Export Controls Innovation: How Pressure Built China’s AI Stack and What Schools Must Learn

Input

Modified

Export controls can accelerate innovation by forcing substitution China’s AI stack shows rapid adaptation under GPU limits Education must train for constraints, secure compute, and resilient supply chains

The fastest story in technology this decade is not a new model or a new chip. It is the speed at which policy pressure forces systems to change. In late 2022, U.S. rules cut China off from Nvidia’s H100 class of processors. Nvidia responded with “China-only” variants. By November 2023, those were restricted as well. In 2025, Washington again tightened its control over the H20. Each time the line changed, China adapted. Huawei advanced the Ascend family and, by April 2025, prepared a dual-package 910C for mass shipment. Industry sources indicated this chip could reach H100-class performance by pairing two 910B dies. The point is clear: the impact of export controls on innovation is real. It doesn’t stop progress; instead, it redirects it under pressure. This dynamic should influence how we plan talent, research, and curricula at universities training the people who will either hit or build the next chokepoint.

Export Controls Innovation: What the Data Really Shows

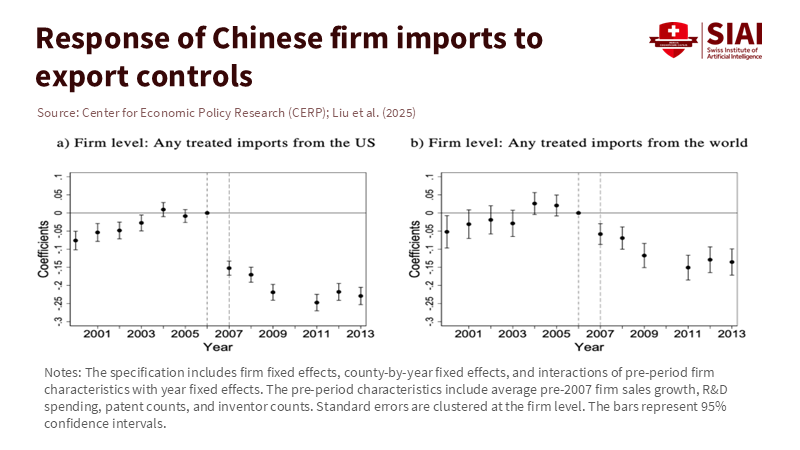

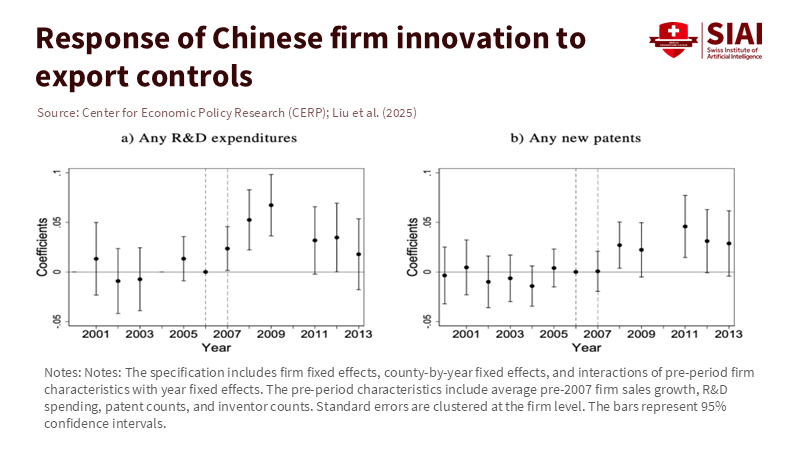

Growing evidence shows that technology sanctions can cut off supplies in the short term but increase local invention in the medium term. A recent study on a 2007 U.S. rule found that Chinese importers of now-controlled goods reduced purchases from the United States by nearly 90 percent compared to pre-period levels. However, those same firms boosted R&D spending by around 49 percent and patent applications by about 41 percent. Patents linked to the sanctioned technologies increased by approximately 65 percent. Domestic suppliers also stepped up patenting in the targeted areas. The lesson is clear: export controls on innovation aren’t just a slogan; they're a measurable response by firms when access to foreign inputs is denied. The mechanism is straightforward. Scarcity concentrates effort, raises the expected return to substitution, and draws in capital and engineers.

