The Public R&D Crowd-In Effect: Why Cutting the Catalyst Will Shrink America’s Next Big Wave

Input

Modified

Public R&D crowd-in effect primes private investment and productivity growth Cuts and freezes break the catalyst, raising risk and slowing diffusion Protect catalytic grants, require private matching, and use procurement to anchor demand

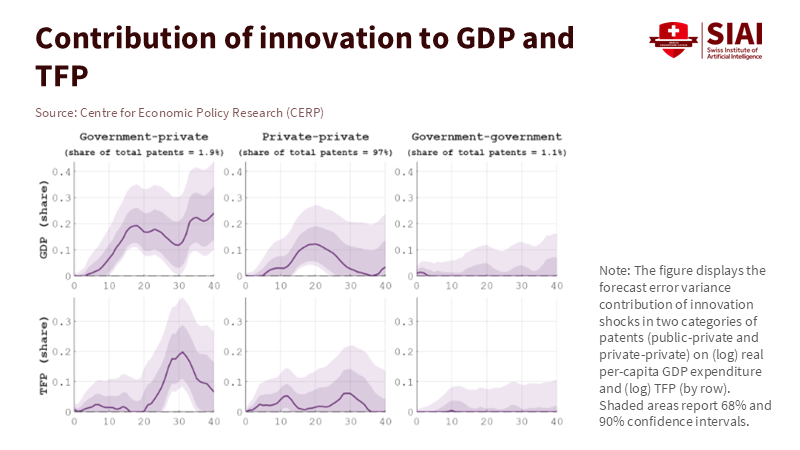

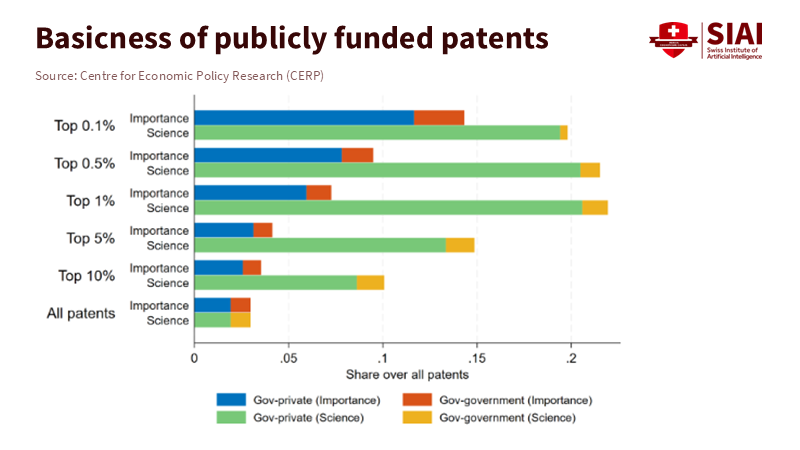

The most crucial fact in the current research debate is also the simplest: in the United States, publicly funded but privately owned patents—about two percent of all patents—are linked to roughly one-fifth of medium-term changes in productivity and GDP growth. This small share makes a significant impact, generating ideas that companies can expand on and reducing the cost of private investments in high-risk, early-stage companies. This is the robust public R&D crowd-in effect. When that “calling water” flows, private capital follows; when it dries up, so does much of the momentum behind new platforms, ranging from chips to biotech to AI. This is important now because proposed cuts and freezes to federal science budgets in 2025 have already halted hundreds of trials and unsettled labs, while venture capital has become more selective. Remove the catalyst, and we can expect slower spread, weaker spillovers, and fewer groundbreaking innovations.

The public R&D crowd-in is, in effect, real

The evidence is obvious, especially for innovation policy. Using digitized U.S. patent records since 1950, recent analysis shows that government-funded, privately owned patents have significant macroeconomic importance. They make a bigger impact than their numbers suggest—not because the government “picks winners,” but because early public support shifts the risk frontier. Companies then patent, hire, and invest more in follow-on R&D. In macro data, those spillovers align with medium-term changes in productivity and output. The share is small, but the leverage is enormous. When we talk about crowding in, this is what it means in practice. It’s not public labs replacing private initiative; it’s public funds lowering uncertainty where the market won’t go alone, allowing the market to do what it does best.

