Euro Stablecoins, Not Digital Dollar Dependence

Input

Modified

Euro stablecoins can limit digital dollar dominance MiCA rules let Europe steer stablecoins toward multilateral payments Education and public sectors can jump-start euro stablecoin use

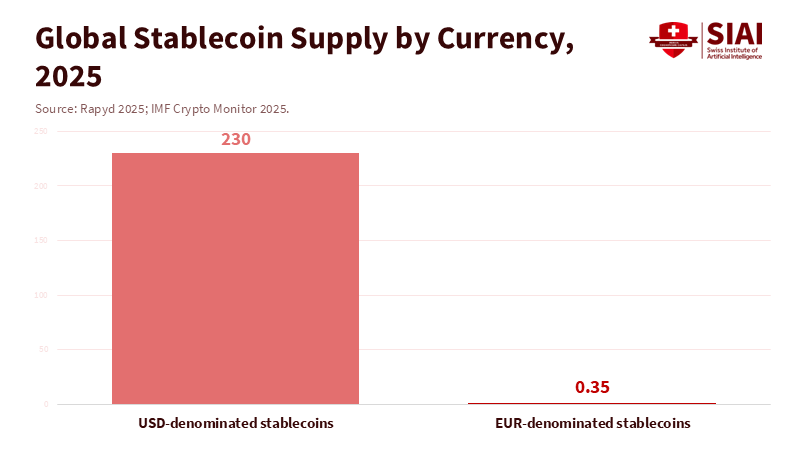

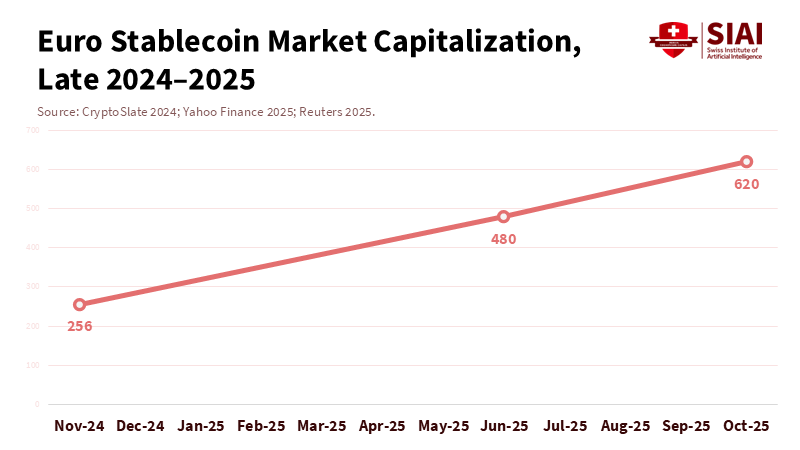

One number captures the new politics of digital money. In 2025, nearly every primary stablecoin worldwide is pegged to the US dollar. Analysts estimate that dollar stablecoins account for about 98-99% of the global stablecoin market. Euro stablecoins barely make an impact, with a market value of only a few hundred million dollars, roughly one dollar for every five hundred on-chain. However, euro stablecoins are the fastest-growing segment, more than doubling in size over the past year from a tiny base. Meanwhile, stablecoins processed an estimated $5.7 trillion in payments in 2024, a volume that now rivals global card schemes and shows they are real payment networks, not just a crypto sideshow. This imbalance should concern policymakers in Brussels and Frankfurt. The risk is not that dollar tokens exist, but that euro stablecoins stay marginal. At the same time, infrastructure for the next payment era is being built, highlighting policymakers' crucial role in shaping Europe's financial future.

Commentary often simplifies this imbalance as a story about digital dollarization. If dollar stablecoins dominate, there's a real fear that Europe will lose control over its own money and interest rates. That concern is valid, but it is not the complete picture. European regulations under the Markets in Crypto-Assets Regulation (MiCA) already limit how much foreign issuers can target EU users and how large foreign-currency tokens can grow in the single market. A recent CEPR analysis even describes US "dollar stablecoin mercantilism" and argues it could be turned into an opportunity for payment cooperation and a stronger role for the euro internationally. The real risk is more subtle. It is a slow slide into a world where only dollar tokens matter because euro stablecoins do not become a serious alternative. Europe faces a choice: either let US tokens set the rules or use euro stablecoins to create a more balanced system.

