Stablecoin Regulation and the Two-Tier Test: Why Tokenized Deposits Will Win Unless Open-Loop Risks Are Tamed

Input

Modified

Stablecoin regulation is about making token money behave like deposits in a crisis The open transaction layer is the main weak point If it stays weak, bank-issued tokenized deposits will win

In mid-November 2025, the total amount of stablecoins in circulation exceeded USD 280 billion. According to the European Central Bank (2025), about USD 184 billion was in Tether and USD 75 billion was in USD Coin. The key difference between these is not in how tokens function technologically, but in who stands behind the promise: both are obligations from private companies to redeem one dollar per token upon request. However, banks promising redemption have longstanding institutional safeguards, while stablecoin issuers generally do not. Most stablecoins operate on open networks with continuous trading and unrestricted wallet access, a contrast to traditional banking hours and access controls. Because of this, regulation is shifting from niche oversight to addressing systemic payment safety. The central issue is institutional reliability: if a token acts as a daily deposit, who honors that promise when stress occurs? Until this distinction is clarified, users may move toward banks with established solutions, and away from entities that merely assert they have backing.

Stablecoin rules are based on the two-part money system

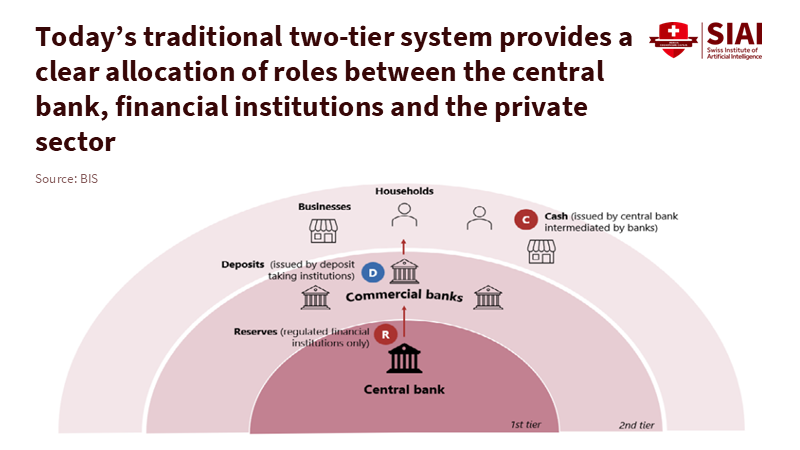

Today's money operates as a two-part system that combines public and private credit. Central bank money is at the center. It settles payments between regulated banks. Commercial bank money surrounds it: deposits that people and businesses see as cash for daily use. This works since deposits stay equal in value across banks. One euro in one bank is worth the same as one euro in another, and transfers happen at the same value. This equality is not by chance. It comes from licenses, oversight, rules about money and assets, payment control, and central bank support that protects the ability to change the money. Deposit insurance and ways to handle failing banks also matter, as they outline what happens when a bank closes. The government knows that banks create money by lending, but it asks for protection in return. Because of this deal, deposits are not just a product. They are a system safeguarded by rules that maintain trust when things get bad.

Stablecoin companies often say that having enough money to back the coins can recreate that trust. Many keep cash and short-term government bonds, and new laws want them to hold even safer assets. But just having money to back coins is only part of what makes deposits work. A bank deposit is a legal agreement within a strong system: the bank has a license, is audited, is monitored, and has rules for early intervention. If it fails, officials have a plan to keep things running. Stablecoin holders might not have as strong a claim. It might take time to get their money back, there might be limits, or they might have to go through certain partners. Holders might not even be the company's direct customers, as they may be customers of an exchange, broker, or wallet provider. So, the question from economists is valid. Tokenized deposits are deposits because the claim is inside that public system. A stablecoin is like a deposit only if the system is built around it, not just because the money looks safe.

Stablecoin rules fail at the open transaction level

The weak spot in stablecoin rules is in the open part of the payment. Most stablecoins run on public blockchains. They go through wallets, exchanges, bridges, and smart contracts. That open system gives them reach and speed, but also removes the checks that keep deposit payments safe. In banking, access needs an account. Banks and payment companies must verify users, monitor for scams, and detect money laundering. In open chains, those checks are inconsistent and often occur later. The BIS says this cannot work for everyday payments. It also makes it hard to tell who is responsible. If a token is taken, sent to the wrong place, or stuck in a bad contract, there might be no one who can fix it.

