Tariffs at the Gate, Classrooms on the Line

Input

Modified

Tariffs push India and China toward pragmatic corridor-based coordination Chokepoints like Malacca demand education focused on logistics, compliance, and applied R&D Build corridor-ready micro-credentials now to hedge volatility and capture growth

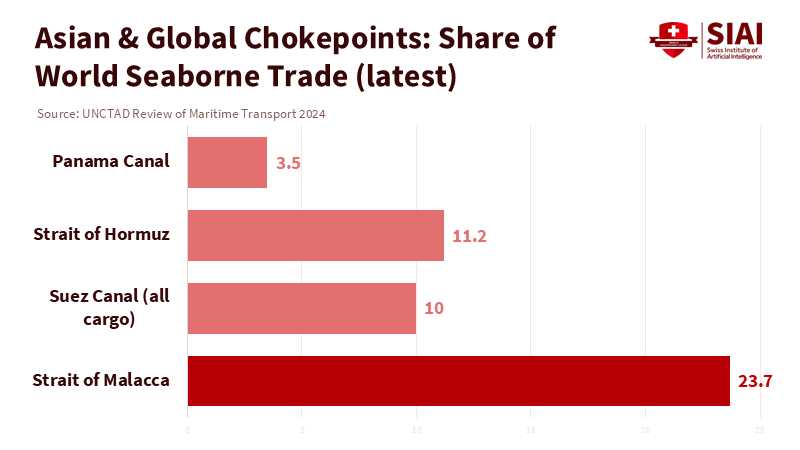

Nearly one quarter of the world's seaborne trade travels through a single maritime route: the Strait of Malacca. The statistics are striking; 23.7 percent of all cargo by volume in 2023 means that small changes in power dynamics, port standards, or shipping insurance along this route can have widespread economic impacts. If India and China, even cautiously, move from stalemate to selective cooperation around these critical points, the effects will surface first in classrooms. This includes how South and Southeast Asia prepare logisticians, maritime pilots, customs auditors, battery engineers, and bilingual compliance officers. Rising tariffs from Washington in 2025, coupled with legal and diplomatic uncertainties regarding presidential trade powers, have made this shift more likely, increasing the cost of inaction. In a region where bottlenecks—not strategic plans—determine who thrives, education systems must either adapt to the new demands or risk being left behind.

From geopolitics to pedagogies

The role of tariffs has evolved from a negotiating tool to a disruptor of educational systems. The United States' tariff policy changes in 2025, including the end of duty-free entry for many low-value Chinese shipments, have set a new precedent. A pivotal Supreme Court case is currently testing the legal limits of these global tariffs. Companies are already adjusting prices and finding new suppliers, making higher border taxes a chronic challenge that managers must now teach about, rather than warn against. The figures are significant enough to change company behavior: by July 2025, U.S. tariffs collected since January had reached around $122 billion. The White House's imposition of a punitive total of 50 percent tariffs on Indian goods over energy ties with Russia further underscores the need for expertise in trade compliance, rules-of-origin knowledge, and port operations skills that can quickly adapt to policy changes.

India's approach to China is rooted in practicality. In FY 2024/25, India's trade deficit with China reached a record of approximately $99 billion, revealing significant dependencies in electronics, solar cells, and batteries. However, in 2025, relations began to thaw. This is not a blossoming friendship; rather, it is practical maneuvering under pressure. For universities and polytechnics, the message is clear: curricula must prepare students for ongoing strategic competition and tactical cooperation in supply-chain standards, logistics training, rare-earth processing, and safety certification—fields where skills, not just slogans, define value.

The freight map backs this up. Malacca handles almost a quarter of global seaborne cargo; the Suez Canal accounts for about 10% of total tonnage and 22% of global container traffic; and the Strait of Hormuz moves over 11% of all seaborne trade, much of Asia's fuel. If disruptions in the Red Sea or Panama force rerouting, voyage times can stretch by weeks while freight rates surge. It is logistics professionals—planners, brokers, and port engineers—who ensure that food, medicine, and components keep moving. Education that treats maritime logistics as an elective is missing the point of the 2020s. Program design should begin with chokepoints and work backward to the necessary competencies.

What a China–India pragmatism would demand from education systems

Selective cooperation doesn't require a major alliance to change training demands. Suppose India reopens air services and targeted border trade while China reassures smoother access to crucial inputs. In that case, the quickest gains will likely come in electronics assembly, energy storage, and port-side services. Take the smartphone boom: India's mobile phone exports in the first five months of FY 2025/26 surpassed ₹1 lakh crore (≈ US$12 billion), reflecting a growth of over 50 percent year-on-year, with Apple-related supply chains at the forefront. Maintaining this growth requires skilled technicians proficient in process control, quality metrics, and cross-border component standards—talent often lacking in traditional engineering programs. Combine this with volatile container routes, and a specific set of skills emerges: customs digitization, rules-of-origin expertise, mastery of Incoterms, and basics of charter-party agreements. Curriculum developers should create stackable micro-credentials recognized by employers on both sides of the Himalayas and in ASEAN ports where much cargo transits.

