Policy Uncertainty, Not Polarization, Explains Spain's Talent Squeeze

Input

Modified

Policy uncertainty, not polarization, drives Spain’s talent loss Low vacancy rates and selective outflows show thin, unreliable opportunities Fix it with stable multi-year funding and fixed calendars to lift hiring

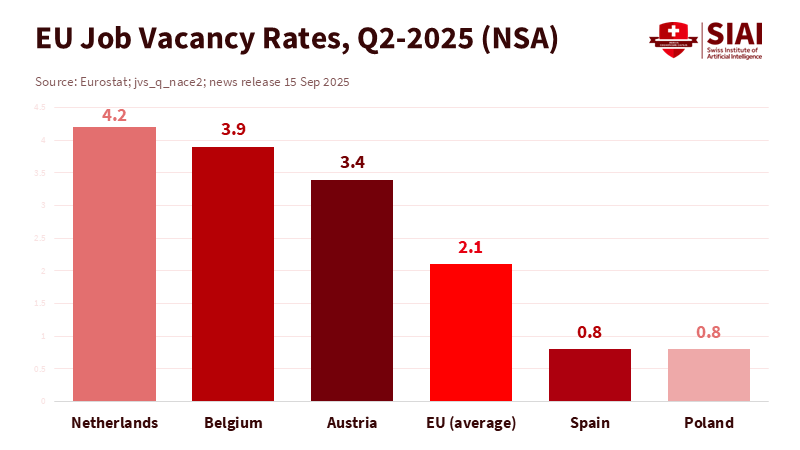

Spain entered 2025 with the lowest year-end unemployment since 2007. However, it also has one of the thinnest pipelines of new jobs in Europe. The job vacancy rate stands at 0.8%, among the lowest in the EU in Q2 2025, even as employment has risen. This number reframes the debate. If political polarization were driving talent away, we would see high labor demand in safer areas of Spain. But we do not see that. Instead, we observe a typical story of policy uncertainty: companies hold off on hiring, government agencies delay rulemaking and budget decisions, and professionals look abroad for opportunities. When policies are predictable, investment happens first, followed by people. When policies are unpredictable, investment and job openings stagnate, leading to the departure of highly skilled workers. The actual issue here is policy uncertainty, not polarization itself. Spain's low vacancy rate, which aligns with recent declines across the EU, clearly shows that opportunity—not ideology—limits job growth.

Rethinking the Link: Polarization Is Not a Sufficient Cause of Brain Drain

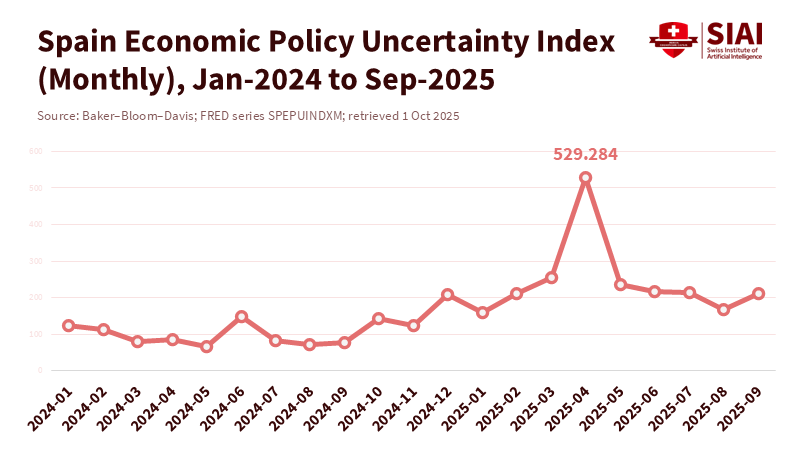

A common argument holds that political polarization breeds cynicism, driving talent away. However, this argument overlooks the mechanism at work. Polarization becomes economically significant when it leads to policy uncertainty, such as budget deadlocks, sudden changes, delays in approvals, or legal obstacles that hinder projects. This uncertainty stifles investment and hiring. Recent research shows that an increase in fiscal policy uncertainty significantly reduces real activity. In cross-country studies, higher uncertainty causes businesses to delay spending and production. Each month may show small uncertainty shocks, but they persist and eventually lead to weaker job creation. Spain is not unique in this respect; it follows a classic wait-and-see approach.