Open networks also change how runs occur. Bank deposits are not traded on a big, continuous market. Stablecoins are, and that changes what happens. In March 2023, USDC fell to USD 0.88 after the company said it had USD 3.3 billion in reserves at Silicon Valley Bank, and investors withdrew about USD 3 billion in three days. The Federal Reserve's review shows how pressure shifted when it took longer to get money back. The trading volume jumped to almost USD 2 billion on March 11, and the price only rose again after redemptions resumed. This is important for stablecoin rules since it is not possible to close the window when the coin can be traded on exchanges and DeFi pools. A stablecoin can keep trading while the company slowly returns funds, and the market price reflects the level of trust at that moment. When cross-chain bridges and smart contracts are involved, a reserve issue can quickly escalate into a network-wide issue. So, being able to handle problems and to have clear responsibility are essential and central to good rules.

Stablecoin rules also pose problems for the business model. The BIS discusses a built-in conflict: a coin must maintain its value during tough times, yet the company still wants to make money. If reserves are used to try to get a return, the value can be hurt by price and liquidity issues. If reserves are held only in the safest assets, profits decline, and payments might rise. Either way, this can push activity into open areas, such as offshore companies, poorly run platforms, or difficult-to-control systems across borders. That is why it is important to work together globally. The Financial Stability Board wants consistent rules on how stablecoins are run, how risks are managed, how redemptions work, and how countries collaborate if the stablecoin system becomes widespread. The goal is not to stop new payments. It is to prevent a payment tool from growing faster than its responsibilities for users can handle. This means rules for the company and for the key groups that manage custody, transfers, and access to the exchange.

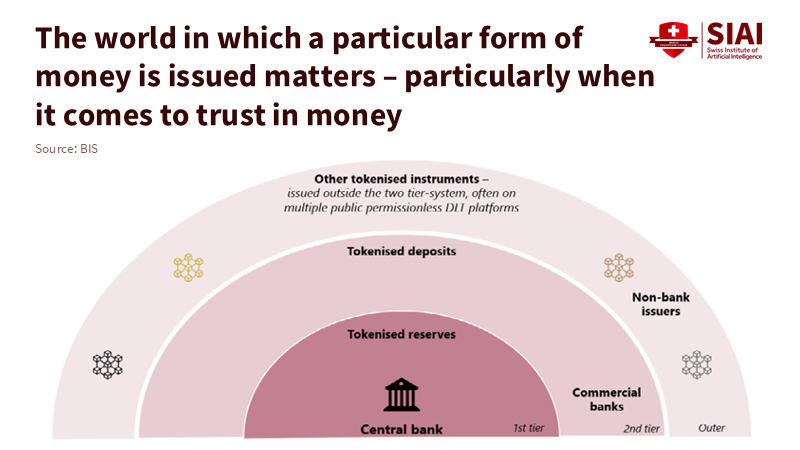

Tokenized deposits and bank tokens change stablecoin rules

Tokenized deposits, also known as bank tokens, are the banking response to stablecoin rules. They do not create a new claim outside the banking sector. They convert the bank deposit into a token usable on new systems. The idea is careful: keep the same legal claim, the same supervisors, and the same plan for what to do if a bank fails, but let money move faster. This also keeps the user relationship with a company that already checks users, detects scams, and has strong controls. Fireblocks says this change is about banks regaining control of settlement and liquidity flows while still under watch. Big banks are already testing this. A 2025 McKinsey review says that JPMorgan's deposit-token system has handled more than USD 1 billion in daily transactions for big clients. Industry groups also say that banks are starting 24/7 tokenized cash services for corporate fund transfers. These steps aim to bring deposit safety to new technology, not to ask people to trust a different money system.

