Grid Modernization Is the New Industrial Policy

Input

Modified

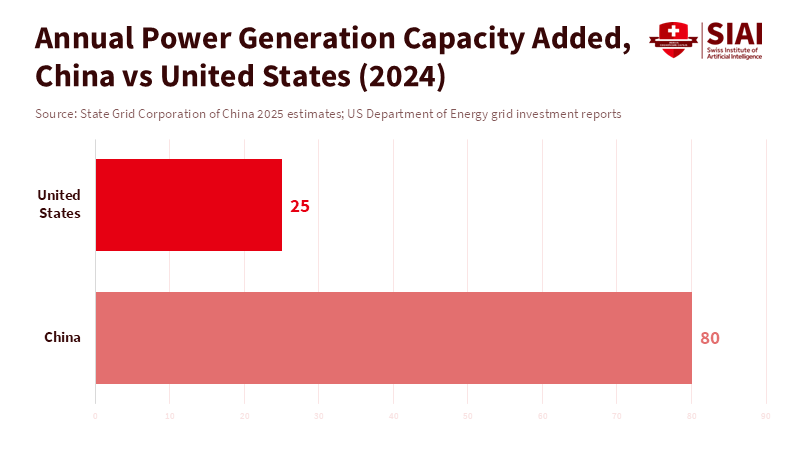

Grid capacity now limits economic growth more than energy supply China is modernizing faster than the United States Transmission, not generation, is the next policy frontier

The difference between China's booming data networks and America’s struggling power lines isn't just a minor technical issue; it's the key to growing industry versus being stuck with limited expansion. Updating our power grids is now super important, as it determines where we can place factories, data centers, and research facilities without experiencing constant power cuts or limited availability.

For the last decade, China has been building massive, super-efficient power lines. And they're now spending billions to expand these lines and make them better suited for a future powered by renewable energy. The result is a system that can move massive amounts of power from places like deserts and plateaus to the coast. In the U.S., on the other hand, large parts of our power grid still depend on equipment built in the 60s, 70s, and 80s. At the same time, industries that rely on electricity and the huge computing power needed for AI are increasing electricity demand faster than power lines can handle. If government leaders focus only on generating more power while paying insufficient attention to power lines, they'll create power shortages for the new digital economy. So, it's not just about producing more electricity; it's about creating smart, flexible networks that can deliver that power where it’s needed.

China's Grid Upgrade and America's Infrastructure Problem

China has made some major, well-planned investments in its power grid. The State Grid and regional companies have made it a priority to build long-distance, ultra-high-voltage (UHV) lines linking resource-rich inland areas to industrial centers on the East Coast. These lines can carry large amounts of power over long distances with less loss than older lines. This is a game-changer because it means that wind and solar energy generated in western China can be reliably sent to factories on the coast, addressing local power outages and enabling renewable energy plants to grow without hurting their profits. From 2025 to 2026, there have been many news reports about accelerating grid investments and planning new main power lines to handle the increasing use of renewable energy. So, it's clear that when you coordinate grid improvements with power generation locations, the power system supports business rather than getting in the way.

By comparison, the U.S. power grid is a mix of local utilities, many with old equipment and approval processes that can delay projects for years. Key pieces of equipment, such as large power transformers, are aging, and replacing or upgrading them takes a long time, which can be difficult due to supply issues. In the meantime, the places where power is needed are changing. Huge cloud computing centers and AI operations need cheap power and reliable connections. This creates a tough situation with rising power demand concentrated in specific areas and an old power delivery network. The result is a risk of local power shortages, higher energy costs for new businesses, and motivation for companies to move to areas with better energy infrastructure. These aren't just potential problems; they're impacting investment decisions in industries that rely on big data.

Modernizing the Grid for AI and Data Centers

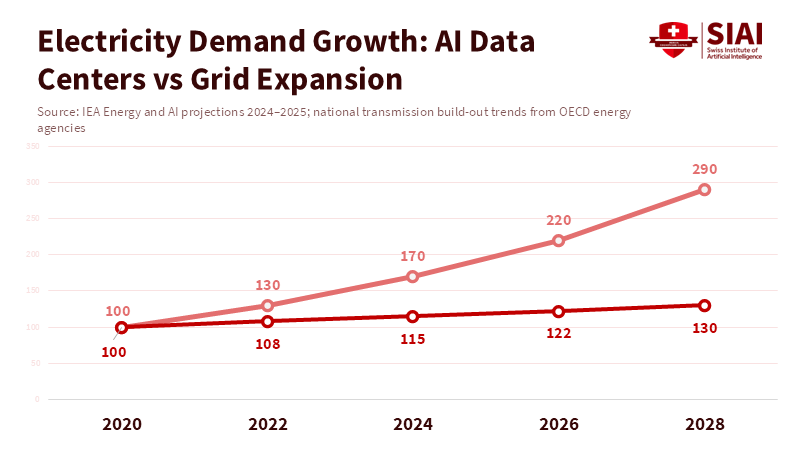

Data centers are using a lot more power. Energy studies show that electricity demand from data centers will grow rapidly through 2030 as more people use online services and AI becomes more widespread. Data centers are consuming an increasing share of the world's power. This is a big deal because data centers tend to be located in specific areas with favorable land conditions, tax policies, and internet connectivity. When you have many data centers in one region, especially in one with old power lines, upgrading the local power grid can be costly and time-consuming. So, our power grid needs to be designed to handle not just the average power demand, but also the high peaks and rapid changes in demand that come with digital infrastructure.

