Multi-Issuer Stablecoins Can Make Europe Safer, If We Build the Backstop

Input

Modified

Europe shouldn’t ban multi-issuer stablecoins; it should backstop them Require joint redemption, a prefunded mutual buffer, and fast resolution to contain failures This builds euro-scale alternatives to dollar coins while reducing systemic risk

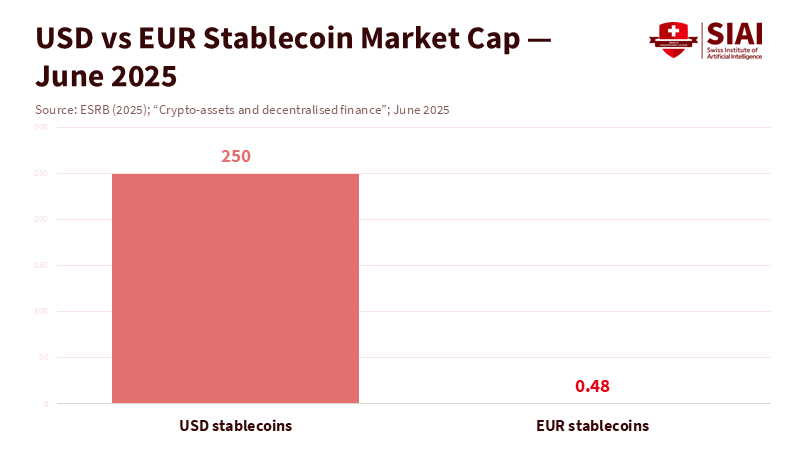

A single number frames Europe's choice. By June 2025, dollar-pegged stablecoins reached about $252 billion in value, while euro-pegged stablecoins stood at around $480 million. This represents a gap of more than 500 to 1. The gap will likely grow unless Europe adopts rules that support the growth of safe euro tokens. Regulators are currently considering a hard ban on multi-issuer stablecoins. The concern is simple: if one issuer fails, the coin collapses, and losses spread across borders. That concern is valid. However, a ban would leave Europe dependent on dollar coins and limit options that could strengthen the euro system. A better approach is to allow multi-issuer designs while requiring a shared buffer, joint redemption rights, and a quick-resolution mechanism. The same union that built collective safeguards for sovereign debt can create one for digital money. The choice is not between a ban or disaster; it's between a backstop or dependence.

Why multi-issuer stablecoins can improve resilience

"Multi-issuer stablecoins" are tokens backed by reserves but issued by multiple regulated entities under a single brand. This model is not without risk. Pegs have slipped under pressure, and operational mistakes have occurred. Yet, the multi-issuer structure isn't to blame for those slips; weak backing and uneven redemption rights are the real issues. Multiple licensed issuers, supervised under a common rulebook, can add redundancy rather than fragility if their design connects them. One issuer can step in if another falters. Service interruptions do not freeze redemptions. Competition enhances service quality while the common reserve and rules keep the coin pegged to the euro. A narrow ban would sacrifice these benefits while doing little to curb the global dominance of dollar tokens that already dominate liquidity and payments. Europe needs safer euro settlement options, not fewer of them.

The market context makes this case urgent. Global stablecoins are now central to crypto settlement and are infiltrating fintech and wholesale use. The total market reached a record in mid-2025 and continues to expand. U.S. policy has shifted in favor of dollar-based tokens, pushing them into mainstream finance. By contrast, European officials warn of monetary dependence if euro tokens don't scale. Their concerns are valid. If most tokenized settlements rely on dollar systems, Europe will face higher costs and reduced autonomy. The solution isn't to freeze innovation locally; it's to steer it toward safe, regulated instruments that can compete. Multi-issuer stablecoins can be one of those instruments if they have solid backing, uniform redemption rights, and credible resolution.

