Publicity Rights Valuation in the Age of AI

Input

Modified

Publicity is now a measurable asset, not just awareness AI “digital doubles” and new laws make identity portable, licensable, and enforceable Schools should value identity with attention-adjusted EMV and share revenue transparently

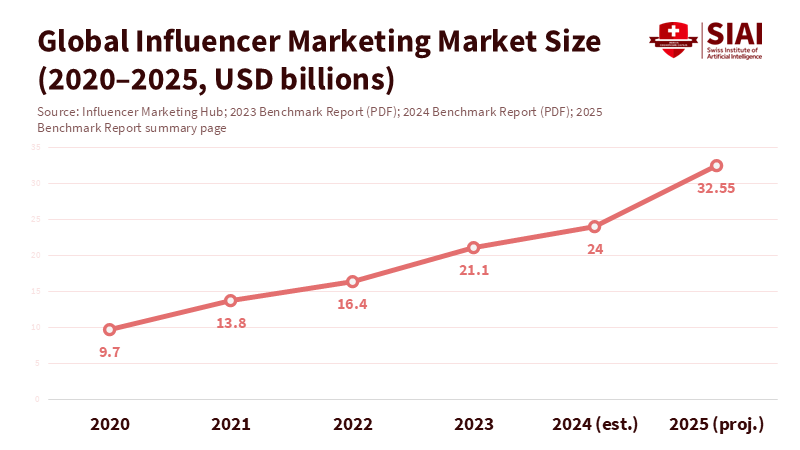

If you are looking for a clear indicator of where education, media, and law are headed, consider this: the influencer economy was valued at about $24 billion in 2024 and is expected to exceed $32.5 billion in 2025. This money does not go to factories or schools. It goes to attention, identity, and trust, which old textbooks dismissed as “publicity.” However, that term no longer reflects reality. Publicity is now an asset class. It can be priced, insured, licensed, securitized, and enforced. This is the foundation of publicity rights valuation in 2025. Students, professors, athletes, and ed-tech founders no longer need a sneaker line or a textbook to turn their reputation into economic value. Synthetic media and platform analytics allow identity to generate value even while its owner is not active. Laws are catching up, and so are markets. The question for education policy is not whether this matters, but how to measure it accurately and share it fairly.

Publicity Rights Valuation after the Product Era

Publicity used to depend on products. Think of the Jordan model: a personality creates demand while a product secures the revenue. In 2024, Jordan Brand alone generated an estimated $6.59 billion for Nike, illustrating the old “awareness to product sales” progression. That model still works, but it is no longer the only way. Today, creators earn money directly through platform payouts, subscriptions, affiliate sales, and licensing. Universities are also adapting to this change: professors with substantial online followings offer cohort-based courses, while student-run channels provide paid mentorships. In this environment, the value of identity stands on its own and doesn’t need a physical product to back it up. The message is clear. Institutions treating reputation as a minor asset risk losing significant revenue and overlooking real hazards.

The new framework relies on two main factors. First, markets for attention now operate at scale. Social platforms and marketplaces connect micro-audiences with micro-influencers in real time, lowering barriers and clarifying pricing. Second, measurement has advanced. We can now assign a consistent shadow price to reach and engagement across various formats and channels. This transition moves publicity rights valuation from theory to practice. It also reveals why the broader creator economy continues to grow, even as traditional ad budgets fluctuate: buyers can see the tangible impact of identity and pay for it with increased confidence. For education, this means a university’s brand and each community member’s identity can become complementary sources of income rather than competing for attention.

How to Measure Publicity Without Sales: A Practical Standard for Publicity Rights Valuation

The most challenging policy question is also the most practical: how do we assign a value to identity without relying on product sales? Begin with Earned Media Value (EMV), a crucial metric for valuing attention driven by creators. EMV translates engagement into a cash equivalent, enabling us to track the publicity rights valuation of individuals or programs even when no product changes hands. Major analytics firms define EMV as the monetary value of third-party content about a brand or individual, based on reach and interaction. While it has its flaws, it is consistent enough to act as a baseline across campaigns, creators, and time. When institutions calculate EMV for their faculty creators, athletic programs, or online courses, they establish a common standard for contracts, revenue sharing, and insurance. This is far more important than having a perfect metric that no one actually uses.

EMV alone is inadequate. The quality of attention—the kind that leads to results—needs to be factored in. Here, industry attention metrics bridge the gap between exposure and outcomes. Recent cross-industry case studies show that investing in high-attention areas yields significant improvements in both upper- and lower-funnel results. Adoption of attention-based verification is increasing among media buyers. For universities and ed-tech companies, this means you can assess the value of an instructor’s or athlete’s identity using a blend of EMV and attention-adjusted measures. Let’s call it EMV-A. A course trailer that maintains sustained attention is worth more than a viral clip that viewers quickly scroll past. Basing publicity rights valuation on EMV-A strengthens negotiations, clarifies expected returns on investment, and provides compliance teams with a solid, auditable method.

Digital Doubles Make Publicity Portable—and Tradable

A significant change is happening: digital doubles—authorized AI versions of likenesses and voices—allow identities to function without the person being present. Laws are adapting quickly. In March 2024, Tennessee passed the ELVIS Act, the first state law to explicitly extend the right of publicity to voices and address AI misuse, effective July 1, 2024. This law indicates a broader trend toward treating identity as property that can be consented to, priced, and enforced—not merely as a privacy issue. For education, this opens up legitimate markets for licensed digital replicas of lecturers, coaches, and student leaders. It also establishes clear responsibilities for authentication, recording consent, and compensation. Institutions that develop these responsibilities now will avoid costly disputes later.

