Japan's Chip Plan Needs People, Stat

Input

Modified

Japan’s chip revival must be talent-first Play niches—packaging, sensors, photonics—over a scale race Tie subsidies to audited workforce and yield outcomes

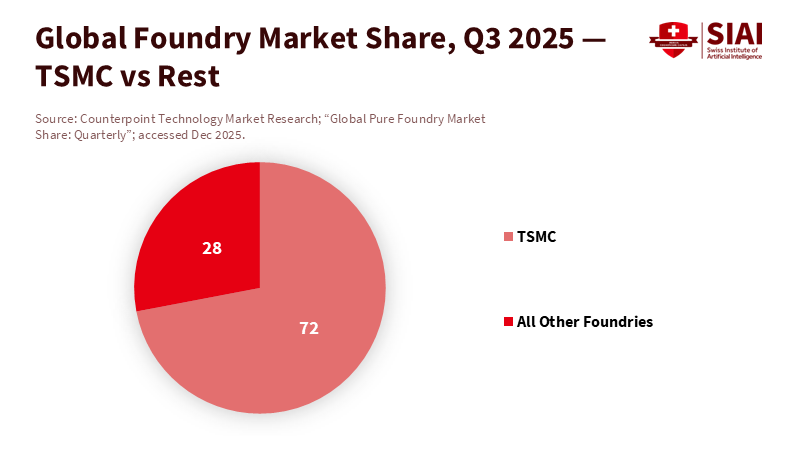

The scariest number in the chip biz isn't about cash or size. It's TSMC, a Taiwanese company, which will own about 70% of the chip-making market by 2025. They're getting bigger because of AI and new tech. They’re good at what they do, have solid supplier stuff, and train people well. Japan used to be number one but is now spending heavily to get back in, giving money to Rapidus in Hokkaidō and to TSMC's factories in Kumamoto. But if they don't fix the people problem – not enough skilled workers – they might fail like before, with lots of public cash but not enough private effort and shaky results. Here's the thing: Japan's chip plan won't fly unless it focuses on getting the most skilled people for every dollar spent. That means focusing on training people, not just building fancy factories.

Japan's Chip Plan After a Lost Decade

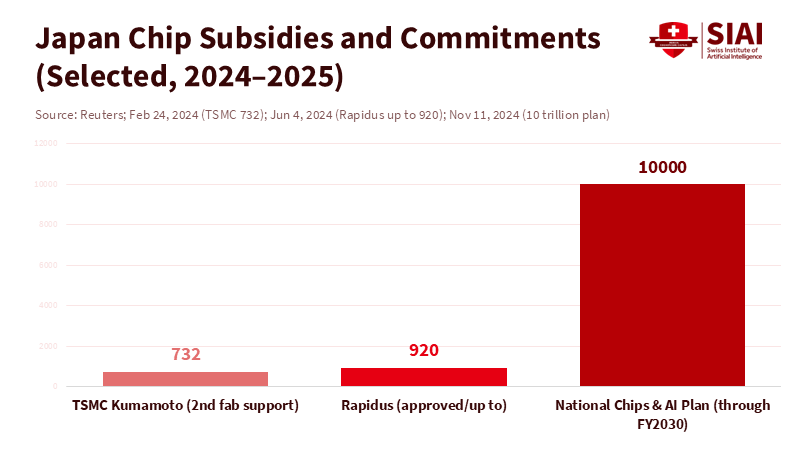

Japan used to be the boss in the 80s. By 2022, they were at about 12% of the chip game, mostly doing materials and gear, not making loads of chips. Now, they're trying three things: making chips at home, using new tech, and doing more research. The government's putting about $65 billion into chips and AI by 2030, and over $6 billion into Rapidus alone. They're also helping TSMC's Kumamoto factories with over $1 trillion, with one factory already going and another on the way. This makes sense because it shortens supply chains, brings suppliers to Kyūshū and Hokkaidō, and lets Japanese companies get their hands on decent chips. But money can't replace skilled workers who can set up machines, achieve good results, and keep factories running around the clock.

The bad news is that Elpida, which was supposed to save Japan, failed even with help. People said it was because of bad leadership, being out of touch, and scandals. To avoid that now, every bit of help should be tied to real results – making chips, getting good results, and training workers, not just making announcements. The government can help start things, but the private sector has to keep it going. It's not just about having the best chips. It's about making chips cheaply and reliably with a solid workforce that can handle new updates fast.

Not Enough Chip People: The Real Problem

Japan's plan is limited by the number of people it has. Industry groups say they'll be short on engineers for factories by 2030. Some things are happening – Kyūshū is starting chip programs, Kumamoto University changed its courses to help local factories, and the government's adding billions for research and production. But there's still a shortage, and demand is going up everywhere. SEMI says the world will need about a million more skilled workers by 2030, with big shortages in Asia. Japan can't just wait for people to show up. They need to train people actively – turn IT engineers, scientists, and car technicians into factory workers in months, not years. Keeping them is as important as hiring them.

Here's what to do: First, judge success by workforce outcomes. Give money based on how many people are trained, how fast they learn, how long they stay, and how well they learn different skills. Second, quickly expand training programs. Japan's already short on IT people, but that means it has a lot of potential if it makes training easy to learn, flexible, and paid. Have short training camps run by companies and universities, with paid apprenticeships at TSMC Japan, Rapidus, Sony, and supplier places. Copy the best ideas from Germany and Taiwan, but adjust them to Japan's needs.

