Italy’s Fiscal Rehab, France’s Drift, and Why US Fiscal Sustainability Now Shapes Education

Input

Modified

US fiscal sustainability is strained; interest now tops defense Italy rebounds with primary surpluses; France lags with 5%+ deficits A near-term US primary surplus would stabilize debt and shield education

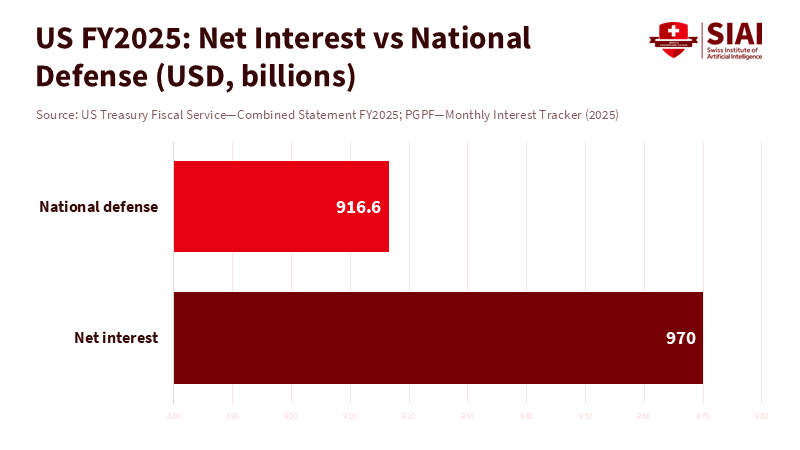

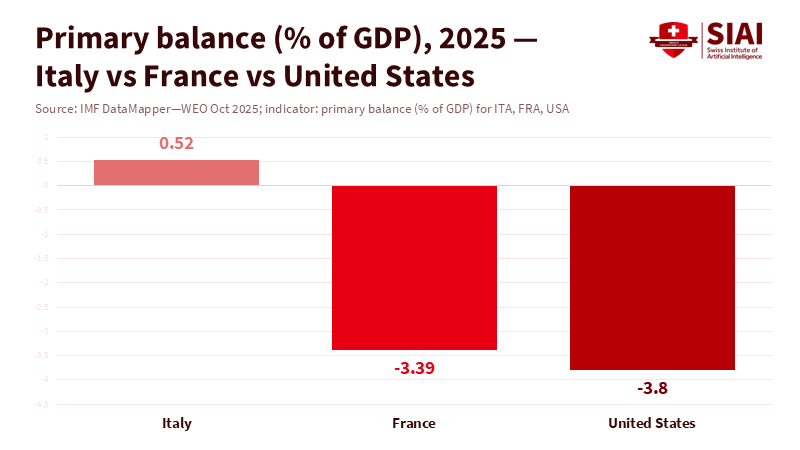

Interest on the US national debt now exceeds defense spending—a tipping point for fiscal sustainability debates. In 2025, the United States spent about $970 billion on net interest, roughly 3 percent of the economy, and that figure is rising. Interest is not just a future risk; it is a rapidly growing present expense, rising even when Congress stands still. Italy once served as a warning sign. Now, it has reduced its deficit to around 3 percent and achieved a primary surplus. France, in contrast, faces deficits above 5 percent of GDP and pressure on its ratings. The US increasingly mirrors France, not Italy, in crucial fiscal health measures. School districts and universities feel this strain as interest costs crowd out education budgets. US fiscal sustainability is no longer abstract; it directly curtails the future of public education.

Reframing US Fiscal Sustainability: The Flow Beats the Stock

The public cannot afford to focus on debt-to-GDP ratios alone any longer. That perspective dangerously obscures the pressing reality: annual deficits and spiking interest costs now drive the crisis. The federal deficit in 2025 stood at a staggering $1.8 trillion, almost 6 percent of GDP, even as revenue held strong. Alarmingly, debt service has surpassed defense spending and will continue to do so for years to come. This marks a new, critical phase we ignore at our peril. Without urgent action to reach a primary balance—matching revenues to non-interest expenses—debt will outpace the economy and choke off public investment. Education will be among the earliest casualties as shrinking discretionary budgets trigger cuts.

