ASEAN Third Path: Turning a Tariff Shock into a Skills Strategy

Input

Modified

A 55% China tariff is rerouting supply chains toward ASEAN ASEAN can seize a third path by treating skills as trade infrastructure Bind investment to portable credentials and cross-border training to grow without picking sides

One number now shapes the new Asian order: fifty-five. When the U.S. Trade Representative described 55% tariffs on Chinese goods as a "good status quo" in late September 2025, the comment did more than harden a negotiating stance; it altered the movement of supply chains, capital, and students for years to come. A tariff this high is not just a minor change. It represents a new reality. As shipments change routes and investors reassess political risks, the question is whether ASEAN can turn this shock into an advantage and create a credible ASEAN third path—neither aligned with Washington nor Beijing—based on open markets, human capital, and scalable rules. This choice is not just theoretical. It impacts classrooms, training centers, and university labs, where budgets and strategic focus will determine who gets the next decade's jobs and who is left behind in the digital, green, and semiconductor economies. If the ASEAN third path is genuine, it will be demonstrated not at summits but in course listings and hiring plans. The potential for growth and development is significant, offering a hopeful outlook for the future.

ASEAN third path: from narrative to numbers

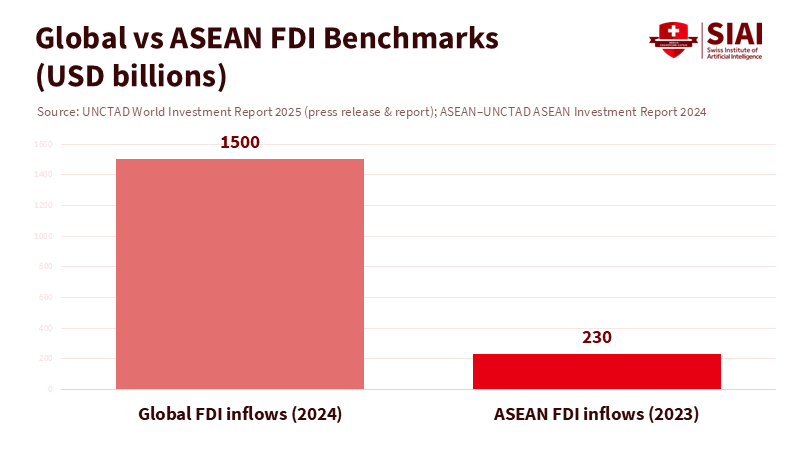

The momentum is already apparent in the data. ASEAN attracted a record $230 billion in foreign direct investment in 2023—its highest total ever—while global FDI fell again in 2024 to $1.5 trillion, a drop of 11%. Developing Asia absorbed $605 billion, showing resilience even as companies considered geopolitical risks. These figures are not random; they indicate that investors are opting for diversification and scalability, with Southeast Asia being the practical choice. Within the region, trade ties are strengthening. In 2023, intra-ASEAN exports accounted for 22.1% of total exports, providing a foundation that cushions against external shocks. The ASEAN third path relies on this solid ground and the importance of regional cooperation. If tariffs remain high, supply chains will continue to shift toward economies that can ensure both market access and skilled labor. This is the key point for policy: it's not about whether the bloc is neutral, but whether it is useful.

