From Tariffs to Teachers: Turning the Industrial Subsidy War into a Skills Truce

Input

Modified

Industrial subsidy wars starve education just as industry needs more skilled workers Rivalry is shifting from price to rules, making compliance and MRV literacy essential Redirect subsidies into a “Skills Safe Harbor” that funds verifiable training and apprenticeships

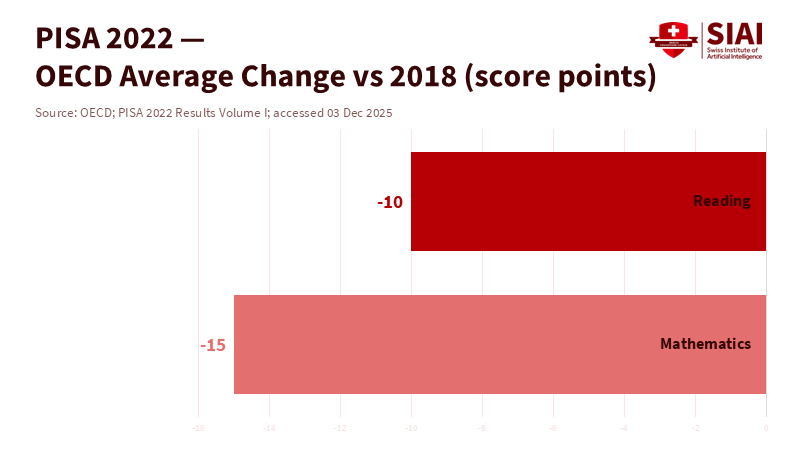

An industrial subsidy war is taking place while the future workforce faces serious issues. Between 2018 and 2022, average mathematics scores across OECD countries fell by almost 15 points, marking the most significant drop on record—about three-quarters of a school year lost. This isn't just a problem for one sector; it's a call for policymakers to recognize their role in shaping a resilient system. It happens just as governments invest in batteries, chips, and green steel, while schools should be preparing students to operate those plants instead of merely observing from a distance. Suppose the next phase of competition hinges on tariffs, quotas, and local-content rules. In that case, the fallout won't be limited to factories. It will affect teacher hiring, curriculum time, and student choices. The question for education is straightforward: should we keep funding this price war, or should we redirect that money into developing the human capital that can truly win?

The industrial subsidy war is hollowing out the skills base

Industrial subsidies have increased to levels not seen since the financial crisis. The OECD's latest report shows that direct industrial subsidies for listed firms exceeded USD 108 billion in 2023, with below-market loans focused mainly in China. Meanwhile, the United States has added extensive tax credits. If Congress were to repeal the energy provisions of the Inflation Reduction Act, federal revenue could rise by an estimated USD 852 billion from 2026 to 2035, reflecting a level of implied support similar to that provided by the Inflation Reduction Act. These sums exist alongside rising trade defenses: the EU plans to impose countervailing duties on Chinese EVs in late 2024, and the U.S. plans a 100% tariff on Chinese EVs in 2024. None of this comes for free; every euro and dollar lost in tax revenue or collected at the border is money and political support that cannot be invested in teachers, labs, and apprenticeships, thereby weakening education capacity and skills development efforts.

The global energy workforce now exceeds 67 million people, adding nearly 2.5 million jobs in 2023, driven by growth in clean energy. Battery factories, grid upgrades, and efficiency retrofits require electricians, coders, and technicians who can adhere to strict safety and data standards. Yet, the pipeline of skilled workers is shrinking just as demand increases. The record decline in PISA mathematics results underscores a broader decline in the very skills that underpin industrial capacity. This isn't an argument against industrial policy; it is an opportunity to shift subsidies toward building measurable human capital, empowering industries and educators to meet future challenges with confidence.

Rivalry has shifted from price to rules—and classrooms bear the cost

Supporters of China's subsidy shift argue that funding can be directed toward 'cleaner' capital expenditures. However, the world's major trade blocs have moved beyond the label on the check to the rules governing market access. The EU's Carbon Border Adjustment Mechanism (CBAM) will begin charging in 2026, and a two-year reporting regime is already in place. This serves as a template: measure what matters, report it, and pay if you can't meet the standards. The battle over EVs reveals a similar trend. Brussels has imposed definitive duties on subsidized Chinese battery electric vehicles (BEVs), and discussions have included minimum-price agreements as a regulatory alternative to blunt tariffs. The message to educators is clear. Price competition is shifting to compliance competition, requiring skills in measurement, reporting, verification (MRV), product standards, and trade law understanding-essential employability skills for the future workforce.

Concerns about Chinese subsidized exports are not limited to the "West." Japan has initiated anti-dumping investigations into galvanized steel from China and South Korea. At the same time, South Korea has placed provisional duties of up to about 38% on Chinese steel plates after finding that local producers are harmed. China's steel exports have remained high through 2025, increasing pressure in Asian markets and intensifying calls for regional protection. Southeast Asia's policy debates highlight the challenges faced from both sides: U.S. tariffs and Chinese subsidies can put smaller economies in a tough spot between supply-chain dependence and retaliation risks. If the rivalry escalates, more governments will respond with trade barriers and local content targets, leading to sudden changes in labor demand and forcing schools and training systems to adjust quickly, even though they have not set a timeline.