Let's examine Spain's fundamentals closely. By late 2024, unemployment had dropped to a 17-year low, yet the job vacancy rate stayed among the lowest in the EU. When job opportunities are limited compared to job seekers, skilled workers do not wait for a more favorable government. They look for stable career paths elsewhere. Eurostat's 2025 data shows Spain alongside Poland and Romania at the bottom of the EU's vacancy rankings, far from the Netherlands and Belgium, where companies continue to advertise positions despite economic challenges. This trend reflects an investment and hiring climate hampered by uncertainty, rather than a general exodus due to "polarized" politics. The data reveal that labor demand is tight in certain areas but weak overall, as we would expect when policy signals fluctuate across budget cycles and regulatory processes.

Spain's policy uncertainty has also increased due to overlapping shocks, including energy prices, changes in fiscal policy since the pandemic, and electoral conflicts. The European Commission's 2024 report emphasizes the impact of uncertainty on euro-area activity. Spain experiences this through delayed private projects and uneven public execution of the Recovery and Resilience Plan. None of this requires us to claim that polarization alone drives talent away. Instead, it shows that uncertainty amplifies every structural challenge Spain already faces: a heavy reliance on employment services, relatively low business research and development intensity, and uneven regional governance capacity.

What the Numbers Really Say About Talent Flows and Opportunity

If polarization triggered a simple exodus, we would expect a large-scale exodus. Instead, Spain reports sustained positive net migration—over 640,000 in 2023—reflecting strong inward movement, especially from Latin America, alongside continued departures of some Spanish citizens. This situation arises from two factors: Spain's appeal to many migrants and the mobility of its top graduates seeking better opportunities abroad. The key point is not contradiction; it is segmentation. Positive net migration can hide targeted departures of high-skilled Spaniards responding to limited job openings and administrative delays in key fields.

Health care provides a clear example. Spain is not losing doctors in large numbers, but it is losing enough to signal a concern. In 2024, 395 physicians formally deregistered to work overseas, according to the National Medical Council. Meanwhile, the total number of doctors in Spain continued to grow, thanks to domestic training and the arrival of new professionals. This does not indicate a collapse but rather a response from mobile professionals who find better advancement opportunities outside Spain when hiring freezes, contract uncertainty, or regional budget disputes hinder promotions and specialty placements. Studies of doctor emigration highlight work conditions and clear career paths—typical signals of policy uncertainty—rather than ideology as the primary issues.

The international context also plays a role. The United States is clearly polarized yet remains the top destination for long-term migrants in the OECD. It also attracts highly educated workers. This does not mean polarization has no downsides; it indicates that large, diverse markets and substantial research funding can offset it. The U.S. welcomed about 1.05 million new long-term immigrants in 2022, and OECD data shows that by 2023, the U.S. still hosted nearly one-third of all foreign-born individuals in the OECD. Talent gravitates toward size, pay, and reliable career paths, even amid political turbulence. While Spain cannot match the U.S. market size, it can work to reduce the policy uncertainty that widens the gap.

The Missing Variable: Policy Uncertainty as the Mediator

If polarization is the spark, policy uncertainty is the fuel. Evidence from multiple countries and the euro area shows that uncertainty dampens investment and industrial output. It raises risks, slows permits, and forces businesses to delay hiring. Election dynamics, especially close and contentious races, often spike the Economic Policy Uncertainty index. Spain's index has fluctuated with major domestic events over the last decade, but what matters for talent retention isn't just individual peaks; it's the duration of time spent above a "comfort band" that keeps HR budgets and grant timelines on hold. This represents a direct pathway to brain drain.

There is also a structural component at play: a low overall vacancy rate limits early-career options in science, health, and high-tech fields, where steady multi-year funding is crucial. Spain has made progress—public R&D funding reached record levels in 2023–2024, thanks to Next Generation EU support—but execution gaps and fears of future budget cuts cast doubt. The 2024 Innovation Scoreboard shows venture funding above the EU average, yet Spain still struggles with low business R&D intensity. For a doctoral candidate weighing a postdoc in Madrid against opportunities in Boston or Berlin, this situation seems risky. The risks are tied not to ideology but to the unpredictability of policy.

What To Do Now: From Quiet Signals to Credible Commitments

The solution is not to police speech but to reduce the variability in rules, budgets, and timelines. Education and health agency leaders can do more than urge civility. They can create safeguards against policy uncertainty to keep careers on track, even when political tensions rise. The first step is multi-year, rules-based funding. Spain should establish medium-term budgets for doctoral contracts, residency positions, and competitive research calls with guaranteed extensions. This approach would keep hiring and training cycles going, even during elections or changes in administration. Recent IMF work shows that when fiscal policy uncertainty decreases, real activity increases. Translating this into the everyday operations of universities and hospitals means maintaining steady and predictable intake.

