Tariff Diplomacy: Asia's Summit Theater and the Real Supply-Chain Math

Input

Modified

Asia practiced tariff diplomacy: public deference, private deals China’s rare-earth grip set the terms, yielding a short truce and modest tariff relief Schools should hedge purchases and teach the supply-chain math behind these negotiations

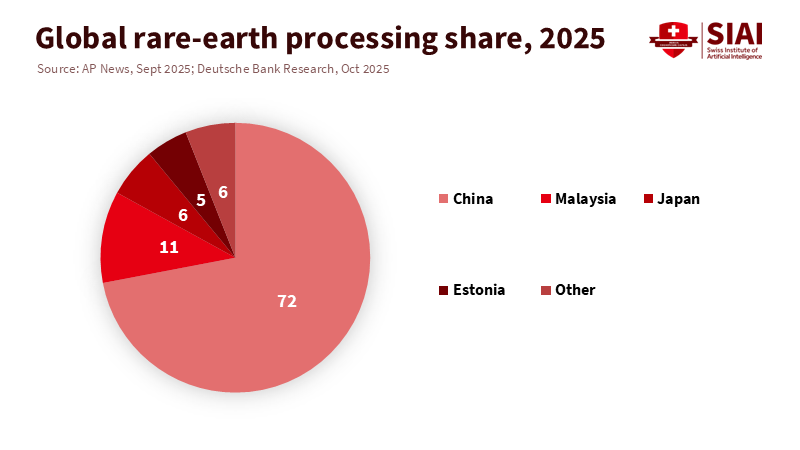

A single fact explains the focus of this autumn’s Asia summits: China refines about 90 percent of the world’s rare earths. This concentration is central to electric motors, wind turbines, smartphones, sonar arrays, and most robotics kits used in STEM classrooms. It also explains why the Busan meeting between Donald Trump and Xi Jinping lasted about 100 minutes and ended with a slight easing of trade controls. Leaders in Asia opted for ceremony as a strategy. When one country controls key resources for both industry and education, others learn to navigate the chokepoint. This is tariff diplomacy in action: public friendliness, private negotiations, and real concessions on tariffs and export rules to keep supply chains functioning. Even after public “truces,” the United States maintains an effective tariff rate close to half on all Chinese imports. At the same time, Beijing carefully adjusts its rare-earth policies. This theater is not just a distraction. It is the policy.

Understanding tariff diplomacy

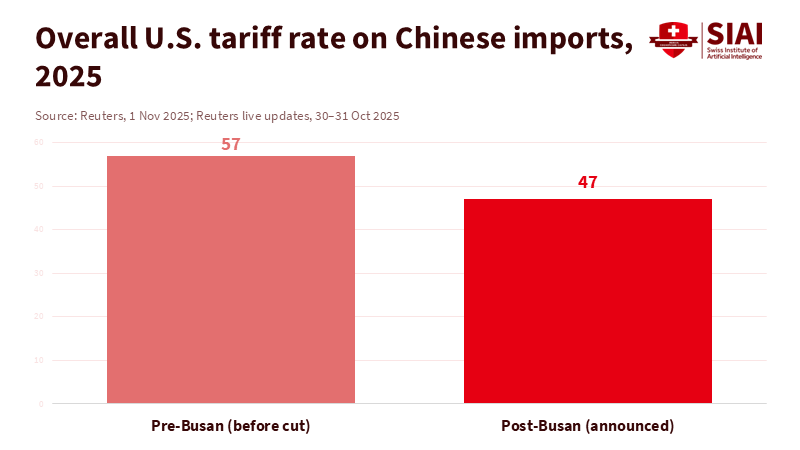

Tariff diplomacy is a negotiation style that views tariffs as the starting point and ceremonial respect as a way to facilitate agreements. In late October and early November, Trump met Xi in Busan during the APEC summit, following visits to Tokyo and Kuala Lumpur. The discussions resulted in a limited reduction in tariffs and mutual pauses on some export controls and port fees. Analysts described it as establishing a one-year guardrail rather than a reset. This is the essence of tariff diplomacy: keep penalties visible but ease pressure where it hurts most, then signal “stability” to markets and voters while negotiations continue. For universities and school systems that purchase magnetically heavy lab equipment, servers, sensors, and devices, this distinction is essential. Announced friendliness does not eliminate costs. A 47 percent effective tariff rate, down from 57 percent, still increases the price of learning tools and slows down replacements in under-resourced districts.

