QR Code Payments Are Changing Market Access for Small Businesses

Input

Modified

QR code payments cut entry costs and let micro-merchants sell digitally Cash use is falling, ATMs are shrinking, and cards and wallets are rising Policy should standardize open QR rails, keep fees low, and teach acceptance skills

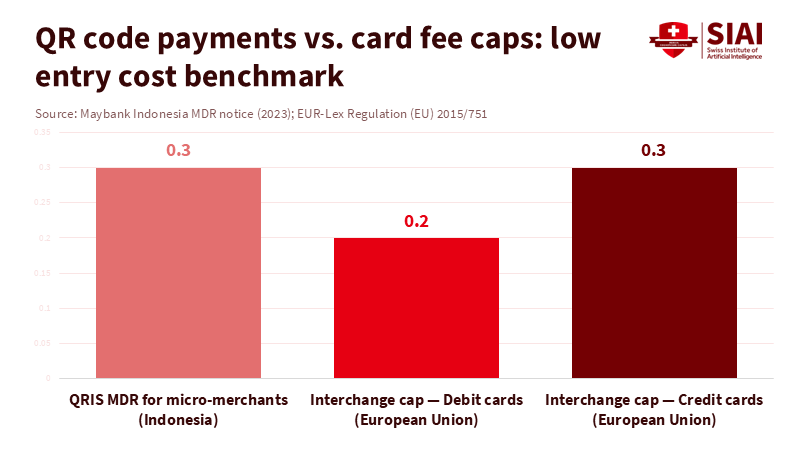

In Indonesia, the merchant discount rate for a micro-merchant accepting a QR code payment is 0.3%. This single number reflects a significant shift. When receiving digital payments costs only a fraction of a percent, small vendors like stallholders, home bakers, and sole traders can compete with chain stores. This is not just a rare occurrence. Indonesia's national QR standard, QRIS, serves tens of millions of users and countless tiny merchants, with similar systems appearing across Southeast Asia. In Europe, the situation is different but similar: consumers are using less cash at checkout, banks are reducing the number of ATMs, and card usage continues to grow. The trend is clear. FinTech is changing how the market works through two main drivers: affordable, software-only payment systems and a gradual move away from cash. This change results in lower costs for the smallest businesses and a larger customer base for anyone who can create a sticker and use a phone.

QR code payments lower entry costs for small firms

The cost of accepting payments influences who can enter a market. Traditional point-of-sale terminals require hardware, installation, and contracts. QR code payments change those expenses to a printed code and a wallet app. In Indonesia, Bank Indonesia established a 0.3% merchant discount rate for micro-merchants using QRIS after an initial fee break, making it affordable for the smallest sellers. Malaysia is rolling out an interoperable standard, DuitNow QR, aiming to reach 2.6 million acceptance points by the end of 2024. The Philippines has adopted QR Ph as a national standard as part of a broader push that has boosted digital payments year after year. The common theme is clear: software-based acceptance reduces barriers for small merchants, and standardization keeps switching costs low.

The business impact becomes evident when mobile or QR code acceptance is widespread. A multi-year study of Singapore's mobile payment launch reveals that after consumer-to-business QR payments started, small-business formation increased, cash-reliant micro-entrepreneurs experienced higher inflows and spending, and banks adjusted their strategies. Within a year, QR code adoption climbed, and ATM withdrawals decreased among users; banks cut back on ATMs in cash-heavy areas and expanded card and credit services. These are fundamental changes in the economy, not just app downloads. The same trend—affordable acceptance drives market entry and formalization—appears in Indonesia's QRIS data, where users exceeded tens of millions, and merchants reached well into the many tens of millions by 2025, with triple-digit growth in QR transactions expected in 2024. QR code payments are not just a niche trend. They provide an affordable way for millions of tiny businesses to connect with digital customers.