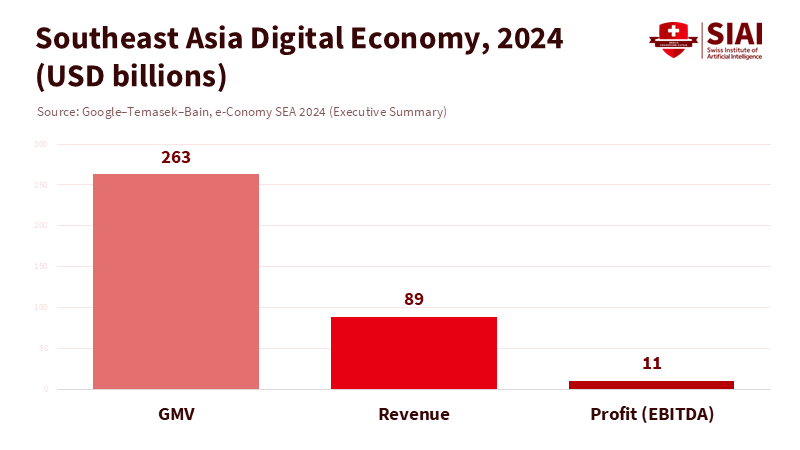

Rhetoric alone will not connect geoeconomics and education. Yet market signals point the way. The region's digital economy reached a gross merchandise value of $263 billion in 2024, with double-digit growth in revenue and profit. Meanwhile, U.S. monthly data indicate how trade is already changing: by July 2025, America's goods deficit with Vietnam reached nearly $16.1 billion that month, driven by a surge in electronics, furniture, and machinery. Investment is also following these data trends. Malaysia's Johor approved 42 data-center projects worth about RM 164.45 billion (≈$39 billion). At the same time, governments push for local talent in chip design and engineering. The ASEAN third path can capitalize on these trends if education ministries quickly scale targeted skills—especially in AI infrastructure, advanced manufacturing, and cross-border services. The alternative is a mixed scenario: a few hubs racing ahead while others lag.

ASEAN third path and supply-chain realignment

The tariff wall is not a brief challenge; it is altering routing rules. A 55% tax on Chinese imports encourages "friend-shoring" and "near-sourcing". This influences two outcomes simultaneously: it boosts Southeast Asia's negotiating power and reveals gaps in customs, logistics, and workforce development. The bloc's own structure supports this. The Regional Comprehensive Economic Partnership (RCEP) connects ASEAN with Japan, Korea, China, Australia, and New Zealand in the world's largest trade area, covering about 30% of global GDP. This network enables companies to divide production while staying inside preferential rules. However, a network is only beneficial if countries can certify skills as easily as they certify parts. The ASEAN third path must treat skills passports and recognition systems as essential to trade, not as secondary social policies. This logic should be integrated into procurement and investment approvals.

Policy is beginning to catch up. In September 2025, Malaysia, as the ASEAN chair, convened the ASEAN Geoeconomics Task Force (AGTF) alongside the 57th ASEAN Economic Ministers' Meeting to align economic and foreign policy responses. Plans were made to share the findings in a joint session of foreign and economic ministers before the Summit. This is the appropriate forum to establish a regional supply-chain-plus-skills agreement, including synchronized customs upgrades, common cybersecurity standards for data center locations, and time-limited visas for technical trainers. It is also the space to test a simple rule: any large investor that receives fast-track permits must commit to funding accredited dual-training positions across the supply chain. The urgency of timely implementation is apparent, and this is how the ASEAN third path transitions from promises to action.

The ASEAN third path for education and skills

Education is central to credibility. The region has already demonstrated strengths at the top level, with Singapore ranking first in mathematics, reading, and science in the 2022 PISA results. However, the median still needs improvement, and public education budgets are feeling pressure from high global interest rates; developing countries paid a record $1.4 trillion in debt service in 2023. Given this fiscal situation, every new program must be financially sustainable. Ministries should prioritize three quick wins aligned with the ASEAN third path for education and skills. First, establish regional micro-credential standards linked to industry apprenticeships in semiconductor, power electronics, and data center operations. Second, implement cross-border dual training, where Year 12 or first-year university students rotate through factories and server farms within RCEP supply chains. Third, link procurement to skills funds: for every new facility, a fixed share of capital expenditure should support vocational training seats, instructor development, and lab upgrades. These aren't empty slogans; they represent the most cost-effective way to build credibility in a world with limited fiscal resources.

The pipeline can be rapidly developed if approached as a regional market. Start with demand: the digital economy's profit growth indicates a need for talent at higher wages; chip design plans and engineering scholarships in Malaysia suggest forward momentum; data center approvals in Johor, Batam, and Greater Bangkok will require thousands of certified technicians. An ASEAN-wide "Skills-as-Infrastructure" agreement would establish portable credentials, competency assessments, and common safety standards, allowing an apprentice trained in Penang to work in Da Nang or Bandung without the need for redundant paperwork. Universities can contribute by co-developing micro-degrees with industry and ensuring credit transfer. This approach prevents the ASEAN third path from becoming a story where capital flows but people do not. It also positions the region as the go-to hub for firms seeking scale without political risk.