Historical examples remind us this isn’t new. Arms races during World War II accelerated applied R&D in Germany and Japan. More recently, when China restricted urea exports, South Korea faced a shortage of diesel exhaust fluid and quickly took steps to diversify and localize its supply. By December 2023, Seoul supported a supply-chain stabilization fund of up to ₩10 trillion (about $7.6 billion) and established legal frameworks to strengthen inputs, later enhanced by new resource-security laws and cooperation with partners. These actions turn a shock into domestic capability. Education systems must assume that shocks will persist and design for resilience instead of frictionless globalization.

Export Controls Innovation and China’s AI Stack

The clearest current example lies in AI hardware and software. U.S. restrictions cut access to top-tier GPUs, tools, and certain memory technologies. In response, Beijing is working to build a full-stack alternative, including chips, frameworks, compute networks, and talent pipelines. China’s leaders have linked national AI goals to “autonomous and controllable” systems. They are investing public funds to achieve this, including an $8.2 billion national AI fund and power-hungry data-center hubs in the interior. Despite this, performance gaps persist. As of mid-2024, the United States controlled about 75 percent of global AI compute, while China held approximately 15 percent. China’s total compute reached around 246 EFLOP/s with a goal of 300 EFLOP/s by 2025, but much of that is not optimized for leading-edge training. Domestic frameworks like MindSpore and PaddlePaddle lag behind global leaders in terms of adoption. Export controls innovation is therefore inconsistent: rapid in infrastructure development and inference, but slower in advanced training.

Hardware is a key area. Huawei’s 910C combines two 910B dies to achieve near H100-class results in specific workloads, effectively maximizing the potential of mature nodes. This approach demonstrates how advanced packaging and scale can mitigate chokepoints. However, it doesn’t eliminate them. Chinese chips still fall short for large-scale training, and yields at leading domestic foundries remain restrictive.

Meanwhile, U.S. regulators have tightened controls to block workarounds by adjusting performance-density metrics and tightening rules on high-bandwidth memory and advanced packaging. This ongoing back-and-forth creates its own technical curriculum. Policy changes target interconnects, memory bandwidth, and cluster-level performance because these factors are critical for scaling. Students who understand these aspects—not just model architectures—will be valuable in any system that emerges from the next set of regulations.

Export Controls Innovation and the Cost of Tariff Escalation

Export controls are not the only form of pressure. General tariffs are a coarser tool with obvious domestic costs. Independent estimates suggest that a uniform 20 percent tariff would cost the average U.S. household between $2,600 and $4,000 a year, with the burden falling hardest on low-income families. If tariffs expanded from the roughly $380 billion of imports initially targeted in the last trade war to the $3.1 trillion worth of all goods imports in 2023, the shock would extend from sector-specific to economy-wide. Tariffs may provide negotiating leverage, but as a long-term policy, they tax consumers and firms while inviting retaliation. For universities and labs, the costs of equipment, chemicals, and even construction inputs needed to expand computing facilities also increase. This is why the innovation in export controls should be studied alongside the tariff debate.

Retaliation is not a theoretical concern. Since 2023, Beijing has enforced its own controls on gallium, germanium, and graphite, which are essential for chips and electric vehicles. There have been instances where exports were halted entirely for months. By April 2025, shipments of key minerals were still below pre-restriction levels, and the restrictions were expanding to more products. Policy related to critical minerals is now part of the technology race. This topic should be included in classrooms and boardrooms because mineral inputs and memory technologies are interconnected. As we develop curricula around AI safety and governance, we should incorporate “materials literacy” and the geopolitics of memory. Educators preparing engineers for export-restricted global markets must teach them how to design with both plentiful and scarce materials in mind, and how to substitute wisely when policies or prices create shortages.

Export Controls Innovation: What Educators and Policymakers Should Do Now

First, we need to rebuild the supply side of human capital intentionally. If controls push firms to invent domestically, we should encourage campuses to train for substitution as a vital discipline. Key courses should link model training needs to compute architecture and memory bandwidth, not just algorithms. Students must learn why interconnect speeds, HBM tiers, and packaging methods matter as much as parameter counts. They should practice training on constrained hardware and learn about compression, quantization, and efficient fine-tuning at scale. Schools that teach how to operate within constraints will graduate engineers capable of succeeding under any rules.