What made this round unique was how the public ceremony supported private bargaining. South Korea organized a reception tailored to Trump’s preferences and symbolism. He received the country’s highest honor and was presented with a replica Silla-era gold crown. Flattery may not be policy, but in tariff diplomacy, it plays a role in the negotiation process that turns a leader’s desire for grandeur into practical space for deals. By combining formalities with offers on autos, agriculture, and critical minerals, Seoul made a smart move: invest in cultural goodwill and ceremonial time to gain real concessions. Japan took a quieter approach during a Tokyo visit that reinforced alliance strength under a new prime minister and maintained trade relations. Regional leaders did not yield; they optimized. The public displays served as the price of entry to the negotiations, where tariff rates and licensing rules could shift by five or ten percentage points—changes that influence whether factories hire and whether schools can afford new equipment.

Using deference as a bargaining tool

Performative deference is a reasonable choice in a situation with high concentration risk. When one supplier dominates a crucial input, being polite is cheaper than severing ties quickly. China’s lead in refining essential minerals and rare earths raises the stakes for miscalculation. In October, Beijing tightened and then partially eased export controls on specific categories of rare earths. Washington responded by lowering some tariffs on China and suspending some of its own controls. The mixed but clear message to markets was that both sides would protect their leverage while managing political risks. For Asian partners, the lesson is straightforward. Use public displays to gain time, then secure narrow technical wins on licensing, standards, and port fees where it counts. While public optics invite criticism at home, the policy results are tangible: smoother paperwork, lower costs, and enough certainty to keep factories and classrooms operating.

This is not about appeasement. It is a practical, low-cost strategy in a world where tariffs stick and finding alternatives takes time. Consider what would replace performative deference: ramping up punitive tariffs while scrambling for non-Chinese suppliers that don’t exist at scale yet. The IEA’s 2025 critical minerals outlook shows that China remains the primary refiner for nineteen out of twenty essential minerals, with a market share of around 70 percent. For rare-earth magnets, vital to electric vehicles and many lab devices, Chinese companies retain significant positions across various stages of production. Even optimistic U.S. initiatives to increase domestic magnet production and diversify mining efforts face long lead times. In this context, ceremonial diplomacy serves as a negotiation tool. It reduces short-term uncertainty without giving up the opportunity to diversify in the medium term. The aim is to buy a year, not commit for a decade.

The rare-earth challenge and the one-year ‘truce’

The Busan meeting opened a narrow path for trade. Reports suggest that the United States will reduce some tariffs to about 47 percent from around 57 percent by cutting a portion of tariffs on fentanyl-linked goods. At the same time, China will suspend specific rare-earth export limits and restart agricultural purchases. The two leaders agreed to continue discussions—a vital indication, not a solution. This indication rests on a fundamental fact: China processes most of the world's rare earths and remains a key player in the critical minerals sector. In 2024, the U.S. imported about 70 percent of its rare earths from China. This reliance directly affects costs for everything from high-end robotics kits to motors in campus shuttles. Even after the "truce," cost pressures persist because effective tariffs remain high, and suspending export controls can be reversed with little notice.

Referring to this as a one-year truce isn’t cynical; it reflects how tariff diplomacy functions. APEC provided the venue, but supply chain realities dictated the logistics. Beijing’s actions in April and October reminded markets that export licensing could be adjusted without formal bans. Washington’s response showed that selective tariff cuts could reassure political groups—like farmers and automakers—without abandoning a tough stance. Both sides claim victory while keeping options open. For educators and administrators, the practical takeaway is clear: treat 2025–2026 as a period of managed friction. Budget for higher equipment costs, even if some rates drop. Diversify purchasing towards allies when possible. And in every course that addresses trade, governance, or industrial policy, teach tariff diplomacy as a case study of how perception, law, and logistics intersect. Students should understand why a gold crown can influence a steel tariff—or at least the paperwork involved.

