Central Bank Communication Diversity Is a Public Good for Education Finance

Input

Modified

Diverse central bank messages help schools manage borrowing and risk Single-voice guidance can harm welfare via the Hirshleifer effect Adopt disciplined plurality: fixed venues, ranges, and scenario-based planning

When a single day of Federal Reserve testimony affects Treasury yields by nearly five basis points on average, school budgets take notice. In 2024, the Cleveland Fed found that the first-day Monetary Policy Report testimony from the Fed Chair changes two- and ten-year Treasury yields by about 4.7 basis points within minutes. While that may seem small, it has real consequences. For example, a $100 million, 30-year school bond costs roughly $50,000 more per year if market yields rise by five basis points, totaling about $1.5 million over the bond's life. To estimate the annual cash-flow impact, multiply the principal by the rate change, keeping coupons and amortization constant. Although this is an approximation, it effectively illustrates the budget implications of communication. The key takeaway is not about excitement; it's about carefulness. Markets quickly respond to the tone and timing of central bank statements. Public education finance operates in this fast-moving environment every day.

Why central bank communication diversity matters now

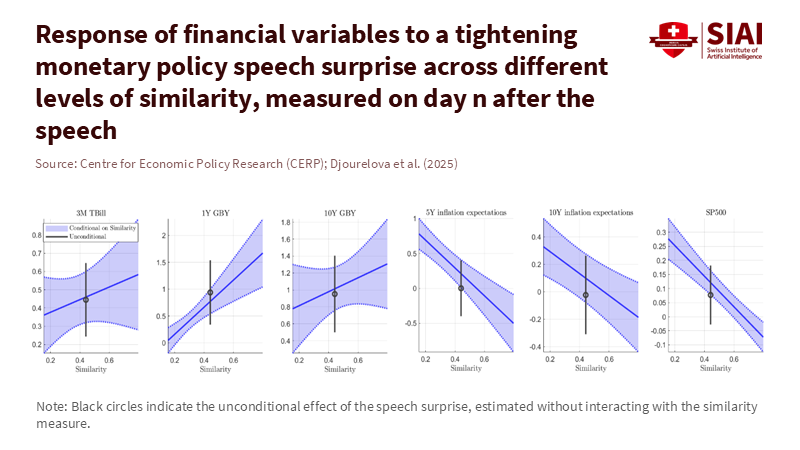

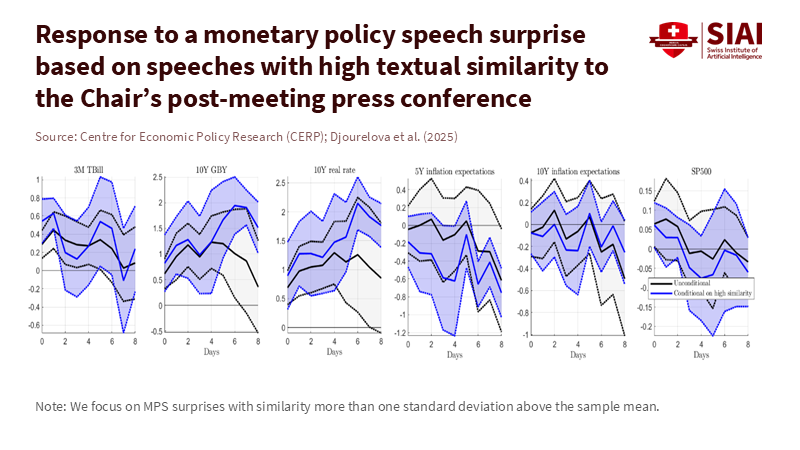

Today's debate assumes that having a single voice is the best approach. It's neat and easy to summarize. Recent research from VoxEU suggests that when members of the Federal Open Market Committee (FOMC) share the Chair's press-conference message, markets interpret the signals more clearly and policy transmission improves. The pattern makes sense: speeches that align push near-term yields in the expected direction and lower inflation expectations; conflicting messages do the opposite. For managing expectations, uniformity is successful. However, this finding focuses on short-term asset-price reactions, not the broader social welfare of sectors that must plan, borrow, hire, and provide services amid uncertainty. Education is one of those sectors. It operates with tight margins, long-term capital plans, and fixed obligations influenced by rates shaped by central bank communication. Clarity is beneficial, but clarity is not the only public goal.