Second, we should establish “trusted-compute corridors” for research without risk of leaks. Many universities may never operate frontier-scale clusters, but they can still collaborate in secure consortia and share capacity through federated access that complies with regulations. Funding agencies should support regional compute pools that are audit-ready and aware of policy requirements, allowing faculty to schedule work on approved hardware with known sources. Innovating export controls means that research management is now a compliance-focused task. Simplifying safe and efficient computing will help maintain lab productivity when rules change and reduce the temptation to bypass them. Policymakers should align licensing guidance with academic timelines and publish predictable update schedules where possible—aiming for speed with certainty, not surprise.

Third, we should diversify inputs and teach students to do the same. The South Korean urea crisis serves as an example. A disruption in low-profile chemical transport prompted rapid policy innovation, which included a multibillion-dollar resilience fund and new legal frameworks. Education leaders should conduct drills that test research plans against standard inputs, such as adhesives and gases, when one supplier or country is unavailable. Procurement teams should work with engineers to identify multiple substitutes in advance. Grant programs could reward labs that document material and vendor diversification as part of their data management strategies. The practice of dual-sourcing and designing for substitution should be ingrained in graduate training and lab operations.

Fourth, we must view the talent pipeline as the true frontier. China’s policy approach now emphasizes state-supported labs, national compute networks, and targeted funds, while privately led teams push models and tools forward. Though this model may not align with liberal market systems, the focus on talent applies universally. Universities should expand cross-training that integrates systems engineering, chip fundamentals, and security policy. Regulators should create clear visa and research security rules so that trusted researchers can collaborate and contribute. Innovation in export controls will continue to change the technical landscape; if we maintain our talent advantage, we can adapt successfully.

Each time the export control line shifted, actors on both sides responded more rapidly. U.S. rules required redesigns and narrowed access; Chinese firms countered with packaging innovations, software adjustments, and significant investments. That illustrates export controls innovation in action. The question for education is whether we prepare people for a world shaped by these developments. The answer must be yes. Teach engineers to work within constraints. Create compliant compute corridors that remain functional when rules are updated, and stress-test supply chains for essential components that can still hinder scientific progress. And keep opportunities open for trusted talent. After all, people, not policies, create the following solutions. If we act on these steps now, we can safeguard legitimate security interests without hindering discovery. We will not need to choose between openness and resilience; we can build the ability to achieve both, even as circumstances change again.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Center for Strategic and International Studies (CSIS). (2024, December 12). Where the Chips Fall: U.S. Export Controls Under the Biden Administration from 2022 to 2024.

Congressional Research Service. (2025, September 19). U.S. Export Controls and China: Advanced Semiconductors (R48642).

East Asia Forum. (2024, August 23). Urea crisis sparks South Korean supply chain revamp.

International Energy Agency (IEA). (2025, April 28). Special Act on National Resource Security—Republic of Korea.

KED Global. (2023, December 11). South Korea to launch $7.6 bn supply chain fund, make urea locally.

Peterson Institute for International Economics (PIIE). (2024, October 7). Tariffs on all imports would create chaos for business.

Peterson Institute for International Economics (PIIE). (2024, September 27). The American consumer is going to pay the Trump tariff.

RAND Corporation. (2025, June 26). Full Stack: China’s Evolving Industrial Policy for AI (PEA4012-1).

Reuters. (2025, April 22). Exclusive: Huawei readies new AI chip for mass shipment as China seeks Nvidia alternatives.

Reuters. (2023, August 1). China’s controls take effect: Wait for gallium and germanium export permits begins.

Reuters. (2023, October 19–24). China tightens exports of graphite; shipments of gallium and germanium curbed.

Reuters. (2025, April 20). China’s export controls are curbing critical mineral shipments.

VoxEU/CEPR. (2025, October 19). Why export controls accelerate innovation: Evidence from the 2007 U.S.‘ China Rule’.