The Super Bowl Is PR — The Enterprise Buys the Orchestration Layer

Published

Modified

Enterprise AI competition is decided inside procurement systems, not public ad campaigns The real battle is over who controls enterprise AI orchestration and workflow integration Governance, interoperability, and institutional trust now matter more than model branding

Enterprise artificial intelligence (AI) management is like a concealed competition. It determines if a business adds a pre-made chatbot or completely restructures its operations around a new kind of tech foundation. A trusted forecast suggests businesses will spend heavily on AI, with hundreds of billions in 2025. But there are warnings that many AI projects, almost half, might fail before they ever generate lasting value. These two facts, the huge potential spending and the risk of failure, change things. Big public displays, like Super Bowl ads, can improve brand image and pique customer interest. But they don't materially affect the checklists, integration plans, or compliance rules important to purchasing departments. The true competition isn't about who has the most amusing ad, but about who becomes the go-to management system for business processes. That's where the real control, consistent income, and long-term market dominance are established.

Where the Real Buying Power Lies: Enterprise AI Management

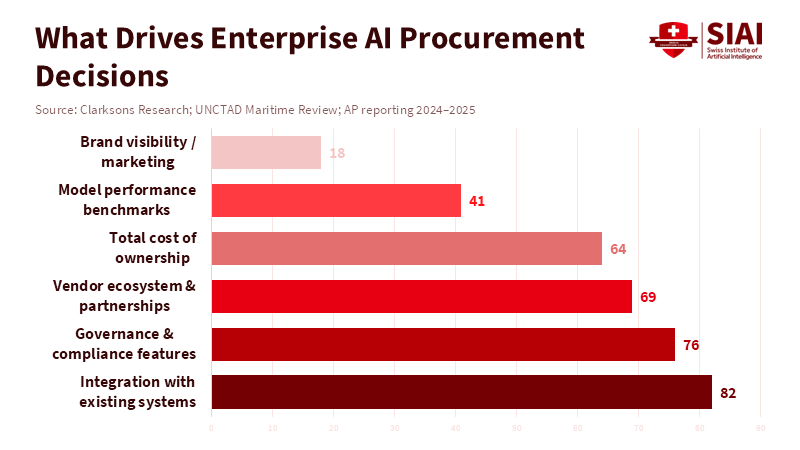

The discussions that matter most to tech chiefs and purchasing teams are very functional. What they care about includes connectors, audit trails, the risk of being locked into a single vendor, how quickly the system responds to key operations, and how much responsibility a vendor takes for AI errors. Another consideration is which vendor has the right relationships to integrate with systems such as SAP, Salesforce, Workday, and airline reservation platforms. Vendors who can supply solid connectors, role-driven access controls, and clear options for data storage will win deals. This isn't just a theory. Top-tier business platforms are already selling themselves as management systems. They glue AI models into workflows and connect them with a company's data resources. OpenAI's recent introduction of the Frontier platform, designed as a business-focused AI management product for early adopters, signals a shift from model-to-model competition to platform-to-platform competition.

