Lab-Grown Diamonds and Conflict Diamonds: The Real War-Breaker?

Input

Modified

Certification helps but is narrow and assumes high natural diamond prices Lab-grown diamonds crush prices, shrinking conflict rents at the source Pair stronger traceability and sanctions with support for mining communities and education

A striking number plays a significant role in global security: 5% to 10%. That’s how much lab-grown diamonds currently cost compared to mined stones. Some trade reporters have found polished synthetics selling for as little as $15 per carat. The price drop is dramatic, extensive, and worldwide. This change has been driven by increased capacity in China, improved reactors, and a retail shift that prioritizes profits over mystique. The outcome is not just an additional option for consumers; it disrupts the illegal diamond market's revenue stream. If armed groups once benefited from high diamond prices, that support is diminishing today. We should ask a difficult question. If armed groups require funding and a key commodity has lost much of its value, perhaps the true “war-breaker” in diamonds isn’t a certificate stamp. Instead, it might be the rise of a nearly perfect substitute that cuts profits at the source.

Reframing the resource-conflict link

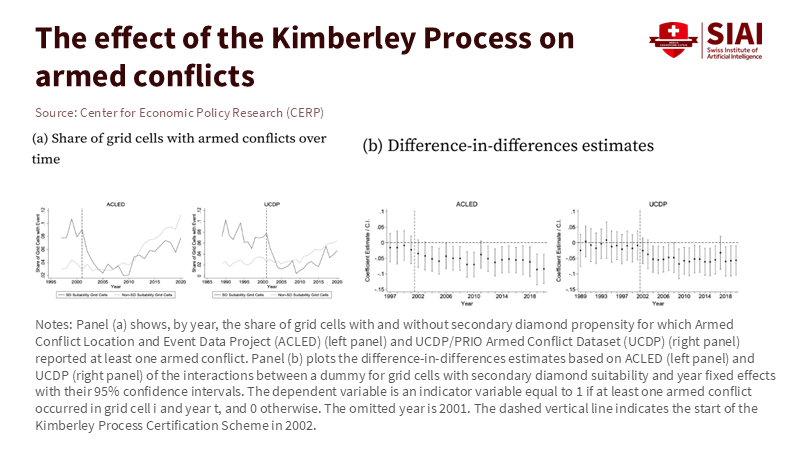

The traditional narrative suggests that diamonds finance violence while certification limits rebels’ resources. That narrative isn't entirely incorrect. Recent research shows that after a certification system for rough stones was implemented, the chances and spread of armed conflict in areas suitable for alluvial diamond mining decreased. The reasoning is straightforward. Certification makes it harder to launder rough stones into the legal market, thereby increasing the costs of selling stolen goods and lowering potential earnings for armed groups. However, this logic has a crucial limitation. It assumes that demand and prices for mined diamonds remain high enough to justify the risk of laundering. That assumption is no longer valid.

What has shifted is not just policy but also price. In recent years, lab-grown diamonds have transitioned from novelty items to the norm for many buyers. Wholesale prices for synthetics have dropped by 90–95% from initial mainstream levels, and the gap with natural stones has widened significantly. U.S. retailers report substantial deflation in both categories, but the decline is more pronounced on the synthetic side. When a three-carat lab-grown diamond can be purchased wholesale for a few hundred dollars, it makes the prospect of smuggling a mined stone much less appealing. Reduced potential profits lessen the motivation to steal and tax alluvial deposits. A market factor has entered the security equation.

What the Kimberley Process is—and is not

The Kimberley Process is the official framework that aims to prevent “conflict diamonds” from entering global trade. It brings together governments, industry, and civil society. It includes 86 countries and claims to oversee 99.8% of the world's production. In practice, it issues and verifies certificates for shipments of rough stones and has the authority to suspend countries that do not comply. The system is supported by the UN and enforced via customs, with national authorities monitoring imports and exports. No one should overlook the influence of this network; it established a standard for transparency in a previously unclear trade.

However, scope is essential. Critics note that the legal definition of a "conflict diamond" is limited. It focuses on rough stones used by rebel groups to oppose legitimate governments. It does not directly address state violence, corruption, labor violations, or environmental damage. Over two decades, it has only officially labeled a few countries as “conflict,” most notably Côte d’Ivoire in the 2000s and parts of the Central African Republic after 2013. In many other situations where diamonds are linked to violence, the system neither suspends nor reforms; it merely certifies. This is not just a moral flaw but a deliberate design choice. The model addresses a specific issue while leaving many others unexamined.

Rules have also evolved beyond the Kimberley Process. In 2024, the G7 and the EU began introducing bans and traceability requirements aimed at Russian diamonds. These measures have become stricter over the year, including documentation requirements for polished goods. They create a separate enforcement pathway, based on origin tracking and trade regulations. The focus is shifting from a single certificate to comprehensive visibility. The trend is clear: increased traceability, more data, and heightened scrutiny of origin claims. This shift underscores the limitations of an approach based solely on certificates and indicates where policy efforts are currently directed.

How lab-grown diamonds reshape conflict diamond markets

Lab-grown diamonds directly change incentives in several ways. First, prices. Trade reports and analyst insights agree that synthetic prices have plummeted as production scales up. This decline lowers retail prices and further reduces wholesale values. The impact is not limited to synthetics. Natural diamond prices have also been affected, leading miners to lower rough prices and, in some cases, to reduce valuations. As deflation spreads throughout the diamond market, the income that once fueled looting, taxation, and smuggling diminishes. It doesn’t resolve the issue but makes the rewards less appealing.

