Thailand Green Energy Transition: Why Southeast Asia’s Next Growth Wave May End the Oil Shock Era

Input

Modified

Thailand is pivoting to green-powered growth Its green shift loosens Asia’s oil dependence Education must fast-track clean energy skills

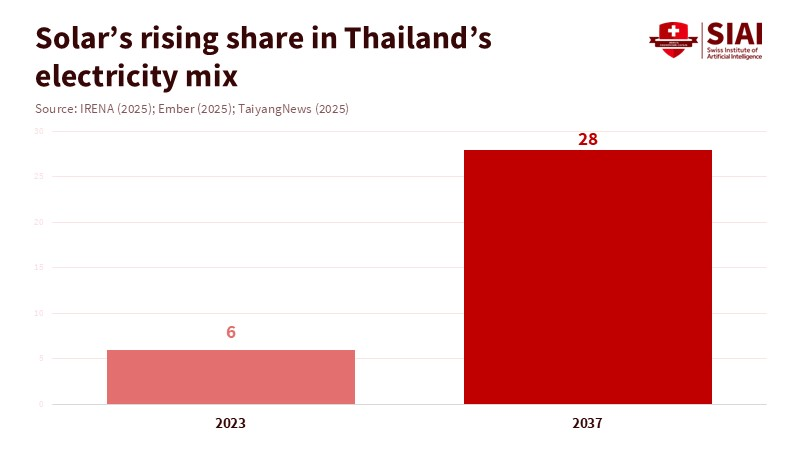

For once, the most critical number in global energy comes from a country where more than 80% of the power system relies on coal and gas, not an OPEC bulletin. Thailand’s latest power modeling indicates that, with stronger policy, solar could rise from about 2% of national electricity today to approximately 28% by 2037. Renewables and storage together could supply roughly half of the grid, avoiding about 147 million tonnes of CO₂. This economy aims to become Southeast Asia’s hub for electric vehicles and data centers, which run on electrons rather than barrels. If successful, Thailand’s green energy transition could reshape regional growth and influence future oil shocks, making it a pivotal development for policymakers and investors alike.

Thailand's green energy transition and the new shape of growth

The starting point remains complicated. Coal and natural gas provide more than four-fifths of Thailand’s electricity, with gas recently accounting for over two-thirds of power output. The share of imported gas has risen from just over 20% in 2015 to about 40% by 2024. A draft revised Power Development Plan released in 2024 aims to add about 64 gigawatts of new renewable energy and storage capacity by 2037. This plan targets clean sources to supply around 51%of domestic electricity. Analysis from Ember shows that advancing solar and battery technologies is feasible and cost-effective. An improved pathway would cut gas consumption by more than 10%, prevent 147 million tonnes of CO₂ emissions, and reduce power system costs by about US$1.8 billion by 2037, despite higher initial investments. In this scenario, solar alone could provide close to 28% of Thailand’s electricity, up from about 2% today.

What sets this phase of Thailand’s green energy transition apart is the timing. The country is aiming to move up the value chain just as renewables shift from niche technology to the default choice for new power. In 2024, global electricity generation increased by about 1,200 terawatt hours, with over 80% of that growth coming from low-emission sources, led by solar, wind, and nuclear. The International Energy Agency (IEA) now predicts renewables will increase their share of global power from around 32% in 2024 to about 43% by 2030. They will meet over 90% of the net growth in electricity demand from 2025 to 2030. Ember’s mid-year electricity review shows that in the first half of 2025, wind and solar together produced more power worldwide than coal for the first time, with solar alone providing around 83% of the extra electricity needed. Thailand’s grid may not look like this yet, but it benefits from the same cost trends and technologies.

The industrial logic behind this shift is at least as compelling as the climate logic. Thailand’s automotive sector contributes around 11-15% of GDP and supports about 750,000 jobs. Policymakers want that foundation to pivot towards electric vehicles, batteries, and components rather than ceding ground to regional competitors. Meanwhile, Thailand’s data center market is projected to grow at around 7.5-8.5% per year between 2025 and 2027, as cloud and AI services expand throughout Southeast Asia. Global manufacturers and tech companies face increasing pressure from investors and regulators to reduce carbon in their supply chains. They now enter long-term contracts that require new factories and data centers to use verifiable clean power. In this context, Thailand's green energy transition is not merely a side project or a branding effort; it is essential for remaining competitive in the coming decade of investment.