Less cash, fewer ATMs, more cards: the structure is changing

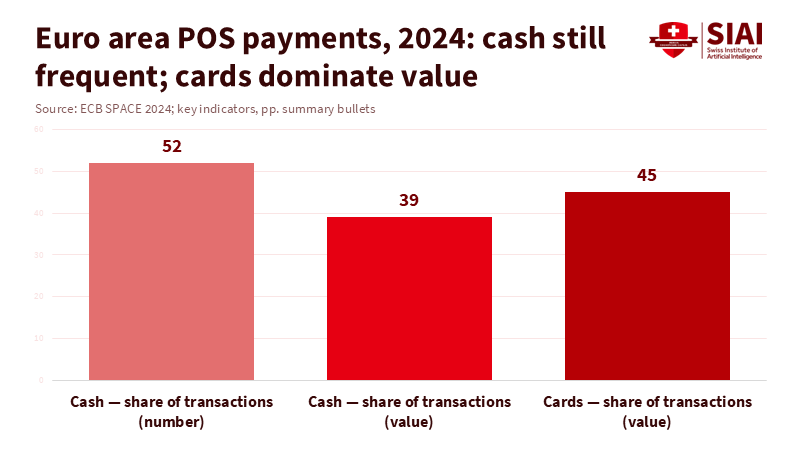

Retail payment behavior in Europe is gradually shifting away from cash. In the ECB's 2024 consumer survey, cash accounted for 52% of point-of-sale transactions by number, down from earlier years, while cards accounted for 45% of value. A growing majority of consumers now prefer cashless options in stores. Banks are following suit. Across the euro area in 2024, the number of cards in circulation stood at about 2.1 per person, while ATM numbers fell by about 3% in just six months. The European Banking Federation's structural data for 2023 provides a longer-term perspective: ATMs in the EU declined again to 319,573—continuing a trend reflecting lower cash demand and increased digital usage. FinTech isn't eliminating cash on its own; consumers are doing that as digital tools become easier and more affordable.

The mix of payment methods matters for small businesses because it affects acceptance costs. When a country standardizes on QR codes, a merchant can begin accepting digital payments without purchasing a terminal or dealing with complex merchant accounts. In regions leaning toward cards, scale grows, and fees often decrease at the margin, supported in the EU by capped interchange fees. Innovative acceptance methods like softPOS make entry easier than it was in the terminal-only era. The shared outcome is similar: less cash handling, fewer ATM trips, simpler reconciliation, and increased sales because customers can pay however they prefer. That's why street vendors in Jakarta and market stalls in Kuala Lumpur appear more "digitally open" every quarter and why cafés across the euro area quietly display tent cards with QR links next to contactless logos.

What should educators and administrators do next?

Education systems prepare tomorrow's small business owners and workers. They should consider QR code payments as essential infrastructure rather than an option. Business schools, vocational programs, and adult-learning centers can include payment acceptance in entrepreneurship courses. Topics could include setting up an interoperable QR system, pricing with a 0.3% MDR in mind, reconciling QR, wallet, and card inflows, and using instant payment systems to manage cash flow. In Southeast Asia, students who learn to accept QR code payments can start selling in wet markets and on social platforms right away; in Europe, the same skills apply to softPOS, wallet links, and account-to-account options that reduce fees and enhance working capital. This approach encourages practical inclusion, enabling a high school graduate to become a trader rather than just a cashier.

Administrators can take action too. Universities and training providers that still collect fees in cash or through expensive card systems can pilot QR acceptance linked to instant payment systems, then expand once they have practical reconciliation, refunds, and fraud controls in place. School-run clinics, cafeterias, and bookstores offer natural testing grounds. Collaborations with local banks and wallets can replace hardware terminals with software solutions, promote merchant education in student clubs and incubators, and use fee transparency to negotiate better rates. For local governments, the policy guidelines are clear: adopt a common, interoperable QR standard; publish fair MDR caps for micro-merchants; ensure that offline-capable wallets work in areas with poor connectivity; and maintain cash accessibility for those who need it. This approach combines inclusion with efficiency without forcing a strict either-or choice.

