rates, lower rents weaken the argument that cities are so crowded that prices will always stay high.

People can only afford so much. Mortgage rates are staying around 6.2% this month. Wage growth has slowed to about 3.5% per year, and many measures indicate housing remains unaffordable. The Atlanta Fed's HOAM index shows that the typical household can't afford the typical house in most places, and other reports say that homes are less affordable than usual in most counties. Price numbers can stay steady for a while, but when the cost of buying a house rises faster than incomes, fewer people can afford to buy, and prices actually go down. You don't need a recession for housing prices to fall; you just need math.

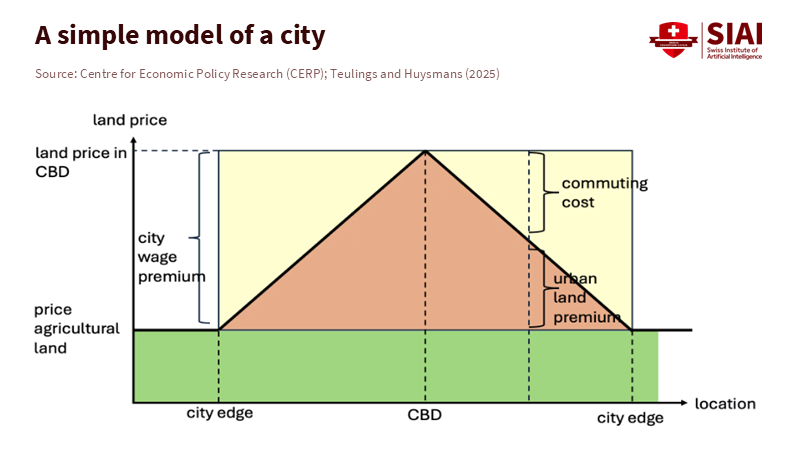

Cities are great, but they still have to be affordable

Economists are correct that big cities are valuable. They have many jobs, information, and connections that boost productivity. But recent studies show that remote work has made cities less attractive and changed where people want to live. Cities are still great, but they're not as important as they used to be. Now that it's less important to be close to work, prices in city centers aren't as high as they used to be, even in cities with a lot of talent. That's what some new papers have found by examining how people move, how much they earn, and prices across different zip codes.

We also need to be realistic about wages. Average hourly earnings rose 3.5% year over year, a slower pace than before, suggesting the job market is cooling. Mortgage rates have fallen a little, but they're still much higher than during the pandemic. There's still a big gap between what people earn and what it costs to buy a house. In some areas, like the Sun Belt and some tech cities, that difference, plus rising insurance costs and new apartments, has led to prices actually dropping this year. The idea that having a lot of talent will keep prices high can't overcome people's budgets and borrowing costs.

The key thing to remember is that cities are still valuable, but now they have to compete with remote work, slow wage growth, and a lot of new apartments. This makes it harder for landlords to raise rents, which slows the rate of home price increases. The result is complicated: Some global cities still have tight rental markets in certain areas, while others are seeing prices correct. Overall, the pattern is that housing prices are slowly declining in reality, with the biggest drops in the places that rose the most during the pandemic.

What China's problems can teach us

China is a good example of how talent doesn't always protect prices. Its biggest cities have a lot of talent, but new-home prices fell 2.4% since last year, and used-home prices fell even more in every city. The government has tried to fix the problem, but the slump that began in 2021 continues. Talent didn't prevent these markets from weakening as demand, population changes, and financial problems worsened. Cities are great, but they're not a shield against everything.

It's not a perfect comparison – China has different problems with developers and too many empty buildings – but the message is still important. Having a lot of talent doesn't guarantee that housing prices will rise if people's incomes don't grow and there are too many homes available. Beijing and Shanghai are still important to the economy, but prices still fell. This should make people more careful about saying that cities alone will keep prices high, especially when job markets weaken and borrowing costs rise. Housing prices can still go down, even with a lot of talented people.

