India’s Energy Lifeline: Why Cheap Russian Oil Is the Hidden Engine of Delhi’s Strategic Choices

Input

Modified

India’s reliance on cheap Russian oil is not a diplomatic preference but an economic necessity Energy security now outweighs export dependence on the United States in India’s policy calculus This constraint narrows India’s strategic options and weakens Washington’s leverage in Asia

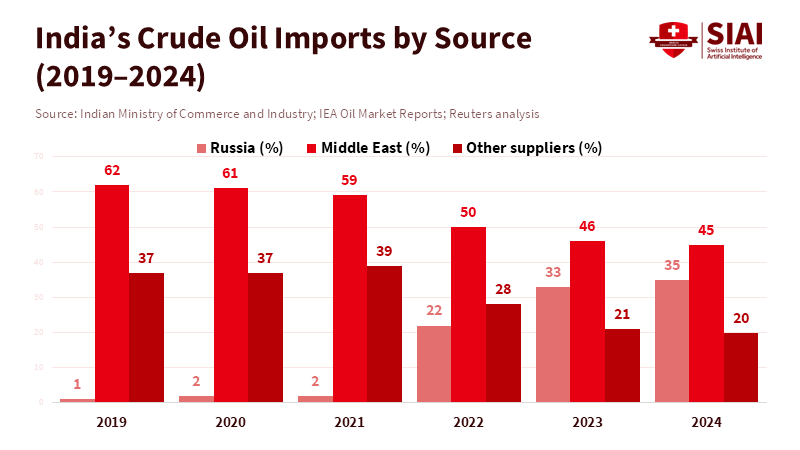

Since 2024, Russia has become a main source of India's crude oil, accounting for about a third of all imports. This is a big change from ten years ago, when Russia barely supplied any oil to India. This reliable flow of cheaper oil has not only reduced import costs but also boosted oil refineries' earnings. This keeps fuel prices reasonable for many people and frees up funds for important projects like infrastructure and power grid upgrades, helping prevent blackouts. Simply put, getting oil from Russia at a discount helps India grow by boosting industries and supporting investments in factories, transportation, and energy. With the United States putting more pressure on trade through tariffs, India faces a choice: sticking with affordable Russian oil for now to keep its industries, transportation, and power systems running smoothly, or focusing on other options. This shows that India’s decisions are more driven by economic needs than by a close relationship with Russia.

India's Energy Lifeline: The Real Trade-Off

Many view India's choice to purchase Russian oil as a matter of diplomacy. They think it's about checking where different countries stand, but it's actually about keeping their economy alive. Between 2018 and 2024, India's crude oil imports from Russia rose sharply. It went from almost none to about 35% of India’s total oil imports. This happened because Russia offered big discounts after 2022. These discounts helped India lower its import bills, even as domestic oil demand was growing. In a country where electricity use and industry are growing rapidly, cheaper oil means refineries spend less on refining. It also means transport fuel is cheaper, and there's more money to upgrade electricity grids and start new projects. This isn't just a small benefit. It is a big deal for the economy, affecting decisions about where to put money in many areas.

For India, the bigger risk isn't upsetting Russia—it's losing affordable oil. Losing this supply would mean paying more to other countries, switching fuels abruptly, or accepting slower growth—all risky options. Higher fuel costs strain budgets; sudden supply disruptions worsen deficits; slower growth cuts funds for priorities. India’s main argument centers on securing stable, affordable energy now, while planning for a shift to cleaner sources. This is about practical needs, not just foreign relations.

These calculations become even trickier as pressure from other countries increases. In 2025, the United States imposed high tariffs on many goods coming from India. This was meant to discourage India from buying Russian oil. For India, this meant deciding between maintaining access to markets and investments in Western countries and meeting its urgent economic needs by securing affordable fuel. This issue explains India's recent approach to foreign policy. It publicly states that its energy decisions are its own and part of its right to set its own policies. At the same time, India tries to protect its important economic and trade relationships. The result is a foreign policy that seems limited, not unpredictable. It is based on considering fuel costs, refinery needs, and balanced budgets, rather than just aligning with Russia.

How Cheap Russian Oil Changed India's Economy

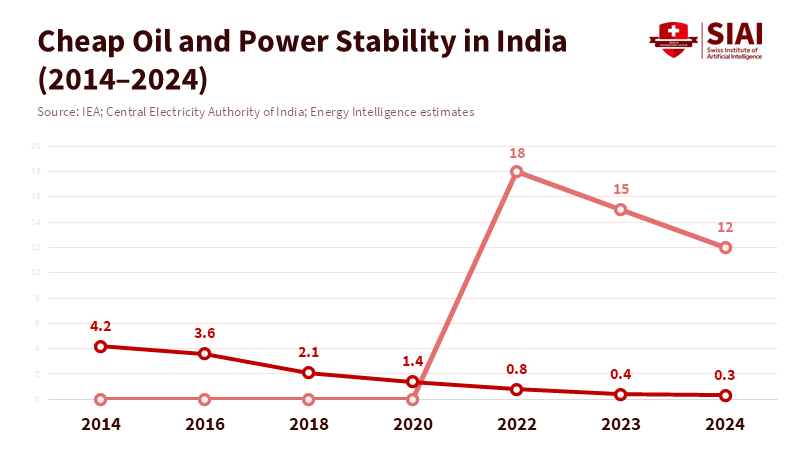

Discounted Russian oil has had a lasting impact on India's economy. Lower global prices boost refinery profits and keep fuel stable during market shifts. Since 2022, buyers able to manage logistics have benefited from the price gap between Russian and benchmark oils. This increases refineries' profits, supports public investment, and funds upgrades, ensuring a more reliable energy system.

