Specialize, But Insure: Managing Bank Specialization Risk in the Euro Area

Input

Modified

Specialized banks help firms but amplify shocks in their niche Concentration risk—now visible in CRE—can turn local downturns into credit crunches Policy should “specialise, but insure” with sectoral buffers, syndication, and clean risk transfer

One figure that should give us pause when it comes to bank specialization risk is the staggering €1.3 trillion. This represents the total loans euro-area banks have made to commercial real estate, a sector that the ECB has identified as the system's weak link. A substantial portion of balance-sheet capacity is tied to one volatile cycle, with overall economic conditions adding to the pressure. In 2024, Germany experienced a 14.4% drop in apartment completions, bringing the total to about 251,900, significantly below the target of 400,000. Throughout 2025, the ECB maintained policy rates unchanged as inflation hovered near the target. This prolonged period of high interest rates poses challenges for sectors sensitive to interest rates. Asset quality remains better than expected, with the EU-wide NPL ratio for significant institutions at around 2.3% by the end of 2024. However, stress is not evenly distributed. Commercial real estate and specific manufacturing niches exhibit sharper weaknesses. Specialization exacerbates these local shocks. The issue is not whether banks should specialize, but that they should. The real question is how to protect against risks to ensure specialization remains beneficial rather than creating fragile situations.

Bank Specialization Risk: Why It Matters Now

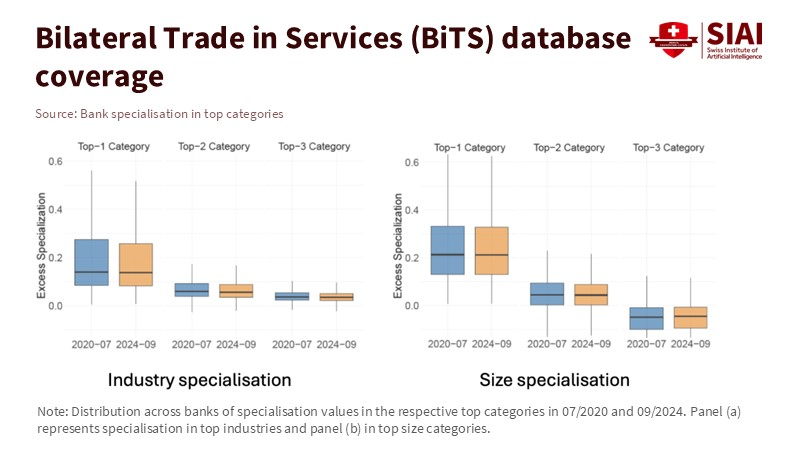

The argument for specialization is compelling. Recent research in the euro area, using detailed loan data, reveals that banks often specialize based on industry and borrower size. When specialization deepens, borrowers can access larger loans, longer terms, lower interest rates, and more stable credit. This aligns with decades of theory: specialization generates informational advantages, enhances screening and monitoring, and increases credit supply to businesses that general lenders may overlook. Some studies even indicate that default rates are lower in the specific areas banks know well. Therefore, bank specialization risk reflects the cost of valuable expertise. The aim is not to eliminate it but to manage it.

Real-world numbers highlight the necessity for management. The ECB estimates that around €1.3 trillion in euro-area bank loans are tied to commercial real estate. Supervisors and the EBA have identified commercial real estate as a current weak spot, particularly as office demand adjusts and property values decline. Germany's construction cycle is currently in a prolonged downturn, with completions falling by 14.4% in 2024 and a thin pipeline of projects. Despite this, the overall NPL ratio for significant institutions stood at about 2.3% at the end of 2024, which may seem reassuring at first glance. However, the risks lie in the distribution of losses. They tend to accumulate where portfolios are highly concentrated. This is precisely what bank specialization risk indicates. Concentration transforms a sector shock into a localized credit crunch, even when overall system averages appear stable. The ECB's supervision already considers concentration risk in the SREP framework. The necessary policy tools exist, but they require clearer, automatic connections to measured concentration.