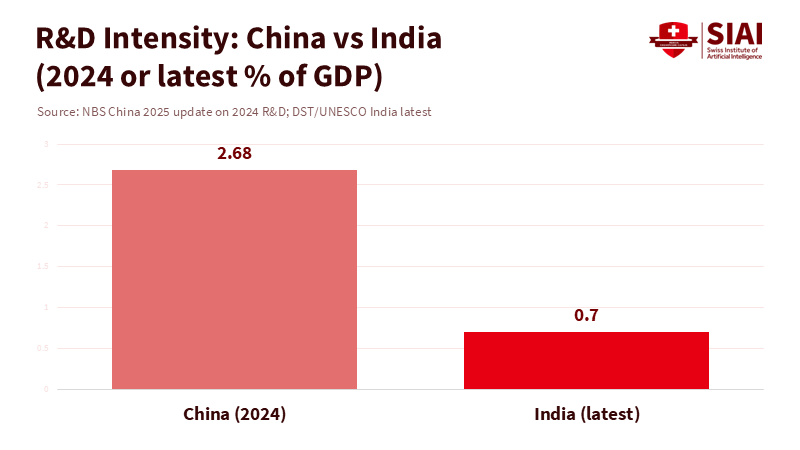

Research and development gaps create limitations. China's R&D intensity in 2024 reached about 2.68% of GDP, with total spending exceeding 3.6 trillion yuan and basic research increasing by double digits. In contrast, India has hovered between 0.6 and 0.7 percent of GDP. These ratios impact the classroom: they influence lab equipment availability, the depth of capstone projects, and the feasibility of industry-funded apprenticeships. A more open relationship between the two economies will shift demand toward applied research—such as battery recycling, low-voltage power electronics, and port electrification—where shared testing protocols and joint measurements can minimize duplication and redundancy. Upgrading India's applied research capacity and technician training pipelines is essential. Without this, supply-chain friend-shoring becomes assembly work without depth. Education ministers should view R&D intensity as a key performance indicator for human capital, not just a budget item.

Student mobility is also part of this equation. The United States has over 1.1 million international students, with Indian enrollments reaching record highs in 2023/24—over 330,000 by one count, making up roughly a quarter of all international students by another dataset. These students are mainly in STEM fields and professional master's programs that align directly with supply-chain jobs. If Washington's tariff policies remain unstable, part of this demand may shift to intra-Asian options that provide work-integrated learning, such as logistics and maritime programs in Singapore, universities in Thailand, Malaysia, and Vietnam linked to port clusters, and joint labs tied to SCO or BIMSTEC initiatives. Institutions in India and China should act quickly to co-develop dual-degree micro-paths with guaranteed industry placements in neutral hubs, such as Singapore or the UAE, where legal and visa risks are lower and cargo flows smoothly.

Evidence, objections, and policy steps

Two objections often arise. First, border politics may undermine any sustained cooperation in education or standards. This risk is real, but it affects both sides. Given that defense talks are fragile, quieter education and industry channels could serve as practical safeguards against disruptions. In the summer of 2025, there was progress: envoys talked about border stability and trade, channels reopened, and both parties expressed interest in restarting direct flights and targeted border commerce. Education partnerships can be designed to focus on specific corridors and operate in a modular manner, with sunset clauses and neutral governance structures, so they don't require trust—only practicality. Universities already know how to do this: joint IP agreements, shared testing labs with mirrored equipment, and credit recognition aligned with international standards rather than ministries.

Second, skeptics claim that Southeast Asia and Central Asia are mere bystanders. Geography suggests otherwise. The Straits of Malacca and Suez form the core of these trade flows. BIMSTEC has a transport master plan and is negotiating a Motor Vehicles Agreement. The International North–South Transport Corridor, linking India to the Caspian Sea and Russia via Iran, reported double-digit growth in 2024 volumes. For the education sector, this means building capacity where containers and railcars are actively in motion. ASEAN and Bay of Bengal universities should expand maritime academies, customs and trade facilitation labs, and bilingual programs focused on logistics, English, and Mandarin/Hindi. Central Asian institutions along the INSTC can specialize in refrigerated chain management and rail scheduling. These are not speculative investments but align with corridors that are experiencing increased activity and have globally significant chokepoints.

