Dual-Use Defense R&D: Why Markets Are Really Paying for Immediate Demand

Input

Modified

Rearmament budgets and backlogs—not civilian optionality—drove the valuation surge Dual-use R&D earns its premium by de-risking delivery and scaling deployable systems Policy should fund deployability, embed compliance, and protect targeted spillovers

Investors prefer a straightforward narrative. In 2025, European defense companies with significant dual-use exposure saw a market premium mainly driven by the procurement cycle, as rapid budget increases and multi-year contracts boosted profits. A one-standard-deviation rise in R&D intensity was linked to a 43% increase in the forward P/E ratio, an 84% rise in the price-to-book ratio, and a 34% boost in expected earnings per share after late 2024, when rearmament picked up. These figures suggest that markets value dual-use defense R&D for its potential civilian applications. However, this period also saw record backlogs at missile, radar, and ammunition manufacturers. When order books grow, profits typically increase. The premium we see reflects urgent defense demand more than a distant shift toward civilian uses. Dual-use defense R&D does help reduce cash flow risks. However, right now, the main factor driving valuations is the procurement cycle. Optionality is just an added benefit, not the primary focus.

Rethinking the premium on dual-use defense R&D

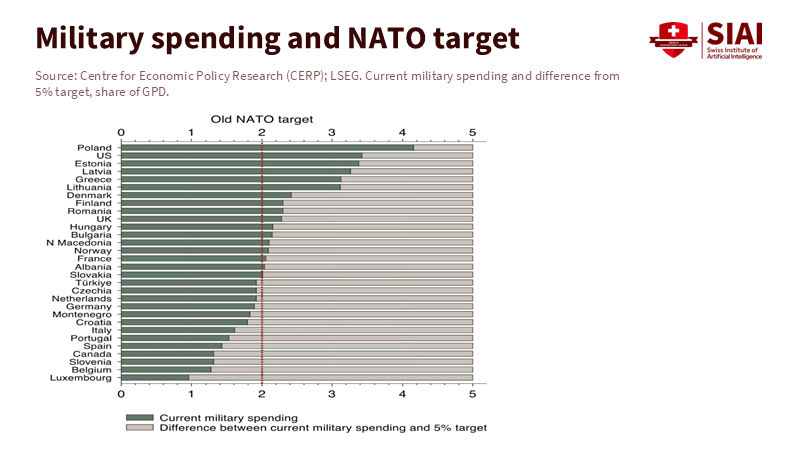

The common perspective is straightforward: dual-use defense R&D warrants a valuation premium because civilian markets can adopt the technology when military demand decreases. Recent evidence seems to back up this viewpoint. Market valuations in Europe rose fastest in regions with high research intensity and dual-use revenues. Yet, we should consider this trend alongside recent policy changes. NATO countries have increased spending, with many going beyond the 2% of GDP benchmark. The alliance is now indicating a more challenging target of 3.5% on core defense over the next decade. These policy signals, including increased defense budgets and new spending commitments, influenced budgets and boosted defense stocks. They also accelerated earnings for companies that can deliver deployable systems right now.

What has changed the most since 2023 is not the vague idea of civilian applications. It is the apparent shift toward readiness and inventory. Europe’s ammunition production capacity has quickly risen from a low base toward an EU-supported goal of around 2 million 155mm shells per year by the end of 2025, backed by the Act in Support of Ammunition Production (ASAP). This serves as a direct signal to suppliers, rewarding immediate production, quality, and logistics, rather than theoretical potential. R&D remains essential—process innovations improve yields and reliability—but the current strategic focus is on fulfilling contracts, ramping up production lines, and reducing lead times to meet urgent demand.

Look at companies leading this shift. Rheinmetall reported a record backlog of €55 billion for 2024 and continues to boost ammunition production. MBDA increased annual orders to €13.8 billion, resulting in a €37 billion backlog, enhancing output on key missile lines. HENSOLDT’s order book rose to new levels for radars and optronics associated with real programs. These backlogs represent immediate defense demand and reliable cash flow. The equity market’s premium for “dual-use defense R&D” is primarily based on this pipeline. The civilian benefits help valuation multiples slightly; however, the primary driver is the munitions and systems pipeline.

Immediate demand, predictable margins—not optionality—in dual-use defense R&D

Defense procurement is moving quickly. EU-level initiatives are designed for speed and scale: ASAP speeds up ammunition production; EDIRPA supports joint purchases; and the European Defence Fund allocates €8 billion to joint R&D and prototyping. The Commission’s new European Defence Industry Programme also provides funds for industrial readiness. These programs do more than finance research. They support production, streamline order schedules, and reduce risks in partnerships. In this environment, dual-use defense R&D earns a premium mainly because it aligns well with funded projects and reduces execution risk, not because consumer markets are waiting to adopt radar technology tomorrow.

This same reasoning applies in the venture capital space. Europe’s defense-tech VC hit a record of roughly $1.5 billion in 2025. However, it is still small compared to the U.S., which captures about 85% of the defense VC in the NATO region. Investors in Europe are becoming more active, but they are focusing on systems that can be delivered to the Ministry of Defence within expected timelines—counter-UAS, ISR, secure communications, fire support, and production tools. The label “dual-use” remains essential for export control and flexibility in use. However, at the seed and Series A stages, the critical factor is whether the unit can be deployed. Backers ask: Can this pass trials? Can it scale under EU procurement guidelines? Can it fit into NATO standards? This is not a story driven by civilian demand. Instead, it is driven by procurement, where dual-use defense R&D adds value to resilience rather than being the primary source of profit.

