How Education Can Break China’s Rare Earth Monopoly

Input

Modified

China’s rare earth monopoly sits in midstream refining and magnet production, not mines An education-led push—rapid training, teaching factories, and industry-linked research—builds the workforce to shift capacity Procurement, recycling, and allied coordination then cut risk faster than tariffs alone

We face an uncomfortable reality. In 2024, China exported about 58,000 tonnes of rare-earth magnets, enough to manufacture components for millions of cars, turbines, and defense systems. Despite this, China still retains most of its refining and magnet-making capacity. In mid-2025, the International Energy Agency warned that markets for critical minerals remain heavily concentrated in a few regions, with rare earths among the most vulnerable. Prices surged this summer when U.S. shipments to China halted and export licenses tightened. A temporary trade agreement calmed the markets, but the underlying structure remained unchanged. The situation is clear: the rare earth monopoly is real, and it is in the midstream—at separation plants, metal and alloy lines, and magnet factories—where the world relies on China. Unless we develop skilled individuals and programs to operate those plants elsewhere, tariffs and agreements will only shift headlines without impacting power.

Rare earth monopoly: the bottleneck is midstream talent

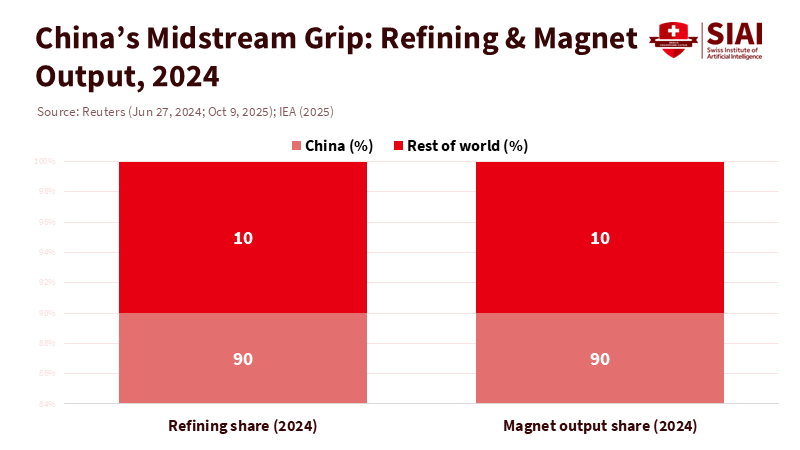

The standard narrative suggests that the issue lies with mines. While this is partially true since China does mine abundant ore, the critical factor is the midstream. Reliable estimates indicate that China’s share of rare-earth refining is around 90% or higher, and its share of permanent-magnet production is similar. Between 2024 and 2025, analysts and reporters reached a consensus: the bottleneck is not geology, but rather the expertise in processing and the scale of magnet manufacturing. When Beijing tightened export controls and licensing in 2025, European carmakers faced the risk of production halts within weeks. This reflects a monopoly in skills and processes more than in resources. To disrupt this, countries need thousands of chemical operators, metallurgists, quality engineers, toolmakers, and magnet technicians who are knowledgeable in oxalate precipitation, hydromet circuits, grain boundary diffusion, and sintering—fields that are part of curricula, apprenticeships, and unwritten knowledge, not customs forms.

A realistic view of timelines emphasizes this point. New mines frequently require a decade or longer from discovery to production; in the United States, the average time approaches thirty years due to permitting and legal disputes. Refineries and magnet lines can be established more quickly, but this is only feasible with a trained workforce and a solid vendor base. That base is still primarily in China, with smaller clusters in Malaysia and Estonia. Policymakers who focus solely on tariffs and quotas will find that capacity does not follow declarations. It follows individuals who can meet specifications and maintain yield over time. Education—from secondary schools to doctoral programs, vocational training to executive development—determines who possesses these skilled workers.