How to Catch Up: Looking at Korea, Taiwan, and China

Japan and China are trying to catch up with South Korea and Taiwan, who got ahead in the 2000s. TSMC in Taiwan dominates chipmaking and is expanding in Japan. Their secret is not just money but knowing how to get good results and having a strong support system. South Korea is also investing heavily with tax breaks and new projects to support its chip industry. These countries have consistent plans, big sites with resources, and constant training. It's hard to copy them. Japan should focus on what makes them different – specialty chips, packaging, or photonics – rather than trying to beat the big guys at their own game.

China is doing the same thing, putting loads of cash into chips. Despite restrictions, Chinese companies are making progress with older chips, investing in gear and materials. This means two things for Japan. First, money can speed things up if you also focus on workers and suppliers. Second, money has limits if you can't get the tech or build a support system. Japan has strong materials and equipment manufacturers and a safe investment environment, which means it can succeed if it addresses the worker problem. They don't need to be as big as China, but they can be more reliable and specialized at prices customers trust.

A Better Chip Plan for Japan

Experts in Japan say don't try to compete head-on. The head of NTT suggests focusing on making specialized products with better profits, along with photonics tech. This aligns with Japan's strengths and the number of skilled workers it has. Making specialty chips, packaging, sensors, and photonics only needs smaller, professional teams and can still help car, robot, and industrial companies. Rapidus's goal to make 2-nm chips by 2027 can be part of this, but they should also focus on building a strong base in packaging and testing that customers will pay for now.

The way subsidies are given should change. Right now, they've helped TSMC's Kumamoto factories and Rapidus's Hokkaidō site. In the future, more money should be tied to worker results at the local level. Kyūshū and Hokkaidō should make deals with governments, universities, and factories to double the number of trained workers in two years, cut the time to install machines by 25% through training, improve the performance of new lines, and offer bonuses to keep workers in the area. These goals are real and can be checked to make sure they are doing what they are supposed to. The lesson from Elpida is that money without training doesn't work. The solution is to turn money into skills with clear agreements.

Another thing is to use TSMC's presence as a training center, not just a supplier. With a factory already running in Kumamoto and another on the way, TSMC Japan can train workers across the entire industry, not just itself. They should offer training to other companies and programs for a fee, with the government helping pay for it. Universities also need to update their courses. Kumamoto University is starting, but it needs to expand across Kyūshū, Hokkaidō, and Kantō with standards for skills in different areas. Workers should get certificates that allow them to work to varying factories without needing new training.

Japan should also protect its chip investments against delays. Building factories takes time. While they wait, they can focus on other areas: fixing up equipment for older chip tech, specialized packaging, and reliable image sensors for machines. These use Japan's current strengths and don't need as much size as the best chips. As the world moves toward AI and specialized devices, being good enough, on time, and at the right price is better than being the best, late, and rare. This is a good chance for Japan to focus on a mix of different products.

Finally, the rules need to be fair. The Elpida situation hurt trust in government help and made mistakes more costly. There need to be strong checks on subsidies, public reporting on worker outcomes, and ways to recoup costs if goals aren't met. The boards of companies receiving government help should include experts judged on results, not just public image. People will support the long-term plan if the rules are clear, the numbers are visible, and the focus is on people working hard, not just fancy events. This is about good government as much as it is about industry.

Focus on People, Not Just Hype

Japan can buy time with money, but it can't buy skill. TSMC's success shows that skill comes first, not the other way around. Japan will spend a lot on Rapidus, TSMC's Kumamoto project, and research. This can pay off if they measure success by the number of skilled workers they have, how fast they learn, and how long they stay. A plan that focuses on a mix of products, advanced packaging, and photonics aligns with Japan's strengths and the number of workers it has. It also protects against risks in a world of complex politics and changing demand. The key is to shift from just building factories to training workers. If Japan can focus subsidies, universities, and companies on this, their plan will work well. It's expensive, but not having enough skilled workers would be even worse.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

AMRO (ASEAN+3 Macroeconomic Research Office). “Japan’s Chip Revival Is On Track. The Real Challenge Begins Now.” October 7, 2024.

Counterpoint Research. “Global Pure Foundry Market Share: Quarterly.” Accessed December 2025.

Digitimes. “TSMC’s Second Kumamoto Fab to Break Ground after July 2025.” June 12, 2025.

East Asia Forum. “Is Japan’s Economic Security Strategy Economical?” December 16, 2025.

Japan Times. “Talent, Reforms Crucial for Chip Revival: Expert.” December 16, 2025.

Nippon.com. “Elpida and the Failure of Japan Inc.” May 8, 2012.

Nippon.com. “Collapse of Elpida Tarnishes Hopes for Industrial Policy.” May 2, 2012.

NTT / Reuters. “Japan Needs a Niche Approach to Get Back in the Chip Game, NTT Chairman Says.” December 15, 2025.

Reuters. “China Sets Up Third Fund with ¥344 Billion to Boost Semiconductor Sector.” May 27, 2024.

Reuters. “Japan Approves $3.9 Billion in Subsidies for Chipmaker Rapidus.” April 2, 2024.

Reuters. “Tokyo Pledges a Further $4.9 Billion to Help TSMC Expand Japan Production.” February 24, 2024.

SEMI. “The Semiconductor Talent Crisis: Why Growing Demand Can’t Find Leaders.” June 23, 2025.

Trade.gov (U.S. International Trade Administration). “Japan – Semiconductors.” November 20, 2025.

TSMC (Press Release). “TSMC Celebrates the Opening of JASM in Kumamoto, Japan.” February 24, 2024.

Tom’s Hardware. “TSMC’s Second Japanese Fab Reportedly Delayed, Mass Production Pushed to 2029.” August 2025.

Tom’s Hardware. “TSMC Ponders Upgrading 2nd Japan Fab to 4nm.” December 2025.

Trade-press summary (PC Gamer). “TSMC Hits Record 70% Foundry Market Share.” September 2025.

Comment