Make It Real: Why Europe Must Finish the Job on a European Safe Asset

Input

Modified

EU-Bonds cost more than Bunds due to design and index rules Make them sovereign: permanent issuance, one agency, hedging tools, clear own resources Tighter spreads free billions for education and investment

In mid-2025, the European Commission had €661.6 billion in outstanding EU bonds and was on track to reach €1 trillion by the end of 2026. However, these bonds continue to trade at a persistent premium, roughly half a percentage point higher than German Bunds for five-year terms. They are priced off the swap curve, similar to agency or supranational paper, not like core sovereign debt. This gap isn't due to credit issues. EU-Bonds are AAA-rated, track closely with Bunds in times of stress, and are now central to Europe’s funding plans. The gap is about design and political choice, including classification, index rules, and a temporary issuance horizon. This added cost is high. Each basis point paid above actual “safe asset” levels drains public budgets for health, skills, and schools without increasing security or growth. If Europe wants a European safe asset that functions like US Treasuries, it must stop hesitating and act like a sovereign. Anything less leaves money—and resilience—on the table.

The European safe asset is still priced like a stranger

The EU now issues bonds at scale and speed. By June 2025, outstanding EU bonds reached €661.6 billion, and by November, the total debt stock was around €733 billion. The Commission has openly signaled continued issuance under its unified funding approach and became the largest net issuer of euro-denominated debt in 2025. The market has reacted. Liquidity has improved, order books are robust, and the investor base has expanded across central banks, asset managers, and bank treasuries. On paper, the building blocks of a European safe asset are in place.

However, the reality is different. EU-Bonds trade at a discount to top euro sovereign bonds and are priced off swaps rather than the sovereign curve. While liquidity has improved since the early days, bid-ask spreads and free float still lag behind Bunds. The ECB’s analysis is precise: limited index inclusion (restricted to “supranational” categories) and the lack of derivatives tied to EU-Bonds affect pricing and market depth. Classification decisions by major index providers have reinforced this segmentation. In 2024–25, key benchmarks treated EU-Bonds as “sovereign,” reducing automatic demand from passive investors. Addressing these structural issues empowers Europe to shape its financial future and reduce unnecessary costs.

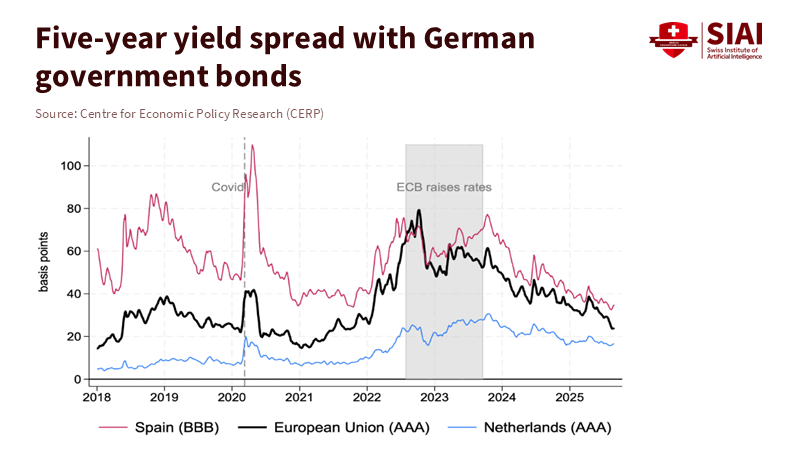

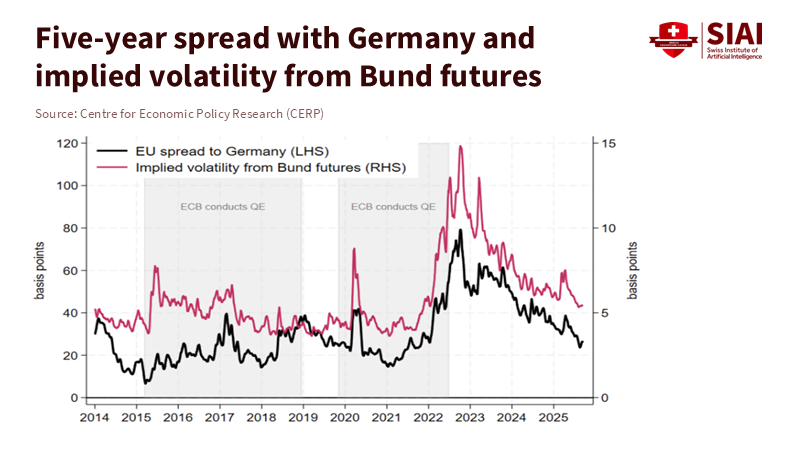

This cost becomes evident during times of stress. VoxEU analysis shows that five-year EU-Bond spreads over Bunds have averaged about 50 basis points since 2022, sometimes widening sharply when investors doubt the ECB's willingness to backstop markets. This is a premium sensitive to policy rather than credit. Improving the system and establishing a permanent, sovereign-style program can deliver tangible benefits: saving billions over time, easing pressure on national budgets, and supporting schools, training, and research. Such reforms can foster a more resilient and efficient European financial system, directly benefiting public services and long-term stability.

