After the Vote: Taiwan’s Energy Choice Is About Price, Risk, and Time

Input

Modified

Taiwan’s nuclear referendum failed due to low turnout, not a lack of support Its grid now relies more heavily on costly imported gas A balanced mix with renewables, storage, and a safety-vetted nuclear option is vital

Taiwan recently conducted a unique democratic experiment in energy policy. In August, about three out of four voters who participated supported restarting the closed Maanshan nuclear plant. However, the referendum failed because the voter turnout did not meet the legal requirement. The irony is striking. The last operating reactor provided about 3 percent of the island’s electricity before it shut down in May 2025. Since then, the grid has relied more on imported gas and coal. Taiwan already imports around 98 percent of its energy. This dependence is expensive and vulnerable. It leads to higher bills for households and puts the country at risk from maritime issues. The main takeaway is that, although 74 percent of voters supported the measure, it failed to pass because of low turnout. The underlying problem is clear: a slight loss of stable power is forcing much larger choices about cost, reliability, and geopolitics. This is not a cultural battle over technology—it’s a matter of budget, security, and timing. Public engagement in these issues must focus on costs and reliability, as the decisions made will directly impact the lives of all citizens.

What the vote actually told us

The vote was not a simple pro- or anti-nuclear stance. It tested how strongly people felt. A significant majority supported reactivating Maanshan, but not enough voters showed up. Analysts observing the information landscape noticed a late rise in familiar concerns about waste, earthquakes, and Fukushima. However, these discussions did not gain traction in the broader media until the last few weeks, which is significant. Low public interest, rather than a clear ideological divide, led to the failure. The legal requirements also played a role. Taiwan’s referendum law stipulates that a quarter of eligible voters must vote “yes.” Supporters were close—approximately 4.3 million votes—but still fell short of the required number. This should be seen as soft non-participation rather than a firm rejection. It keeps open the possibility for evidence-based choices in the coming months, offering a glimmer of hope for a balanced and sustainable energy future.

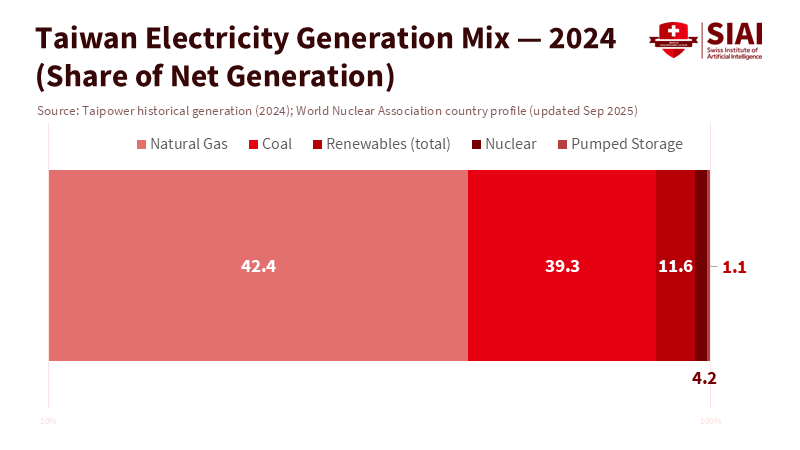

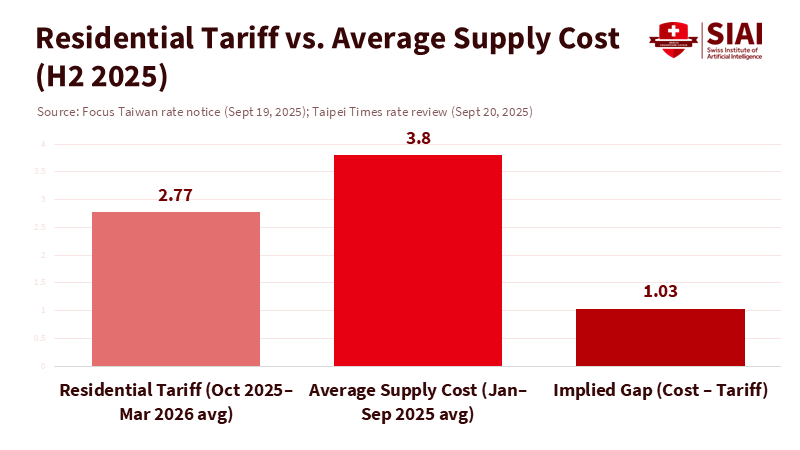

The energy system's challenges are more significant than the political ones. Maanshan’s two pressurized water reactors were authorized for 40 years, with Unit 1 scheduled to shut down in 2024 and Unit 2 in May 2025. Before their closure, the last reactor contributed about 3 percent of electricity. While that may seem minor, losing reliable, low-cost capacity during times of low reserves results in high costs. Taiwan's power demand has been increasing, driven by data centers, manufacturing plants, and a growing services sector. While LNG and coal still dominate energy generation, renewable sources like solar and offshore wind are expanding, but have yet to reach the size or reliability needed for peak demand. The state utility, Taipower, has been incurring significant losses despite adjusting tariffs. This indicates that the current energy mix is costly to maintain, particularly given the volatility in global gas markets. The failure of the referendum does not resolve these issues; it keeps them active and pressing, highlighting the urgent need for evidence-based choices in the coming months without shutting down the nuclear option for years.

