Instant Cross-Border Payments Will Eclipse Stablecoins' Edge If We Finish the Last Mile

Input

Modified

Domestic transfers are instant; cross-border isn’t Linking FPS enables instant cross-border payments Stablecoins’ edge narrows; universities integrate

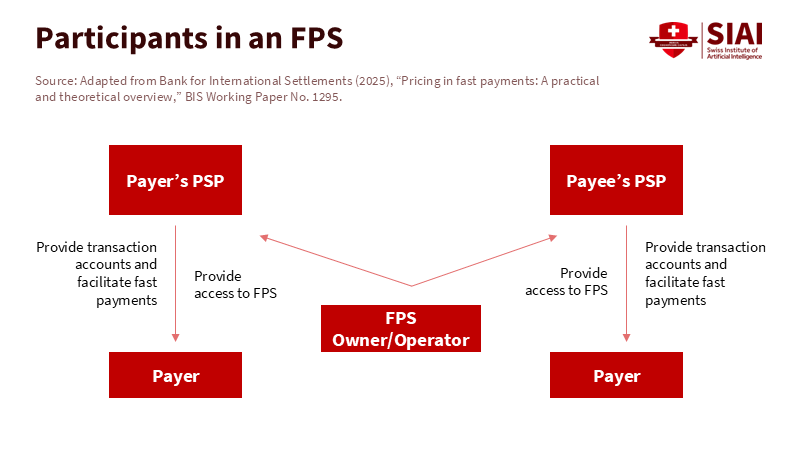

Over seventy countries already transfer money domestically in seconds and often for minimal cost. However, the average price to send money internationally is still much higher than what people pay for local transfers. This disparity presents both a policy challenge and a market opportunity. Once instant cross-border payments become the norm, the benefits of USD-denominated stablecoins will fade into a niche role. The necessary infrastructure is taking shape: fast payment systems are now active on every continent, the EU has rules mandating instant payments at the exact cost as standard transfers, and plans to connect national systems in under a minute are underway. The main obstacles are not technical but rather economic and cooperative: issues like who pays for the connections, how currency exchange rates are determined, and which governance rules allow banks and non-banks to connect safely. If these issues are not solved, stablecoins will lose their main appeal. The time to complete the last steps is now.

The race to instant cross-border payments

The story starts domestically. Fast payment systems now complete local transactions in seconds across many regions, from Brazil to India to the UK. Central banks and networks are working to connect these national systems, allowing payments sent in one country to reach recipients in another in about a minute. The BIS's Project Nexus, a significant initiative in this context, has published a clear plan and is moving toward live implementations, starting with a coalition that includes Malaysia, Singapore, Thailand, the Philippines, and India—linking UPI and similar systems. Europe is pushing for the same advancements, focusing on interoperability and shared standards. SWIFT's gpi has demonstrated how legacy networks can be improved: most gpi payments now reach recipients within 30 minutes, and in Europe, some connections allow near-instant completion by transferring payments to local systems. The goal is clear: link the fast systems we already have.

The policy case has sharpened in 2025. The ECB describes the "quest for cheaper and faster cross-border payments" as a task focused on linking existing infrastructures, not building new ones. Regulators and the Financial Stability Board (FSB) have set targets for cost, speed, and transparency. Some deadlines may shift—global coordination is challenging, and the FSB now warns that the goals set for 2027 might not be met—but the incentives drive toward making international transfers as quick and reliable as domestic ones. Suppose cross-border transfers can arrive in seconds with clear fee structures. In that case, the added value of using a blockchain token for consumer payments decreases. Stablecoins might still play specialized roles, but their edge in the mainstream market will lessen as bank systems improve in speed and reliability.

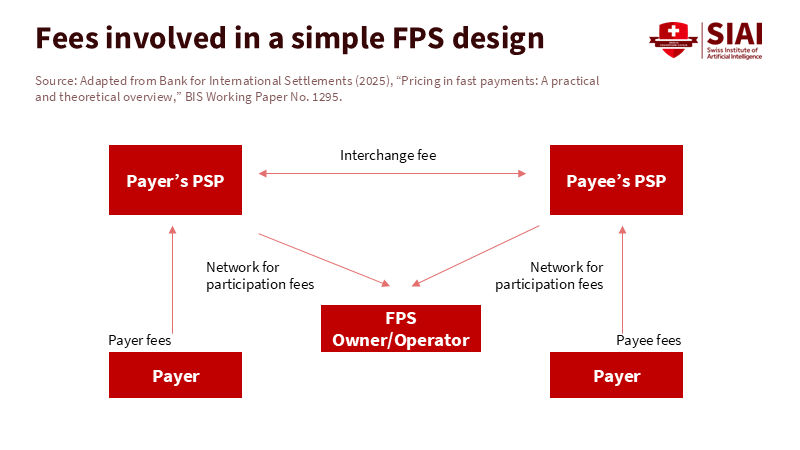

The cost curve: integration beats tokens

Speed alone is not enough to win this competition; price matters too. Europe's Instant Payments Regulation enforces an 'equality of charges' rule, a significant provision that means banks that offer instant euro transfers cannot charge more than standard credit transfers. It also requires name verification and a phased approach, with forces receiving capability as early as January 2025 and sending capability from October 2025 in the euro area, with additional deadlines through 2027-2028. This changes the economics from 'premium speed' to 'commodity speed.' Once instant payments become the standard and cost the same as regular transfers, merchants and consumers will no longer have to pay extra for real-time transactions. The logic is simple: broaden access, limit fee differences, and let increased volume lower costs.