The fair-cost debate, security risks, and the "too dependent on cards" critique

Skeptics raise three main concerns. First, they argue that low QR code payment fees apply only in a few countries. In contrast, cards already have regulated interchange caps in Europe. They are correct that the EU's Interchange Fee Regulation caps interchange at 0.2% for debit and 0.3% for credit. However, these are just one part of a merchant's total service charge, which also includes scheme and processing fees. Regulators in the UK and the EU have called for transparency amid rising non-interchange fees. In this context, low hardware costs and widespread QR code acceptance provide micro-merchants with a more affordable starting point. The goal of policy is not to eliminate cards, but to ensure multiple low-cost options remain available for small businesses to choose the option that best suits their profit margins and risk levels.

Second, critics point to fraud and consumer harm as real risks, especially with social engineering scams. However, the regulatory response illustrates that FinTech can be safer than cash when strong safeguards are in place. For example, Thailand has implemented transfer limits and stricter controls to address online fraud in mobile banking and wallets. Instant payment systems and QR code acceptance can also reverse fraudulent transfers more rapidly than cash ever could. The takeaway is not that digital payments are unsafe, but that rules, authentication measures, and consumer education must keep pace with technological advancements.

Third, some raise concerns about reliance on foreign networks and the decline of cash infrastructure. This risk exists, especially in Europe, where international networks process a significant portion of card transactions and where cash use has been declining for years. The solution lies in diversification and openness. Central bank papers advocate interoperable account-to-account systems, alongside wallet and QR code payments, to reduce reliance on a single network. The ECB's latest surveys reveal that while consumers prefer cashless payments in stores, they still value having cash as an option, and the number of cards continues to rise even as ATMs decline. This is a balanced approach, not a one-sided battle. If policies ensure a well-rounded mix—access to cash, instant bank systems, cards, and interoperable QR codes—small businesses will not be at the mercy of a single authority.

The strongest argument for QR code payments is not aesthetic or futuristic. It is simple math. When a micro-merchant can accept digital payments for 0.3% without a terminal, a new market opens up. When millions of consumers can pay with a simple scan, small businesses can grow without having to choose between expansion and survival. In Southeast Asia, affordable QR systems have brought millions into formal commerce. In Europe, the shift away from cash and the rise of software-based acceptance are moving in similar directions, even if card usage is more prominent. The task for policymakers is to consolidate these gains while ensuring no one is left behind: maintain cash access where necessary, keep interchange and processing fees reasonable, standardize QR acceptance, and teach every entrepreneur how to utilize it. If we achieve this, the two factors driving change—lower entry costs and reduced cash reliance—will keep the market open to the next wave of tiny businesses. The benefits will be widespread, clear, and compounding.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Bank Indonesia. (2023). MDR QRIS: Kategorisasi dan simulasi.

Bank Negara Malaysia. (2025). Annual Report 2024: Promoting safe and efficient payments. (DuitNow QR acceptance points).

Bangko Sentral ng Pilipinas. (2025). 2024 Status of Digital Payments in the Philippines. (QR Ph national standard).

CEPR VoxEU. (2025, Nov. 29). The real impact of FinTech: Evidence from mobile payment technology. (Singapore rollout effects on firms, consumers, and banks).

Checkout.com. (2025). A guide to QR code payments. (Why QR acceptance is cheaper for many merchants).

European Banking Federation. (2024). Banking in Europe—Facts & Figures. (ATM totals in the EU, 2023).

European Central Bank. (2024). Study on the payment attitudes of consumers in the euro area (SPACE 2024). (POS payment shares; consumer preferences).

European Central Bank. (2025, Jan. 30 & Jul. 23). Payments statistics, 2024 H1 and 2024 H2 press releases. (Cards per inhabitant; ATM decline; POS terminals).

Fintech Times. (2024, Jul. 13). Financial inclusion and the rise of QR payments in Asia.

Reuters. (2024, Dec. 19). Cash use declines in euro zone; cards overtake cash by value.

UK AP News (Associated Press). (2025). Thailand caps daily transfers to fight scams. (Fraud controls on mobile rails).

World Bank & BIS sources on fast payments and QR initiation costs. (2024–2025). BIS Papers / WBG briefs on fast payments and merchant acceptance.

Comment