India's Clean Energy Strategy: Tariffs, Batteries, and Cheaper, Reliable Power for Growth

Input

Modified

India can secure cheap, reliable evening power at $0.042/kWh with solar plus storage Tariffs and volatile fossil imports make firm renewables the safest growth path Scaling batteries and recycling ensures long-term energy security and stable prices

One number that should be at the forefront of our national conversation is the $0.042 per kWh tariff. This 25-year tariff, a result of recent auctions for solar paired with four-hour battery storage, is a game-changer. It not only provides reliable power during the evening peak, but also undercuts much of coal production and beats imported gas at current prices. In a year marked by sanctions, new U.S. tariffs, and tight shipping conditions, this figure is crucial. It demonstrates that India's clean energy strategy can secure reliability at scale and at a cost that supports rapid growth. When geopolitical tensions increase the risk of fossil fuel imports or alter the price of essential components, the logical solution is firm renewables plus storage. Locking in this hedge reduces wholesale volatility, eases inflationary pressure, and keeps factories, data centers, and classrooms running during heatwaves.

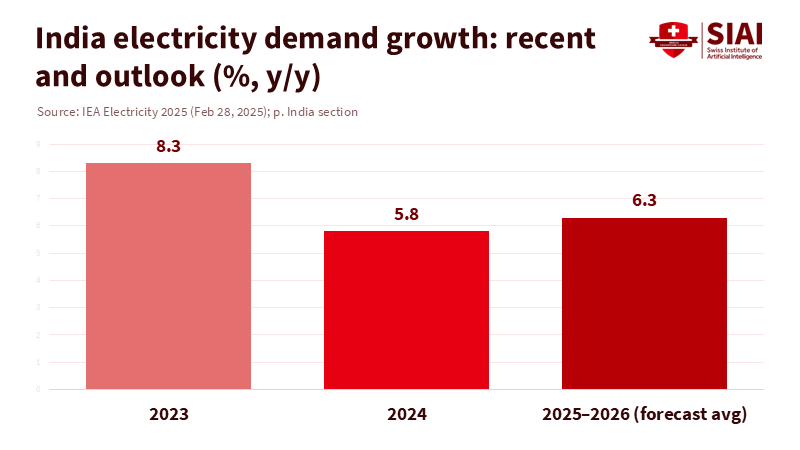

India's policy framework requires a significant shift. The old question of whether to decarbonize now or later is no longer relevant. The more pressing question is how to secure the cheapest, most reliable kilowatt-hour, especially in the face of increasing electricity demand and trade issues. After a significant 8.3% jump in 2023, consumption continued to rise in 2024 and is expected to remain strong in 2025—demand peaks in hot evenings when solar fades, but cooling needs surge. A system built on solar, wind, and battery energy storage systems is not a luxury; it is a necessity for controlling inflation and promoting growth. It is also the quickest capacity India can add with predictable operating costs. The country has committed to 500 GW of non-fossil capacity by 2030. The best path forward is to turn today's global oversupply of modules and batteries into stable, long-term tariffs that can manage the evening peak.

India's clean energy strategy and the tariff shock

The shock in 2025 has been as much political as it has been economic. Recent U.S. tariff moves created friction in trade and finance. They also heightened pressure on India's purchases of discounted Russian crude. None of this has halted imports completely, but it has increased the risks and complications associated with shipping, insurance, and payment channels. The market's message is clear: the discount can shrink at any moment, and the cost of hedging can rise unexpectedly. Each additional dollar per barrel increases power costs through diesel backup and gas peakers. Every minor disruption in fuel logistics pushes up spot prices when grids are under stress. In this context, a fixed-price evening power rate of $0.042 serves as a macroeconomic stabilizer. It limits the peak impacts on household budgets, small business margins, and school utility bills.

There is another channel for tariffs, which involves clean-tech equipment. The U.S. and Europe continue to adjust trade barriers on Chinese solar and battery products. China still dominates the supply chains for cells, modules, and batteries, holding strong positions in anode and cathode materials. That dominance lowers global prices during oversupply, but it also concentrates risk if export controls tighten. Indian policy must tread carefully. In the short term, the economy needs affordable batteries and inverters now to stabilize evening power. In the medium term, it needs domestic capacity in cells, modules, and key components to avoid setbacks from future shocks. The tools already exist: production-linked incentives, an Approved List of Models and Manufacturers, and phased domestic content rules. The timing is crucial. Utilize the global surplus to maintain tariffs at around $0.042 while developing local supply, and then tighten content rules as capacity becomes a reality rather than an aspiration.

Method note: treat geopolitics as a risk factor, not an absolute barrier. A sustained $2 to $5 per barrel rise in the effective cost of marginal fuels can push clearing prices up a few percent during peak hours. Conversely, every gigawatt of solar paired with four-hour battery storage procured at $0.042/kWh secures a slice of peak power, shielded from freight rates, sanctions, or refinery outages. This is how energy security and price stability intersect.