Price, security, and the reliability premium

Taiwan's energy dependence is not a mere concept. About 97-98 percent of its energy comes from imports, primarily LNG and coal, brought in by ship. In 2023, Taiwan consumed approximately 24-25 billion cubic meters of LNG, with over 80 percent of it used for power generation. When gas prices soared after Russia invaded Ukraine, governments helped consumers, but the burden shifted to state budgets. Taipower's accumulated losses surged into the hundreds of billions of New Taiwan dollars. Authorities raised tariffs in 2024 and again in late 2025 for households, while continuing to warn of ongoing losses. Adding to this is strategic risk. A blockade could strain LNG terminals, shipping lanes, and reserve stocks. The system can prepare for disruptions, but long supply chains present stubborn challenges. Each additional gigawatt of domestic, reliable capacity lessens that exposure or at least diversifies it.

The reliability aspect is equally concrete. Taiwan has faced region-wide outages in recent years due to human error and equipment failures. The grid operator has strengthened contingency measures, including fast-response storage, to mitigate disturbances. While these steps help, planning reserves remain a moving target as peak demand rises. For manufacturing plants and data centers, the cost of lost service is substantial; even minutes of downtime can result in millions of dollars in losses. This is where reliable power—dispatchable, predictable, high-capacity generation—commands a premium. In the short term, that premium is reflected in the cost of gas. In the medium term, this can be achieved through storage, demand shifts, and a greater share of renewables, provided that developments occur quickly and grid improvements keep pace. In the long term, it could involve extending the life of existing reactors or developing new ones, provided regulators deem them safe and financing is favorable. These options could provide a more stable and cost-effective energy supply, reducing the vulnerability to global commodity fluctuations.

We also need to discuss prices openly. Systems reliant on gas are more sensitive to global commodity fluctuations. Taiwan's household tariffs remain low by OECD standards, but the trend is upward. The government has limited or frozen increases for businesses to manage inflation and support exports, shifting more cost adjustments to households and the public budget. This is a policy decision, not an inevitability. However, no tariff structure can escape basic math. If fuel becomes expensive and capacity increases are delayed, bills will rise. The role of nuclear energy in this framework is not ideological; it’s about reducing system costs and managing risk. A 3 percent share of low-cost power does not change the mix on its own, but it can help reduce peak demand, stabilize reserves, and lower wholesale prices marginally. Over many hours each year, that translates to a significant amount of money.

A constructive way forward

The critical question is not “nuclear or renewables.” It’s “how to quickly build a resilient and affordable energy portfolio.” Here’s a new perspective: consider reliability a public good essential for schools, hospitals, and factories. Price it explicitly in planning, not only as a technical reserve margin but as an insurable service level. Viewed through that lens, we can evaluate options in terms that are meaningful to educators and administrators: outage minutes avoided per million New Taiwan dollars, emissions per kWh, and volatility exposure per percentage point of import dependence. Based on those factors, Taiwan’s most practical near-term steps are clear. Accelerate the deployment of grid-scale batteries and flexible demand programs to mitigate fluctuations and manage emergencies. Increase distributed solar and storage on school and municipal buildings where rooftop space is underutilized and where the social return is highest. Advocate for onshore wind and improvements to connections to reduce curtailment. Prioritize industrial efficiency in manufacturing plants and data centers through predictable “pay-for-performance” programs linked to reduced peak demand. None of these actions will completely resolve base energy needs, but each reduces the cost and risk of falling short of them.

At the same time, keep the nuclear option ready, rather than making it a politically contentious issue. The law permits safety reviews; the utility has indicated that these could be completed in 18-24 months under favorable circumstances. Establish that process with clear benchmarks for seismic safety, waste handling, and economic feasibility. Publish a cost range that considers decommissioning and waste, then compare it to long-term LNG supply contracts at realistic price levels. Use a regulatory process that is transparent, audit-ready, and includes public hearings and expert cross-examinations. If Maanshan or any of its successors cannot meet these criteria, the decision will be straightforward. If it can, then nuclear energy isn't competing with renewables; it’s competing with unserved energy and costly gas. That introduces a different and healthier debate.

Education policy has a stake in this issue. University laboratories require steady power. Digital learning platforms and testing systems need reliability. School budgets are quick to feel the effects of changes in tariffs. There is a practical opportunity: transform the education sector into a visible pillar of the energy transition. Test microgrids at large campuses with solar, storage, and intelligent controls to keep essential buildings operational during outages. Combine schools into virtual power plants and compensate them for being flexible during peak demand. Link curriculum components to real-time energy monitoring, allowing students to learn from their own environments. These projects are not mere slogans. They provide resilience to the grid while strengthening social infrastructure. They also illustrate that “energy security” isn’t just a naval term; it affects whether a classroom stays lit, an exam can continue, or a lab course is conducted.