Euro Stablecoins as a Strategic Counterweight

Viewed this way, euro stablecoins are not merely a niche experiment. They are a test of Europe's strategic vision. The global stablecoin market, valued at almost $300 billion, is still small compared to traditional bank deposits. Still, it already plays a vital role in cross-border trade, crypto markets, and tokenized assets. Almost all of that value is held in US dollar tokens. Euro stablecoins, on the other hand, have a combined market value of less than €350 million, and European currency tokens make up well under 1% of the supply. Dollar stablecoins, primarily backed by US Treasury bills, create constant demand for US public debt and draw payment activity into dollar-centric networks. This is a quiet but powerful policy tool.

Euro stablecoins provide the euro area with a way to respond without imitating the US model. MiCA, which is now in effect, requires issuers serving EU users to be licensed, backed one-to-one with high-quality liquid assets, and face stricter oversight once their tokens gain significant traction. It also bans algorithmic and interest-bearing stablecoins, treating fiat-backed tokens as regulated e-money rather than unregulated investment products. This framework empowers regulators to shape a resilient and trustworthy euro stablecoin ecosystem, reinforcing Europe's control over its financial stability and fostering confidence among stakeholders.

Designing Euro Stablecoins for Multilateral Payments

The real opportunity is not to replace dollar tokens directly, but to create a more balanced system around them. Today, many merchants, platforms, and even universities invoice in dollars because currency conversions involve hidden fees, delays, and repeated checks. The World Bank's monitoring of remittance prices shows that cross-border transfers still cost households an average of about 6.5% of the amount sent, far above the G20 target of 3%. In that context, sticking to the dollar often seems like the best option. If euro stablecoins are designed to be widely available and easily exchangeable, this perception can shift. Converting between them can happen on-chain, in seconds, at almost no extra cost beyond the basic network fee. This can inspire confidence among users and stakeholders that euro stablecoins will significantly improve cross-border payments and financial inclusion.

Decisions around the design of euro stablecoins will determine if this potential becomes a reality. The basics are straightforward. Euro stablecoins should be backed one-to-one with cash and very short-term government securities. They should provide frequent and concise reports on their reserves and redeem at par in regular bank money. These are now standard practices in MiCA and related regulations. However, design cannot end with financial statements. Euro stablecoins should be integrated into trusted European payment systems, such as SEPA and the TARGET instant payment service, rather than operating in isolation. They should also connect with wholesale tokenization projects so that euro-denominated bonds, money-market funds, and trade finance tools can settle against regulated euro stablecoins or the digital euro rather than defaulting to dollar systems. Central bank experiments with multi-currency central bank digital currencies show that shared technical standards can support fast cross-border payments. In contrast, each central bank retains control over its unit of account. Suppose Europe commits to these standards and demands open access. In that case, euro stablecoins can help route value through the euro rather than around it.

Why Euro Stablecoins Matter for Universities and Learners

For educators, administrators, and students, this discussion may seem like distant financial infrastructure. In practice, euro stablecoins will first affect how people pay for and receive education. International students already transfer large sums across borders. In the United States alone, international students contributed about $44 billion to the economy in 2023-24, and European universities also rely heavily on tuition and living-cost inflows from overseas students. Yet the systems moving those funds remain slow and costly. World Bank data indicates that sending money home costs an average of about 6.5% of the amount sent, and tuition payments can be even more expensive due to foreign exchange fees and intermediary costs. A delayed transfer can lead to missed visa deadlines, late enrollments, or the need for short-term credit, which can create student debt.

Dollar stablecoins currently provide a partial solution, and private providers are now targeting universities with promises of near-instant cross-border settlement in US tokens. However, suppose the only practical option is a dollar stablecoin. In that case, the education sector will quietly lock itself into a new layer of dollar dependence. Fees will be charged in dollars by default, EdTech platforms will invoice in dollar stablecoins, and scholarship funds will find it easiest to disburse in the currency that partner universities support on-chain. Euro stablecoins offer an alternative. Universities, scholarship organizations, and programs like Erasmus can price services in euros while still providing students the speed and certainty of programmable payments. For administrators, euro stablecoins simplify matching invoices with incoming funds, reduce failed transfers, and utilize straightforward smart contracts that release payments only when enrollment or attendance criteria are met. For students, they eliminate the hidden cost of cross-border fees and reduce the risk that fluctuating exchange rates will erode part of a term's financial support.

