Cashless by Design, Resilient by Default: Digital Money Resilience for Schools and Universities

Input

Modified

Schools must plan for digital money resilience as payments go cashless Keep layered rails—fast digital by default, cash and offline modes for outages Pilot CBDC/stablecoin use with strict safeguards, contracts, and treasury diversification

A striking fact frames the choice before us. As of 2025, 137 countries and currency unions, covering about 98% of global GDP, are exploring central bank digital currencies (CBDCs). Forty-nine are already in pilot, and three have launched. The world is rapidly building a digital future for money. Yet when systems fail, payments stop. Classrooms, cafeterias, student buses, and bursars' offices feel the shock within minutes. This isn't a hypothetical risk. Power cuts, network outages, cyber incidents, and vendor failures happen every year. Europe's card networks have experienced high-profile interruptions. The Nordic countries, pioneers of cashless living, now urge citizens to keep some cash for emergencies. In this rush to digitize, education systems face a direct challenge: can they keep teaching and feeding students when the network fails? The focus should be on digital money resilience—a capacity to maintain learning even when payment systems break, not just on innovation or speed.

Reframing the transition: from "digital by default" to digital money resilience

Most debates focus on whether cash will disappear or when CBDCs or stablecoins will take over. This perspective is too narrow for schools and universities. The key question is whether daily education services can endure disruptions in a world where money exists on connected devices. Digital payments already lead in Europe. In 2024, a majority of euro area consumers preferred cashless payments in stores, but 62% also stated that having cash available still matters. These two facts coexist for good reason. People want speed and ease of use day to day, along with a backup when necessary. Education budgets, meal programs, exam fees, transit passes, and tuition plans should reflect this same logic. Digital money resilience requires us to create systems that perform well in regular times and manage failures effectively during tough times.

The trends are clear. E-money transactions in the euro area rose by 2.6% in the second half of 2024 to 4.6 billion, with a 15.8% increase in value. In the UK, the share of cash payments continues to fall, while mobile wallets are on the rise. However, the same period saw significant card outages at national retailers, with a higher number of failures reported. Sweden's civil-contingencies agency and the Riksbank have advised households, shops, and local governments to maintain small cash reserves, noting that digital systems can go down. These aren't contradictions; they represent two parts of a consistent policy. Digitize for reach and efficiency, but engineer for digital money resilience to ensure schools can operate when issues arise.

Adoption without overreach: stablecoins, CBDCs, and digital money resilience

Private stablecoins surged during 2024–2025. The global stablecoin market reached new heights in 2025, with estimates ranging from $216 to $252 billion in early to mid-2025 and approaching $300 billion by September. Transaction volumes also jumped significantly. This momentum explains why lawmakers have introduced bills that require high-quality liquid reserves and monthly disclosures. Policy is beginning to keep pace with practice. However, for widespread use in public services, including education, strict guardrails are necessary: fund segregation, settlement finality, and operational resilience standards that match or exceed those for card networks and clearinghouses. Digital money resilience can transform the benefits of instant, programmable settlement into safe public systems instead of introducing new vulnerabilities.

CBDCs are transitioning from research to the building phase in Europe. In October 2025, the ECB moved the digital euro to its next preparation stage, with pilot projects likely in 2027 if legislation is approved in time, and potential issuance around 2029. The ECB has also started contracting fraud-risk technology, emphasizing that anti-fraud measures and uptime are crucial design elements. Public authorities still stress that the decision to issue a digital euro will follow legislative approval, and a cash option remains part of the policy toolkit. For education ministries and university finance offices, this clarity aids in procurement: plan for interoperability, staged pilots, and digital money resilience measures that bridge traditional cash handling with new systems.

The broader lesson from recent bank runs is also significant. Silicon Valley Bank failed, with over 90% of its deposits uninsured. Depositors withdrew $42 billion in a matter of hours, with another $100 billion queued. This was not a failure related to cryptocurrency; it was a modern run on a networked system. Payment and treasury systems at schools and universities can similarly experience liquidity issues if they rely on a single provider or if digital systems connect to a weak treasury structure. Diversification, real-time monitoring, and pre-approved backup plans are essential to the resilience of digital money, just as they are in prudent cash management.

When the lights flicker: outages, disasters, and the case for layered systems

Digitization isn't guaranteed success. In early 2025, analysts asked a straightforward question: how do you pay in a disaster? The answer isn't to rely solely on cash, but to enable peer-to-peer digital value transfers that continue to work even when major systems fail, while also maintaining cash as an option. Recent outages in Europe illustrate potential operational issues: if a cloud region fails, card terminals can stop working; if a vendor API fails, meal-card checkouts can freeze. For a school district, this means students might miss lunch, bus fares can't be processed, and field-trip payments could fail. It's challenging to resume learning when the cafeteria line stalls. Digital money resilience means the cafeteria can still serve food, bus routes can still operate, and attendance systems can still function, even if some financial reconciliations take place afterward.