What this means for schools and governments

This is happening right now. Universities and school districts are hiring people into housing markets that are changing: staying high in some areas but softening in others. If housing prices are going down a little, schools can take advantage of it. They can sign long-term leases and help employees find housing at lower rents as new buildings become available. Nonprofit developers near campuses can buy apartment buildings at better prices than before. If schools plan for slower rent growth, they can save money, help more people, and keep employees from leaving. This also applies to community colleges that help train the workforce. Lower costs can be used to guarantee student housing, shorten waitlists, and make stipends more predictable.

Governments should focus on what's happening, not just hope for the best. First, they should keep housing affordable by allowing shelter inflation to fall without triggering a construction crash. This means maintaining permits and inspections consistent, making it easier to convert offices into apartments, and avoiding sudden rent policies that halt new construction. Second, they should offer down-payment assistance with rules that consider today's income changes. Wage growth has slowed down, and the unemployment rate has risen to 4.6%, so they should help people buy homes without causing prices to spike again. Third, they should treat the AI transition as a risk to incomes, not just assume that it will cause job losses. About 40% of jobs could be affected by AI, mostly in developed countries. Training and wage insurance are more important than ever for maintaining stable housing. Talent is important, but it can't pay a mortgage on its own.

We shouldn't expect prices in the most expensive areas to rise quickly. Mortgage rates near 6.2% are better than before, but still high compared to the 2010s. Many people are stuck with low-interest loans, which limit their ability to buy and sell. Builders are using price cuts and incentives to sell homes, even though they're not very confident. These aren't the signs of a quick price surge. They're signs of a slow shift where real prices can fall or stay the same while numbers hide the true adjustment. It's just math.

The last housing cycle taught us to fear collapse and chase growth. This one requires patience. In the United States, real home prices are already falling, rents are getting cheaper, and vacancy rates are rising a bit. Mortgage rates have fallen slightly but remain a problem. Job markets are cooling off, and wage growth is slow. In China, prices have fallen even in areas with abundant talent. The takeaway is that talent and connections are valuable, but can't overcome budget problems. Leaders in education and local government should plan for a world in which housing prices can fall without triggering a crisis. They should lock in lower costs through innovative leasing, targeted buying, and reasonable assistance. They should protect incomes with training and wage insurance as AI becomes more common. They should change the rules to keep construction steady. The goal isn't to fight the market but to make the system work, so that falling real prices create possibilities for stability.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Apartment List. (2025). National Rent Report (December 1, 2025 update).

ATTOM. (2025). Q3 2025 U.S. Home Affordability Report.

Bureau of Labor Statistics. (2025a). The Employment Situation—November 2025.

Bureau of Labor Statistics. (2025b). Consumer Price Index—September 2025.

Federal Housing Finance Agency. (2025a). U.S. House Price Index Report—Q3 2025.

Federal Housing Finance Agency. (2025b). HPI data tools and release calendar.

Freddie Mac. (2025). Primary Mortgage Market Survey (PMMS)—Weekly data, December 2025.

International Monetary Fund. (2024). Gen-AI: Artificial Intelligence and the Future of Work.

Monte, F., Porcher, C., & Rossi-Hansberg, E. (2023, rev. 2025). Remote Work and City Structure (NBER Working Paper No. 31494).

Mondragon, J. A., & Wieland, J. (2022, rev. 2025). Housing Demand and Remote Work (NBER Working Paper No. 30041).

Reuters. (2025, December 15). China’s home prices slide further in November.

S&P Dow Jones Indices. (2025, November 25). S&P CoreLogic Case-Shiller U.S. National Home Price Index—September 2025 report.

U.S. Census Bureau. (2025). Quarterly Residential Vacancies and Homeownership—Q3 2025.

Federal Reserve Bank of St. Louis (FRED). (2025). S&P CoreLogic Case-Shiller U.S. National Home Price Index (CSUSHPISA/CSUSHPINSA). Zillow. (2025). U.S. and metro home value trends (ZHVI; October–December updates).

Comment