SEC-CFTC Harmonization Now, Merger Later: A Risk-Tiered Path for Digital

Input

Modified

SEC–CFTC harmonization now; no immediate merger Use a risk-tiered model while stablecoin rules cover payment risks Merge only if regulated payment stablecoins dominate activity and definitions converge

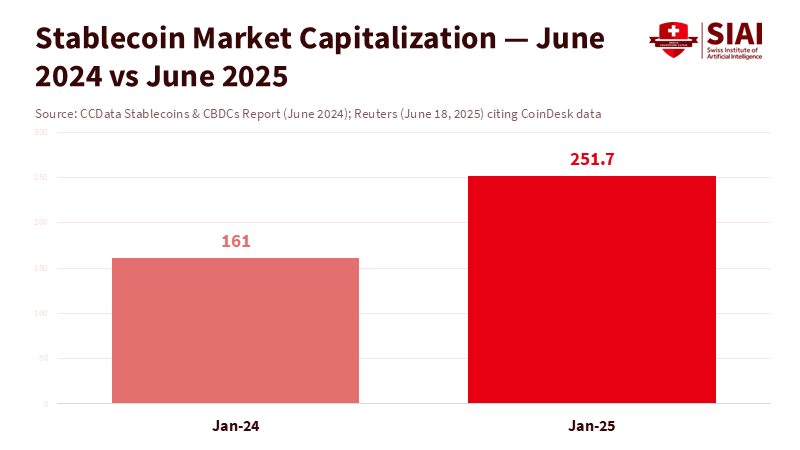

In June 2025, stablecoins reached a record market capitalization of $251.7 billion as the U.S. Senate passed essential rules for this market. This combination of a rising dollar-linked instrument and a clear federal framework marked a significant turning point. It also set a better framework for U.S. market oversight: SEC-CFTC harmonization today, with a merger only when payment-grade stablecoins become the primary channels for everyday transactions. The direction is clear. Regulators have entered a new cooperative phase, and the main risks are separating into distinct categories: public-company-style disclosure and market-abuse risks for crypto asset securities; market-integrity and derivatives risks for digital commodities; and prudential, payments, and operational risks for regulated stablecoins. The statistics support this. Stablecoins are now a quarter-trillion-dollar asset class, and the Senate’s vote indicated bipartisan support for consistent rules on reserves and reporting. Cross-border payments still incur high costs on average, which is why policymakers need harmonization now and why a complete merger can wait until payment stablecoins dominate the market.

SEC–CFTC harmonization is already policy, not theory

SEC-CFTC harmonization is not just a theoretical concept but a concrete policy now in effect. This progress should provide a sense of reassurance about the direction of the industry. The agencies have not simply waited for a merger debate to take action. On September 2, 2025, they announced a joint initiative to coordinate guidance on leveraged and margined spot retail commodity transactions in digital assets. This purposeful cooperation should instill confidence in the regulatory process.

The enforcement stance also shows how the agencies' roles differ yet complement each other. The CFTC’s FY2024 report noted 58 new actions, including groundbreaking digital-asset commodities cases. During that same period, the SEC initiated 33 crypto-related actions, with significant monetary penalties concentrated in a few large settlements. This pattern illustrates the point. The CFTC focuses on manipulation, fraud, and illegal derivatives in markets it considers commodities. At the same time, the SEC addresses unregistered securities offers, violations by exchanges and broker-dealers, and misleading disclosures. Harmonization allows each agency to continue working in its area of expertise while minimizing contradictory definitions that confuse businesses and investors.

Stablecoins will dictate the pace of SEC-CFTC harmonization

The U.S. now has a federal law for payment stablecoins. The GENIUS Act, enacted in July 2025, creates a regulatory structure: liquid-asset backing, monthly reserve disclosures, and a licensing process for issuers. This shift changes the regulatory landscape. It moves dollar-pegged tokens towards a payments framework that resembles modern money regulation more than securities or commodities law. The market has reacted positively. By mid-June 2025, stablecoin capitalization hit an all-time high of $251.7 billion, and analysts forecast further growth as regulations reduced legal risks. European regulators have cautioned that mainstream adoption could raise financial stability issues, primarily as tokens transmit dollar strength abroad. Now is the moment to focus on SEC-CFTC harmonization around peripheral issues while allowing a specialized stablecoin framework to address payment risks.

Usage data is concerning as well. Chainalysis reports that Tether alone processed about $703 billion per month between June 2024 and June 2025, peaking at $1.01 trillion. The BIS has noted that the combined market capitalization of leading stablecoins is substantial enough to warrant targeted, data-rich oversight, without assuming they are securities or deposits. There is a real-world reason to take this seriously: cross-border remittances still cost about 6-7% for small transfers, despite years of G20 efforts to lower those costs. Stablecoins could reduce those expenses through regulated channels, but only if there is clarity on what constitutes a security, a commodity, and which instruments qualify as payment products under federal law. This is the rationale for harmonization now and the argument against a hasty merger.

Practicality Prevails: a Risk-Tiered Model Now Over a Premature Merger

A merger might create a neat organizational chart, but that does not address the real risks currently faced. A better immediate solution is a risk-tiered mandate with SEC-CFTC harmonization at its center. On the securities side, the SEC's role is clear: overseeing the offers and sales of crypto asset securities; platforms acting as exchanges, brokers, ATSs, or clearing agencies for such assets; and disclosure obligations that align with public-company rules where relevant. On the commodities side, the CFTC should continue to address manipulation, retail leveraged commodity transactions, and digital-asset derivatives. These roles do not overlap; they complement each other within the same framework. Recent enforcement totals and penalty trends reinforce this division of responsibilities.

