Price, Pressure, and the Classroom: Why the China-Russia Entente Endures

Input

Modified

China–Russia stick together because discounted energy and sanctions pressure align their interests Despite mistrust, flows of oil, gas, and parts—often via North Korea—keep the bond tight Education systems should budget for energy shocks, harden compliance, and teach scenario planning

In 2024, China's significant import of approximately two million barrels of Russian crude oil per day, nearly one-fifth of the barrels entering the country, brought substantial economic benefits. The fact that China often paid less than the global benchmark for those shipments resulted in significant savings. A US$10 difference multiplied by daily volumes over a year equates to savings of about US$8–10 billion for Chinese refiners. If that gap reaches US$15, the savings climb into the low tens of billions. Even when tighter enforcement narrows the gap, Beijing still benefits because even a slight difference matters when economic growth is sluggish and consumer prices stay flat. For Moscow, this is a matter of survival. A reliable buyer replaces lost European customers and maintains a steady flow of hard currency despite sanctions. Their alliance is not based on friendship. Instead, it focuses on price and pressure. As long as the United States and NATO remain central strategic challenges, both sides have strong reasons to stay close.

The debate often frames this partnership as a morality tale. A clearer view is more mechanical. Russia needs a big buyer that can pay, transport, insure, and refine under sanctions. China seeks steady energy at a cost that cushions a slowing economy and lowers domestic political risks. Both want a counterbalance to the influence of Washington. A key point is that the deal becomes stronger when pressure increases. If global prices rise or enforcement tightens, the value of being each other's indispensable partner grows, not shrinks. This is why their bond has strengthened since 2022, despite reputational costs and past mistrust. It also explains why their relationship affects educational institutions far from Moscow and Beijing. Energy prices, compliance rules, and technology controls are now changing how schools operate, just as they affect conflict zones and trade routes.

Price, Pressure, and Mutual Need

The economic reasoning begins with oil and gas and extends outward. After Europe cut back on buying most Russian crude and products, China and India absorbed much of that redirected flow. Many independent Chinese refiners, known as "teapots," have focused on blending, processing, and re-exporting products derived from discounted barrels. As enforcement tightens and the discount shrinks, volumes and routes adjust. When enforcement loosens or shipping restrictions increase, the discount widens again. Throughout this cycle, mutual need remains the constant. Russia finds it challenging to replicate China's scale, and China struggles to match Russia's proximity, pipeline connections, and pricing flexibility that result from sanctions. However, the mutual benefits of the energy partnership, such as the steady supply of energy for China and a reliable buyer for Russia, provide optimism about its future.

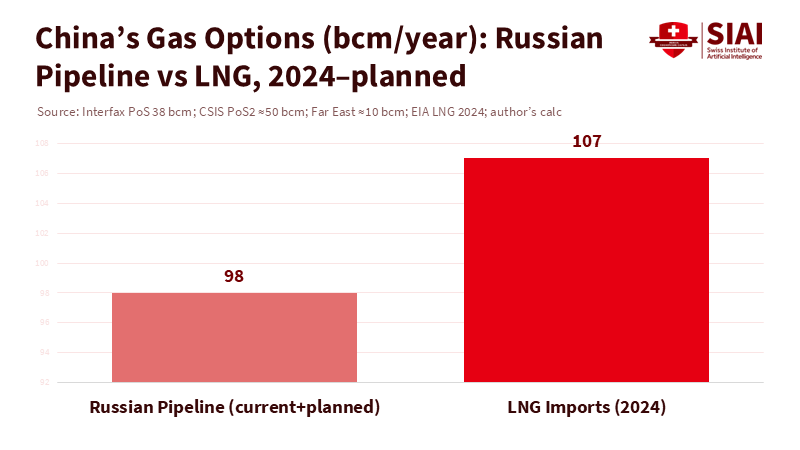

Natural gas plays a significant role in strengthening the China-Russia relationship over the long term. The nearing of the Power of Siberia pipeline to its contracted capacity and talks about a second route with a 50 bcm capacity could, if realized, significantly reshape Asia's energy landscape with Russian pipeline gas. Beijing protects itself by maintaining diversified liquefied natural gas imports, yet pipeline gas from a neighbor offers a steady supply at prices less affected by volatile spot markets. This is about managing resources, not ideology. It solidifies the partnership through physical agreements rather than statements, making it resilient to changing political conditions.