Nordic preparedness policies excel in this area. Sweden's civil protection guidance advises households to keep cash at home and prepare for a week without digital payments. The Riksbank recommends specific measures to safeguard cash acceptance and the cash infrastructure, ensuring support for a highly digital economy. Education authorities can learn from this approach. Maintain a small, auditable cash reserve for essential school transactions. Have a backup of offline-capable devices at high-traffic points (canteens, transport kiosks, ticketing). Pre-print emergency QR codes that link to accounts with later confirmation. These aren't nostalgic actions; they represent practical digital money resilience.

A playbook for ministries, university CFOs, and school leaders

First, focus on structure. Treat payments as critical infrastructure in the education system, akin to heating or network access. Require at least two independent payment options across different providers. One can be the default cloud-processed card or mobile wallet flow; the second should operate locally and support offline capabilities. Many modern terminals and wallet SDKs can cache transactions and sync them later, applying risk thresholds and limits. Set these limits in policy and test them each term. Integrate this into a business continuity plan that elevates digital money resilience to the same level as data backup drills.

Second, aim for cash-continuity rather than just creating a "cash-only day" scenario. Evidence shows that while most consumers prefer digital methods, a solid majority still want access to cash. Schools should reflect that preference through small, well-managed cash reserves, clear reconciliation rules, and documented handover procedures. Make vendor contracts clear about cash acceptance during outages and outline service credits triggered by downtime. Digital money resilience involves both contractual and technical components.

Third, prepare for CBDC and stablecoin trials without risking essential services on them. The ECB's timeline for the digital euro indicates a multi-year process, with pilots around 2027 at the earliest. This provides an opportunity to conduct non-essential pilot projects, such as scholarships disbursed to a limited group with programmable features that release funds based on enrollment milestones, or micro-grants for teachers with instant settlement to approved vendors. Pair these with thorough opt-outs, privacy assessments, and backup systems. Explore stablecoin use for international tuition deposits or visiting scholar stipends when conversion costs are high, but only with regulated, transparent issuers that publish reserve audits and meet uptime standards comparable to those of card networks. The goal isn't to chase novelty, but to rigorously test the resilience of digital money before core services become dependent on it.

Fourth, prioritize user-level continuity. A payment system fails if human workflows don't function. Train bursar staff, cafeteria managers, and transport coordinators to switch to offline and cash-continuity modes within minutes. Provide quick-reference cards at registers and help desks. Alert parents when the district shifts to backup modes, providing brief instructions on specific alternative methods: "bring exact change," "show student ID for deferred billing," "scan this fallback QR code that will settle later." Resilience relies on simple, practiced steps.

Fifth, consider cybersecurity and fraud prevention as fundamental design elements of the payment system. The ECB's recent contracts for fraud-risk management for the digital euro emphasize this. Education systems handle minors' data, public funds, and vast amounts of small transactions, making them attractive targets for criminals. Fraud risk analysis, anomaly detection, and limited access reduce the likelihood of a local outage that could lead to a system-wide failure. Connect fraud controls to a plan for graceful degradation so that if risks increase, the system can slow high-risk transactions while keeping essential services running. That encapsulates digital money resilience from a security perspective.

Sixth, monitor the treasury and counterparty risks closely. The SVB failure demonstrates how speed and risk concentration can combine. Education treasurers should distribute operating balances across multiple institutions and verify collateral and insurance levels. Map the flow from the point of sale to settlement banks to treasury accounts. If one part fails, how quickly can funds be redirected? Conduct a quarterly simulation of what would happen if a provider failed. Small steps in treasury management can enhance digital money resilience on the front lines.

Finally, communicate with families. When parents understand that the school can serve lunch, run buses, and accept fees during a regional outage, trust increases. Publish a brief on digital money resilience on the district website. List the primary and backup systems, the cash continuity plan, and a summary of privacy measures. Commit to testing the plan and providing annual updates. This isn't just about operations; it's part of the social contract that keeps classrooms calm when systems face issues.

Anticipating critiques—and answering them with evidence

One critique suggests that these concerns are overstated. In practice, outages are brief and infrequent. However, the frequency of national-scale payment interruptions and the growing reliance on mobile wallets suggest caution is warranted. If the cafeteria line stops during a single lunch period, the impact is immediate, visible, and difficult to recover from. A resilient system treats even minor disruptions as design challenges rather than accidents. Another critique argues for rushing to a cashless system, claiming that cash is costly and enables crime. Economists have long made that case. Yet EU data reveal significant support for maintaining cash availability, and Nordic authorities are creating laws to protect their basic infrastructure. Cash acceptance and small reserves are not nostalgic; they serve as a low-tech layer that strengthens a high-tech system. Digital money resilience lies at this intersection.