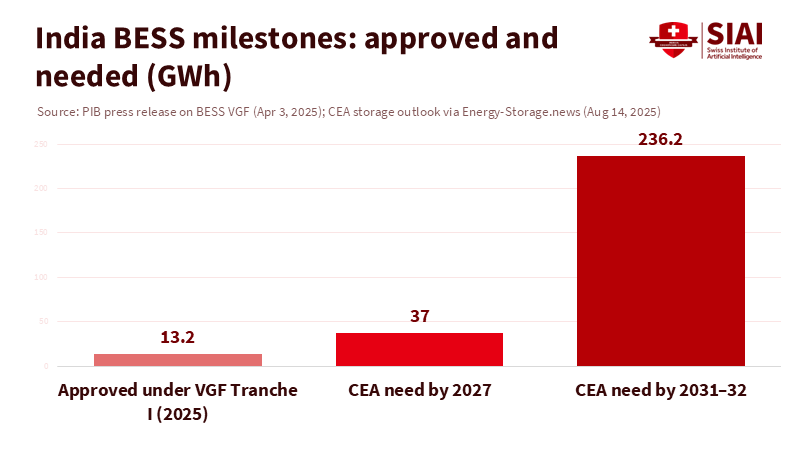

Batteries are essential infrastructure

Storage has become vital grid infrastructure. Evening demand spikes are steep. Coal plants deal with water stress and cycling penalties. Gas is limited and costly. Batteries can be built in months, not years. The Central Electricity Authority estimates that India will require approximately 236 GWh of battery storage by 2031–32, alongside significant additions to pumped hydro. Independent analyses for 2030 suggest a range of 60 to 220 GWh of battery energy storage, depending on how capacity credits and ancillary markets are organized. These are not just numbers; they are essential for keeping feeders functional during heat waves and enabling transmission lines to deliver more usable energy by shifting loads over time. The urgency of the situation is apparent. The first 50 to 60 GWh should be viewed as the most cost-effective reliability investment India can make over the next decade.

Price trends highlight this urgency. Auctions in 2024–2025 indicate that battery capital costs are around $115 to $125 per kWh for co-located systems, after accounting for savings on inverters and balance-of-plant expenses. Four-hour systems are still more expensive than one- or two-hour blocks. Still, long-duration tariffs have decreased sufficiently to support widespread deployment under SECI-style contracts. When we convert recent winning bids into a levelized cost of peak shifting, the findings show that they outperform diesel peakers and compete with gas in terms of price and response time.

The challenge is execution, not technical limitations. Interconnection delays, land acquisition issues, transformer wait times, and transmission congestion slow down projects more than cell prices do. The Ministry of New and Renewable Energy has had to extend some commissioning deadlines due to logistical delays. Policy should focus on details. Expand joint auctions that procure capacity, energy, and ancillary services together. Standardize four-hour blocks to meet evening demand. Publish a rolling three-year tender calendar with clear rules for performance, augmentation, and revenue from frequency and reserves. On the distribution side, provide DISCOMs with financial space and templates to sign storage-backed power purchase agreements that reduce peak purchases and technical losses. Reliability improves. Bills stabilize—emissions decrease, even with coal remaining in the mix for several years to come.

India's clean energy strategy: buying batteries and hedging the supply chain

India cannot currently escape its reliance on China for batteries. China remains the leader in the lithium-ion supply chain due to its scale, pricing discipline, and infrastructure. This presents both an advantage and a risk. The practical solution is a diversified portfolio. Between 2025 and 2028, purchase bankable batteries at the lowest prices while developing domestic production and partnering with South Korea and Japan for higher-spec chemistries. Hedging upstream risk through recycling is essential. A modern system that combines digital tracking with stricter recovery quotas can convert retired cells into a secondary resource. India's Battery Waste Management Rules have moved towards barcodes, online credit registries, and extended producer responsibility. Now, they need clearer recovery goals for lithium and cobalt, as well as a fee floor high enough to finance safe recycling and processing plants. Establish that the circular buffer is now in place, and each new gigawatt of storage will reduce import exposure compared to the previous one.

Solar manufacturing faces a similar scenario. India has surpassed 100 GW of installed solar and is working to increase domestic module capacity to a similar level. The government has indicated that, starting from June 2026, clean energy projects will be required to use locally manufactured solar cells in addition to modules. This is a strategic goal for capacity building. However, it also introduces a short-term risk: if cell production lags, delivered tariffs will start to rise. The solution lies in proper sequencing and transparency. Keep import channels for cells open for a sufficient period to maintain tariffs around ₹3.5 ($0.042) while Indian cell production ramps up. Then phase in content rules to align with the actual output. Industrial policy must prioritize system costs and reliability over all else. India's clean energy strategy should be assessed by the expenses of schools, small businesses, and households, along with the number of hours of reliable evening power provided, not just by the number of factory launches.