Method matters here because scale drives policy. With roughly eleven million barrels of crude oil imports daily, a US$10 shift in global prices impacts China's annual oil costs by around US$40 billion, even before factoring in natural gas. If prices doubled from a US$70 baseline—an extreme scenario rather than a forecast—the additional cost could reach well over a quarter-trillion. In a macroeconomic environment where consumer inflation has hovered near zero and producer prices have been weak, this kind of shock would ripple through utility bills, public finances, and industrial profits. Therefore, affordable and secure access to hydrocarbons from Russia is essential for Beijing; it acts as a stabilizer for the economy. For Moscow, ongoing offtake agreements and financial channels—often operating through non-Western systems—are a crucial protection against sanctions that could severely impact its budget.

History, Friction, and the North Korea Valve

None of this means China and Russia are natural allies. The twentieth century left deep wounds, marked by the Sino-Soviet split, military confrontations, and decades of cautious coexistence. The strategic landscape underwent significant shifts after 2014, with further changes occurring after 2022. They declared a partnership with "no limits," but that phrase really reflects "no illusions." Each country knows the other is hedging its bets. China maintains its relationships with Europe and the Global South, adjusts its financial commitments, and carefully manages technology support to avoid explicit sanctions violations. Russia relies on lesser-known partners and intermediaries, becoming more dependent on Chinese imports of consumer and industrial products. Both accept this imbalance because the external constraint—U.S. power and NATO support—shapes their relationship. As long as this constraint exists, their alliance will be measured by the flow of resources and goods, not by warm speeches. This strategic foresight and adaptability of both countries reassure the stability of their energy partnership.

The friction points in the China-Russia partnership are significant. Moscow is awkwardly deepening military ties with Pyongyang, while Beijing values stability on the Korean Peninsula and generally prefers not to support Russia's logistics in wartime. However, North Korea has become a proper channel. When Russia needs ammunition, rockets, or inexpensive labor, and China wants to avoid direct involvement, Pyongyang can provide support from a politically acceptable distance. This triangular arrangement keeps the larger partnership intact without forcing either country to overstep boundaries that could trigger harsher sanctions. It is complicated, and it won't solve every procurement issue, but it helps maintain focus where it counts: on the essential economic exchanges that ensure the partnership remains functional.

Some skeptics argue that the relationship will fracture due to its imbalances. China's economy is much larger and more varied, while Russia risks becoming merely a resource supplier. China is concerned about becoming overly dependent on pipelines and the reputational damage that could result from appearing to support aggression. All of this is true. But asymmetry isn't a flaw in these types of partnerships; it's part of the design. Both sides recognize each other's limitations and adjust prices accordingly. This is why the alliance is surprisingly sturdy. It relies more on calculated self-interest than on trust. If pressure ramps up, prices adapt, volumes shift, and the relationship finds a new balance. The adaptability of the energy partnership instills confidence in its resilience. The outcome looks less like friendship and more like a well-tuned market backed by political safeguards.

What Education Systems Should Do Now

This partnership will inevitably affect schools. Energy costs and regulations impact everything from district budgets to research timelines. The first consequence is financial. Heating, cooling, transportation, and campus operations hinge directly on energy markets. When price caps, sanctions, or shipping delays impact crude oil and gas, utility bills follow, often with a delay. The correct response is not to predict market movements; it's to build safeguards. Multi-year purchasing contracts with flexible terms, small reserves for unexpected spikes, and manageable capital projects that reduce baseline energy consumption—like insulation, smart thermostats, LED upgrades, and heat pump trials—can turn sudden shocks into manageable expenses. Even a slight reduction of five to ten percent in basic energy use can absorb significant geopolitical volatility without compromising services.

The second consequence is regulatory. Export controls and sanctions are increasingly affecting academic institutions. Universities involved with high-performance computing, advanced materials, or dual-use software already face challenges with licensing, restricted-party checks, and cross-border data rules. As the China-Russia partnership strengthens and enforcement becomes stricter—often through the very insurance and shipping channels used for energy—research offices need clear strategies that integrate legal, procurement, and IT considerations. This involves training principal investigators and departmental administrators to identify potential issues, mapping supply chains for essential laboratory equipment, and maintaining a current list of restricted entities, including subsidiaries and vessels. The aim is to ensure swift and predictable responses to changes in regulations, not to rely on improvisation when compliance issues arise after a purchase.

The third consequence is educational. Students often struggle to connect broad news stories to local realities. The China-Russia deal makes that connection clear. A few dollars difference per barrel can determine whether a school district can replace windows this winter or has to delay a digital literacy program. A new export-control rule can postpone the launch of a robotics lab for a semester, leading students to rely on alternative methods that focus on algorithmic efficiency instead of hardware. Educators can use this situation for learning by assigning students to analyze a school's energy budget under various oil and gas scenarios or design a machine-learning project that runs on common GPUs. This exercise extends beyond economics and coding; it prepares students for a world where geopolitical issues can impact local decisions.

