Physical vs Transition Climate Risk is Distinct, and Our Curricula Need to Catch Up

Input

Modified

Physical and transition climate risks are orthogonal inside firms Physical risk is geographic and weather-driven; transition risk is policy- and profit-driven Teach and regulate with two dashboards, not one, so budgets and actions match each risk

The most critical number in climate education this year is 1.6. This was the approximate global temperature increase in 2024 compared to pre-industrial levels, marking the first year to exceed 1.5°C consistently. This temperature rise led to significant losses; global natural disasters in 2024 caused about $320 billion in economic damage, with around $140 billion insured. These figures highlight an undeniable reality: climate change is real, it is costly, and it is already here. However, businesses face climate risk not as a single wave but as two different currents that often diverge. This distinction is crucial for how we teach, fund, and regulate educational institutions and the companies they support. Suppose we continue to treat climate risk as one blended issue. In that case, we risk misjudging risks, misdirecting strategy, and overlooking potential failure points. The solution begins by clearly naming this divide and teaching it effectively.

Physical vs Transition Climate Risk: Two Problems, Not One

In simple terms, physical risk refers to damage arising directly from weather and climate conditions: heat, flooding, wind, wildfires, and drought. This risk disrupts assets, operations, and supply chains. Transition risk, on the other hand, comes from the shift to a low-carbon economy: new regulations, changing prices, technological changes, and shifts in demand. These risks operate on different factors. One relates to geography and exposure, while the other concerns policies, markets, and strategies. Treating them as the same clouds, both understanding and responding. This fundamental distinction is not new; it is central to TCFD and most supervisory guidelines. Yet in classrooms and boardrooms, these categories often blur. We teach "climate risk" and then focus only on emissions or solely on weather events. We must teach both and emphasize that they are distinct in the decision-making process.

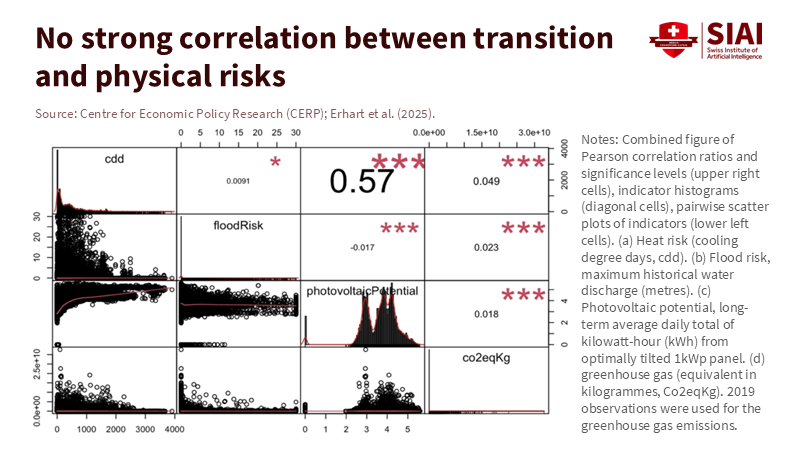

There is an additional nuance to the physical vs transition climate risk distinction. For a single company, these two risks are often not linked. A high-emission steel mill located in a cooler, inland area may face significant transition costs while experiencing only minor physical exposure. Conversely, a low-emitting data center situated on a floodplain may encounter the opposite scenario. Recent large-scale studies of around 70,000 firms across 30 countries confirm this: there is no strong correlation between transition risk and physical risk at the company level. This finding should change how we teach scenario analysis, risk mapping, and due diligence. It shows that a single "climate risk score" can be misleading. We also need to train students to identify two separate drivers and develop two distinct toolkits.

