When Supply Chain Resilience Becomes a National Security Cost

Input

Modified

Supply chain resilience has become a national security issue, not just a business strategy When diversification fails, inventories rise and economic fragility deepens Managing dependence now matters more than restoring efficiency

The core of the discussion lies in a simple but telling observation: From 2018 to 2024, several Southeast Asian economies saw their share of certain manufactured goods imported by the United States double. A smaller number of these economies, however, showed a comparable rise in their domestic value-added capacity. This shows that much of the apparent growth is due to goods passing through, not actual production increases. This distinction is important. Policies that mistake growing export numbers for new industrial capabilities are bound to fail. If a country's economic gains come mainly from rerouting goods and acting as a middleman for products made elsewhere, the benefits in terms of jobs, tax revenue, and stronger supply networks will be limited and unstable. On the other hand, if gains result from shifting production and actual domestic output replaces foreign production, the benefits are lasting. This type of growth creates connections to other industries and justifies investing in worker education, logistics, and quality standards. The key to distinguishing between the two scenarios is to determine whether a country is on a path to sustainable, long-term development or simply subsidizing short-lived transit hubs.

Trade: What Reallocation and Rerouting Truly Entail

Trade reallocation is distinct from mere trade expansion. While trade expansion simply refers to a greater volume of trade, trade reallocation specifically describes an economy increasing its productive capacity. This involves building new factories or improving existing ones, expanding local suppliers’ capacity, and seeing wages and skills reflect the shift toward higher-value activities. Reallocation is evident through higher domestic value added per unit of export, increased foreign direct investment focused on production rather than assembly, and stronger connections to local suppliers. Over time, reallocation reduces reliance on imports of intermediate goods, paving the way for higher wages and increased productivity.

Conversely, trade rerouting is more about logistics and legal maneuvers. Goods or their parts are still made in the original country. However, they are shipped through another country to avoid tariffs, quotas, or to take advantage of favorable tariff rules. Rerouting is marked by a rise in gross export figures without a matching rise in domestic value added. The benefits are mainly in warehousing, administrative tasks, and minor assembly or repackaging. While rerouting can quickly inflate export statistics, it rarely leads to widespread gains in manufacturing jobs or strong supply networks. These two processes require very different policy actions. Reallocation calls for industrial policies and workforce training. Rerouting, however, requires customs controls, trade compliance, and investments in port infrastructure. Recognizing this difference was central to recent analysis that separated the export gains of connector economies into these two categories. The analysis cautioned against confusing them.

Determining which process is dominant means looking past the overall export numbers. One practical method is to analyze value added, which involves determining how much of an exported good's value is generated within the country. If the domestic share rises alongside gross exports, reallocation is likely. However, if gross exports rise while value added per unit remains the same or decreases, rerouting is more likely. Gathering data from businesses to track supplier networks and ownership, along with customs tracking of re-exports, can provide added insight. These assessments are crucial for shaping policy choices. A country experiencing reallocation can confidently invest in vocational training, industrial parks, and export-related research and development. A country driven by rerouting should instead focus on tightening trade documentation, renegotiating rules of origin, and prioritizing higher-value logistics services.

Trade Reallocation and Rerouting: Evidence from Six Southeast Asian Countries

To illustrate how these processes unfold, consider six economies often considered together when discussing China-like growth: Vietnam, Indonesia, Thailand, Malaysia, the Philippines, and Singapore. Vietnam’s overall numbers are remarkable. Electronic exports have grown quickly in recent years, and investment in contract manufacturing has risen. However, a deeper examination of the data reveals a mixed picture. There is strong reallocation in specific areas of electronics assembly, along with substantial rerouting in low-value exports that still rely heavily on Chinese content. Essentially, Vietnam demonstrates genuine capacity-building alongside transit trade corridors, and policy needs to be designed accordingly.

Indonesia presents a different picture. Its large domestic market and resource base make it suitable for reallocation in areas such as processed commodities and emerging domestic electronics assembly. Protectionist measures and local-content requirements, though, can cause distortions. When companies meet local-content targets by simply routing components through secondary suppliers or doing minimal local processing, the gains may be superficial. Indonesia's total export figures, which reached hundreds of billions of dollars in 2023, reflect strong sectors such as palm oil and minerals. Still, improvements in electronics and higher-value manufacturing remain inconsistent and depend heavily on policy choices. This mix indicates some reallocation but also areas where rerouting and regulatory workarounds explain export increases.

Thailand and Malaysia demonstrate the importance of sectoral structure. Thailand’s automotive industry, with its localized supply chains and established foreign-owned factories, is a prime instance of reallocation. Vehicle assembly and parts production offer stable jobs and benefits to suppliers. Malaysia’s semiconductor and electronics exports can show substantial overall gains. However, much of this trade is part of global supply chains in which testing, packaging, or intermediate fabrication occurs within a narrow segment of the value chain, sometimes with imported content accounting for most of the final cost. When exports rise, but domestic content does not, the effect resembles rerouting. This provides a valuable role for logistics and services companies, but does not represent a broad industrial shift.

The Philippines and Singapore are opposites. The Philippines has seen growth in electronics assembly and business process services. Whether higher-value manufacturing succeeds depends on supplier connections and improved skills. Singapore serves as a high-value hub for logistics, finance, and complex re-exports. Its gains come largely from value-chain services, not from reallocating low-value manufacturing. These differences matter, as reallocation and rerouting bring different social and financial returns. Reallocation can widen the tax base and create payroll gains to support social spending. Rerouting may deliver narrow gains for companies, mostly in ports and trading firms. Policymakers should not equate total exports with development.