A second change goes beyond headline debt. When assessing the fiscal gap, which considers the current value of pension and health benefits, the US appears weaker than Italy. This reality matters. It suggests that future taxpayers will face a higher lifetime tax burden here unless policies change. Italy still has a higher total debt, but it has improved its flow position by generating primary surpluses and committing to reforms aligned with EU goals. The US has not made similar commitments. The clear lesson for education is this: if we cannot support current services while preventing debt from increasing as a percentage of GDP, we will have fewer teachers, less upgraded equipment, and reduced student aid in the future. This is the real impact of US fiscal sustainability.

The rise in interest rates adds urgency. Independent budget groups now predict net interest will approach 3.2 percent of GDP and reach 4 percent by the mid-2030s if current policies remain in place. This projection assumes short-term rates will fall from current levels. If they do not, costs will rise even quickly. Education leaders should prepare for a future in which interest claims a significant share of new revenue for many years, not just months. The current situation is not neutral; it slowly shifts resources away from classrooms and research labs.

Italy’s Recovery Path Is Real—and Instructional

Italy’s experience offers a clear lesson: deliberate fiscal consolidation can change national prospects. Its deficit dropped to about 3 percent of GDP, and a primary surplus is expected, which should lead to market upgrades. Takeaway: Even with slow growth and political turmoil, a steady path toward primary surplus improves a country’s fiscal outlook and credibility.

How did Italy achieve this? Part of the answer lies in administration. Tax collection has improved. Another part is institutional; recovery fund milestones enforced discipline and a timeline. It is also a strategic choice to focus on the primary balance rather than short-term claims. The IMF’s 2025 review praises Italy for returning to a primary surplus and advises an ongoing focus to ensure debt continues on a downward path. The Commission’s fall forecast suggests a primary surplus of about 0.9 percent of GDP in 2025. This approach may not be glamorous, but it is steady. Education systems can learn from this perspective. Associate growth with proven outcomes and designate one-time funds for specific short-term needs.

There is also a political takeaway. Italy’s upgrade occurred amid tumultuous domestic politics and mixed economic growth data. Yet, investors looked at the flow and the overall framework and lowered risk assessments. This contrasts with the US, where economic growth and a dominant currency can mask fiscal problems until rising interest rates begin to affect budgets. For schools, the lesson is clear. A reliable multi-year plan is more effective than last-minute fixes. Build reserves in good years. Use those reserves to protect key priorities when financial conditions become tougher.

France, the UK, and the US: When Drift Becomes a Regime

France is a pressing warning. The deficit hovered near a distressing 5.8 percent of GDP in 2024, with little improvement forecast for 2025. Mounting rating pressure forced a September downgrade to A+ and left France vulnerable to further warnings because of the absence of a credible debt stabilization plan. Interest costs threaten to soar as a share of GDP—regardless of hoped-for growth. The political gridlock is dire; the fiscal math is worse. Without an urgent plan to secure and sustain a primary balance, relentless debt service will slash public services and force harsh tax hikes to tread water. Higher education and research are poised to be early targets for cuts as fiscal pressures mount.

The UK faces a less severe but similar issue. Public sector net debt is in the mid-90s percent of GDP and is expected to peak near 97 percent before declining later in the decade. Large financing needs and significant debt repayments pose a risk. This does not necessarily mean a crisis. However, it suggests less capacity to fund skills, labs, and campus improvements unless the primary balance improves. The broader concern is that advanced economies with high debt, ongoing deficits, and rising interest rates are converging toward a state where interest consumes a larger share of resources. The US is on that path now. Reversing this trend will require policy decisions, not mere luck.

For the United States, the comparison is striking. The deficit was $1.8 trillion in 2025. Debt service has surpassed defense spending and is expected to overtake discretionary spending later this decade. When considering the fiscal gap, the US appears weaker than its headline debt suggests, given the present value of its pension and healthcare commitments. Therefore, “US fiscal sustainability” needs to evolve from a catchy phrase to a practical plan focused on achieving primary balance. Without that, interest will continue to grow faster than classrooms and laboratories can accommodate.