When Bank Specialization Risk Meets Monetary Policy

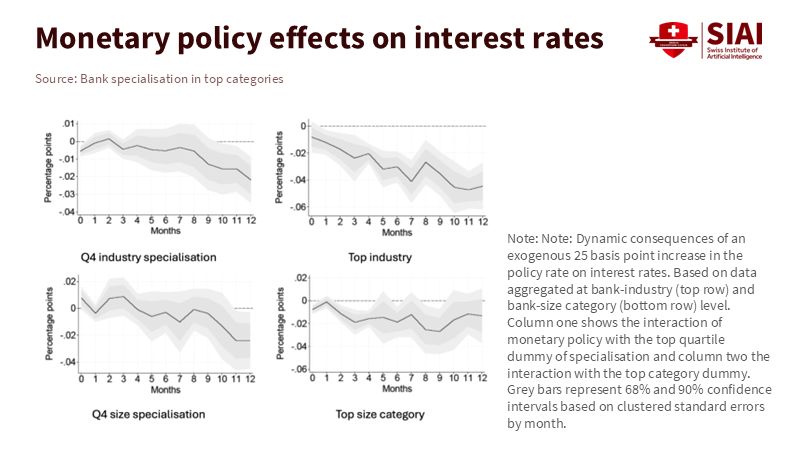

Specialization influences not only micro-risks but also the impact of interest rate changes on the market. If a lender is heavily invested in a single industry, a rate increase that negatively impacts that industry results in greater credit reductions within that bank's area. Detailed euro-area data support this: specialized banks transmit policy shocks differently across sectors and borrower sizes. During stable periods, competition within a niche can lower interest rates and reduce returns. During stress, niche expertise allows lending to continue for clients that the banks understand best. This benefits both transmission and firms relying on relationship banking. Thus, bank specialization risk is a macroeconomic concern, not merely a matter of portfolio choice. The exact process that effectively channels monetary policy can also amplify sector downturns.

The current economic context highlights this tension. The ECB's stance on policy throughout 2025 has remained steady following changes to the operational framework in 2024. Meanwhile, sectors like energy-intensive manufacturing, automotive supply chains, and commercial real estate are facing unique challenges. In such a landscape, specialization can transform stable interest rates into uneven local tightening if one shock dominates a bank's portfolio. Macroprudential authorities have a ready tool to mitigate this risk: the sectoral systemic risk buffer (sSyRB). This allows for targeted capital requirements based on specific exposures—by sector, activity, or collateral—and is currently utilized in Europe for commercial real estate. A sectoral buffer does not restrict credit but provides insurance against correlated losses. The policy proposal is straightforward: adjust buffers so that concentrated portfolios require additional capital during favorable times and relax those buffers as conditions improve. This maintains effective transmission while softening the impact when a niche faces challenges.

Designing Guardrails: Diversify Without Diluting Skill

We can preserve the advantages of specialization while reducing its associated risks. Start by implementing capital measures that correspond to bank specialization risk. When a bank's sector concentration exceeds a certain level, additional capital requirements should automatically increase. Make this connection clear and transparent. Treat it like a sector-level sibling of the countercyclical buffer: minimal in stable times, heightened when risk indicators signal trouble. Even minor adjustments can influence management decisions, prompting them to ask, "Do we still want to increase this exposure, or should we share it?" The ECB already evaluates concentration risk; establishing a clear and automatic link between measured concentration and capital could make this evaluation impactful.

Secondly, facilitate diversification without diluting expertise. Two market mechanisms can aid in this effort. Syndication allows sharing of risks while maintaining the bank's edge in originating loans. Supervisors can promote club structures and mandate credible backup syndication plans for large loans in vulnerable sectors. High-quality credit risk transfer operates similarly at the portfolio level. Europe's simple, transparent, and standardized (STS) securitization framework exists precisely to transfer well-defined slices of risk with clarity. By utilizing STS, banks can offload specific sectoral risks from concentrated balance sheets while keeping "skin in the game." This approach ensures that borrowers still benefit from relationship lending without leaving the system exposed to undiversified losses. The macroprudential framework ought to coordinate. When a sectoral buffer is increased, the capital released through risk transfer should be acknowledged, up to a reasonable limit. This maintains resilience while rewarding banks that actively manage concentration, all while preserving the benefits of relationship lending.

Third, integrate macro and micro perspectives. Monetary authorities can pair interest rate guidance with informative signals on sectoral capital policies. When the ECB signals a prolonged pause, supervisors could pre-announce plans for building or easing sectoral buffers in the upcoming year, based on observable indicators such as price-to-rent ratios in commercial real estate or trends in interest coverage within energy-intensive industries. This approach reduces potential coordination failures and prevents many specialized lenders from simultaneously seeking the same limited funding during a shock. Additionally, it supports project sponsors—municipalities, universities, and mid-sized manufacturers—by helping them plan financing and avoid clustering their borrowing during tight periods. Commercial real estate stands out as a testing ground. The ECB's stability studies demonstrate the connections between real estate funds, insurance providers, and banks. In such an interconnected sector, clarity is more beneficial than silence.