China has responded by building a robust power grid and flexible systems to deliver power where it’s needed. With these high-capacity power lines, data centers don't have to be located right next to large fossil-fuel power plants. This approach also makes it easier to balance the intermittent nature of renewable energy sources, freeing up power capacity near areas where it's needed most. If the power lines are strong, companies can feel more confident about buying power since operators can schedule power distribution and manage any reductions in power supply. The U.S. faces more difficulties because it takes a long time to get approval for new power lines, there are often disputes over land rights, and regional planning is not always coordinated. Unless the U.S. speeds up the construction of power lines between regions and improves the rules that enable them to operate effectively, companies will have to pay more to run large computing operations. So, investments will probably go to areas that have already addressed these power-delivery problems; areas that have matched their power-generation goals with a solid plan for power transmission.

How Policy and Funding Can Help Update the Grid

To improve the power network, we need to make changes in three important areas. First, government policies need to treat upgrades to power lines not just as routine maintenance but as crucial to our industry's success. This means setting clear goals to connect different regions with better power lines, speeding up approvals for key routes, and finding ways to fund these large projects to reduce investment risk. China's recent investments in expanding its power grid are a good example of a government-led approach. When the investment plans are clear, construction follows, and power capacity increases. For countries with less centralized governments, this means creating ways for federal and state authorities to work together, coordinate investment timelines, and share the costs. This isn't just about the money; it's about aligning the planning process across different areas so that when a wind farm is built, the power lines are ready to connect it when it starts producing electricity.

Second, the way we finance these projects should reflect the realities of the assets involved. Power lines and modern substations are long-term investments that generate steady income once they're operational. By combining different funding sources, setting regulated returns that reflect the value to society, and offering guarantees for early-stage projects, we can attract private investment without requiring utilities to bear all the initial risk. When procuring equipment, such as transformers and UHV converters, takes a long time, it’s important to have domestic manufacturing capacity and strong supply chains. This approach reduces the risk of delays and cost increases, and it creates an industrial base that can supply equipment for domestic upgrades and export expertise. Third, we need to teach people to think about the whole power system. The curriculum for electrical engineering and public policy should incorporate planning, market considerations, and climate goals to enable graduates to design and manage power grids that can meet new and evolving demands. These are practical changes.

There are also some clear technical steps that can be taken. Modernizing the grid is not just about building more power lines. It's about operating the grid more intelligently. We can use technology to send power where it’s needed, get more detailed data on grid conditions, manage demand, use batteries to improve power distribution, and create digital marketplaces for energy. Where UHV lines support regional flexibility, local storage, and active load management, the power supply becomes more reliable. Government leaders should prioritize integrating digital control systems with investment planning. Utilities should implement pilot programs to test operating procedures with large customers such as data centers, manufacturers, and campuses, so that upgrades are designed to meet real needs. Regulators should allow pricing that reflects the real cost of power to encourage companies to make responsible decisions about where to locate. By connecting regulated investment with operational rules that reward reliability and flexibility, we can create a better system.

Addressing Concerns and Providing Evidence

There is a common concern that investing heavily in power transmission could result in wasted assets if power generation patterns change. While this is a valid concern, modern planning techniques can actually reduce this risk. Using scenario-based planning and gradually building out the grid allows us to adapt to changing conditions. According to a recent article by Ameli and colleagues, robust adaptive supplementary control methods can be used to improve grid stability, enabling more flexible deployment of standard controls and potentially enabling phased development of main power lines, as well as the integration of adaptive protection systems and versatile converters. Flexible markets and energy storage shorten the payback period by allowing power companies to generate revenue from sources beyond energy sales. According to a report from El País, China’s major UHV transmission projects, such as the Ningxia-Hunan line, have enabled the delivery of large amounts of renewable energy—mainly from wind and solar—across long distances, helping the country more efficiently absorb clean energy when management and market mechanisms support these investments.

Another worry is that building transmission lines takes too long compared to the pace of digital demand growth. Yet there are ways to address this challenge. Faster permitting processes and modular construction methods can shorten project timelines. Government-led demand aggregation, such as public-private partnerships that reserve capacity for development, can provide time for network upgrades. Local microgrids and on-site flexibility, such as solar power combined with storage and customized demand response systems, can be combined with phased transmission expansion to support near-term needs without compromising long-term grid reliability. These approaches help avoid situations where we have to choose between speed and scale.

The story of energy over the next decade will depend on power lines, software, and the organizations that manage them. Modernizing the power grid is key to supporting industry because it affects where new factories are built, where research centers are located, and whether AI becomes an engine for growth or a barrier to competitiveness. China's recent investments demonstrate the benefits of coordinating power transmission with power generation. The U.S. can learn from this approach while maintaining open markets. The important task is to set priorities, improve planning speed, coordinate financing, and train a generation of engineers and policymakers to think holistically. By doing so, the new era of energy and computing can drive widespread economic growth rather than concentrating advantages in a few areas.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

ABI Research. 2025. “Data Center Energy Consumption Forecast, 2024–2030.” ABI Research.

CKGSB Knowledge. 2026. “China’s power grid: leading the world and barely keeping up.” Cheung Kong Graduate School of Business (English). 4 Jan 2026.

DOE. 2024. Large Power Transformer Resilience Report. U.S. Department of Energy. 5 Jul 2024.

International Energy Agency (IEA). 2024. “Energy and AI: Energy demand from AI.” IEA Reports.

Reuters. 2026. “China’s power grid investments to surge to record $574 billion in 2026–2030.” Reuters, 15 Jan 2026.

Reuters. 2024. “China’s rapid renewables rollout hits grid limits.” 4 Jul 2024.

U.S. Energy Information Administration (EIA). Various technical notes on UHV lines and international electrification statistics.

Lawrence Berkeley National Laboratory / reporting. 2024–2025. “Major Berkeley report puts numbers on tech’s ‘surge’ in energy guzzling.” (summary reporting on LBNL analyses).

Comment