From the summit theater to the classroom strategy

Education systems shouldn’t wait for the next summit to determine what to teach or buy. Start with the curriculum. Policy, business, and engineering schools should create a foundation on tariff diplomacy that connects trade law, economic policies, and supply chain design. Use current case studies with verifiable figures: effective U.S. tariff rates after the Busan meeting; China’s dominance in refining; licensing processes for rare earth exports; and alliance-based strategies from Japan and South Korea. Students should assess how a five or ten-point tariff shift impacts a bill of materials for a robotics kit and how a licensing suspension changes delivery risks. This goes beyond international relations. It relates to the details of a lab order: the number of magnets, the applicable tariff line, the export code, and the shipping schedule. Incorporating tariff diplomacy into practical coursework equips graduates to understand the following statement and adjust a purchasing plan by Monday.

Next, address budgets and access. Even after cuts, tariffs keep prices high, and licensing issues extend lead times. Universities should establish framework agreements with suppliers across multiple regions, including Australia, the EU, and Japan, and pilot refurbishment and recycling programs for devices that use a lot of magnets. This may not be glamorous, but it pays off. Where possible, combine purchases across departments and school districts to achieve scale and reduce tariff impacts. Create a rolling inventory reserve for critical components most vulnerable to licensing fluctuations. The goal is not to hoard but to reduce the time between policy shifts in Beijing or Washington and a canceled lab session in Marseille or Manila. Use this friction as a learning opportunity. Students can model the cost impact of a tariff reduction from 57 to 47 percent, analyzing its effects on a district’s robotics program. That’s how we convert the Summit Theater into a practical classroom.

Finally, link trade realities to educational outcomes. PISA 2022 recorded the most significant drop in math scores since the survey began. This decrease is not due to tariffs, but it amplifies their effects. When systems face pressure, delays, and higher costs, they hit hardest. Use tariff diplomacy to revive quantitative skills: have students calculate effective rates, simulate sourcing options, and analyze choices under different export-control systems. In policy tracks, require brief memos that translate summit announcements into purchasing guidelines for public school systems. In teacher training, highlight how global shocks affect classroom resources and how to address them with open hardware, local production, and partnerships. By emphasizing tariff diplomacy across programs, we prepare graduates who can understand the politics and manage the numbers. This combination of narrative comprehension and numerical acumen equips individuals with the skills needed for the next decade.

The number that shaped this season is still valid: China refines about 90% of the world’s rare earths. This is why leaders displayed friendliness in Busan, why the United States reduced a high tariff, and why the term “suspension” was prominently featured in official statements. Tariff diplomacy is not a trend. It is the operating system for a world where access to resources and political theater intersect. The education sector cannot ignore this. Curricula must address the logic behind these negotiations. Purchasing strategies must consider risks. Administrators must understand effective rates and licensing risks. If we do this, the subsequent “truce” will not just be another headline. It will be a year to build capacity, recycle wisely, make better purchases, and teach students why a crown, a handshake, and a note on export rules can influence an academic year. The choreography will persist. Our task is to ensure learners can follow the steps—and then create their own.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

AP News. (2025, September). What to know about China’s new regulations on rare earths (notes near-90% processing share; ~70% of U.S. REE imports from China).

Brookings Institution. (2025, November 5). What happened when Trump met Xi? (meeting lasted roughly 100 minutes in Busan).

East Asia Forum. (2025, November 9). Trump’s Asia trip a surprising success (tariff cuts, suspensions of export controls and port fees; diplomatic context).

East Asia Forum. (2025, November 10). The United States and China take a step back and send a signal of hope (editorial synthesis of concessions and guardrails).

International Energy Agency. (2025). Global Critical Minerals Outlook 2025: Executive Summary (China dominant refiner for 19 of 20 minerals; ~70% average share).

OECD. (2023). PISA 2022 Results (Volume I): The State of Learning and Equity in Education (sharp post-2018 declines in math and reading).

Reuters. (2025, October 30–November 1). What did Trump, Xi agree to on tariffs, export controls and fentanyl? (effective U.S. tariff rate cut to ~47% from ~57%).

Reuters. (2025, Oct. 30–31). Trump shakes hands with Xi in Busan; South Korea gifts replica gold crown (symbolic gifts amid trade talks).

U.S. Geological Survey. (2025). Mineral Commodity Summaries: Rare Earths (U.S. production and import trends).

Comment