What Bank Specialization Risk Means for Campuses and Classrooms

This issue matters beyond just central bankers. It affects budgets for schools, colleges, and training providers that rely on bank financing for infrastructure, student housing, and energy improvements. In regions where local banks focus on property or small-business lending, the risk of bank specialization leads to rapid shifts in campus cash flows during sector shocks. The situation in Germany serves as a clear warning. As housing completions decline, developers pull back and construction risk premiums rise. This causes delays in campus projects and increased costs. Suppose your lenders are concentrated in a struggling sector. In that case, the impacts will be felt first in terms of higher interest rates, stricter covenants, and longer approval processes. Project managers should map their lender exposures to sectors critical for their projects and maintain connections with at least one generalist bank to protect against niche-related risks. This proactive approach is crucial, but the cycle after 2022 showed how few institutions have implemented it.

For educators, bank specialization risk offers a new teaching opportunity. It connects how balance-sheet structures influence outcomes in classrooms and laboratories. Finance courses can move beyond the simplistic idea that "diversification is good" and explore how synthetic risk transfer (sSyRBs), syndication, and credit-risk transfer affect incentives. Case studies can examine how loan terms for student housing or vocational lab enhancements changed as interest rates rose and sector buffers tightened. There is enough research available to support this educational shift. Recent findings from VoxEU illustrate notable specialization and better loan conditions in banks' preferred niches. Previous research into specialized micro-lenders indicates that greater expertise does not always guarantee higher returns in stable situations and can increase vulnerability during shock events. The practical lesson is clear: specialize to enhance service for communities, but structure financing to prevent cancellations when one sector falters.

For policymakers, the action plan is explicit. First, create a simple, comparable dashboard for concentration risk across major institutions, organized by sector and country, updated quarterly. Second, implement sectoral buffers where indicators warrant it, and establish public criteria for their adjustment. Third, collaborate with securities regulators to ensure the STS securitization pathway remains open for clear, well-defined risk transfers from concentrated portfolios. Fourth, incorporate concentration into stress tests, linking shock sizes to external price indices wherever feasible, especially in commercial real estate. The ECB has previously noted that commercial property is a weak point in euro-area finance, and the EBA has identified vulnerabilities from increased real estate exposure over the last decade. The necessary tools and data are available; what's missing is their application in a rules-based manner before the next localized shock occurs.

We don't have to choose between expertise and resilience. The evidence shows that we can retain the advantages of specialization while managing its risks. Specialized banks offer better terms and maintain lending in situations where information is scarce. This supports monetary policy in reaching the real economy. However, concentration can make the system vulnerable when sector shocks arise, particularly through narrow channels like commercial real estate. The solution is to specialize while insuring against these risks: integrate bank specialization risk into capital calculations, incentivize diversification through syndication and clear risk transfers, and synchronize sectoral buffers with transparent metrics and forward guidance. Begin with commercial real estate, where exposures are already around €1.3 trillion and noticeable stress exists, then broaden the framework to cover other unstable sectors as necessary. If we follow these steps, the next setback in the industry will be a manageable bruise rather than a damaging fracture. This is how Europe can maintain the benefits of banking expertise while safeguarding campuses, businesses, and households from unnecessary disruptions.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Behn, M., et al. (2024). The Sectoral Systemic Risk Buffer: General Issues and Application to Residential Real Estate-Related Risks. European Central Bank, Occasional Paper Series No. 352.

Bonfim, D. (2024). Specialization in Banking — Discussion slides (ARC, Sept. 2024). European Central Bank conference materials.

Boston Fed (Kimball, R., 1997). "Specialization, Risk, and Capital in Banking." New England Economic Review.

CEPR VoxEU (2025). "Bank specialisation and the transmission of euro area monetary policy."

ECB (2024). Macroprudential Bulletin: Mapping the maze — a system-wide analysis of commercial real estate. €1.3 trillion loan exposure estimate.

ECB (2025). "Monetary policy decisions, 11 September 2025."

ECB Banking Supervision (2023). Credit risk SREP methodology — concentration risk dimension.

ECB Banking Supervision (2025). Supervisory banking statistics — Q4 2024 (press release). NPL ratio around 2.3%.

ESRB (n.d.). Systemic risk buffer (SyRB) — framework and application.

Reuters (2024). "Commercial property is weak link in euro-zone finance, ECB says."

Reuters (2025). "Germany builds 14% fewer apartments in 2024."

Swedish FSA (2025). Notification template for Article 458 CRR measure on CRE exposures.