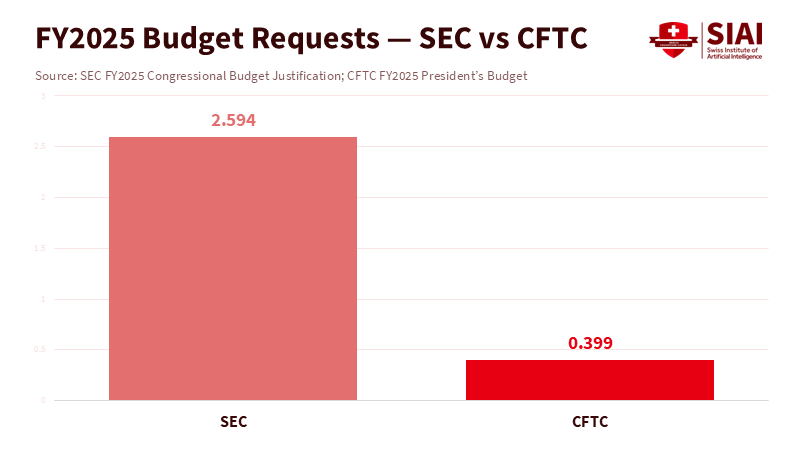

Resources also support this approach. The SEC’s FY2025 budget request was for $2.594 billion to fund over 5,000 FTEs, with a lengthy list of market oversight tasks beyond crypto. The CFTC requested about $399 million and around 725 FTEs. These differences are intentional and reflect distinct missions. Harmonization leverages these strengths collaboratively—standard definitions, joint guidance, shared data—without forcing one agency to replicate the other's expertise. If Congress ever considers a merger, it should happen after the market has converged around regulated payment tokens that dominate activity, not before. Until then, a structured, risk-tiered approach will better protect investors, improve markets, and support real-world use cases.

The merger test: when payments dominate the perimeter

There is a straightforward way to set the stage for the debate. First, finalize SEC-CFTC harmonization on definitions and procedures: joint guidance on retail commodity transactions, coordinated no-action relief for transitional issues, and a unified taxonomy for token types that corresponds with existing laws. Second, allow the new stablecoin law to demonstrate its effectiveness. If regulated payment stablecoins become the primary traffic on digital rails—used by banks, fintechs, and merchants—the case for a merger will strengthen. Under such a future, a single market conduct regulator could eliminate duplicate registrations, simplify cross-margining rules, and maintain a single surveillance framework across spot and derivatives. That would be the right time to consolidate crypto market supervision into a single agency, with stablecoin prudential oversight in parallel. We are not there yet. Currently, trading activity dominates, while real-world payment trends are only beginning to change. Policymaking should reflect this reality.

Creating a trigger is also essential. One practical indicator is the proportion of on-chain volume accounted for by regulated, dollar-backed stablecoins used for payments rather than trading. Another is the risk of international spillover. European and U.S. regulators already warn about financial stability issues as stablecoins grow. A third is the cost and accessibility of cross-border transfers. Suppose the average price of sending small remittances stays around 6-7% while regulated dollar tokens are available. In that case, policymakers will feel pressure to encourage adoption within the existing financial system. In such scenarios, a merger could formalize a single market conduct framework and reduce friction for firms navigating both spot and derivatives markets. Until those conditions are met, harmonization offers the most significant benefits with the least risk of organizational disruption.

The initial fact still teaches a lesson. When stablecoins reached $251.7 billion as the Senate approved the first federal framework, policymakers gained a clear roadmap. SEC-CFTC harmonization should continue—more swiftly, thoroughly, and transparently—because it addresses today’s coordination issues while allowing each agency to manage the risks within its expertise. A merger isn’t off the table; it’s simply a future consideration, contingent on the rise of payment-grade stablecoins as the primary channel for everyday value transfer. If that occurs, a single market conduct regulator could reduce friction and enhance surveillance across spot and derivatives. For now, the focus is simpler and more urgent: align definitions, publish joint guidance where the law is unclear, and pave the way for compliant payment tokens to tackle the real costs in the economy—like the 6-7% charges for small remittances. The U.S. doesn’t need a single large agency to do this work. It requires collaborative agencies that work together effectively—this is what harmonization currently achieves.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Arnold & Porter. (2025, July 21). The GENIUS Act: Analyzing the new U.S. stablecoin legislation.

Bank for International Settlements. (2025). Stablecoin growth – policy challenges and approaches (BIS Bulletin No. 108).

Chainalysis. (2025, September 2). The 2025 Global Crypto Adoption Index.

Commodity Futures Trading Commission. (2024, December 4). CFTC releases FY 2024 enforcement results (Press Release 9011-24).

Congress.gov. (2025, July 18). Public Law 119-27 (S. 1582), Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act.

Cornerstone Research. (2025, January 20). SEC Cryptocurrency Enforcement: 2024 Update.

European Systemic Risk Board. (2025, October 10). Crypto-assets and decentralised finance.

Hogan Lovells. (2025, September 29). Two regulators, one direction: Key takeaways from the SEC–CFTC joint statements on crypto markets.

Kaiko. (2025, March 10). Stablecoin adoption amid new rules.

Reuters. (2025, June 18). Stablecoins’ market cap surges to record high as U.S. Senate passes bill.

Reuters. (2025, September 2). U.S. securities, commodities regulators announce joint crypto initiative.

SEC. (2024, March 11). FY2025 Congressional Budget Justification (Request: $2.594 billion; 5,621 positions).

World Bank. (2025, March). Remittance Prices Worldwide: Q1 2025 (global average cost metrics; data portal).

Comment