Can the ASEAN third path succeed?

Skeptics highlight fragmentation. They warn that hardware export bans, cloud division, and security disputes may create uneven standards and limit opportunities. They point out that ASEAN budgets are tight and that many countries are still spending below OECD averages on education as a portion of GDP. These concerns are valid, and the political climate is indeed a reality. However, the region has tools it is starting to use. ASEAN's internal trade volume is now thicker than it was a decade ago. The bloc has an effective mega-FTA that keeps options open. The chair's office is pushing non-alignment as policy, not just a stance. It is shifting the focus from declarations to ministerial sessions with a geoeconomic outlook. The ASEAN third path will endure if these tools are leveraged to elevate standards—harmonized data rules, shared teacher training resources for STEM vocational education, and financial support for training funded by investors. Achieving this does not require taking sides; it requires selecting standards that are transferable and universally applicable.

The economic rationale is also becoming stronger. U.S. data show that the trade deficit with Vietnam now matches those with Mexico and the EU, indicating a shift in production. Investors are preparing for multi-node networks. When tariffs increase or export controls tighten, companies do not return home; they reconfigure. This reconfiguration incurs costs—transport, inventory, compliance—but it can also create local benefits if governments require training connections. The ASEAN third path succeeds when every major decision about location is accompanied by commitments to education, when customs and standards agencies share information as a standard practice, and when teacher training programs update curricula to include industry certifications. If the bloc can achieve this swiftly, the tariff wall becomes a ladder. If it cannot, subsidies may secure facilities but not future opportunities. The consequences will first show up in school schedules, then in paychecks.

We began with one number—55%—because a single figure can shift an entire system. The risk is to react to the shock and overlook the opportunity. ASEAN has a unique chance to create a third path that balances diplomatic positioning with effective delivery in education and skills. The plan is easy to state but challenging to carry out: view skills as essential to trade infrastructure, and connect every investment boom to classroom capacity that can move across borders as easily as products and data do. The region has achieved record FDI, increasing intra-ASEAN trade, a growing digital market, and a chair that has prioritized geoeconomics in its agenda. That is sufficient to take action. If ministers, university leaders, and employers tie investment to training and implement portable credentials now, the next decade's tariff headlines could reflect the beginning of a regional skills advantage. The momentum is building. Whether it propels progress or causes setbacks depends on the decisions made this academic year.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

ASEAN Secretariat. ASEAN Key Figures 2024. Jakarta: ASEAN, 2024.

ASEAN Secretariat & UNCTAD. ASEAN Investment Report 2024: ASEAN Economic Community 2025 and Foreign Direct Investment. Jakarta/Geneva, 2024.

Anwar Ibrahim, A. “ASEAN at a Crossroads.” Project Syndicate, September 4, 2025.

Bain & Company; Google; Temasek. economy SEA 2024. November 2024.

Bureau of Economic Analysis (U.S.). “U.S. International Trade in Goods and Services, July 2025.” News Release, September 4, 2025.

OECD. PISA 2022 Results (Volume I): The State of Learning and Equity in Education. Paris: OECD Publishing, 2023.

Reuters. “Malaysia reins in data centre growth, complicating China’s AI-chip access.” September 11, 2025.

Reuters. “Trump trade chief Greer says 55% China tariffs a ‘good status quo’.” September 30, 2025.

UNCTAD. World Investment Report 2025. Geneva: United Nations, June 19, 2025.

The Star (Malaysia). “Asean geoeconomics task force to present findings at proposed joint session between Asean ministers.” September 23, 2025.

ASEAN. “Joint Media Statement of the 57th ASEAN Economic Ministers’ Meeting.” September 24, 2025

ERIA. RCEP: Implications, Challenges and Future Growth. Jakarta: ERIA, 2022. (RCEP scale ~30% global GDP.)

Reuters. “Developing countries’ record $1.4 trillion debt service bill squeezes budgets.” December 3, 2024. (Debt-service constraints.)