The education sector's exposure to rates is significant. Higher education alone accounts for approximately $262 billion in municipal debt, which is around 6% of the municipal market. K–12 districts also issue bonds; by mid-2025, school districts had sold nearly $45 billion in bonds, exceeding a third more than the same period in 2024. This was partly to replace expired federal relief and support, and to delay facility work. Yields impact budgets: a portfolio of A-rated school district bonds in late 2025 yielded approximately 4.8 percent tax-free, resulting in significantly higher overall borrowing costs than in the last decade. When information from the Fed is condensed into a single voice, financing conditions can shift in one direction, with fewer opposing views to support alternative scenarios. This can be detrimental for school systems that aim to hedge, refinance, or stage projects.

The Hirshleifer effect and central bank communication diversity

There is a deeper economic issue that the single-voice argument overlooks. Jack Hirshleifer's classic idea is that some public information can actually harm social welfare by eliminating risk-sharing opportunities. Suppose uncertainty is solved too quickly or too accurately. In that case, parties can't protect themselves against scenarios that would have stayed grouped, leaving some worse off. Further research extends this notion to modern disclosure: excessive precision can be detrimental when parties already possess private signals, as public signals carry too much weight in coordination situations. This doesn't call for secrecy but serves as a reminder that information has a social cost. When central banks streamline diverse views into a single, clear message, they limit the ways schools, universities, and their financiers can interpret and hedge against future rate changes. In education finance, this loss of flexibility appears as fewer issuance opportunities, less varied scenario planning, and more uniformity in risk attitudes.

This isn't just theory; the FOMC's own projections demonstrate genuine uncertainty and variation. In September 2025, official reports showed a broad distribution of participants' views for the period 2025–2027. Mainstream commentary noted a range for 2025 that exceeded a whole percentage point between the most dovish and hawkish perspectives. This variation reflects different risk assessments, data interpretations, and regional viewpoints, not noise. When communication flattens these differences into a near-unified message, markets might react uniformly in the short term. However, this can be a negative tradeoff for sectors that thrive on various beliefs. Education finance is one such sector. Districts can time projects when opinions differ. Endowments can adjust duration when paths vary. Lenders can price tranches suited to different buyers. A single story reduces options for risk-sharing and pushes systems toward the same conclusion simultaneously.

Designing central bank communication diversity with guardrails

The goal is not chaos; it's disciplined variety. Evidence suggests that coordinated messages move markets quickly and cleanly. However, the lesson for public policy is to cultivate communication diversity instead of eliminating it. The Cleveland Fed's event study suggests that both content and timing are essential: first-day testimony provides more insight than second-day repeats. This suggests a straightforward guideline: concentrate crucial signals in specific venues and timeframes, allowing the market to respond, while allowing time for committee-level diversity. This approach can involve explicit ranges and error bands in forward guidance, regular publication of disagreement metrics, and post-meeting maps that outline differing risks without endorsing a single narrative as the only truth. Markets will still analyze, but the social benefit comes from maintaining diversity when it aids risk-sharing rather than turning guidance into a guessing game.

A second guideline is to prioritize robustness rather than pinpoint accuracy. The Morris-Shin framework cautions that when people already have private information, overly precise public signals can lead to unwarranted coordination on what may be an unreliable focal point. Robustness in central bank communication for educators and finance teams would involve stable signposts—such as policy reaction functions, scenario thresholds, and tolerance bands—rather than fixed numbers presented as certainties. This enables districts to create debt calendars that are adaptable for various future scenarios, and it helps universities assess endowment risks without overreacting to a sharp message that might change next month. Precision itself isn't the issue; misplaced precision is. To avoid it, we need to maintain central bank communication diversity under a clear rule: a shared map with multiple routes.