A 10-year race we cannot win without schools

Recent policy objectives are ambitious. The EU’s Critical Raw Materials Act sets 2030 goals to process 40% of domestic needs and recycle 25%, while limiting dependence on any single third country to less than 65%. Washington’s agencies, along with allies in Australia and Japan, have announced funding and project lists. Markets reacted, but experts continue to describe a decade-long struggle to reduce China's dominance, even with favorable prices and political resolve. This challenge arises because the number of trained midstream workers is limited and aging, while China's ecosystem is developing and retraining workers at scale. Without a focused education policy, every factory initiative will run into the same obstacle: an insufficient number of technicians, operators, and process engineers to maintain consistent production lines.

Meanwhile, demand continues to grow. Automakers indicate that a typical electric vehicle requires about half a kilogram of rare earths for its motors, and wind energy equipment remains in high demand. When export licenses slowed in mid-2025, producers in Europe and the U.S. scrambled, with some factories temporarily shutting down. Even after some recovery, approvals remained unclear, highlighting how a rare-earth monopoly disrupts 'just-in-time industrial schedules', which are production strategies that aim to minimize inventory and waste. In this environment, an education-first strategy is not simply a soft approach; it is the only sustainable solution that builds over time: the ability to teach, certify, and place a workforce that can establish separation and magnet lines at home or with trustworthy partners.

From classrooms to cleanrooms: building magnet literacy

Suppose the rare earth monopoly exists in the midstream. In that case, the response must begin where midstream capacity is created: in classrooms, laboratories, and workshops. First, we need accelerated programs that treat magnet manufacturing like nursing: short cycles, high standards, practical hands-on training, and guaranteed job placements. Community colleges and applied universities can collaborate with companies to offer one-year diplomas in hydrometallurgy, powder metallurgy, and statistical process control geared toward NdFeB and ferrite lines. Government ministries can fund shared “teaching factories” equipped with pilot-scale furnaces and separators that replicate the operations of actual plants. This is already how top magnet clusters in China pass on practical knowledge, and it’s time to adopt a similar model.

Second, we need research institutions to tackle the failure modes that prevent non-Chinese lines from scaling effectively: oxygen control in sintering, diffusion of heavy rare earths for high-temperature grades, and waste treatment that complies with strict environmental standards. Public research agencies can link grants to partnerships that include a recycler, a magnet producer, and a machine manufacturer. New facilities in Estonia and France, along with Lynas’s long-standing efforts to separate materials outside of China, illustrate the path forward and the challenges: scaling requires investment and repeatable processes. Education policy can reduce risks by standardizing methods, training auditors, and enabling the transfer of quality systems across countries.

Third, educators should incorporate magnet literacy throughout the STEM pipeline. High schools can integrate simple labs on alloying and magnetic domains into physics classes. Engineering departments can offer micro-credentials focused on magnet design for electric vehicle drivetrains and turbines. Teacher training programs should include modules on critical minerals and industrial ecology. While none of this is glamorous, all of it is essential for forming industry clusters. Over time, graduates will move into supplier industries—tooling, furnaces, powders, coatings—so magnet manufacturers do not rely on importing every crucial component. This network of vendors is a quiet solution to the monopoly issue.

Policy guardrails for a contested decade

Education alone is not enough. However, without it, all other efforts will fall short. The best approach combines workforce investments with targeted public procurement, reforms to stockpiles, and secure yet open research collaborations. Governments should use defense and grid purchasing to establish magnet specifications that reward recycled materials and non-Chinese processing, provided performance is verified. They should finance apprenticeships tied to specific magnet production lines and require participating companies to offer rotating work placements for students. They should establish cross-border “skills corridors” with fast-tracked visas for separation chemists and magnet engineers from trusted allies because developing capacity takes time, and experience is crucial. The goal is to change the demand signal from "any magnet now" to "qualified magnets from resilient sources."