Critics may ask whether this agenda represents a hidden return to nuclear energy. It does not. It is a portfolio that keeps nuclear as an option alongside rapid storage solutions, demand response, and increased renewables. Others may argue that more LNG terminals would solve the issue. Additional terminals can reduce single points of failure, but they won’t eliminate exposure to global gas prices or maritime risks. Some people might reference Germany’s exit from nuclear power as a model. Germany’s experience highlights that shutting down nuclear without adequate replacements increases coal use and drives up prices; the country is now reassessing certain aspects of its approach. Taiwan should learn a broader lesson: sequencing matters. Phase out only as quickly as clean, reliable, or flexible alternatives can be built, and only as fast as the grid can accommodate them.

There is also the issue of emissions. Taiwan has committed to achieving net zero by mid-century. Switching from coal to gas has helped, but the next steps toward reducing emissions will be more complex. Offshore wind will continue to expand, and solar energy can continue to grow, but curtailment and grid limits will become significant challenges without major improvements in transmission. Batteries are crucial, but they only shift energy over time; they do not generate it. Nuclear energy is among the few sources that can cut emissions while adding reliable capacity. This does not make it a foregone conclusion. Still, it does make it worthy of serious evaluation in public discussions, considering the total costs we currently incur from gas and the real costs of outages that aren’t reflected in retail bills.

Finally, communicate with citizens as adults. Voters accepted nuclear energy; many did not participate. This suggests that everyday concerns—such as wages, housing, and childcare—often overshadow energy discussions unless the stakes are clearly defined. Present those stakes in relatable terms. If household bills rise by a few percent each cycle, what does that mean in New Taiwan dollars for a typical family over a year? If a school installs solar panels and a storage system, how many hours of outage could it withstand? If LNG prices surge for a quarter, how much public funding supports the utility? When policy decisions are framed in terms of costs and time rather than slogans, citizens are more likely to engage. And when they engage, voter turnout is expected to increase.

Taiwan’s referendum outcome appeared paradoxical: a major “yes” that counted as a “no.” It was neither. It reminded us that democratic systems struggle with low public interest and that energy systems struggle with delays. The island has talented engineers, investment-ready for stable projects, and a public that values clean air and reliable power. The task now is to prioritize sequencing. Quickly build what can be built—rooftop solar, batteries, flexible demand, grid enhancements—and recognize reliability as the public good it is. Maintain a rigorous nuclear review process to ensure it can be activated only if it meets both safety and value standards. Treat schools as key parts of a visible energy network within the community. By doing this, a 3 percent gap can become a catalyst rather than a burden. The next time voters are asked for their input, they should encounter a different question: not whether to revisit the past, but whether to expand what has already demonstrated it can provide reliable energy at a cost families and institutions can manage.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Asia Pacific Foundation of Canada. “Taiwan’s Referendum to Restart Nuclear Plant Defeated as Energy Debate Heats Up,” 5 September 2025.

Associated Press. “Taiwanese opposition survives another recall vote, and referendum on nuclear power fails,” 23 August 2025.

East Asia Forum. “Taiwan’s nuclear phase-out faces public opinion shift,” 25 September 2025.

Financial Times. “Taiwan weighs return to nuclear power amid AI surge and China fears,” 21 August 2025.

Focus Taiwan (CNA). “Household electricity rates to rise 3.12% on average,” 19 September 2025.

Focus Taiwan (CNA). “Nuclear plant safety key regardless of referendum results,” 22 August 2025.

Focus Taiwan (CNA). “Despite power rate hike, Taipower will see NT$410 billion in accumulated losses,” 20 September 2025.

Ministry of Economic Affairs, R.O.C. “Promote Green Energy, Increase Natural Gas, Reduce Coal-fired Power Generation,” policy overview (accessed 2025).

PwC Taiwan. “Global and Taiwan Electricity and Renewable Energy Market Updates 2024,” 2024–2025 page (accessed 2025).

Reuters. “Taiwan to raise electricity prices by an average of 11%,” 22 March 2024.

Reuters. “Taiwan freezes electricity prices, reports power utility losses of $13 bln,” 28 March 2025.

S&P Global Commodity Insights. “Taiwan vulnerable to LNG supply risks in the event of a maritime blockade,” 30 May 2024.

Taipower. “Historical Electricity Generation,” updated June 2025.

Taipower. “Maanshan Nuclear Power Plant Unit 2 Ceases Operation,” plant notice (accessed 2025).

Taipei Times. “Taipower to raise electricity rates by an average of 0.71%,” 20 September 2025.

Taiwan FactCheck Center. “Analyzing the Narratives Behind Taiwan’s Third Nuclear Power Plant Referendum,” 9 September 2025.

Trade.gov (U.S. Dept. of Commerce). “Taiwan — Electric Power Equipment and Energy,” 10 January 2024.

World Nuclear Association. “Nuclear Power in Taiwan,” updated 19 September 2025.

World Nuclear News. “Taiwan’s pro-nuclear vote fails to hit turnout threshold,” 26 August 2025.