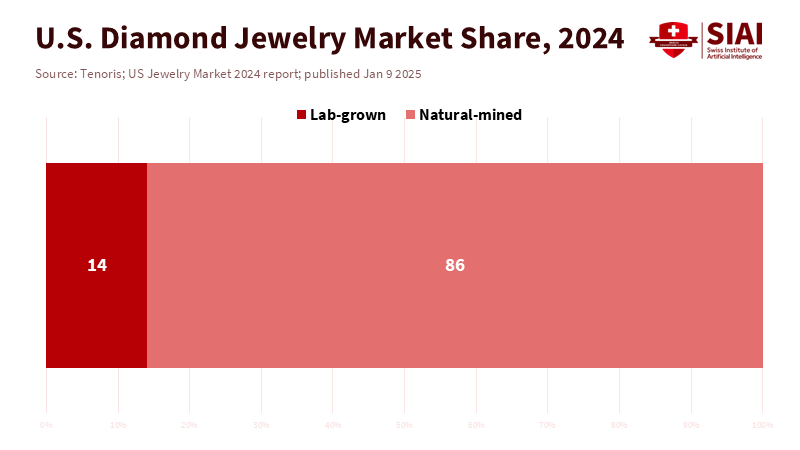

Second, market share. Estimates vary, but U.S. data indicate that lab-grown diamonds now account for a significant portion of diamond jewelry sales. Some sources estimate their share at around 15% of the overall jewelry value. In contrast, others state that nearly half of engagement ring purchases include synthetics. Engagement rings are essential because they are high-value products that set retail standards. If many couples accept synthetic stones as “real enough,” the status appeal that supports natural diamond prices declines. As buyer preferences shift, the demand for mined diamonds decreases, putting illegal operators at a disadvantage. The allure of high profits from unlawful extraction is fading.

Third, technology and traceability are coming together. Detection tools are improving. Retailers can test stones, and origin tracking is being integrated into G7 markets via new regulations. This makes it more challenging to mix conflict stones into legal channels. At the same time, the lab-grown supply is flexible and global. Producers can increase output without the geographical limitations that restrict mines. This combination of easier detection, stricter traceability, and a cheaper alternative lowers the potential value of smuggling. Suppose the quickest way to obtain a “bigger” stone at a lower cost is a lab-grown option backed by a jeweler’s authentication and accepted by consumers. In that case, illicit miners lose their strongest sales argument.

Lab-grown diamonds as a security externality

This isn’t an argument against certification. It’s an argument about relative power. Certification and traceability raise the costs of laundering mined stones. Sanctions remove major suppliers from lucrative markets. Lab-grown diamonds decrease the price floor that once provided looters with cash. Together, these factors change the incentive structure that linked alluvial deposits to violence. The hard truth is that the connection breaks not only when rules are enforced but also when profits decline. In that sense, lab-grown diamonds are a security externality. They were not explicitly created to end conflict. They still matter because they limit financial resources.

What should educators do with this? Teach the underlying mechanisms. Show how a close substitute can alter a war economy by driving down prices and shrinking illegal margins. Use the diamond example to explain rent-seeking, black-market arbitrage, and the interaction between certification and market structure. Combine the formal definition of “conflict diamonds” with the critique that its scope is too limited. Then trace how policy has evolved from paper certifications to digital traceability and sanctions. Students should understand that rules are beneficial, but market design and technology can shift incentives faster than laws alone. This is applied political economy, not just a moral narrative.

Administrators and policymakers also have options. Public buyers and university foundations can set procurement rules that differentiate between mined and lab-grown stones when acquiring ceremonial items or donor gifts. Teacher-training programs can develop case modules that explore price trends and trade policies. Governments can invest in livelihood support in mining areas connected to education and skills, as lower diamond profits won’t automatically create good jobs. Suppose we claim that a market shift can weaken a war economy. In that case, we must also consider the people who relied on that economy, many of whom are informal diggers with few choices.

We started with a significant range: 5-10%. The price gap between lab-grown diamonds and mined stones is too considerable to ignore. It threatens the very profits that once fueled conflict. Certification remains important. Recent studies suggest it has helped reduce violence near alluvial deposits. Meanwhile, traceability enhances this effort by closing off easy laundering paths. However, price is also a key policy factor that shapes incentives on a large scale. The rise of lab-grown diamonds diminishes the incentive to loot, and this change occurs more rapidly than many laws can adapt. The call to action is clear. Continue improving the legal framework. Invest in traceable supply chains and skills for mining communities. Teach students to view markets as part of peacebuilding efforts. Suppose we aim to break the link between diamonds and war. In that case, we should leverage every available resource—certification, policy changes, and lab-grown diamonds that make violence less profitable.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

BriteCo. (2025). The Lab-Grown vs. Natural Diamond Report.

De Beers Group. (2024). Spotlight on Diamonds [presentation].

European Commission. (2025). FAQs: Restrictions on diamonds of Russian origin and traceability requirements (updated Aug. 4, 2025).

Financial Times. (2025). How the diamond industry lost its sparkle.

IPIS. (2025). Why the Kimberley Process is not the answer to today’s mineral governance challenges.

JCK Magazine. (2025). The Narrative About Lab-Grown Diamonds Is Changing.

Kimberley Process. (2025). About the KP: Participants and coverage.

McKinsey & Company. (2024). The diamond industry is at an inflection point.

Skadden, Arps. (2024). EU further strengthens restrictive measures against Russia: diamond ban and traceability.

Tenoris. (2025). U.S. jewelry market 2024: Sales rise 1.4%; lab-grown share 14%.

U.S. Customs and Border Protection. (2025). Conflict Diamonds and the Kimberley Process.

VoxEU/CEPR. (2025). Certification schemes may break the link between natural resources and violent conflict.

Wall Street Journal. (2025). Natural diamonds had a rough year—some hope to restore their shine.

Comment