The EU's real risk: not fragmentation, but lacking backstops

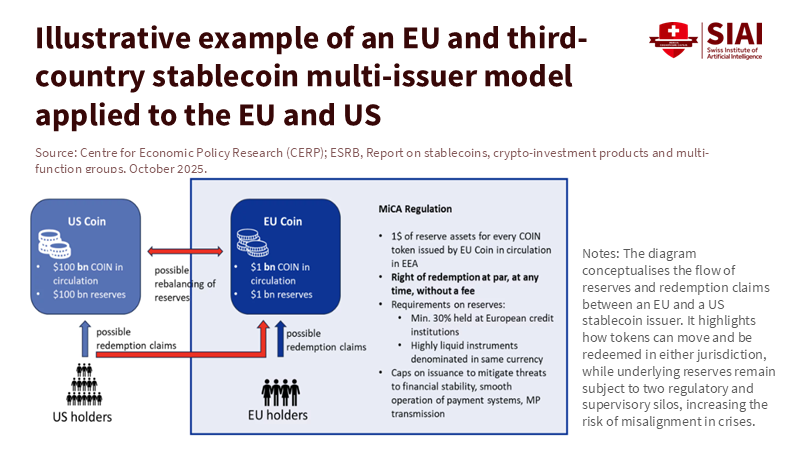

The core fear in Europe is familiar: cross-border loss-sharing. Picture one sub-issuer failing while others remain stable. Who bears the loss when coins already circulate throughout the bloc? That question recalls the discussions during the sovereign crisis a decade ago, when Europe created standard tools to prevent contagion. Today's stablecoin discussion needs the same mindset: mutualized buffers and clear resolution, not a preemptive ban. The supervisory framework is already in place. The EU's MiCA regulation has applied to stablecoin issuers since June 30, 2024, with strict rules on reserve assets, disclosure, and redemption at par. The European Banking Authority has pushed for more stringent liquidity requirements for reserves. The pieces are ready. What's missing is a cross-issuer backstop that makes several issuers function like one robust coin.

Recent signals heighten the stakes. Europe's risk watchdog has suggested a ban on multi-issuance arrangements, citing the danger that no single authority or balance sheet supports a coin during a crisis. The new ESRB report cautions that crypto assets, particularly stablecoins, have entered the financial mainstream, aided by policies abroad. It highlights the sharp rise in global market value since 2023 and calls for stronger risk management tools. Those points are accurate. However, they argue for backstops rather than bans. A ban would leave Europe dependent on foreign coins it cannot regulate, and it would cut off a design that can absorb shocks when supported by the right buffers. A better interpretation of Europe's own experience is to build the essential institutions rather than retreat from growth.

A practical plan for safe multi-issuer stablecoins

The plan starts with one coin, one rule. All coin units must be redeemable at par, on demand, from any issuer in the system. Redemption rights must be the same across the bloc, with no gaps based on geography or channels. A single supervisory college—led by the EBA with national authorities—should approve the scheme's rulebook, audit the reserves, and test redemption flows under stress. These steps combine several legal entities into a single economic issuer in the user's view. They also eliminate the weakest-link issue that currently drives concerns. If any unit can be redeemed anywhere, the scheme itself—not just one sub-issuer—stands behind the peg.

Next is the buffer. MiCA already requires full, liquid reserves. This shields against normal outflows. However, it does not provide a cushion against a unique failure within a multi-issuer scheme. The solution is a mutualized, prefunded stabilization fund that sits above the reserves and is legally separated for the protection of coinholders. Imagine it as a narrow "capital-like" layer designed to absorb the default of a sub-issuer and cover the operational costs of rapid substitution. A simple, conservative plan could set the floor at 3–5% of outstanding coins in cash or central bank deposits, funded by issuers based on their share. When a sub-issuer fails, the fund pays for immediate switching and any losses that may arise if a portion of the assets is illiquid. In regular times, the fund earns a modest interest rate, but during stress, it maintains the peg. This is akin to the familiar prudential buffers used in finance.

Redemption must be operationally reliable. The scheme should maintain a shared treasury function that can move reserves between issuers during the day and send payouts through various correspondent banks. It should have agreed liquidity lines with banks that meet high collateral standards, ensuring redemptions clear even if one issuer's access is interrupted. It should publish daily outstanding supply by issuer, reserve composition, and stress-test results, all under a standard template approved by the supervisor. These aren't exotic measures; they reflect liquidity coverage and disclosure standards across risk management systems. They ensure that multi-issuer stablecoins appear and act like a single, well-supervised instrument.

Resolution is the final step. Europe should define a short, transparent process for handling issuer failure within a scheme. Step one: freeze new issuance by the failing entity while ensuring redemptions continue through others. Step two: transfer customer accounts and operational roles to a stable issuer within two days under a standing transfer agreement. Step three: utilize the stabilization fund to cover costs and losses, with repayments from surviving issuers over twelve months. Step four: if losses exceed the fund, implement a temporary cap on redemption fees (e.g., 10 basis points) until the buffer is restored, then remove the cap. This route maintains the peg, speeds up the process, and ensures transparency. It also aligns incentives: issuers cover the risks they bring to the scheme, while users enjoy a straightforward promise—par on demand.