Redirect the fight: a skills-first truce with strict guardrails

We should change the focus from price to people. Governments could create a "Skills Safe Harbor" within their industrial strategies: any subsidy that supports open, transferable human capital—like apprenticeships, competency-based micro-credentials, safety training, and shared testbeds—would earn reciprocal restraint from trade partners. The guiding principle is neutrality: funds spent on skills shouldn't be used to undercut prices. The enforcement mechanism would be digital: providers must disclose anonymized training outcomes and certification pass rates, audited by independent agencies and listed on a standard registry, similar to CBAM's reporting. This transforms subsidy races into a competition to train better and in greater numbers, instead of simply selling for less. Additionally, it would make the next round of tariffs politically more challenging, as governments would be taxing the crucial upskilling that their industries claim to need.

A skills-first truce wouldn't start from scratch. The energy transition is already dealing with significant labor shortages. Automotive companies and governments have launched reskilling initiatives for high-voltage safety, robotics, and software. Europe's emerging Battery Academy aims to train hundreds of thousands of workers across the value chain. The International Energy Agency (IEA) projects that energy employment will rise again in 2024, with clean energy investment surpassing USD 2 trillion. These developments offer a chance for negotiation: set enforceable minimum training requirements as conditions for market access, and trade some blunt tariffs for pricing commitments tied to apprenticeship quotas and technology-neutral safety standards. This way, competition funds lasting public goods such as skills, standards, and safety, instead of just leaving price gaps.

What schools, universities, and ministries must do now

Education leaders can't wait for trade diplomats to develop a perfect strategy. They should incorporate "trade-and-technology literacy" into core STEM and business courses starting this year. Students need to understand a product's lifecycle as thoroughly as they read a poem: where emissions occur in the supply chain, how standards bodies create tests, and why MRV is essential for export jobs. Teacher teams could establish simple CBAM studios where learners calculate embedded emissions from steel, cement, or batteries using publicly available data, then draft compliance plans. Community colleges and technical schools should offer short, stackable credentials in industrial data logging, EV safety, and battery handling. Universities can create test-and-learn labs with companies, provided that a third of the spots are reserved for teachers from schools serving low-income students. The shared goal is to make understanding regulations and practical safety skills as common as calculus.

Ministries should revise procurement and state-aid rules so that every euro in industrial support translates into verifiable human capital. They should make training outcomes a requirement for grants, monitor completions and wage outcomes over three years, and publish the results. They should require any company receiving a subsidy for battery, solar, or green steel projects to fund teacher externships and provide equipment to partner schools. They should prioritize university-industry partnerships that commit to open standards and publicly available course materials. Immigration and visa policies should be aligned with apprenticeship mobility, enabling credentialed technicians to train in one country and work in another without bureaucratic delays. Above all, they should invest in reversing the drop in math scores through intensive tutoring and evidence-based curricula. The alternative is spending more on market protection than on preparing students to thrive in those markets.

The figure that should guide our next steps isn't a tariff rate. It's the 15-point drop in math scores. This indicates that the current situation—tariffs on one side and unclear subsidies on the other—has not produced the skilled workforce that modern industry needs. Suppose we continue an industrial subsidy war that prioritizes price over quality. In that case, we will continue to undermine the institutions that cultivate individuals capable of winning. A skills-first truce offers a more straightforward path: protect against distortions when necessary, but prioritize and reward investments in clear, verifiable human capital. The global trade system is already transitioning from price battles to rule battles; classrooms are where these rules develop into practical knowledge. Let's invest in them meaningfully. If we don't, we can expect more barriers, more waste, and fewer graduates ready to succeed. The timeline is short, and the stakes are high. Choose teachers over tariffs.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

American Action Forum. (2025, January 8). Evaluating the IRA's clean energy tax provisions.

Chatham House. (2025, October). Trump and Xi won't reset China–U.S. rivalry, so other nations must prepare.

European Commission. (2024, October 28). Definitive duties on BEV imports from China.

European Commission (DG TAXUD). (2023–2025). Carbon Border Adjustment Mechanism: Transitional and definitive phase guidance.

Fulcrum. (2025). Trump's tariffs and China's subsidies: Southeast Asia caught between a rock and a hard place. Retrieved 2025.

GMK Center. (2025, November 7). China increased steel exports by 6.6% y/y in Jan–Oct 2025.

IEA. (2024). World Energy Employment 2024: Executive summary. Paris: International Energy Agency.

OECD. (2023–2025). PISA 2022 Results (Volume I): The State of Learning and Equity in Education. Paris: OECD Publishing.

OECD. (2025, June 23). The state of play of industrial subsidies as of 2023. Paris: OECD Publishing.

Reuters. (2024, May 14). Biden sharply hikes U.S. tariffs on Chinese imports including EVs.

Reuters. (2025, August 6). China steel exports rise despite protectionist backlash.

Reuters. (2025, April 10). EU, China explore setting minimum prices on EVs.

WTO Secretariat. (2025, July 3). Trade Monitoring Update: Latest Trends. Geneva: World Trade Organization.

Yomiuri/Argus via METI & JISF. (2025, August 18). Japan's steel industry urges Tokyo to close anti-dumping loophole.

Yonhap/Reuters. (2025, February 20). South Korea provisionally slaps tariffs on Chinese steel plates for dumping.

Comment