These gains have benefited India's power and manufacturing areas. Since the early 2010s, the country's power system has improved significantly. Capacity has increased, power shortages are now rare, and better grid connections have made blackouts less common, even in luxury hotels. This progress stems from infrastructure spending, changes in how power is distributed, and increased power production. All of this is easier when companies and the government have more money to work with. While coal and renewable energy remain the most common electricity sources, cheaper oil has lowered transport and industrial costs. This also makes it easier to switch to electricity by keeping logistics and supplies affordable. In general, getting discounted oil gives India time and flexibility to switch to cleaner energy without having to make sudden, big cuts.

Lower transport fuel costs reduce prices of goods, helping labor- and energy-intensive industries stay competitive. A steady discounted oil supply lets refineries expand into higher-value products, driving job creation and more tax revenue. Cheap oil has thus supported both industry and public finances over time.

However, these benefits come with risks. Dependence on a single supplier or a group of suppliers leaves India vulnerable to changes in politics and policy. Problems with discounts, new rules, or shipping could quickly eliminate these benefits. For example, changes in deliveries and refinery orders in late 2025 showed how quickly things can change when rules or business decisions are altered. Therefore, India faces two main questions: how to maintain the benefits it has now, and how to turn short-term price breaks into long-term energy security by diversifying suppliers. It needs to build storage and invest in clean energy. To reach both goals, careful planning and cooperation across different government departments are required.

Education, Policy, and What's at Stake for the Next Government

This careful balancing of energy and economics directly affects what is taught in schools and how people are trained for work. As industries grow, there is a greater need for skills from vocational programs, technical training, and higher education in fields like engineering and energy management. If using cheaper fuel helps manufacturing now, those in charge need to ensure that what is taught and how people are trained match the new jobs that are created. They also need to help workers shift to cleaner ways of making things as markets change. This involves investing in apprenticeship programs that can grow and updating courses at technical colleges for those working in refineries, petrochemical plants, and power grid operations. We need to broaden research into how to combine different energy systems. Education isn't just an afterthought; it's an important part of the system that links industrial growth to job creation and increased productivity.

Administrators must also make plans for unexpected events. If tariffs, rules, or market changes lead to fewer discounted imports, there will be financial and business consequences: higher fuel prices, smaller profit margins. It could also mean slower investment in big projects. Schools and technical institutes should be informed about national plans to handle these situations. They can accelerate funding for modular retraining, offer grants to companies that switch to more efficient technologies in their furnaces or plants, and provide scholarships for those seeking to gain skills in the energy sector. These are the kind of small, impactful adjustments that prevent long-term damage to the job market within a single government's term. Focusing too much on diplomatic signals means missing the chances that education policy can provide.

India’s energy strategy must remain broad and purposeful. Policymakers face the challenge of converting short-term benefits from discounted oil into long-term energy security. Securing supply lines and investing savings in reserves and renewables will be critical for continued progress. Bolstering interstate connections and market access while advancing trade talks can reduce vulnerability to external pressures. Amid evolving global dynamics, India’s ability to keep factories operating and homes powered depends on striking a careful balance: acting swiftly to safeguard today’s stability, while investing strategically in a more resilient, diversified energy future. This transition is not just about economics—it is about shaping India’s autonomy, growth, and prosperity for years to come.

Cheap Russian crude oil has acted as a hidden boost to India's industries. It is not a political perk but an economic necessity. It has supported profit margins, kept prices stable, and freed up resources for infrastructure upgrades. From a practical point of view, this makes India's choices understandable, even if they are not always favored in foreign relations. The challenge for policy is to turn these short-term price advantages into long-term energy security: protect the supply when needed, while also investing the gains in finding alternative suppliers and improving workforce skills. The goal is to ensure the country is not dependent on a single source. Teachers, administrators, and ministers must work together to train the workforce for new industries. They can strengthen grids and build storage and renewable energy capacity today. This is the only practical way forward: turning something essential into a path toward a stronger, more diverse energy future.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Al Jazeera. 2025. “US raises India tariffs to 50 percent over Russian oil purchases.” Al Jazeera, 27 August 2025.

Centre for Policy Research (CPR). 2025. “Russia and India’s Imports of Petroleum Crude.” CPR Insights, 19 September 2025.

DGCIS. 2025. Insights into Import of Crude Oil and International Crude Oil Prices. Directorate General of Commercial Intelligence and Statistics, Government of India. 24 October 2025.

Energy & Cleanair (CREA). 2025. “December 2025 — Monthly analysis of Russian fossil fuel exports and sanctions.” December 2025.

IEA. 2024–2025. India country and electricity reports and Global Energy Review 2025. International Energy Agency.

Ministry of External Affairs (India). 2025. “State Visit of the President of the Russian Federation H.E. Mr. Vladimir Putin to India (December 04–05, 2025).” Press release, 28 November 2025.

Ministry of Power / PIB (India). 2025. India’s Energy Landscape: Powering Growth with Sustainable Energy. Press Information Bureau, 22 June 2025.

Reuters. 2025. “View: Trump order imposes additional 25% tariff on goods from India.” 6 August 2025; and related coverage on tariff impacts, August 2025.

The Guardian. 2025. “Putin and Modi to meet amid politically treacherous times for Russia and India.” 4 December 2025.

World Bank. 2025. “Reinvigorating India’s Electricity Distribution for Access, Reliability, and Digitalization.” Project summary, July 2025.

Comment