Policy Steps and Education Pathways

What should governments and university leaders do in the next academic year? First, align degree programs with chokepoints. In regions dominated by Malacca and the Bay of Bengal, focus on maritime navigation, port electrification, and ship-to-shore safety. Where there's high exposure to Hormuz, develop energy-logistics programs that include tanker scheduling, insurance, and sanctions compliance. Second, integrate rules-of-origin and tariff simulations into business programs, using real tariff regimes and live policy trackers to train students in analyzing scenarios. Third, expand apprenticeships through industry clusters that already engage in India–China value chains—such as electronics, pharmaceuticals, and renewables—so students can learn about documentation, quality checks, and audit trails. Finally, invest in applied labs at the polytechnic level, as those are where the skill shortages are: trained technicians who can maintain port cranes, calibrate battery production lines, and manage customs digitization. The benefits are immediate; otherwise, there's a risk of producing too many graduates that the job market cannot absorb.

Policy must also address the tariff timeline. Even if courts restrict presidential power, the last seven years have taught firms to see tariffs as a long-term risk. Education needs to keep up. Business schools should introduce a "trade operations" focus alongside finance and operations. Law schools should establish cross-border customs clinics, and engineering schools should incorporate supply-chain measurement, component tracking, and failure analysis related to recognized certification standards in India and China. Governments can initiate tri-national credentials—stackable 12-credit micro-certificates in trade compliance, maritime safety, and battery recycling—that can be converted into degrees across India, China, and at least one ASEAN partner. Scholarship programs should center on trade corridors, targeting students committed to working in port cities, logistics parks, and industrial clusters that support these trade routes.

Skeptics caution that any shift toward China could lead to over-dependence. That's precisely why education strategies should emphasize corridors rather than specific countries. Educate students on transferable standards—SOLAS and ISM codes, ISO measurement techniques, WCO customs norms, AEO programs—so graduates can transition between employers in China, India, and ASEAN as political climates change. Promote internships and co-op placements in neutral hubs and shared labs. Use dual-supervisor research projects that involve data from both sides of the Himalayas. Maintain a portfolio approach: develop parallel tracks for India–U.S. and India–EU collaboration because a more diverse trading system enhances resilience. The goal is not to focus on one partnership, but to equip a generation to handle tariff and route changes by instilling fluency in the universal rules that govern them.

Looking back at the opening statistic, the case becomes clearer. With almost a quarter of seaborne trade passing through Malacca and a tenth through the Suez Canal, education that treats logistics, standards, and compliance as secondary is not effectively utilizing talent. Tariffs have only accelerated a long-term trend: supply chains, not political speeches, will shape the opportunities in Asia. India and China will continue to compete, and their cooperation may only be limited to specific routes. This is sufficient. A practical, evidence-based educational agenda—centered on understanding chokepoints, fluency in rules-of-origin, and applied research in crucial sectors—can maximize benefits and soften the impact of challenges. By allowing freight maps to guide curriculum development, cycles of tariffs won't determine who benefits from education; instead, it will be the students who benefit. That is the only adequate safeguard.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Asian Development Bank (2022). BIMSTEC Master Plan for Transport Connectivity. (accessed 2025-09-19).

Carnegie Endowment for International Peace (2025). India–China Economic Ties: Determinants and Possibilities. (accessed 2025-09-19).

CFO Economic Times (2025). “India’s smartphone exports surpass ₹1 lakh crore this fiscal so far; Apple leads: data.” (accessed 2025-09-19).

International Labour Organization (2024). Navigating the Future: Skills and Jobs in the Green and Digital Transitions. (accessed 2025-09-19).

International Monetary Fund (2024). The Price of De-Risking: Reshoring, Friend-shoring, and Quality Downgrading. Working Paper. (accessed 2025-09-19).

Institute of International Education (2024). Open Doors 2024 Fast Facts; “US hosts more than 1.1 million international students…”. (accessed 2025-09-19).

Ministry of Commerce & Industry, Government of India (2025). Press Release: India’s Merchandise Trade 2024-25. (accessed 2025-09-19).

National Bureau of Statistics of China (2025). “China’s R&D expenditure and intensity in 2024.” (accessed 2025-09-19).

Peterson Institute for International Economics (2025). “Tariff revenue tracker”; “US revenue implications of 2025 tariffs.” (accessed 2025-09-19).

Reuters (2025-04-16). “India trade deficit with China widens to record $99.2 bln.” (accessed 2025-09-19).

Reuters (2025-07-14). “Avoiding trade curbs vital for normalisation of ties, India tells China.” (accessed 2025-09-19).

Reuters (2025-08-18/19/31). “India, China envoys discuss border peace, trade”; “Agree to resume direct flights”; “Partners, not rivals, Modi and Xi say.” (accessed 2025-09-19).

Reuters (2025-09-12/18). “US Treasury urges G7/EU tariffs on China, India over Russian oil; Trump’s 50% tariff on Indian goods”; “US Supreme Court to hear Trump tariffs case Nov 5.” (accessed 2025-09-19).

UNCTAD (2024). Review of Maritime Transport 2024 (full report and chokepoints chapter). (accessed 2025-09-19).