Index inclusion and market structure: the bold steps Europe keeps delaying

Benchmark status is vital for achieving accurate, safe asset pricing. Currently, many large investors must stick to government-bond indices; if an issuer falls outside those indices, demand automatically decreases. One study estimates that indexed demand for EU-Bonds would be over 80% lower than for similar sovereign bonds under current rules. This is a mechanical disadvantage that Europe can eliminate only by changing how the market perceives and trades its bonds. Two primary actions are crucial: formal sovereign-style treatment in major indices and a risk-management system.

Index providers have been reluctant. MSCI and ICE have delayed upgrading EU bonds to sovereign status, citing mixed feedback and concerns about permanence and liquidity. This choice immediately weakened prices and highlighted a broader truth: without a long-term commitment to issuance and a unified curve, index committees will remain cautious. Europe cannot wait for the market to “come around.” It must tackle the criteria directly: commit to permanent, scaled issuance; publish a clear term structure; and consolidate communications among EU borrowers so investors recognize one curve, one brand, and one rulebook.

Structuring is crucial. The ECB has identified three gaps: limited index participation, pricing based on swaps rather than a sovereign benchmark, and the absence of futures or swaps referencing EU bonds. Europe should create and support a comprehensive derivatives ecosystem—benchmarked futures, cleared interest-rate swaps, and standardized repos—so risk managers can hedge EU duration risk as easily as they can hedge Bunds. This requires active collaboration with exchanges, clearinghouses, and dealers. It also necessitates a single debt management platform—a European Debt Agency—to consolidate issuance by the Commission, ESM/EFSF, and even parts of the EIB program into a coherent structure. The reward is lower volatility, tighter spreads, and a European safe asset with the depth that investors expect.

From temporary programs to a fiscal anchor: own resources without fears of hidden taxes

Scale is necessary, but permanence is essential. The recovery-era legal framework will end net issuance by 2026 unless leaders act. Markets are aware of expiration dates, and so are index committees. Extending and expanding issuance—across defense, green transition, and digital infrastructure—will help. So will a clear, rules-based “own resources” method that repays debt without ongoing ad-hoc negotiations. Europe has proposals on the table: allocate a share of emissions-trading revenues and part of Carbon Border Adjustment Mechanism receipts to the EU budget, and add contributions tied to reallocated multinational profits under global tax reforms. These are modest, transparent funding sources—not a hidden, broad-based income tax—and they address the specific concern that supranational debt requires supranational taxing authority over households.

The political worry is understandable: once Brussels acts like a sovereign, won’t it seek tax authority like one? The evidence suggests a narrower path. The EU already utilizes “own resources” that do not involve new personal taxes: a plastics levy, ETS-based contributions, and now potential CBAM shares and Pillar One revenues. These raise a few to several billion euros annually—small in comparison to national tax systems, but enough to support the stable service of EU debt. This reliability lowers the risk premium that investors demand. Market signals support this: as the EU unified its funding strategy in 2023–25 and communicated a larger, steadier supply, spreads decreased from their mid-2023 peaks. The lesson is clear. A predictable structure and cash flows reduce costs. A European safe asset needs both.

This issue will become more urgent if Europe introduces common defense bonds. Analysts expect significant multi-year needs and argue that joint instruments would be cheaper than many national options and better for coordination. If defense debt is time-bound and rule-bound—with strict scopes, limits, and sunset clauses—Europe can meet strategic objectives without compromising fiscal accountability. Good design alleviates concerns about federalism while maintaining the advantages of scale.

Why should schools, universities, and training providers care about the European safe asset? Because the cost Europe incurs to borrow influences every national budget cycle. A credible EU-level safe asset lowers the reference rate across much of the euro yield curve. More affordable funding and smoother market functioning lessen the need for sudden fiscal cuts when volatility arises. This safeguards long-term spending—hiring teachers, apprenticeship programs, digital curricula, campus upgrades—that cannot be easily adjusted with every spread fluctuation. During the banking stress of 2023, EU-Bonds closely tracked Bunds and maintained value; that is the resilience we should secure, not dismiss as a fortunate coincidence.