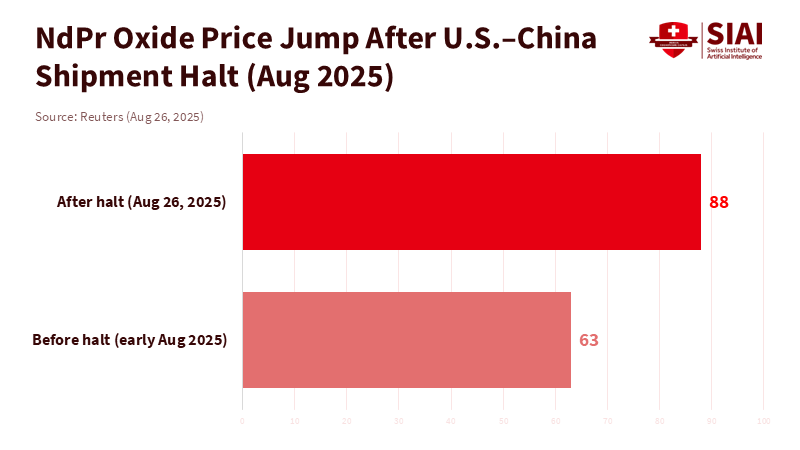

At the same time, we must be realistic about the risks. If tariff pressures return or export licenses become more restrictive, shortages may resurface. Traders will stockpile raw materials. Prices for neodymium-praseodymium oxide can rise by 40% within weeks, as seen when U.S. ore shipments to China halted in August. Tariffs are blunt instruments; they may serve as negotiation tools, but they can also obstruct clean energy projects and raise costs for schools upgrading bus fleets and laboratories. The education sector feels these impacts sharply through procurement budgets. Achieving stability requires more innovative solutions: collective purchasing among allies, transparent licensing processes, and published timelines for export approvals so that schools and ministries can adequately plan.

Critics might argue that education cannot overcome financial and political challenges. While that’s true, education amplifies both. A refinery without operators is just an empty facility. A tariff without a training strategy is merely a press release. In contrast, the EU’s processing and recycling benchmarks for 2030 can only become achievable if member states also invest in magnet-specific training and teacher development, and if universities align their materials science laboratories with immediate industrial needs. In the U.S., even slightly shortening the typical mine-to-production timeline necessitates a significant recruitment effort across permitting agencies, paired with standardized curricula for environmental reviews that enhance skills and reduce disputes. Education ranks among the few initiatives we can scale now that will also minimize future project risks.

Lastly, we should not assume that “rare-earth-free” motors will save us time. Researchers are making strides, and some companies are testing alternatives. However, the mainstream electric vehicle and wind energy platforms of the late 2020s will still rely on rare-earth magnets, and the factories that produce them are located where skilled workers are available. The quickest way to reduce reliance on China is to invest in people who can manufacture, qualify, and recycle magnets at scale outside China, and then connect those individuals into a dense network of suppliers and standards. This is fundamentally an educational challenge from start to finish.

In 2024, China exported 58,000 tonnes of rare-earth magnets and still holds most of the world’s capacity to refine, alloy, and produce the materials essential for modern technology. This is the reality of the rare earth monopoly. We can spend the next decade arguing over tariffs and agreements, or we can create an education-driven strategy that ensures.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

AP News. (2025, August). What to know about China’s new regulations on rare earths.

Business Insider. (2025, Oct.). Breaking China’s rare earth dominance could take a decade, Goldman Sachs says.

CSIS. (2025, Jul.). Developing Rare Earth Processing Hubs: An Analytical Approach.

European Commission. (2025). Critical Raw Materials Act—2030 benchmarks.

IEA. (2024–2025). Global Critical Minerals Outlook; Rare earth elements; Commentary on export controls; China’s share in rare-earth magnet production; 2024 magnet export volumes.

Innovate UK. (2025, Jul.). Rare Earth Permanent Magnet Manufacturing—Innovation Landscape Report.

NSB/NSF. (2023). Science & Engineering Indicators: Higher Education in S&E.

Reuters. (2025, Jun.). Auto companies ‘in full panic’ over rare-earths bottleneck.

Reuters. (2025, Jun.). China’s rare earths are flowing again, but not freely.

Reuters. (2025, Aug.). Rare earth prices hit two-year peak after MP Materials stops China shipments.

S&P Global (press release). (2024, Jul.). United States ranks next to last in development time for new mines.

U.S. Geological Survey. (2025). Mineral Commodity Summaries 2025—Rare Earths; MCS overview.

World Bank/IEA commentary as cited by IEA sources (2025). Concentration risks in critical minerals supply.

Comment