From coal-fired China to clean-powered Thailand

To understand why this is important for global oil markets, we can look back. When China's manufacturing boom surged in the late 1990s and 2000s, its power system was heavily based on coal. In 2000, coal generated about 77% of the country's electricity; by 2020, that share had fallen but remained around 63%. Analysis of more recent data suggests that coal still accounted for nearly 60% of China’s electricity in 2023, even after rapid growth in hydropower, wind, and solar. That coal-heavy system coincided with a rise in oil demand from construction and industry, as well as a surge in private vehicle use. This combination fueled the early-2000s "supercycle" in fossil fuel prices. Fast-growing Asian economies had no choice but to buy whatever coal, gas, and oil global markets could supply, often at high prices.

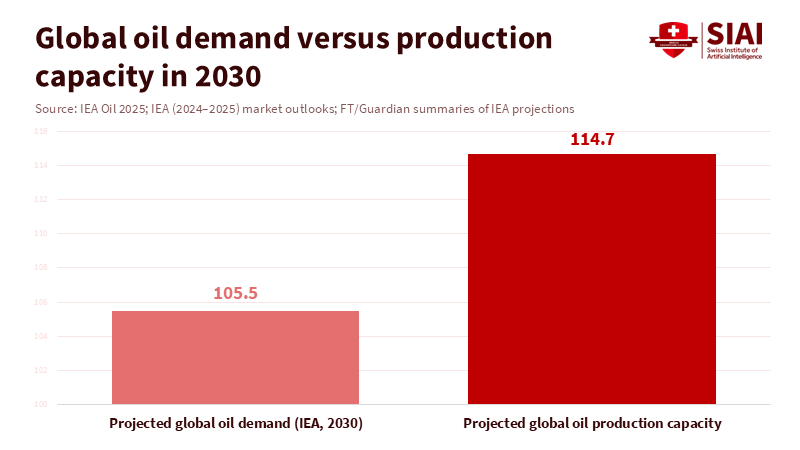

Thailand and its Southeast Asian neighbors are not following that narrative. Their industrial strategies are being shaped in a world where electric vehicles already account for more than 20% of global new-car sales and are projected to exceed 50% by 2035. Under the IEA’s stated policies scenario, a growing fleet of EVs—more than 840 million vehicles by 2035—could displace around 10 million barrels of oil per day, mainly in Asia and Europe. At the same time, the IEA expects global oil demand to level off at around 105-106 million barrels per day before 2030, then begin a slow decline, even under conservative policy assumptions. Producers and analysts may differ on the exact peak year, with some expecting demand to rise into the 2040s, but the structure of growth is shifting. The following factory or data center in Thailand is being designed to draw from the grid, not from refinery output.

Why Southeast Asia’s green growth dulls the next oil shock

Thailand's approach illustrates why this structural shift is significant. The enhanced Ember scenario suggests that by 2037, solar power could generate close to a third of Thai electricity, while imports of hydropower from neighboring Lao PDR could lead to cumulative savings from lower fuel and generation costs reaching around US$5 billion and reducing average power costs by about US$1.3 per megawatt hour. The shelved 2024 power plan already aimed for 64 gigawatts of new renewable and storage capacity and an 8-gigawatt reduction in fossil capacity by 2037; more ambitious solar and storage targets could go further while cutting dependency on imported gas. When viewed from a broader perspective, the regional picture is even clearer. ASEAN energy ministers have endorsed a plan to raise renewable electricity to 45% of installed capacity and 30% of primary energy supply by 2030. According to the ASEAN Power Grid vision model, achieving national targets would increase the share of renewables in the region's electricity mix from below 30% today to above 70% by 2050.

This matters for oil shocks because those shocks depend on a tight, inelastic market responding to a sudden disruption. In the 1970s and early 2000s, demand for transport fuels and industrial feedstocks was both high and inflexible. At the same time, supply came from a limited group of producers. Today, near-term oil demand remains stubborn in sectors like aviation and freight. However, the IEA now expects total fossil fuel use to peak before 2030 if governments follow their stated policies, with renewables supplying almost all additional growth in electricity demand. If Thailand's green energy transition succeeds and similar approaches take hold in Indonesia, Vietnam, and the Philippines, the fastest-growing parts of Southeast Asian GDP will rely on regional clean power flows rather than imported crude oil. That will not erase oil from the global energy mix but will likely weaken the old connection between every percentage point of Asian growth and the next sustained spike in oil prices.