The Distinction Tested: Evidence from Firms, Markets, and Disasters

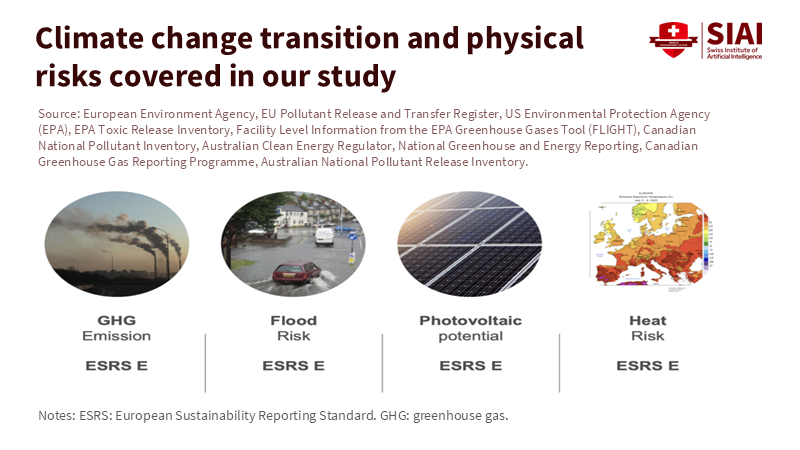

Evidence for this separation appears in three areas. First, we see it in the data. Firm-level data used by regulators, investors, and insurers now distinguish between metrics of physical exposure—such as cooling-degree days or flood risks—and transition indicators like emissions or carbon pricing. When plotted for individual firms, the data show very little correlation. This aligns with what the cross-country study mentioned above reveals. It also matches the behavior of global loss statistics.

Physical losses increase during hot years regardless of a firm's emissions. In 2024, the world recorded high temperatures and significant losses from storms and floods, underscoring that physical risk is primarily related to weather and location. A firm may reduce its Scope 1 emissions yet still be in a flood zone. Their mitigation plan does not change the course of the river.

Second, the policy landscape for transition risk is intentionally inconsistent. Carbon pricing mechanisms covered about 24% of global emissions in 2024, with varying levels of enforcement and scope. Coverage is expanding unevenly across sectors and countries. China is now expanding its emissions trading scheme beyond the power sector into heavy industry. In contrast, the shipping industry will face its first global greenhouse gas fee starting in 2027. This patchwork means that similar firms can incur very different transition costs depending on their location, sector, and product offerings. At the same time, their physical risks—heat, flooding, wind—are determined by climate and geography, not by regulations. By combining these two maps, we can expect a weak correlation between the risks at the firm level. This is precisely what the evidence shows.

Third, markets are beginning to reflect this distinction. Studies in European equity and credit markets show separate premia associated with physical and transition risks that move differently over time and across sectors. In years marked by significant weather-related losses, physical risk premia rise; in years with substantial policy changes or fuel price increases, transition premia take precedence. Neither pattern indicates a straightforward correlation at the level of individual companies. Instead, it suggests that investors monitor two separate risk factors with different indicators and hedges. This illustrates orthogonality in practice. The curriculum and policy should align with this insight.

Why Policy Signals Fail Within Firms

If physical and transition climate risk factors are separate in firm data, why does this occur? The reasons lie in their different drivers. Physical risk is tied to location, while transition risk relates to policies and revenues. A firm cannot alter its coastline, but it can change its production site, product line, or energy sources. This ability for adjustment means managers prioritize responding to policies and pricing when assessing transition risk. However, many policies still lack effectiveness, consequence, or predictability. With global carbon pricing covering only about a quarter of emissions, many companies face a modest immediate cost for carbon and therefore view transition risk as something that can be postponed. Simultaneously, insurance coverage for weather-related losses is thinning in high-risk areas, raising physical risk for vulnerable assets without affecting a firm's emissions calculation. The pathways through the income statement differ, leading to a weak correlation.

Regulation is also applied in a staggered manner. The EU's climate disclosure standards (ESRS E1 under the CSRD) require detailed reporting on both mitigation and adaptation strategies. The goal is to drive integrated management of both risks. Yet the implementation of these policies is uneven, with differing thresholds, timelines, and sector regulations fluctuating with political changes. Even when a broad scope includes around 50,000 firms in Europe, the timing and specifics vary by firm size and listing status. In contrast, the parameters for non-EU firms remain undecided. Firms thus focus on complying with the clearest transition regulations—such as emissions measurements, targets, and plans—while adaptation remains treated as a separate budget item at specific sites. This governance divide reinforces orthogonality because different teams, datasets, and performance indicators guide decision-making.

Lastly, the paths to profitability differ. Transition policies alter the relative costs of fuels, technologies, and products, leading to winners and losers within sectors rather than across them. A cement company that has access to inexpensive renewable energy and an effective carbon-capture method may see its transition risk decrease despite having high baseline emissions. However, it may still face rising flood risks at its riverside facilities. In contrast, a low-emission software company may experience little transition pressure but might face a significant cooling challenge for its data center in a hot, water-scarce area. When we discuss "climate strategy," we must treat these as two distinct strategy games that may interact, but often do not, within the time frame relevant to the firm.

What to Teach Now: A Two-Toolkit Approach

For educators, the implications are clear. Teach two risk maps, two dashboards, and two decision processes. Begin each case with a straightforward, side-by-side comparison: (1) the firm's transition risk under current and potential policy scenarios; (2) the firm's specific physical risk based on recent and foreseeable climate conditions. Use scenario analysis that examines each risk independently before considering them together. This method trains students to avoid the false sense of security provided by combined scores. It also helps them understand that resilience and transition plans are complementary, not interchangeable. Graduates should leave with a good grasp of both aspects: emissions accounting and risk exposure.