There is also a lesson about funding. As ministries and universities plan capital projects, they should specifically link energy efficiency investments to geopolitical risks. Initiatives that reduce vulnerability to fluctuating fuel prices are not just "green"—they serve as risk management strategies in a sanctions-driven environment. Endowments and public funds should stress-test their portfolios for potential shocks in commodity prices and shipping, and boards should expect reports connecting these scenarios to short-term financial operations. None of this requires taking sides in global power struggles. It simply acknowledges that the relationship between Beijing and Moscow—driven by pressure on energy prices—will continue to impact the everyday economy of education.

Concerns deserve a hearing. Some argue that China's economic slowdown means cheap energy won't boost domestic demand, so the bond with Russia is primarily symbolic. Others point out that stricter enforcement has occasionally reduced Russia's pricing advantage to single digits, cutting into Beijing's savings and harming the partnership. A third concern is that pipelines could pose political risks if Moscow were to choose to wield its energy supplies as a weapon. Each concern has merit, but they all circle back to the core of the alliance: optionality. China diversifies its LNG imports and invests in non-fossil energy sources, reducing the impact of any pipeline restrictions. Discount variability is temporary, and even a slight price advantage at high volumes is significant. In a low-inflation context, avoiding price spikes represents a policy win.

The media often depicts this pairing as a menacing alliance. From their perspective, it is more straightforward: one adversary with supporters, equipped with financial resources, standards, and alliances. In this context, staying close to each other is not an act of affection; it is a practical strategy for surviving constraints. Russia gains time and revenue. China secures stability and bargaining power. Each maintains control over exit strategies and the power to influence pricing. This is why attempts to separate them using rhetoric have failed, and why the most effective tools have directly impacted prices and pressure, such as sanctions design, shipping insurance, and alternative energy sources for buyers who might otherwise rely on Russia.

We circle back to schools because that's where policy has tangible effects. Administrators can't rewrite grand strategies, but they can help shield students from the consequences. The practical agenda is modest yet powerful: secure flexible energy contracts, share procurement and compliance assumptions with precise dates and sources, educate researchers and buyers to act quickly when rules change, and teach students to assess risk and design solutions that work around limitations. If the China-Russia alliance is centered on pressure, then educational systems should focus on resilience. This approach ensures that doors remain open when markets fluctuate, promoting responsible citizenship in a complex world.

What could break this bond? Not an abrupt improvement in relations with Washington, at least not soon. The more likely scenario involves gradual shifts, including the development of new pipelines that diversify trade between the two countries, the adoption of alternative payment systems that mitigate the impact of sanctions, and domestic energy reforms that reduce reliance on fossil fuels. Until then, small changes will have significant effects. A few dollars off a barrel, multiplied by millions of barrels daily, can determine whether ministries draw from reserves or cut programs. A single policy change in London or Brussels can significantly alter shipping costs, affecting refinery profits in Shandong. These are not just theoretical issues. They explain why the alliance endures and why educational budgets must prepare for its impacts.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Brookings Institution. (2024). The China–Russia relationship and threats to vital U.S. interests. Washington, DC.

Center for Strategic and International Studies (CSIS). (2025). Power of Siberia 2 and implications for Asian gas markets. Washington, DC.

Centre for Research on Energy and Clean Air (CREA). (2025). Tracking Russian fossil fuel exports and sanctions enforcement. Helsinki.

International Energy Agency (IEA). (2024). Oil Market Report: Global refining, trade flows, and Russian supply. Paris.

International Monetary Fund (IMF). (2025). World Economic Outlook Update: China’s growth and inflation dynamics. Washington, DC.

National Bureau of Statistics of China (NBS). (2025). Consumer Price Index 2024: Annual bulletin. Beijing.

Reuters. (2024–2025). China’s Russian crude imports; bilateral trade milestones; Urals discount movements; shipping and price-cap enforcement. London.

U.K. Government. (2025). Enhanced oil price-cap guidance and enforcement actions targeting Russian energy revenues. London.

U.S. Energy Information Administration (EIA). (2025). Today in Energy: China’s crude import volumes and sources. Washington, DC.

United Nations Security Council, 1718 Committee. (2024–2025). Panel of Experts reports on DPRK munitions transfers and sanctions evasion. New York.

Comment