Europe created a second foundation with the EU AI Act, adopted in March 2024 and effective since August 1, 2024. This act imposes transparency requirements for synthetic content, including the labeling of AI-generated or manipulated media. Incorporating provenance and disclosure into the supply chain enhances measurement. Labeling cuts through noise in analytics and allows publicity rights valuation to reflect whether a human, a clone, or a hybrid earned attention. It aligns with the rapid adoption of Content Credentials (the C2PA standard) across platforms and tools, making identity transactions easier to trace. For universities that operate in or recruit from the EU, this framework simplifies compliance. It encourages consistent consent language for digital doubles across departments.

Policy, Education, and the Balance Sheet

The education sector is already experiencing the effects. In June 2025, a U.S. federal judge gave final approval to a $2.8 billion NCAA settlement, allowing schools to pay student-athletes for the commercial use of their name, image, and likeness while sharing revenue under defined limits. The NIL system has shifted from a patchwork of third-party deals to one in which institutions themselves have payment responsibilities. The key accounting challenge is to differentiate an athlete’s work from their publicity rights and to value both accurately. A reliable publicity rights valuation framework—using EMV-A and contractually recorded attention benchmarks—can accomplish this. It helps athletic departments forecast payouts, allocate coaching resources, and negotiate fair revenue shares without guesswork.

Administrators should take action now on four fronts. First, revise IP and media policies to view identity as a licensable, traceable asset. Clearly define “use,” “scope,” “territory,” and “synthetic use,” and require C2PA-compliant provenance for all institutional media featuring individuals. Second, create a rights registry that logs consent, use periods, and revenue-share arrangements for faculty and students; this registry should integrate with learning platforms and media teams. Third, incorporate EMV-A reporting into annual reviews for large-scale marketing programs—degree launches, MOOCs, and athletics—so budget committees can see the value of identity alongside tuition, grants, and sponsorships. Fourth, treat regular publicity income as an intangible asset under existing accounting standards, with clear impairment tests and disclosures. This is not radical. We already apply this to trademarks and broadcast rights. It keeps investors, donors, and auditors in agreement when identity is as important as inventory.

For educators, the benefits are practical. A licensed digital double can deliver a weekend masterclass without needing to travel. A series of brief, engaging explainer videos can drive more interest in a new certificate than a single flashy advertisement. A precise valuation method also protects junior academics and student leaders from unfair deals. Publicity is no longer just a benefit of fame. It is a product of teaching and learning in public—and it should be priced accordingly.

The common criticism is that publicity metrics are inconsistent, manipulated, or only loosely connected to learning outcomes. That concern should factor into the model, not dictate its use. EMV has known biases; attention scores vary by format and context. However, the trend in measurement is strong. Large datasets show that higher attention correlates with better outcomes, and buyers are increasingly willing to transact based on this. When you reveal methods, log consent, and track results, the remaining uncertainties become manageable—certainly more manageable than relying on gut feelings about sponsorships and unclear “exposure” agreements. Publicity rights valuation is not perfect, but it is a solid basis for governance, and it is advancing rapidly.

One year changed everything. In 2024–2025, lawmakers and markets converged on a key insight: identity is valuable capital. The influencer market’s jump to tens of billions, the ELVIS Act’s voice protections, and the EU AI Act’s labeling requirements all point in the same direction. Publicity rights valuation is now essential for schools, conferences, and ed-tech companies that engage with the public. Treat identity as an asset. Measure it with clear, attention-adjusted metrics—record consent with traceability standards. Share the proceeds with the individuals who create the value. If we do this, the sector will generate more scholarships, broaden access to quality content, and enhance public trust. If we delay, we will be left with rules and royalties established by others. The numbers are already available. The tools are ready. The law is in place. Education should take the lead.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Adelaide. (2024). Outcomes Guide: Attention metrics and advertising outcomes (press/blog summary).

Adobe / C2PA. (2024). Content Credentials momentum and C2PA adoption (industry updates).

CreatorIQ. (2024). What is Earned Media Value (EMV)? and Brands of the Year 2024 (methodology notes).

DoubleVerify. (2024). Global Insights: 2024 Trends Report and newsroom coverage on attention adoption.

European Commission. (2024, Aug. 1). AI Act enters into force.

European Parliament. (2024, Mar. 13). Artificial Intelligence Act: MEPs adopt landmark law (includes transparency obligations for synthetic media).

Influencer Marketing Hub. (2024–2025). Influencer Marketing Benchmark Reports (market size: $24B in 2024; $32.55B in 2025).

Lumen Research / IAS. (2024). Attention metrics landscape and performance lifts (blog synthesis of IAS results using Lumen tech).

Nike / Forbes. (2024, Apr. 22). Jordan Brand revenue context.

Reuters. (2024, Mar. 21). Tennessee becomes first U.S. state with law protecting musicians from AI (ELVIS Act).

Reuters. (2025, Jun. 9). Judge approves $2.8B NCAA settlement allowing schools to compensate athletes for NIL and revenue sharing.

State of Tennessee / Latham & Watkins. (2024). ELVIS Act explained; effective July 1, 2024.

Comment