Protecting Classrooms Through US Fiscal Sustainability

Education leaders’ main takeaway: increase resilience now. Use one-time revenue for overdue needs, support high-performing programs that draw outside funding, and continually seek operational efficiency to weather fiscal pressure. Each action helps preserve quality as budgets tighten.

Policymakers need to concentrate on the flow of funds. The quickest path to US fiscal sustainability is establishing a near-term primary balance that stabilizes debt. This requires a broader tax base, fewer specific exemptions, and better enforcement, rather than punitive, higher rates that hinder growth. On the expenditure side, it means prioritizing high-impact investments in people and technology while minimizing low-impact transfers that waste resources. Italy’s example shows that consistent primary surpluses can mitigate risk even in a low-growth environment. France’s struggles reveal that postponing reforms increases interest costs and limits options. The US still has strong markets and the advantages of the dollar. Yet, these advantages do not pay interest; a plan targeting primary balance does.

The state level is also essential. Governors and state legislatures should create “rainy-day for interest” rules. When federal net interest rises as a share of GDP, states should automatically reserve a portion of revenue growth for K-12 and higher education budgets. States can also expand income-share agreements and outcome-based grants that attract private funding for workforce programs, ensuring transparency. This approach is not austerity; it serves as a safeguard. It helps keep teachers in classrooms and labs operational as the federal budget tightens.

Greece’s transformation strengthens the action case. A decade ago, it was a warning sign for the eurozone. Now it runs a headline surplus, maintains significant primary surpluses, and has a declining debt ratio while gaining a stronger voice in European fiscal discussions. This change did not demand perfection. It required discipline, improved tax collection, and meaningful growth reforms. The US has more room to maneuver and more tools than Greece did. It should take action. US fiscal sustainability is essential for consistent investment in talent. Without it, we risk cutting the very areas that yield the best returns because interest expenses leave us with no other options.

This opening statistic is worth repeating because it summarizes the entire situation. Net interest reached about $970 billion in 2025, surpassing defense costs. It is not just a number; it represents a budget line that will continue to expand. Italy has shown that a course correction is doable. France illustrates that delays complicate the work and limit choices. The US must decide which path to take. A clear plan to reach a modest primary surplus would reduce risk, slow interest growth, and shield classrooms from future battles over resources. This plan should become a central focus of education policy, as nothing else will matter if interest continues to drain our future. US fiscal sustainability is not just about bond calculations. It is about honoring our commitment to students, researchers, and communities that depend on public education for success.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

American Action Forum. (2025, Oct. 28). Sizing Up Interest Payments on the National Debt.

CBO. (2025, Jan. 17). The Budget and Economic Outlook: 2025–2035.

CBO. (2025, Nov. 10). Monthly Budget Review: Summary for Fiscal Year 2025.

Committee for a Responsible Federal Budget. (2025, Nov. 11). 12-Month Deficit Totals $1.7 Trillion; Debt Approaches 100% of GDP.

European Commission. (2025, Nov. 17). Economic forecast—France.

European Commission. (2025, Nov. 17). Economic forecast—Italy.

Fitch Ratings via Reuters. (2025, Sept. 12). Fitch downgrades France’s rating to A+.

IMF. (2025, Jul. 21/22). Italy: 2025 Article IV Consultation—Press Release and Staff Report.

Moody’s via Reuters. (2025, Nov. 21). Moody’s grants Italy its first rating upgrade in 23 years.

OBR. (2025, Nov. 26). Economic and Fiscal Outlook—November 2025.

PGPF. (2025). Interest Costs on the National Debt—Monthly Interest Tracker.

Reuters. (2025, Sept. 29). Italy sees 2025 deficit around 3% of GDP, in line with EU rules.

U.S. Treasury via AAF. (2025, Oct. 17). U.S. Treasury: FY 2025 Deficit Totaled $1.8 Trillion.

VoxEU/CEPR. (2025, Dec. 11). The US is in worse fiscal shape than Italy.

W34340, NBER. (2025). Why Italy May Be in Better Fiscal Shape than the US.

Comment