Policy Responses and Practical Implications

If a country is experiencing reallocation, the right policy steps are clear. Invest in skills that match new jobs. Reduce obstacles in power, transportation, and customs. Create incentives for suppliers to localize. Public-private partnerships that align training with company needs help local workers transition into higher-value roles. Fiscal policy is also key. Tax credits for capital investment and for research and development can secure multinational projects within expanded supply networks. Though costly, these choices are justified because reallocation creates lasting economic benefits.

If a country is primarily a hub for rerouting, policymakers should pivot. The focus should be on tightening customs, enforcing rules of origin, and boosting service exports to capture more value from transit trade—this includes logistics, ports, and standards certification. Encourage transitions toward reallocation by tying export approvals to enforceable local-content rules and using logistics revenue to fund education and infrastructure to grow manufacturing. Do not expect quick industrial gains from rerouting alone. Target finance and training investments carefully. Workforce training yields more return in regions already reallocating.

Trade policy tools matter. Preferential trade agreements and clear rules of origin boost reallocation by making domestic production more valuable in key markets. Weak rules or loopholes encourage rerouting. When a major market imposes tariffs on certain goods, companies may respond by minimal assembly or paperwork in another country—a typical rerouting strategy. Detecting these patterns needs shared customs data, better input tracking, and company surveys to estimate domestic content. Partners and donors can help by funding data systems to show if growth is real or just statistical. The good news is that the methods are practical. Value-added accounting, input-output tracking, and surveys provide policymakers with evidence to choose between more education funding and tighter customs enforcement.

It is vital to anticipate common criticisms. Some argue that rerouting still presents an opportunity, suggesting that transit trade builds management skills and leads to future reallocation. While this can be true, especially when logistics firms reinvest profits into local capacity, it is important to consider the alternative. Many countries have experienced transit booms that have left little lasting manufacturing in their wake. The best approach is to treat rerouting as a temporary state. Use the financial gains from logistics to fund strategic investments in education, standards, and supplier development, but avoid overcommitting to industrial subsidies unless there is clear proof of rising domestic value added.

Base Actions on Proof, Not Just Invoices

The initial point that rising export invoices can mask transit, rather than true production, should change how we measure success. Policies based solely on gross export growth risk misallocate limited public funds. Instead, governments and donors should take a diagnosis-first approach. Measure domestic value added, track supplier networks, and examine investment plans at the company level. Where reallocation is happening, increase investment in training, infrastructure, and standards. Where rerouting is dominant, focus on customs integrity, logistics efficiency, and converting transit revenue into development funding. In Southeast Asia, the situation is varied. Genuine improvements in industry exist alongside active corridor rerouting. This variation presents an opportunity, allowing each country to develop a strategy that aligns with its competitive advantages while aiming to turn temporary transit into lasting capability. The key policy question is not simply whether export shares increased, but whether those shares created real jobs, real suppliers, and real value. If not, the task is clear: create the structures that transform rerouted flows into domestic growth and stop confusing invoices with industrial progress.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

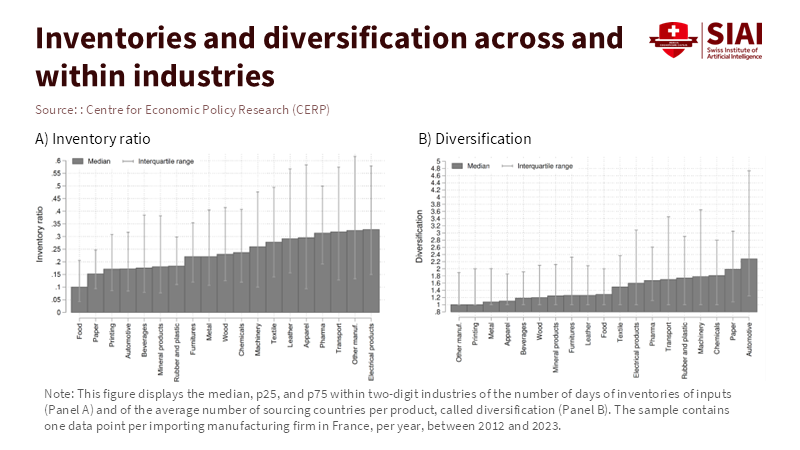

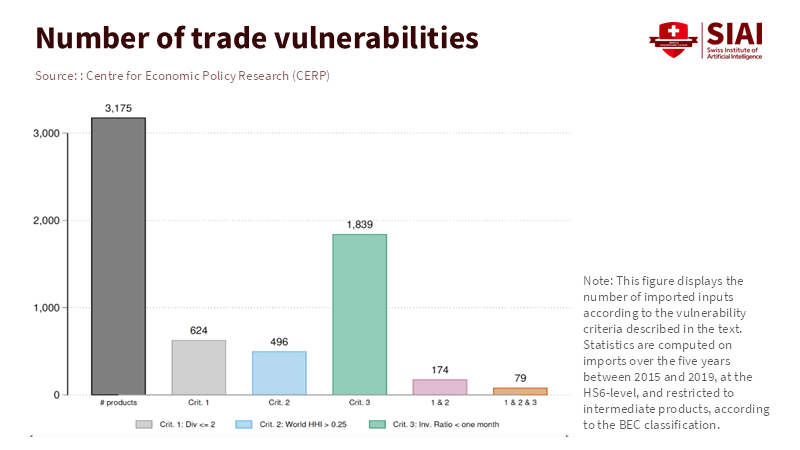

CEPR. “Inventories, Diversification, and Trade Vulnerabilities.” VoxEU Column, 2023.

Federal Reserve Economic Data. Manufacturing Inventory-to-Sales Ratios, 2020–2025.

International Energy Agency. Critical Minerals Market Review, 2024.

OECD. Global Trade and Supply Chain Resilience Report, 2023.

UN Conference on Trade and Development. Trade and Development Report, 2024.

World Bank. Global Economic Prospects, 2025.

Comment