A Regulatory Playbook for Safe Euro Stablecoins

None of this suggests that euro stablecoins come without challenges. European regulators, including the ECB and the European Systemic Risk Board, caution that extensive use of any stablecoin could siphon deposits from banks and create new pathways for runs if reserves lack transparency. However, trying to suppress euro stablecoins while dollar tokens thrive is not a sustainable strategy. A better approach is to treat euro stablecoins as public utilities managed by private companies. This involves clear limits on who can issue them, how large they can become in everyday retail use, and which sectors should adopt them first. MiCA already bars interest payments on stablecoin holdings in Europe, making it easier to view euro stablecoins as payment tools rather than high-interest savings products. Rules on separate reserves, capital requirements, and guaranteed redemption rights further limit the room for hidden leverage and shadow banking.

Policy can now progress in three directions at once. First, regulators can provide clear guidance that euro stablecoins that meet high standards of transparency and governance will have a predictable path to authorization. This includes tokens issued by commercial banks that operate alongside existing payment accounts. Such a signal would encourage European banks and fintech companies to invest, rather than remaining passive while global incumbents build advantages. Second, regulators can apply tools within MiCA to limit the use of foreign-currency stablecoins in everyday payments and settlements once they reach set thresholds, gently directing demand toward euro stablecoins without outright bans. Third, Europe can establish standards for cross-border projects that offer partners in Africa, Latin America, and Asia robust euro-based options alongside dollar tokens. This would position euro stablecoins as supports for monetary cooperation rather than simply another defensive market rulebook.

Critics argue that network effects make this strategy unrealistic. Dollar stablecoins already dominate the largest liquidity pools, the leading decentralized finance platforms, and many merchant integrations. Users have strong incentives to gravitate toward a single unit of account, which currently is the dollar. Nevertheless, network effects also indicate that a few high-volume use cases can shift the landscape. If European public entities, major universities, export-driven companies, and development banks all commit to using euro stablecoins for specific transactions—such as tuition payments, research grants, and regional trade routes—liquidity will develop where those payments concentrate. Others fear that promoting euro stablecoins could undermine the digital euro initiative. In reality, a precise distribution of roles can prevent that issue: the digital euro can serve as core public money for daily retail transactions, while euro stablecoins can function as strictly regulated, programmable solutions for specialized needs in education, trade, and capital markets.

Ultimately, the numbers that introduced this discussion will not remain static. Analysts now predict that global stablecoin supply could rise from around $230 billion in 2025 to approximately $2 trillion by 2028 if current trends persist. If Europe simply observes, almost all that growth will likely occur in dollar-denominated instruments, with euro stablecoins remaining a minor footnote. If Europe acts decisively, the outcome can change significantly: a market where dollar tokens are essential, but euro stablecoins gain a meaningful share of cross-border transactions, anchor international payment routes, and provide students, businesses, and governments with a choice of digital currencies that align with European laws and values. The decision now lies with the ECB, national regulators, and large public institutions. Delaying action will likely lead to increased reliance on the digital dollar. Acting promptly can enable euro stablecoins to shape the next monetary landscape rather than merely accept it.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Bank for International Settlements. (2025). Annual Economic Report 2025.

European Central Bank. (2025a). From hype to hazard: what stablecoins mean for Europe.

European Central Bank. (2025b). Stablecoins on the rise: still small in the euro area, but spillover risks loom.

International Monetary Fund. (2025). Crypto Assets Monitor: Q3 2025.

Krause, D. (2025). Europe's MiCA moment: Racing against time in the stablecoin wars. Oxford Business Law Blog.

Martino, E. D., van 't Klooster, J. M., & Monnet, É. (2025). US dollar stablecoin mercantilism is an opportunity to promote payment multilateralism and the international role of the euro. VoxEU/CEPR.

Oesterreichische Nationalbank, & Boston Consulting Group. (2025). Euro money tokens: Potential economic role of CBDCs and euro-denominated stablecoins.

Rapyd. (2025). The 2025 stablecoin market leaders payment teams must know.

World Bank. (2025). Remittance Prices Worldwide database.

Comment