What the Thailand green energy transition means for education policy

For education systems, the key question is not whether this change is technically possible. The economics are already pointing in this direction. The real challenge is whether countries can quickly train enough people to build and manage a clean power system that meets industrial demand. In Thailand, this begins with the workforce that currently powers its manufacturing base. The automotive industry and its suppliers support around 750,000 jobs and contribute up to 15% of GDP; these workers will need new skills in battery chemistry, power electronics, high-voltage safety, and software diagnostics as factories transition from combustion engines to EV platforms. Technical colleges, vocational institutes, and engineering faculties can no longer consider internal-combustion engine design as the default career path. Electric drivetrains, charging infrastructure, and grid integration must become the new criteria for teaching and apprenticeship.

The same reasoning applies to the digital economy. Data centers, cloud services, and AI workloads are demanding increased electricity and cooling while also requiring staff to manage demand response, energy-efficient hardware, and on-site generation. Thailand’s data center market, projected to grow at about 7.5-8.5% a year in the near term, will face challenges if it cannot find enough engineers knowledgeable in both server operations and substations. Universities can no longer separate computer science from energy. Courses in software engineering and data science should be offered alongside training in grid management, electricity markets, and climate risk. Business schools in Bangkok and Chiang Mai need to teach future managers how power purchase agreements, carbon accounting, and location-based emissions factors shape corporate investment decisions. As multinationals seek new campuses and factories near clean power sources, graduates need to understand both financial management and energy consumption.

There is also a regional and social aspect that education systems must address. Plans for an ASEAN power grid and cross-border renewable projects could fail without engineers, lawyers, and policy analysts who grasp the physics and politics of interconnection. Curricula in international relations, law, and public policy should view energy interdependence as a fundamental theme, not a niche elective. Additionally, moving away from fossil fuels will affect livelihoods in communities connected to gas infrastructure, refineries, or coal transport. Teacher training programs and adult education systems need to prepare for mid-career retraining, local entrepreneurship in solar installation and maintenance, and community participation in planning new projects. Without this social infrastructure, Thailand's green energy transition could falter due to public resistance, even if the economics are sound.

The opening statistic bears repeating. In just over a decade, Thailand could shift from a power system where more than 80% of electricity comes from fossil fuels to one where solar alone provides close to 30% and renewables overall supply about half of the grid, saving billions and preventing millions of tonnes of emissions. This change will not eliminate oil use overnight, nor will it reduce every risk of price spikes. However, it means that the next surge of factories, ports, and data centers across Southeast Asia does not need to be tied to a corresponding increase in oil imports. Suppose policymakers support Thailand's green energy transition by investing in skills, institutions, and regional cooperation. In that case, they can turn a technical pathway into a practical reality. By doing this, they will not only clean up their growth; they will also help shift the idea of another Asia-driven oil shock from a forecast to a historical event.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Carbon Brief. (2025, November 12). IEA: Fossil-fuel use will peak before 2030 – unless ‘stated policies’ are abandoned.

Climate & Capital Media. (2025, October 29). Fossil-heavy Thailand is at a crossroads — with a big green opportunity.

Ember. (2025, October 7). Global electricity mid-year insights 2025.

International Energy Agency. (2024). Southeast Asia energy outlook 2024.

International Energy Agency. (2025a). Global energy review 2025 – Electricity.

International Energy Agency. (2025b). Renewables 2025 – Renewable electricity.

International Energy Agency. (2025c). World Energy Outlook 2025 – Stated Policies Scenario.

International Energy Agency. (n.d.). Thailand – Countries & regions.

PV Tech. (2025, October 1). Ember calls for Thailand to add 32GW of new solar capacity.

Reuters. (2025, October 16). ASEAN endorses action plan to increase renewable electricity share to 45% by 2030.

Reuters. (2025, November 6). Oil demand set to peak by 2029, major supply glut looms, IEA says.

The Guardian. (2025, October 6). Global renewable energy generation surpasses coal for first time.

U.S. Energy Information Administration. (2022, September 22). China increased electricity generation annually from 2000 to 2020, led by renewables. Today in Energy.

Comment