Targeted U.S. Tariffs: Low Averages, High Drama, and What Schools Should Plan For

Input

Modified

U.S. tariffs stay low on average but spike in China-focused sectors Revenue rises yet swings month to month, so it’s no fiscal anchor Inflation effects are modest overall; schools should plan around procurement hotspots

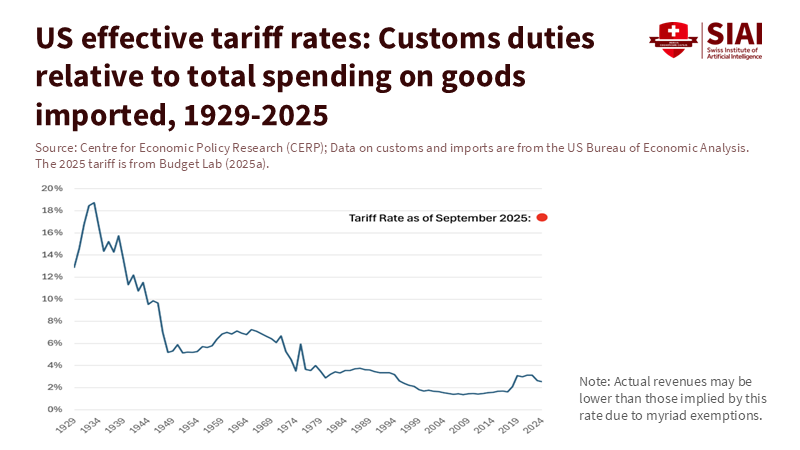

One figure gets lost in all the noise: 2.2%. That was the U.S. trade-weighted average tariff in 2024. It isn't 100%. It isn't even in the teens. It's a low single digit that looks like business as usual at first glance. The average hides significant spikes on a small selection of products and partners. It also obscures how "targeted US tariffs" function today—sharp, visible changes on politically important items paired with exemptions and pauses that soften the impact—resulting in revenue increases, but not in a straight line. Prices rise, but not universally. The overall tariff level remains closer to the past two decades' policy baseline than it does to the 1930s. To understand what lies ahead for budgets, prices, and classrooms, we need to start with that base rate and identify the narrow areas where policy influence is real.

What targeted U.S. tariffs really do

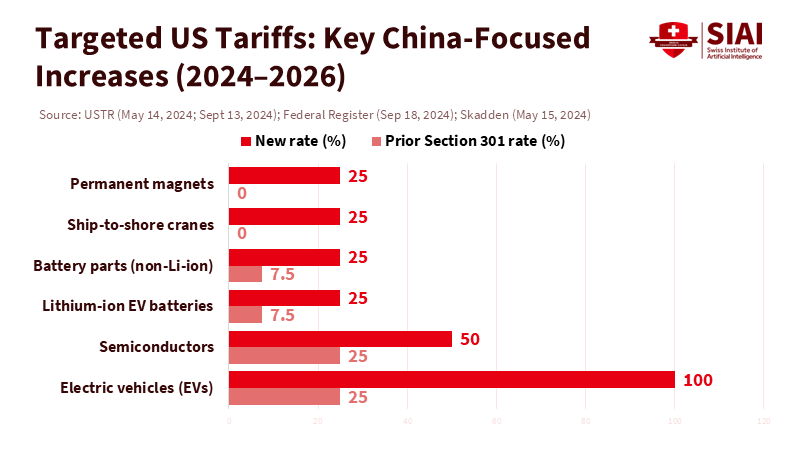

The evidence is clear. On a trade-weighted basis, U.S. tariffs averaged 2.2% in 2024, while the simple average was around 3.3%. This is not a universal tax wall. It serves as a modest baseline with specific pockets of intensity aimed primarily at China. In late 2024, the United States confirmed and refined Section 301 actions against Chinese goods, raising rates on a defined list of products like EVs, batteries, and specific critical inputs. In early 2025, more China-focused measures emerged. These actions did not convert the entire tariff schedule into triple digits. Instead, they created a two-tier landscape: most trade flows at very low rates, while a smaller set flows at much higher rates. This intentional design and narrow scope is why 'targeted US tariffs' can dominate headlines while the nation's average stays low.

Targeting shows up in trade shares as well. China's share of U.S. goods imports has dropped from about 21-22% in 2018 to roughly 13-14% in 2024 as businesses shifted orders to Mexico, Vietnam, and other countries. This shift reduces direct tariff exposure even when nominal rates on China are high. It doesn't eliminate costs; it simply moves them. Companies rework supply chains, pay higher shipping costs, and sometimes compromise on quality or lead times. However, these costs are uneven and take longer to affect the consumer price index than a universal tariff would. The result is a policy prominent to the targeted partner and specific industries, but less noticeable in the overall data most of us read each month.

The cash-flow myth of targeted U.S. tariffs

Tariffs do generate cash. They can also fluctuate significantly. A careful tracker from the Peterson Institute shows that tariff receipts from January 2025 to July reached about $122 billion, which is only 6.5% of the projected $1.9 trillion deficit for the year. This is a decent figure for a single line item, but it doesn't serve as a fiscal fix. Daily claims of $2 billion in tariff revenue do not match the official averages; fact-checkers place the mean closer to a few hundred million per day, depending on the month. Receipts vary with exclusions, shipment timing, and pre-buy surges. When a new rate is announced, the first reaction isn't steady cash flow. It's a rush to beat the deadline, followed by a slowdown as inventories clear. The tax behaves less like payroll withholding and more like a charge on a moving target.