Addressing the critics and setting the timeline

Critics raise three main objections. First, they warn of moral hazard: if others will cover a failure, a weak issuer might take on more risk. The response is to make entry tough and exit quick. Membership must require significant capital at the entity level, a contribution to the shared fund, and real-time data sharing. Reviews should be ongoing, and removal should happen automatically at preset triggers. Shared buffers lower systemic risk; they do not excuse weak firms. Second, critics fear regulatory evasion; complex structures may slip through gaps between national authorities. The solution is a single point of supervisory accountability for the scheme at the EU level, supported by binding colleges and on-site exams. MiCA points in this direction, while the EBA's position on reserve liquidity illustrates how regulatory detail can close loopholes. Third, some argue that multi-issuer designs introduce operational complexity. This is true, but complexity doesn't equal fragility when functions are standardized and tested. Europe manages cross-border payment and settlement systems daily; it can handle this one.

The timeline is crucial. The market is not standing still. Dollar stablecoins are expanding under friendlier regulations abroad, while Europe debates bans. Euro-pegged tokens are small but growing. Eurozone finance ministers have begun discussions on boosting issuance. A group of central European banks has announced plans to launch a euro stablecoin in 2026. If the EU prohibits multi-issuer structures now, it will limit those plans to single-issuer designs that may be slower, less resilient, and less competitive. If the EU establishes a high standard—common redemption, a prefunded buffer, and rapid resolution—it can attract bank and fintech investment toward safe, scalable products that prioritize European users.

The policy choice is not theoretical. It becomes evident when a user in Milan attempts to redeem on a Friday, only to find the Italian sub-issuer experiencing a system failure. It appears that when volume in Paris surges after a significant listing, it requires reserve rebalancing across Amsterdam and Frankfurt. In those moments, a ban does nothing. A backstop does everything. With a shared fund and a unified redemption rule, multi-issuer stablecoins can turn local issues into non-events. Without them, each problem tests confidence. The European lesson from past crises is clear: create institutions that prevent contagion before a crisis occurs. That is how to maintain the peg and the public's trust.

Build the buffer, keep the choice

Revisiting the opening number: a world with $252 billion in dollar coins and under a billion in euro coins is one where Europe does not set the standards for digital money. The ESRB is correct to highlight a real gap. But closing a gap doesn't mean eliminating a market. The safer, more intelligent choice is to allow multi-issuer stablecoins in the EU while requiring a mutualized buffer, joint redemption rights, and a straightforward resolution process. Those measures transform several balance sheets into one credible promise. They also provide Europe with a path to scale that doesn't depend on another currency. The EU has successfully tackled this type of issue before by creating shared institutions that prevent spillovers across borders. It should do so again. Build the buffer. Keep the choice. And create a euro stablecoin that is both safe and strong enough to matter.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Bank for International Settlements (2025). Stablecoin growth – policy challenges and approaches (BIS Bulletin No. 108).

Bloomberg (2025, Sept. 30). EU Watchdog Pushes Multi-Issuance Crypto Ban on Crash Fears.

CCData / CoinDesk Research (2025, June 27). Stablecoins & CBDCs Report – June 2025.

Central Bank of Ireland (n.d.). Markets in Crypto-Assets Regulation (MiCAR): Application Timeline.

European Banking Authority (2025, Oct. 10). Opinions on liquidity and reserve assets under MiCA.

European Central Bank (2025, July 28). From hype to hazard: what stablecoins mean for Europe (ECB blog).

European Systemic Risk Board (2025, Oct. 10). Crypto-assets and decentralised finance (Report).

European Systemic Risk Board (2025, Oct. 20). Press release on systemic risks from crypto-assets and multi-issuer schemes.

Ledger Insights (2025, Oct. 1). EU Systemic Risk Board recommends banning multi-issuance stablecoins – report.

Reuters (2025, June 18). Stablecoins' market cap surges to record high as U.S. Senate passes bill.

Reuters (2025, Oct. 7). Eurozone ministers to look at how to boost euro stablecoin issuance.

VoxEU/CEPR (2025, Oct. 27). Multi-issuer stablecoins: A threat to financial stability.