The last miles matter

Education is where reliability has a profound impact on people's lives. Schools and universities serve as shelters during heat waves and as digital hubs. When the evening peak fails, learning comes to a halt. The quickest solution is local storage coupled with feeder-level or rooftop solar. States can implement school-cluster pilots using standardized 1 to 5 MWh systems with clear guidelines for isolating critical loads during outages. University campuses can install behind-the-meter battery energy storage systems under service agreements that capitalize on reduced demand charges and frequency response opportunities. Where ancillary markets are lacking, regulators can implement a performance adder funded by verified peak shaving, paid for by avoided high-cost purchases. The method is straightforward: measure the baseline, confirm the reduced peak, pay the adder, and publish the data for others to replicate.

Administrators will have financial concerns. Three strategies can help. First, time-of-day tariffs that encourage load shifting and flexibility across schools, hospitals, and public campuses. Second, state-backed storage funds that combine lower-cost capital with utility cost recovery and standardized service contracts, similar to SECI's model, are also viable options. Third, system-level warranties with clear degradation schedules and replacement options are provided. Pool procurement across districts can lower prices and build local maintenance skills. Savings will appear as avoided peak purchases and fewer diesel usage hours, which are crucial for tight budgets.

Critics might point out that coal still provides most of the generation and that building transmission takes time. That is indeed the case. But that is the key point. Storage does not wait for new lines. It optimizes existing infrastructure by efficiently managing energy use over time. It helps reduce coal cycling, cuts local pollution, and improves voltage stability for sensitive equipment in labs and classrooms. It also increases the value of new renewable capacity by turning variable energy into reliable evening service. The goal is not a sudden transformation. It represents steady progress towards the first 50 to 60 GWh of battery storage, on the journey to the Central Electricity Authority's projected need of approximately 236 GWh, as that initial tranche provides the greatest reliability return for the investment today.

Some may argue that if the U.S. and Europe shared more technology, progress would be swifter. They should, and it would benefit both sides through faster learning in India's vast market. However, policy cannot wait for ideal geopolitics. The practical protection is diversification. Maintain access to China for scale and low prices. Strengthen ties with Korea and Japan to ensure quality and safety in next-generation chemistries. Utilize EU partnerships where financial support, recycling regulations, and grid-forming expertise align. Build domestic recycling and cell production lines that reduce import dependency over time. Most importantly, keep project tariffs low and predictable so educational institutions, small businesses, and data-intensive facilities can plan accordingly.

Next steps are clear. Publish a rolling three-year calendar of tenders that include storage, with standardized four-hour blocks, clear augmentation rules, and transparent interconnection processes. Fast-track the standards for grid-forming inverters and fund a national testing facility, eliminating uncertainty for developers. Tighten the Battery Waste Management framework by setting recovery quotas specific to each material, raising the extended producer responsibility floor to match safe recycling costs, and requiring open data about collection, processing, and losses. Support district-level storage procurement for schools and hospitals with standardized contracts and shared maintenance. None of these steps requires a new philosophy. They need practical execution, clear documentation, and discipline to maintain control over evening tariffs.

We started with $0.042 per kWh, a figure that seems small until it becomes the foundation of a strategy. It shows that India can purchase firm evening power for less than the volatile fuels are expected to cost amid rising tariffs and sanctions. The plan for India's clean energy is not about virtue; it revolves around value. Use auctions to convert the oversupply of modules and batteries into low domestic tariffs. Use storage to transform sunlight into reliable evening energy. Use recycling and regulations to turn import reliance into a circular safety net. We do not influence Washington's trade policies or Moscow's pricing. However, we do control how quickly we can convert solar energy and lithium chemistry into dependable electricity that keeps classrooms cool, hospitals strong, and factories operational. Secure the cheap watt now—before geopolitics makes it more expensive.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

BloombergNEF. (2025, April 28). China dominates clean-technology manufacturing; tariffs reshape trade flows.

Central Electricity Authority. (2025). Optimal Generation Capacity Mix (2031–32) — Battery storage requirements.

East Asia Forum. (2025, September 27). Ganguly, M. Recycling reform can kick India's clean energy drive into gear.

Energy-Storage.news. (2025, January–August). SECI solar-plus-storage auctions and implied storage costs; India's battery storage boom—execution lessons.

International Energy Agency. (2025). Electricity 2025 and mid-year updates on India's demand growth.

Mercom India. (2024, December 10). ₹3.52/kWh SECI solar-BESS auction winners.

Ministry of New and Renewable Energy / Press Information Bureau. (2025, February 7). India achieves 100 GW solar capacity; pipeline and tenders.

Reuters. (2025, August–September). Explainers and market updates on India's Russian oil imports and U.S. tariff pressure.

UC Berkeley, IECC. (2025). India's falling solar+storage auction prices and inferred BESS capex.