If this bank-token idea grows, it will put pressure on non-bank stablecoins. Banks provide a claim within the two-part system. Stablecoin companies must gain that trust. Citi says issuance reached about USD 300 billion in 2025 and that bank tokens could grow as rules tighten. Europe's MiCA law applies key stablecoin issuer rules from 30 June 2024, with the wider system from 30 December 2024. The United States also moved toward federal rules in 2025, requiring sufficient liquid assets and the sharing of information about reserves. A non-bank company seeking a payment scale must build bank-like compliance and resilience across the open system. A bank already has much of that. The choice is important: bank-led money can increase fees and limit access. Some say that this could keep banks in power, but open systems and portability can reduce that. Weak stablecoin rules, however, leave users exposed when platforms fail, and it is unclear whether they can recover their funds.

Stablecoin rules and education payments

The two-part system helps here. It clarifies that the core question is not just whether tokens can move, but whether their value holds under pressure, and who bears the loss if it does not. In this way, stablecoin adoption is not only a technical question for finance and policy, but a defining challenge for how education prepares students for the realities of digital economies.

School leaders should view stablecoin adoption as a financial decision, not a marketing choice. If a school accepts stablecoins, it must decide who is responsible for changes in value and for the keys and wallet. It also needs a plan for what to do if an exchange or payment company freezes during a crisis. These are everyday situations. Stablecoins are now a big part of on-chain use. TRM Labs says they account for about 30% of on-chain crypto transaction volume, with volumes exceeding USD 4 trillion by August 2025. As usage grows, the likelihood of a failure affecting a school increases. A safer approach is to base payment decisions on stablecoin rules that govern the open system. This means clear redemption rights, checked reserves, and regulated custody and conversion partners. It also means clear roles: who has the keys, what law applies, and what happens if funds are lost. Education teams already have plans for data privacy and student safety. Digital money needs the same level of care, since payment failure can quickly harm students.

A stablecoin market above USD 280 billion is a test. It shows how much deposit-like money people will accept without deposit-level rules. Faster payments are reasonable, but only if the value holds steady during problems. Stablecoin rules should focus on the open areas where failures can start, including the wallet, exchange, bridge, smart contract, and cash-out gate. Policy should also allow tokenized deposits that bring bank responsibilities to new systems. Those responsibilities are what make deposits work. Education can lead, as it manages public trust every day. It can set vendor standards, reject unsafe systems, and teach the difference between a token claim and a deposit claim. If schools want safe money, the payment system will follow. Students should not suffer because of payment attempts.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Bank for International Settlements. (2025a). Annual Economic Report 2025: The next-generation monetary and financial system (Chapter III). BIS.

Bank for International Settlements. (2025b). How deposits can harness tokenisation (Speech, 28 November 2025). BIS.

Citi Institute. (2025). Beyond Stablecoins: Why Bank Tokens Could Boom (19 November 2025). Citigroup.

Dechert LLP. (2024). MiCA Phase One: Issuers of ARTs and EMTs subject to authorisation from 30 June 2024 (27 June 2024). Dechert OnPoint.

DTCC. (2025). Stablecoins, liquidity and the future of tokenized assets: A global perspective (12 June 2025). DTCC Digital Standard.

Ernst & Young. (2024). MiCA’s full effect drops: take the next step into EU financial digitalization (18 December 2024). EY.

European Central Bank. (2025). Stablecoins on the rise: still small in the euro area, but spillover risks loom (Financial Stability Review, November 2025). ECB.

Federal Reserve Board. (2025). In the Shadow of Bank Runs: Lessons from the Silicon Valley Bank Failure and Its Impact on Stablecoins (FEDS Notes, 17 December 2025). Federal Reserve.

Financial Stability Board. (2023). High-level Recommendations for the Regulation, Supervision and Oversight of Global Stablecoin Arrangements (17 July 2023). FSB.

Fireblocks. (2025). The Next Chapter of Transaction Banking (5 November 2025). Fireblocks Blog.

McKinsey & Company. (2025). The stable door opens: how tokenized cash enables next-gen payments (21 July 2025). McKinsey Insights.

Reuters. (2023). Crypto investors pull $3 bln from stablecoin USDC in three days (16 March 2023). Reuters.

Reuters. (2025). Stablecoins’ market cap surges to record high as U.S. Senate passes bill (18 June 2025). Reuters.

TRM Labs. (2025). 2025 Crypto Adoption and Stablecoin Usage Report (2025). TRM Labs.

Comment