If we look beyond patents, the pattern is still evident. In 2023, the United States spent an estimated $940 billion on R&D across business, government, and higher education—up from $892 billion in 2022. Yet even as totals rise, the federal share of research funding has declined over time, while businesses have taken on a greater share of the burden. This shift is essential for direction and spread. Private R&D often focuses on near-term returns; public R&D pushes the limits and creates platforms others can use. The public investment is the thin edge of the wedge, but it sets the direction for everything that follows.

The mix of policies also matters. Across the OECD, tax incentives now make up about 55% of public support for business R&D, far surpassing direct grants in many countries. Tax tools are helpful and can be scaled. Still, they do not replace grants that make targeted investments, set goals, and integrate procurement, when governments design programs with matching requirements—such as U.S. state-level SSBCI funds that require private capital to exceed public funds—the crowd-in effect is more substantial. The lesson is clear: if we want more private investment, we need public funds that take the first step and invite the market to join, not just observe.

Cuts now risk damaging the catalyst

In 2025, the message to the market became unclear. A proposed federal budget outlined significant cuts to science agencies, including a steep reduction at NIH; a mid-year freeze briefly stopped NIH grants, followed by partial withholds and terminations. Over five and a half months, funding for 383 NIH-backed clinical trials was cut, affecting over 74,000 participants. Even when reversed, freezes create a chilling effect. Labs delay hiring. Startups involved in translational work pause at critical milestones. Private co-investors recognize the policy risk and adjust their calculations accordingly. The cost of capital increases right where the crowd-in effect is strongest.

It is not easy to scale back the federal role. Before the withhold, NIH alone spent about $48 billion annually on biomedical research. Corporate R&D is substantial, but it focuses on pipelines and shareholder timelines. It cannot fill sudden gaps in early-stage clinical work without transferring risk to payers or patients. Nature’s reporting on the 2025 budget battle highlighted the same issue: even a temporary deal leaves the door open for larger cuts in the next cycle. Markets remember these signals. If the foundation appears unstable, the crowd-in effect weakens; private follow-on rounds come with harsher terms or may not occur at all.

This is not just a story about biomedical research. When federal funding becomes unpredictable, general-purpose technologies suffer. Venture capital follows market trends; during downturns, it retreats from science-heavy investments, and the inventions that do emerge are less closely tied to fundamental research. In these situations, public funds are the only force that can keep options open. Cut or delay them, and those options disappear. This is not about ideology; it reflects how risk markets operate.

Designing “calling water” that scales

Effective design of public R&D funding should prioritize maintaining the catalytic role of grants and missions. Pairing them with matching requirements that draw in private funds is key. The OECD’s 2025 benchmarking highlights programs where at least 20% of private capital must be at risk, and in some U.S. state models, private stakes must exceed public ones. This is the productive crowd-in sweet spot: the government makes the first investment and sets the targets; the market validates the approach.

Second, it balances different tools. Tax credits are broad and predictable, and companies value them. But the most substantial evidence for additional impact at the forefront comes from targeted, competitive grants and public venture co-investment that reduce information gaps. Recent cross-country and firm-level studies indicate that well-designed subsidies boost private R&D and enhance innovation outcomes; newer research on young innovative companies finds that subsidies also improve access to capital by signaling quality. These are not blank checks. They serve as filters that allow more “unknown unknowns” to move from the lab to the market.

Third, it emphasizes public-to-private transitions where the evidence is strongest. The SBIR model is a well-known example: competitive federal grants that lead to more patents and subsequent venture funding. While data varies by sector and year, the core mechanism remains consistent. Grant selection reduces uncertainty; procurement creates initial demand; then investors step in. When budgets are stable, this loop strengthens. When they are not, the loop collapses. The result is not just fewer startups; it is less diffusion across supply chains that depend on those startups to drive incumbents.

A narrow fiscal rule for wide spillovers

The right near-term rule is straightforward: protect the essential part of public R&D even under tight budgets. The macro argument is not that more spending is always better. It is that targeted public R&D has multiplier effects that standard budget evaluations often overlook. Patent-level work since 1950 shows a significant link between publicly funded, privately owned patents and medium-term growth. OECD evidence suggests that support design can require private investments that secure crowd-in. Federal trend data reveal that, while total R&D has increased, the public share is shouldering more of the early-stage risk with a smaller fiscal buffer. Remove the water from the well, and it yields less.