Capital markets also matter for education funding. Many universities and research institutions raise capital through bond markets or through public-private partnerships. When benchmarks are weak and hedging options are limited, costs increase, or projects are delayed. A complete derivative system for EU bonds would enable issuers to manage duration and interest-rate risk more effectively. A more robust repo market would tighten financing spreads for investors holding EU-Bonds as collateral, making them more appealing in asset-liability strategies. The overall result is a more secure baseline for planning. It becomes easier to commit to long-term learning reforms when the financial foundation is solid and predictable.

Anticipate the critiques. Some will argue that a sovereign-style EU curve pushes out national bonds or reduces incentives for reform. However, the evidence indicates otherwise. A thicker, more liquid safe asset enhances the transmission of monetary policy and encourages risk-sharing, especially for banks’ sovereign portfolios that remain home-oriented. It can also lower average funding costs for weaker credits without standardizing all fiscal decisions. Others will claim that “markets don’t care about labels.” But markets do care about index eligibility, hedging tools, and issuance schedules. The 2024–25 decisions by index providers affected prices—a reminder that structure influences demand. Fix the structure, and watch the premium diminish.

What should policymakers do now? First, legislate a permanent, sovereign-style issuance mandate beyond 2026, with a published multi-year auction and syndication calendar that covers the curve. Second, establish a European Debt Agency to unify branding, investor relations, and the benchmark ladder across Commission programs and (when possible) ESM/EFSF and selected EIB lines. Third, collaborate with exchanges and clearinghouses to list and clear EU-Bond futures and standardized swaps; inject liquidity through market-making agreements and transparent securities lending. Fourth, complete the “own resources” package linked to ETS, CBAM, and Pillar One to secure service without new personal taxes. Fifth, reignite discussions with index providers, equipped with these reforms, and seek time-bound roadmaps for including EU-Bonds in sovereign categories. These are bold moves, but also fundamental. They turn political resolve into lower spreads.

And what should education leaders do? Seize this moment. Align capital plans with the scenario of falling premiums that reforms can achieve—stress-test budgets at current spreads and at 25–30 basis points tighter. Prepare ready-to-launch projects in digital learning, teacher training, and campus efficiency that can commence when funding opportunities arise. Join the policy conversation: when ministries advocate for market improvements, the education sector has a stake. Lower structural premiums expand resources for every classroom.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Europe has created the foundation of a safe asset, but still hesitates to embrace it fully. The key statistic is the spread: five-year EU debt has averaged about 50 basis points over Bunds since 2022, despite its AAA rating and crisis-tested performance. This gap reflects caution. It stems from index classifications, swap-curve pricing, limited derivatives, and an issuance horizon with an end date. The solution is straightforward but impactful: make issuance permanent, unify the curve, complete the “own resources” package, and ensure inclusion in sovereign categories along with a complete hedging toolkit. Do that, and the European safe asset transforms from a mere concept to the cornerstone of Europe’s budgets, including those funding teachers, labs, and apprenticeships. The call to action is clear: stop treating EU-Bonds like orphans. Integrate them into Europe’s market structure—and allow every student and citizen to benefit from the resulting lower costs.

Bletzinger, T., Greif, W., & Schwaab, B. (2023). The safe asset potential of EU-issued bonds. VoxEU.

Bloomberg / ICE (2025). EU Fails in Bid for ICE to Add Joint Debt to Sovereign Indexes (19 Aug 2025).

ECB (2024). Do EU SURE and NGEU bonds contribute to financial integration? Financial Integration and Structure in the Euro Area 2024 (Box).

ECB (2025). Financial Stability Review (Nov 2025) and related materials.

European Commission (2025a). Funding plans: EU-Borrower & Investor Relations.

European Commission (2025b). Press release: European Commission issues €5 billion in its 10th syndicated transaction of 2025 (17 Nov 2025).

European Parliament Research Service (2023). System of own resources of the European Union (Briefing).

FT (2024). EU bonds fall after MSCI declines to include them in sovereign debt indices (13 Jun 2024).

OMFIF (2025). Yet another reason the EU should borrow more (12 Dec 2025).

Reuters (2025a). Markets eye new wave of joint European bonds in rush to boost defence (26 Feb 2025).

Reuters (2025b). The dawn of euro defence bonds? (11 Mar 2025).

VoxEU (Bonfanti, G.) (2025). A European safe asset will require bolder steps (10 Dec 2025).

Comment