A third critique assumes that stablecoins or a digital euro will resolve all issues. The record-high stablecoin market cap and transaction volumes show promise, and Europe's careful approach to the digital euro may create strong public systems. However, research on systemic risks warns that as digital assets and traditional finance become more interconnected, complexity and concentration risks may increase—even as stability improves with more substantial reserves. The solution isn't to halt innovation. It's to implement high standards for uptime, reserves, transparency, and failover before public service budgets become reliant on the technology. That's at the core of digital money resilience.

Build the future of money where schools do not falter

The world isn't waiting. Governments are piloting CBDCs, lawmakers are drafting stablecoin regulations, and consumers are already using digital payment methods. Education systems can't remain passive. But success isn't about the newest technology or the name of a payment system. It's about whether teaching and care continue uninterrupted when a server crashes, a fiber line is cut, or a vendor fails. The opening fact about widespread CBDC exploration highlights the course ahead. The next step is to ensure that this journey is safe for students and staff. Integrate digital money resilience into every procurement, contract, device, and workflow. Maintain a minimal cash layer. Test new systems in low-stakes environments where learning remains a priority. Publish the plan and execute it. By doing this, the future of money in education can be both fast and inclusive during good times, and calm and reliable during crises.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Atlantic Council. (2025). CBDC Tracker (137 jurisdictions, 98% of global GDP; 49 pilots; 3 launches). Retrieved November 3, 2025. Atlantic Council

Bank for International Settlements (BIS). (2025). BIS Papers No. 159: 2024 BIS survey on CBDCs. Retrieved November 3, 2025. Bank for International Settlements

Birch, D. (2025, January 16). How Do You Pay in a Disaster: Cash and Cryptocurrency in Catastrophes. Forbes. Retrieved November 3, 2025. forbes.com

CIGI (Centre for International Governance Innovation). (2025, July 17). Digital Assets and the Potential for Global Systemic Risk (Paper No. 328). Retrieved November 3, 2025. cigionline.org+1

ECB (European Central Bank). (2024, December 19). SPACE 2024: Payment attitudes in the euro area (press release and summary). Retrieved November 3, 2025. European Central Bank+2European Central Bank+2

ECB. (2025, October 30). Eurosystem moving to next phase of digital euro project (press release), and Progress on the digital euro web pages. Retrieved November 3, 2025. European Central Bank+1

FDIC. (2024, May 17). Lessons Learned from the U.S. Regional Bank Failures of 2023 (speech). Retrieved November 3, 2025. FDIC

PaymentExpert. (2024, July 11). Card outages felt across various UK retailers. Retrieved November 3, 2025. PaymentExpert.com

Riksbank (Sveriges Riksbank). (2024, March 14). More measures needed to protect cash. Retrieved November 3, 2025. Sveriges Riksbank

Swedish Civil Contingencies Agency (MSB). (2024, November 12). Payments and cash in times of crisis. Retrieved November 3, 2025. msb.se

TRM Labs. (2025, August). 2025 Crypto Adoption and Stablecoin Usage Report (transaction-volume growth). Retrieved November 3, 2025. trmlabs.com

UK Finance. (2024). UK Payment Markets 2024 (summary); UK Cash & Cash Machines Report 2024. Retrieved November 3, 2025. UK Finance+1

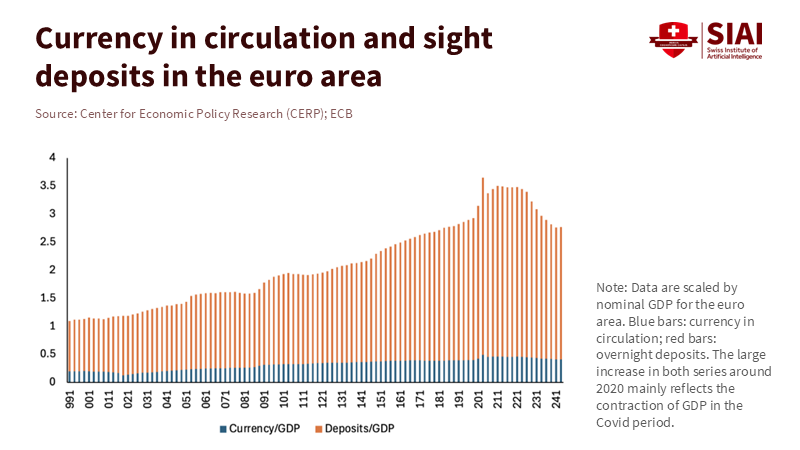

VoxEU/CEPR. (2025, October 18). What money will become: Seven key questions. Retrieved November 3, 2025. cepr.org

Reuters. (2025, June 18). Stablecoins' market cap surges to record high as U.S. Senate passes bill. Retrieved November 3, 2025. Reuters

FN London. (2025, September). Stablecoin market nears $300bn; issuer concentration. Retrieved November 3, 2025.