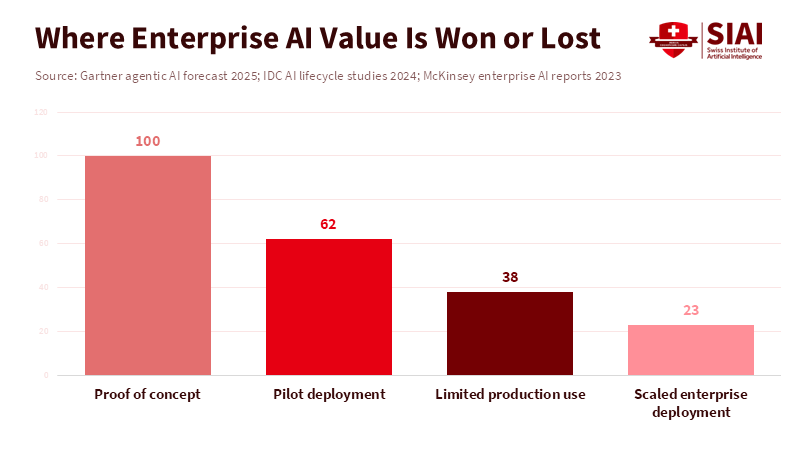

Note that the buying process in large companies is long and complex. For every flashy ad campaign, there is a purchasing spreadsheet, a security review, and a test project. According to Workmate, testing phases vary widely depending on project complexity; simple pilot projects with clean data can progress to production within three to six months, whereas more complex systems may require nine to eighteen months to proceed. Many AI test programs never go into full operation. Studies show a significant difference between demos and systems that are actually ready for use. Gartner, for example, has warned that a large percentage of AI projects could be canceled by 2027 due to costs, unclear business benefits, and insufficient risk controls. This means that major spectacles don't influence decision-makers. They are influenced by ways to reduce risk. This includes vendor service agreements, the ability to observe how the system operates, a record of the model's origins, and a path to supervised production.

Ads Grab Attention but Don’t Drive Enterprise Decisions

Super Bowl ads are great at two things: they raise brand awareness quickly, and they create stories for investors—Anthropic’s ad campaign, which states that Ads are coming to AI. But not to Claude” forces a public debate about how to make money from AI and how to make sure it's trustworthy. It gets headlines and forces company representatives to answer questions on social media. But headlines and social media buzz don't really affect purchasing decisions. Companies don't give out contracts because a vendor ran a clever 30-second ad. They give them out because a platform lowers integration costs, reduces risk, and delivers a consistent return on investment over several months and years. News outlets covered this media battle, and the effect on consumer feelings is immediate. The effect on tech chiefs is small, if it is visible at all.

Think of enterprise agreements as moving along a different path than consumer choices. Sales processes depend on rules, vendor risk evaluations, and partner networks. If a vendor offers an admin layer that handles AI, integrates with business processes, enforces permissions, and creates audit trails, purchasing departments will usually choose that vendor, regardless of how good the Super Bowl ads were. That is why the best way to succeed in the business world is becoming less and less about having the best AI model. Instead, it's more about being the dependable application layer. When vendors refer to these new products as “AI coworkers” or “agent platforms,” they're directly addressing buyers' needs: buyers wanna replace fragile point solutions with components that are governed, interoperable, and live inside the company’s control plane.

The Numbers: Scale, Risk, and the Power of Partnerships

The overall stats are basic but show you a lot. The top research firms have somewhat different predictions, but they all agree on one thing: businesses will spend most of the money. IDC and similar research indicate that companies' AI budgets will reach hundreds of billions this year, and another major research firm predicted that total IT spending on AI will be in the trillions when infrastructure and software are included. To put it differently, the amount of money going into business AI is so large that even small changes in purchasing behavior can create big winners and losers. This money doesn't go to the company with the best ad; it goes to vendors that can fit into purchasing processes and spread the cost across many business units.

The risks and failure rates strengthen the point. Industry studies have found that most pilot programs end before they are effective. IDC and other observers share that most proofs of concept fail not because of model fit but because of data readiness, change management, integration debt, and governance failures. These failure modes are what an admin layer aims to fix. A platform that can reduce integration time, make outputs traceable, and handle administration at scale can turn test projects into ongoing business spending. That's how you turn a purchase win into long-term recurring revenue.

Vendor Strategy: Become the Go-To Admin Layer

For vendors, the plan is simple and calculated: secure positions within business structures where work flows across systems and where people must approve. That means making connectors to ERPs, CRMs, and data warehouses. It is about building governance hooks and role-based controls. Also, you want to offer dashboards that show from which each decision came and how confident you are in it. The reward is not only money. It also controls the data path and the chance pull platform rents via consistent fees and a marketplace. The vendor who becomes the go-to admin earns not only model-use spending but also a share of the business software stack. Proof of this move is everywhere: AI vendors are pitching their products as admin and management platforms and naming business clients as pilots.