For educators and administrators, the implications are immediate. University labs and research hospitals are part of the same crowd-in chain. When grants freeze, doctoral programs shrink, tech-transfer pipelines slow, and regional spillovers disappear. The costs fall on students, faculty retention, and local businesses that hire from those labs. For policymakers, the implications are sharper. If cuts are necessary, protect mission-driven grants, maintain matching features that attract private funding, and use procurement to anchor demand for AI safety tools, energy systems, and biomanufacturing. If resources allow, expand programs with the most substantial evidence of impact and diffusion, and simplify tax credits so smaller companies can claim them without costly intermediaries. The goal is disciplined crowd-in, not blanket subsidies.

Skeptics will argue that public funds crowd out private investments or that governments lack the skill to target effectively. The claim that funds displace private bets weakens when design ensures private co-investment and risk-sharing. The targeting concern is outdated. Mission agencies like ARPA-style units have learned to manage portfolios effectively, make quick adjustments, and take on risks that others avoid. Cross-country studies show that subsidies have additional positive impacts on both inputs and outputs when they are competitive and transparent. If the worry is about waste, the solution is not to reduce the catalyst but to refine it—and to maintain it consistently across political cycles. Hence, the signal to investors remains strong.

A final concern is cost. However, we should consider the cost against the lost spillovers. If just a small portion of public-funded, privately owned patents accounts for a fifth of medium-term changes in productivity and GDP, then a marginal dollar that protects that channel has a very different return compared to one that does not. The goal is not to pursue a specific multiplier. It is to keep the door open for the next platform technology—because once closed, that door is costly to reopen.

The public R&D crowd-in is, in effect, a straightforward idea with significant consequences. A small stream of public funds—focused on innovation and paired with private investments—amplifies the entire system. We have new evidence that a small fraction of government-funded, privately owned patents accounts for a large share of growth. We also have new proof that freezes and cuts—hundreds of stopped trials, billions withheld—damage confidence and slow the transition from lab to market. The call to action is clear. Keep the calling water flowing. Protect catalytic grants, design for matching, and secure procurement that generates initial demand. Then let the market scale what works. If we do that, we can sustain the well for the next wave in health, energy, and AI. If we fail, we will find out again that innovation droughts begin long before the public notices that the well has run dry.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

AP News. (2025, November 18). NIH funding cuts have affected over 74,000 people enrolled in experiments, according to a new report.

BioWorld. Serebrov, M. (2025, November 17). Scrutiny of NIH funding cuts, potential retaliation continues.

Congressional Research Service. (2024, December 9). Federal Research and Development (R&D) Funding: FY2025 (R48307).

Gazzani, A., Martinez, J., Natoli, F., & Surico, P. (2025, October 26). The Public Origins of American Innovation (CEPR Discussion Paper 20788).

Gazzani, A., Martinez, J., Natoli, F., & Surico, P. (2025, November 18). Public money, private innovation: How government funding built – and sustains – America’s technological leadership. VoxEU/CEPR.

Nature. (2025, November 13). The U.S. government shutdown is over: what’s next for science budgets?

NCSES/NSF. (2025, February 27). U.S. R&D totaled $892 billion in 2022; estimate for 2023 indicates further increase to $940 billion. National Patterns of R&D Resources.

OECD. (2025, April 22). R&D tax incentives continue to outpace other forms of government support for R&D in most countries. Data & Insights Statistical Release.

OECD. (2025, June 27). Benchmarking government support for venture capital—United States.

OECD. (2025, June 27). Benchmarking government support for venture capital (Full report).

OECD. (2025). Science, Technology and Innovation Outlook 2025: Mobilising STI policies for transformative change.

Reuters. (2025, May 2). Trump budget proposes drastic cuts for U.S. scientific research.

STAT. (2025, October 22). Corporate support cannot make up for threats to the NIH budget.

Washington Post. (2025, July 29). Trump administration halts, then releases, NIH research funding.

Comment