Administrators should revise capstone projects and executive modules to reflect this dual perspective. Assign one project focused on developing a credible transition plan for a firm based on established standards, and a second project that creates a prioritized adaptation plan addressing physical risks as operational risks—assessing them asset by asset and site by site. Utilize public datasets and registries to minimize costs and enhance comparability across different groups. Recent efforts to integrate pollution registers, greenhouse gas reporting, and satellite observations demonstrate how practical a low-cost, open-data approach can be. The goal is not to produce specialists in a semester but to inculcate a habit of separating the two risks and managing each based on its unique characteristics.

Policymakers who support education and workforce initiatives should also amend their incentive structures by linking grants for campus decarbonization to investments in improving resilience against floods, heat, and wildfires. Motivate community colleges and technical schools to develop micro-credentials that certify skills in assessing physical and transition climate risks for roles in facilities, procurement, and finance. Focus public data initiatives on areas that help reduce costs for smaller schools and supply chain firms. When carbon pricing or sector standards expand, pair them with funding for capacity-building in adaptation planning. The separation we observe in firm data is not a flaw in analysis; it is the nature of the issue. Policies should acknowledge this and be designed accordingly.

A likely criticism will arise: "At the system level, physical and transition risks are interconnected. As the planet warms, regulations will tighten, so the risks must align." This is indeed true at a macro level. However, orthogonality is a current reality observed at the micro level. It reflects time, geography, and regulatory frameworks. It indicates that, within a time frame of three to seven years—the typical duration for capital budgets—the differences in a firm's transition risk do not accurately predict its differences in physical risk. This is why blended scores can be misleading and why teaching must first separate the axes before exploring their interactions. Some industry experts even claim the risks are "inextricably linked." While this serves as a reminder against narrow focus, it does not replace the need for firm-level measurements that inform managers about which actions to take now.

The final step is assessment. We should evaluate student work, institutional plans, and policy initiatives based on whether they demonstrate proficiency with both toolkits. Regarding transition: identify emissions drivers, policy exposures, and the economics of abatement options under likely prices. For physical risk: present hazard maps, asset-level vulnerabilities, and staged adaptation actions, including associated costs and benefits. Incorporate relevant market signals when they exist. Investors are starting to recognize distinct premia linked to each risk type. This insight should be integrated into finance courses, budgeting exercises, and board meetings throughout educational institutions.

The year 1.6 should mark the end of teaching climate risk as one indistinct entity. The losses in 2024 and the evidence from individual firms point to a more precise understanding: two risks, weakly correlated within the firm, each requiring its own analysis, budgets, and governance. Education is where this reframing must start. We can create programs that equip students to manage both playbooks. We can fund institutions to decarbonize and adapt without creating a false dilemma. We can write rules that reflect how firms truly confront risks—by location along one axis, and by policy and profits along the other. If we do this, the next generation of managers and public leaders will not only assess climate risk more effectively but also act swiftly and make smarter investments, as they will understand exactly which factors they are influencing and why.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Aon. (2025). 2025 Climate and Catastrophe Insight. Retrieved January 21, 2025.

Bank for International Settlements (FSI). (2023). Climate risks: scenario analysis – Executive Summary.

Copernicus Climate Change Service. (2025, January 10). 2024 was the warmest year on record and the first to exceed 1.5°C above pre-industrial level.

Erhart, S., Szabó, S., & Erhart, K. (2025, October 10). Integrating pollution registers for corporate climate-risk assessment. VoxEU/CEPR.

European Financial Reporting Advisory Group (EFRAG). (2023). ESRS E1 Climate change (Delegated Act).

European Network for Greening the Financial System (NGFS). (n.d.). NGFS Scenarios Portal.

Earth-Scan. (2024, June 19). Physical vs transition climate risk: what’s the difference?

Munich Re. (2025, January 9). Natural disaster figures for 2024.

Sautner, Z., van den Briel, M., & Zhang, L. (2023). Firm-Level Climate Change Exposure. Journal of Finance.

World Bank. (2024, May 21). State and Trends of Carbon Pricing 2024: Global carbon pricing revenues top a record $100 billion (24% of emissions covered).

Xinhua/Reuters. (2025, March 26). China to expand carbon trading market to steel, cement and aluminium.

Associated Press. (2025, April). Major nations agree on first-ever global fee on greenhouse gases from shipping (IMO).