The 'pre-buy, then dip' pattern has become standard. In March 2025, the U.S. trade deficit soared as importers rushed to bring in goods before impending increases in tariffs. Revenue surged during this spike and then cooled off. This volatility matters for anyone viewing tariffs as a budget tool. It complicates month-to-month planning and undermines the argument that customs receipts can support stable new spending. If policy intends to fund ongoing programs from tariff revenue, it will likely run into timing and reliability mismatches. This is not an ideological claim; it's a practical one based on how companies schedule shipments and how customs records cash.

Inflation and growth under targeted U.S. tariffs

What about prices? Here, the answer is clear but limited. The Federal Reserve's real-time analysis of the 2018-2019 measures found a complete and rapid pass-through to import and consumer goods prices. For the new 2025 China measures, the Fed's estimate through March shows a negligible near-term effect: about a 0.33-percentage-point increase to core goods PCE prices, equating to roughly 0.08 percentage points on core PCE overall, given the weight of goods. That is real; however, it's not a macro shock. The same tracker that measures revenue also shows that category-level practical tariff burdens are low single digits of import value for broad consumer goods, as exemptions and routing reduce the average impact. Some domestic producers also raise prices due to new protections. Still, reduced exposure to China and staggered implementation slow the pass-through. The price signal is there and positive, yet modest at the headline level.

Growth effects are even harder to detect in the short term because many factors are at play. A strong dollar and steady demand attract imports. A front-loaded quarter can make deficits look worse, even as rates rise. Over time, the cost of rerouting inputs cuts productivity and raises capital costs. This is a gradual process rather than a quick change, allowing for long-term planning and preparation. The takeaway for planning is straightforward. Budgets should expect a mild, not dramatic, inflation effect from 'targeted US tariffs' under current rules, with risks concentrated in goods categories that depend on Chinese intermediates. Price jumps will be most visible where there is little domestic spare capacity, limited alternatives outside of China, and minimal inventory buffers. Elsewhere, the impact will show up as gradual increases rather than sudden hits to annual inflation targets.

A practical roadmap for schools and policymakers under targeted U.S. tariffs

Education leaders do not set tariff policy, but they deal with its downstream effects. Three areas require attention now—first, device and lab equipment procurement. Laptops, tablets, networking gear, microscopes, and sensors often contain imported parts that face higher rates if sourced from China. Prices may rise slightly, and these increases add up across district-wide refresh cycles. Procurement teams should bid twice a year, maintain flexibility on country of origin, and ask vendors for clear sourcing information. Small cost increases spread across thousands of units can pose budget risks if identified early, particularly due to facilities upgrades. Electrical equipment, HVAC controls, and solar installations include tariff-sensitive components. Staggering projects over financial quarters, rather than pushing them all into a narrow timeframe, lowers the risk of facing elevated pricing after a rate change. Third, student support. As prices rise in product categories, students from low-income families face tighter budgets for essentials. Schools should prepare for this with focused aid and fee waivers that don't wait for CPI headlines to validate the pressure.

Policymakers can also lessen the burden. Maintain the base rate low while applying "targeted US tariffs" narrowly where national security or significant unfair practices are evident. Provide clear and stable exclusion pathways with definite timelines. Direct any tariff-related revenue toward time-limited credits for K-12 connectivity, community college lab upgrades, and state apprenticeship grants in areas experiencing supply-chain disruptions—such as advanced manufacturing, power electronics, and industrial maintenance. This draws a clear line from the tax to the transition skills we need. Finally, support better data collection. Current mismatches between partner-reported and U.S.-reported trade data with China make it hard to understand real exposure and design accurate measures. More precise, faster, and more detailed import origin data will allow public buyers, including school systems, to plan with weeks of lead time instead of months.

Keep the average in view, and plan for the spikes

The United States still has one of the lowest average tariff rates globally, and the current trend of "targeted US tariffs" hasn't created a wall. It has resulted in sharp spikes at the edges, mainly aimed at China, with fiscal receipts that look solid on annual charts but fluctuate from month to month, and with price effects that are real but limited overall. The thoughtful response is not to panic or be complacent. The focus is on good procurement, diverse sourcing, and a clear link between the revenue generated and the training we fund. If policymakers maintain a low base rate, clarify the spikes, and allocate some of the proceeds to skills training, the tariff era will feel less like a shock and more like a series of manageable adjustments. That is the right approach for budgets, classrooms, and the broader public conversation now.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Atlanta Fed Policy Hub. (2025). Tariffs and consumer prices. Federal Reserve Bank of Atlanta.

Bureau of Economic Analysis (BEA). (2025). U.S. international trade in goods and services, July 2025 (current release page).

Federal Reserve Board. (2025). Detecting tariff effects on consumer prices in real time (FEDS Notes, May 9, 2025).

Peterson Institute for International Economics (Hufbauer, G. C., & Zhang, Y.). (2025). Trump's tariff revenue tracker: How much is the U.S. collecting? Which imports are hit?

U.S. Census Bureau. (2025). Top trading partners—July 2025; Trade in goods with China—2024 tables.

U.S. Department of the Treasury. (2025). Monthly Treasury Statement (landing page for current and previous issues).

U.S. Trade Representative (USTR). (2024). USTR finalizes action on China tariffs following statutory four-year review (press release).

AP News. (2025). Fact focus: Trump exaggerates revenue from tariffs (fact-check).

World Trade Organization (WTO). (2024). United States of America: Tariffs and imports—Summary and duty ranges (World Tariff Profiles).

Federal Reserve Bank of New York (Liberty Street Economics). (2025). U.S. imports from China have fallen by less than U.S. data indicate (Feb. 26, 2025).

Reuters. (2025). U.S. trade deficit surged to record high in March 2025 amid rush to beat tariffs.

Comment