This is also where major cloud providers and existing software vendors are important. A well-designed admin layer has to fit on top of cloud infrastructure and inside corporate identity systems. Cloud providers will compete by offering infrastructure and managed admin services. Also, large software companies will try to add agent features into their suites. Because of this, business buyers will prefer systems that fit with current purchasing flows and partner networks, not platforms that act as separate consumer services. The meaning for startups is blunt: the consolidation strategy playbook should be your product roadmap, not an afterthought for the marketing team.

Advice for Educators, Administrators, and Decision-makers

For educators and program leaders, the lesson is useful: The lesson teaches integration and governance skills, not just model tuning. A new group of AI managers needs to know how to build solid data pipelines, audit model outputs, and draft service agreements that unite vendors and buyers. Classes should emphasize the people-and-process side of AI use — things like change management, contract design, and rules — because these are the things that turn pilots into production. For administrators, the job is to change vendor selection criteria to reward observability, testability, and composability over marketing hype.

Policymakers should make sure purchases are predictable and auditable. If regulators require audit records and source data for high-risk decisions, vendors that already provide those capabilities will have a structural advantage. A policy that clarifies liability for automated decisions will make business buyers more willing to sign multi-year contracts with admin vendors that agree to clear responsibilities. That is the lever that moves spending from tests to recurring contracts. The policy opportunity is not in a regulation; it is in purchasing standards and liability frameworks.

Addressing the Obvious Concerns

One concern is that advertising still matters: brand trust has pull at boardrooms and stock markets. That’s right. A known brand reduces sales friction and helps attract talent. But brand doesn't replace contracts with audit rights, nor does it change the technical burden of connecting with a bank’s core ledger. Another worry is that models still matter: better models make better results. That’s also right. The extra value of a somewhat better model shrinks if the vendor can't run it within a company's control plane. The winner has to unite belief in effectiveness with long-lasting integration and governance.

Another concern is that hyperscalers will own the admin layer. They have size and relationships, but hyperscalers don't automatically gain trust in every business field. Things like banking, healthcare, and government all place rules that reward specialized admin and compliance features. That creates opportunities for vendors who unite field depth with platform interoperability. These aren't simply theoretical openings. They are visible in early partnerships and the naming of first-mover clients on recently announced platforms.

The Super Bowl ad dispute is a helpful story. It shows values and frames public debate, but it isn't how business budgets are chosen. Purchase teams vote with contracts, not with clicks. They give platform dominance to products that lower integration cost, handle risk, and supply observability. The destiny of enterprise AI will be chosen in engineering roadmaps, partner ecosystems, and governance contracts. Vendors who understand this will stop using marketing as a replacement for product engineering. They will build admin layers that become default paths for work. That’s the market that determines winners, not the halftime show. If policymakers, educators, and administrators want to shape good outcomes, they should act on the levers that matter to procurement: clearer standards, better training, and rules that reward auditable, composable, and secure orchestration. The risks are high. The money is moving. The quiet field is now the main one.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

AI Business (2026) Enterprises don’t care about Super Bowl ads. AI Business, February.

CNN (2026) Anthropic and OpenAI take their AI rivalry to the Super Bowl. CNN, 6 February.

Davenport, T.H. and Ronanki, R. (2018) ‘Artificial intelligence for the real world’, Harvard Business Review, 96(1), pp. 108–116.

Gartner (2025) Gartner predicts over 40% of agentic AI projects will be canceled by end of 2027. Gartner Press Release, June.

Gartner (2025) Worldwide artificial intelligence spending forecast. Gartner Research.

IDC (2024) IDC FutureScape: Worldwide AI and generative AI spending guide 2025–2028. International Data Corporation.

IDC (2024) Why enterprise AI pilots fail to scale. IDC Analyst Brief.

McKinsey Global Institute (2023) The economic potential of generative AI: The next productivity frontier. McKinsey & Company.

Reuters (2026) Anthropic buys Super Bowl ads in challenge to OpenAI’s monetization strategy. Reuters, February.

The Guardian (2026) AI chatbots: Anthropic and OpenAI go head to head as ads arrive. The Guardian, 7 February.

Comment