Next, better connect public plans with private hiring. Spain's vacancy rate points to weak demand, even when GDP is growing. Government ministries and regional authorities can commit to procurement and project timelines 12 to 18 months in advance, with specific deadlines and penalties for delays. This would lower uncertainty for suppliers and prompt earlier recruitment for engineers, data scientists, and clinicians. Eurostat's benchmarks indicate where Spain stands; moving its 0.8–0.9% vacancy rate closer to the EU average is a realistic and immediate goal. Companies hire when they believe that permits, payments, and standards will remain constant. Administrations build this trust by meeting deadlines.

Third, eliminate obstacles in the talent market. In health care, streamline recognition of foreign qualifications to address local shortages and facilitate more effortless movement across regions. In higher education, align grant reporting and ethics approvals among agencies to reduce waiting times between awards. Research on Spanish doctors who have left suggests that work conditions and career advancement hurdles are bigger factors than salary alone; these are areas within the government's control. The message to a young specialist or postdoc should be clear: if you do your work, the next step will be timely and straightforward. This is how governments can overcome policy uncertainty, measured in weeks and months.

Fourth, convey risk through data, not adjectives. Publish a quarterly "policy predictability dashboard" that tracks grant execution rates, average payment delays, median time-to-permit, and vacancy-to-application ratios in health and STEM fields. The European Commission and Eurostat already frame the overall situation; Spain should take ownership of the specifics. The audience is not the bond market but the lab principal investigator deciding whether to advise a student to wait for a domestic opportunity or to write a reference letter for Max Planck. A public record of predictability serves as a recruitment tool. Policy uncertainty decreases when institutions show they can meet their own timelines.

A likely critique is that polarization itself erodes trust and heightens uncertainty, so why distinguish between them? Because this distinction highlights practical solutions. The United States remains polarized by any measure. Yet, it attracts global talent because the crucial systems—research grants, hospital accreditation, and venture funding—are supported by strong markets and stable rules, even during partisan conflicts. Migration figures and the presence of foreign-born individuals clearly indicate the draw of dependable opportunity. Spain may not be able to replicate the U.S. scale. Still, it can emulate its commitment to consistent processes and transparent scheduling. Regardless of polarization rates, those safeguards can still work.

The best leading indicator of brain drain isn't ideological polls; it's the job vacancy rate. Spain's 0.8% rate in mid-2025, close to the bottom of the EU rankings, signals that professionals face a sparse and unreliable market as they seek to advance their careers. The mechanism is straightforward. Polarization becomes relevant only when it creates enough policy uncertainty to slow projects, delay hiring, and disrupt family plans. The solution is both simple and effective: multi-year funding commitments, fixed application periods, guaranteed extensions, and transparent performance metrics. This agenda is not about suppressing debate; it's about shielding work from noise. If Spain can establish a reliable schedule, investment will gradually increase, vacancies will move toward the EU average, and skilled individuals will reconsider making permanent moves abroad. Winning every debate isn't necessary; keeping institutional commitments on time is crucial. This is how policy uncertainty diminishes and how talent remains in Spain.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Aisen, A., & Veiga, F. J. (2013). How does political instability affect economic growth? European Journal of Political Economy, 29, 151–167.

Baker, S. R., Bloom, N., & Davis, S. J. (n.d.). Economic Policy Uncertainty Index for Spain (SPEPUINDXM). Federal Reserve Bank of St. Louis (FRED). Retrieved 2025.

European Commission. (2024). The cost of uncertainty – new estimates (Autumn 2024 Economic Forecast).

Eurostat. (2025, September 15). Euro area job vacancy rate at 2.2% (Q2 2025); EU at 2.1%; Spain 0.8%.

Eurostat. (2025). Job vacancy statistics — Statistics Explained (Spain among lowest JVR in Q2 2025).

IMF. (2024). The Economic Impact of Fiscal Policy Uncertainty (Working Paper). International Monetary Fund.

INE (Spain). (2024, December 12). Statistics on Migrations and Changes of Residence (SMCR), 2023 (Positive net external migration: 642,296).

OECD. (2023). Health at a Glance 2023 — International migration of doctors and nurses.

OECD. (2024, November 14). International Migration Outlook 2024 — Spain country note.

OECD. (2024, November 14). International Migration Outlook 2024 — United States country note.

OECD. (2025, September). Education at a Glance 2025 — Spain (country note).

Organización Médica Colegial (CGCOM). (2025, February 20). Datos certificados de idoneidad OMC 2024 (395 doctors deregistered to work abroad).

Reuters. (2025, January 3). Spain finishes 2024 with 2.56 mln jobless, lowest year-end figure since 2007.

V-Dem Institute. (2025). Democracy Report / Country Graphs (polarization measures and trends).

Comment