What should educators do in a world of diverse central bank communication?

Education leaders can't control the Fed's tone, but they can use it more effectively. The first step is to view communication diversity as a key aspect of the policy environment and plan accordingly. Market realities validate this approach. The Fed's course is intentionally uncertain. The official "dot plot" reflects a range of opinions that expanded in 2025. Near-term yields respond most when major communication occurs. Still, they also fluctuate with the steady stream of speeches and Q&A that follow. For superintendents and university CFOs, the practical step is to align financing plans with likely information events—the Chair's testimony, post-meeting press conferences—and to use quieter periods to evaluate debt scenarios based on multiple implied paths, rather than assuming a single outcome. This approach offers straightforward scenario management, with a focus on policy communication, and aligns with both market evidence and well-being principles.

The second step is to combine that discipline with opportunism. When messaging is aligned and yields move in one direction, districts can time issuances or hedge strategically rather than following the crowd. When committee voices differ and markets pause, issuers may secure better pricing for specific maturities or structures. The municipal data indicate that schools have been actively issuing bonds in 2025 as federal relief wanes and capital needs persist. Yields around 4.8 percent tax-free aren't low. However, the after-tax comparison to taxable options still generates strong demand for many buyers. Ultimately, timing and structure are now more critical than ever. A strategy that values central bank communication diversity—rather than trying to ignore it—creates flexibility to issue, refinance, or delay in ways that suit local budgets, rather than adhering to a national trend.

Conclusion. The statistic about a five-basis-point shift following a single testimony underscores the significance of education finance. It's tempting to think that a unified voice from the central bank would lead to minor shifts and therefore call for more harmony. However, the economics of information teaches us a more complex lesson. Perfectly organized, one-directional signals can limit risk-sharing opportunities and leave public systems more vulnerable when predictions are inaccurate. Research indicates that alignment can enhance transmission, but it remains unclear whether alignment always benefits welfare. For educators, the practical approach is to plan for and take advantage of central bank communication diversity: identify the moments when guidance has the most substantial impact, manage debt against ranges instead of specific points, and maintain options when committee members' views diverge. For central banks, the policy recommendation is to design for disciplined variety: provide strong venues for unified signals while also preserving space for recognized disagreement and clear ranges of uncertainty. By doing this, we can turn a market reality into a public benefit, offering schools a better chance to invest, hire, and teach through economic cycles rather than despite them.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Abreu, D., & Brunnermeier, M. K. (2002). Bubbles and crashes. London School of Economics FMG Discussion Paper 401.

Bankrate. (2025, June). The Federal Reserve’s latest dot plot, explained.

Bondsavvy. (2025, September 17). The September 2025 Fed dot plot projects a mid-3% fed funds rate.

Bloomberg. (2025, June 30). US school districts rush to sell bonds after draining Covid cash.

Cleveland Fed. Gordon, M. V., & Lunsford, K. G. (2024, January 16). The effects of the Federal Reserve Chair’s testimony on Treasury interest rates. Economic Commentary EC-2024-01.

Federal Reserve Board. (2025, September 17). FOMC projections materials—September 17, 2025.

Goldstein, I., & Leitner, Y., & Sapra, H. (2018). Stress tests and information disclosure. Journal of Economic Theory (working-paper versions 2013/2015).

Hirshleifer, J. (1971). The private and social value of information and the reward to inventive activity. American Economic Review.

Morris, S., & Shin, H. S. (2002). Social value of public information. American Economic Review, 92(5), 1521–1534.

MunicipalBonds.com. (2025, September 23). School district bonds rally as the federal funding cliff approaches.

Nuveen. (2025, August). Campus capital backed by municipal bonds (Insight; and data brief).

VoxEU/CEPR. Djourelova, M., Ferroni, F., Melosi, L., & Villa, A. (2025, October 4). Communicating monetary policy by a committee: Echoes that move markets.