Europe’s venture pipeline is focused on weapons

The landscape for European defense tech is expanding, covering electronic warfare, space, and autonomy. However, funding flows most quickly to teams that can deliver hardware and software to service soon. This aligns with policy goals for rearmament, stockpiling, and readiness. The main takeaway is not a resurgence of civilian applications. It is a focus on getting systems into the field. Today, dual-use defense R&D is valued for enhancing supply chains and integration, as well as for enabling maintenance and training tools. Yet, the priority remains weapons-first.

The policy introduces another element: stricter export controls and sanctions enforcement. The EU has intensified measures to prevent dual-use technology from reaching Russia via third countries, even centralizing some control powers and adding new designations. The U.S. has also increased its enforcement efforts. This environment benefits firms that incorporate compliance into their designs—such as traceable materials, trusted foundries, and secure data pipelines. It also challenges the “civilian first” idea in sensitive areas. If adversaries can quickly adapt civilian technology, policymakers will limit options, leading buyers to prefer systems that ensure intellectual property, manufacturing steps, and software security. In this context, the most profitable path for startups is to secure defense contracts first and expand into civilian markets later, only when controls and risks permit.

Policy playbook: fund deployability and protect useful spillovers in dual-use defense R&D

What should ministries, agencies, and universities do in response to this shift? First, align funding with deployability. Use the European Defence Fund to fund research that raises technological readiness levels, but combine it with ASAP-like tools to address bottlenecks—powders, fuzes, seekers, sensors, and testing capacity. Link grants to measurable production and reliability outcomes. This is not the time to make vague investments in civil markets hoping to rescue defense R&D later. This is the time to increase production capacity and reduce integration risks, using dual-use defense R&D as a framework to standardize parts across systems and lower production costs.

Second, protect the useful spillovers we want. Export controls will remain strict; attempts to evade them will continue. To maintain the benefits of dual-use defense R&D—robotics safety, secure communications, energy storage—Europe should enhance security during the design phase. Require secure toolchains, watermarking for critical software, and supplier audits. Support EU foundries and energy capacity. The goal is not to eliminate civilian applications. It is to ensure that when they exist, they do not give adversaries an easy blueprint for weapons. Stricter controls and better industrial practices do not kill innovation. They guide it toward long-lasting advantages.

Finally, ensure venture incentives align with tangible outcomes. Europe’s defense VC is advancing but still lags behind the U.S. in substance and exit strategies. Public co-investment should reward achievements that show real defense impacts—test performance, NATO integration, and production readiness—rather than superficial metrics. Market analyses and recent funding figures indicate positive trends. Still, the lesson from equity markets is clear: backlogs and secured contracts drive valuation multiples. If public programs and VC focus on firms that can deliver results now, the premium will rely on more substantial factors than hopes for future civilian demand.

The headline figures tempt us to attribute value to “optionality.” Markets did reward firms with greater dual-use defense R&D, and the statistics are compelling: a 43% increase in P/E and an 84% rise in P/B for companies with higher R&D intensity during Europe’s rearmament phase. However, the more significant narrative relates to demand. Budgets grew, funding focused on production, and industry backlogs increased. Valuations followed suit. Dual-use defense R&D gains a premium because it reduces risk and accelerates delivery into funded projects. Optionality may matter in the future, but it is not the primary driver of profits today. For educators, decision-makers, and policymakers, the message is clear: focus on funding for deployability, embed compliance into designs, and protect the useful spillovers that enhance productivity without providing adversaries with valuable insights. If we focus on these areas, the premium will remain where it should be—on companies that turn research into readiness quickly and effectively.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Albori, M., Ferriani, F., & Ristuccia, L. (2025). Beyond military sales: The market premium on dual-use research and development. VoxEU/CEPR.

AP News. (2025). All NATO members projected to hit old spending target, with just three set to meet new goal.

Dealroom. (2025). The State of Defence Tech 2025.

European Commission. (2024). Act in Support of Ammunition Production (ASAP): €2 billion package and capacity target of 2 million shells by end-2025.

European Commission. (2023). ASAP: Boosting defence production.

European Commission. (2025). EDIRPA: Addressing capability gaps via joint procurement.

European Commission. (2025). European Defence Fund (EDF): Interim evaluation; 2021–2027 budget.

Financial Times. (2025). Rheinmetall opens Europe’s biggest ammunition plant; scaling to EU output goals.

GoHub Ventures. (2025). European defense tech: Market map and VC predictions.

HENSOLDT (Reuters). (2025). Orders up; record backlog above €7 billion.

MBDA. (2025). Record 2024 orders (€13.8 billion) and €37 billion backlog.

NATO. (2024). Defence expenditures of NATO countries (2014–2024).

Reuters. (2024). Over 20 NATO allies to meet 2% of GDP in 2024; 23 above target.

Reuters. (2024). EU Commission proposes €1.5 billion European Defence Industry Programme.

Rheinmetall. (2025). FY 2024 financial figures: €55 billion backlog.

SIPRI/Bruegel. (2024). European defence industrial strategy and ASAP context.

The European Council / Consilium. (2025). Sanctions enforcement against Russia; anti-evasion measures.

U.S. Department of Commerce, BIS. (2024). Export Enforcement Year in Review; disruption of dual-use flows to Russia.

Vestbee. (2025). Europe raises record $1.5 billion for defence tech; U.S. still dominates.

Comment