Outside of Europe, the market is moving in a similar direction. In the United States, the FedNow Service has gained over 1,400 participating institutions and is steadily increasing volume. Meanwhile, SWIFT's upgrade pathway shows that even correspondent banking can achieve nearly real-time outcomes, with most GPI payments credited within 30 minutes and almost all within 24 hours. When you combine these trends, the cost curve levels out. As more banks and payment service providers connect to real-time systems, fixed costs are distributed, and the added cost of each new instant payment approaches that of a regular transfer. The BIS's recent pricing survey highlights this: many fast payment systems offer free or very low-cost transactions for individuals. At the same time, fees for merchants are either market-based or regulated down.

Stablecoins currently promote themselves based on their ability to settle quickly and cheaply across borders. They can do that, but only if users can enter and exit these tokens at a low cost, with compliant on-ramps and without poor foreign exchange rates. In reality, users still incur exchange rate spreads, withdrawal fees, and charges when converting in and out of tokens, which dampens the claimed "near-zero" network fees on-chain. In contrast, instant cross-border payments on connected banking rails will provide speed without the need for converting into a token, while keeping users within familiar consumer protections, recourse paths, and standardized dispute processes. Suppose integration continues to lower fees and increase transparency. In that case, the economic advantages will lean toward bank systems for most retail and small enterprise needs, leaving stablecoins for liquidity management, constant wholesale settlement, and areas with limited banking access.

Education finance and instant cross-border payments

For education, payments are not just abstract systems. They involve crucial tuition deposits that may miss deadlines, stipend transfers that arrive after rent is due, and micro-scholarships that disappear due to fees. However, the potential of instant cross-border payments to transform this sector is inspiring. Two points are key. First, domestic fast payments exist at scale. Second, global remittance costs remain too high for small transactions. According to World Bank monitoring, average remittance prices remain elevated for typical small transfers, reducing scholarship funds and family support for students studying abroad. As universities expand their classrooms and vendors worldwide, this friction creates a competitive disadvantage. Instant cross-border payments can transform this by reducing both delays and fee leaks.

Administrators should prepare for a world where payments are real-time by default. Admissions and finance offices can shift from cutoff dates and "allow three business days" statements to service level agreements measured in seconds. Procurement departments can set milestone-based triggers tied to delivery data and settle instantly with overseas suppliers. Student services can distribute hardship funds in minutes to verified accounts abroad. The risk benefits are significant: name verification reduces misdirection and fraud, while reliable tracking from standards like the Global Payment Initiative (GPI) improves reconciliation. The advantage is clear: fewer reversals, fewer holds, and better cash forecasting for institutions operating on tight budgets.

For edtech companies, the focus shifts from "what token do we accept?" to "which systems do we connect to?" The best approach is to support interoperability by backing SEPA Instant and RTP/FedNow in the U.S., along with the emerging Nexus corridors in Asia. Keep a token or stablecoin connection only when it lowers overall costs or reaches users in banking-restricted areas. This strategy adheres to local regulations and decreases compliance risks. It also aligns with regulator intentions: making bank transfers cheaper, faster, and more transparent as the standard, while treating tokens as optional infrastructure for specific cases rather than a universal solution for consumer payments.

A pragmatic roadmap—and the stablecoin response

The plan is straightforward. First, link to your domestic instant system and request equal pricing from your service providers. In the EU, the law mandates this; elsewhere, competition and network effects will guide you in that direction. Second, focus on corridors that are already integrating, particularly those outlined in the Nexus plan. Third, standardize message formats and reconciliation across departments to ensure payment data aligns with records in admissions, housing, and procurement. Finally, track what matters: time to credit at the beneficiary's account, complete cost transparency at the initiation stage, and reducing error rates with name verification services. These are practical decisions institutions can make now while policymakers finalize the cross-border systems.

What about the argument that stablecoins will succeed because they scale globally and operate 24/7? There is some truth to that. Tokens remain valuable for constant wholesale settlement, bridging liquidity over weekends and holidays, and in areas where banks underperform or face restrictions. Market growth in 2025 highlights this, as stablecoins have rapidly gained traction amid ongoing policy discussions. However, this growth does not resolve the retail payments issue. When bank systems provide seconds-level settlement for cross-border transactions at regular prices—and when compliance, chargebacks, and consumer rights come with the payment—the mainstream use case will favor account-to-account transactions. The FSB's warning that the 2027 targets might shift does not change the overall trend; it merely acknowledges that completing the final steps is challenging. The solution is not to abandon interoperability but to see it through.

Finish instant cross-border payments and let price do the rest

The main point holds firm: domestic transfers are completed in seconds in over 70 countries, while cross-border payments remain too slow and expensive. Once we establish instant cross-border payments that are interoperable, reliable, and priced like regular transfers, the appeal of USD-based stablecoins to most users will wane. The necessary infrastructure is in place: Europe has mandated equal pricing and verification tools, Asia is developing the first practical networks, and SWIFT and FedNow are improving legacy systems. What remains is execution—deciding who funds the connections, how foreign exchange and compliance fit into the user experience, and how governance includes new players without disrupting standards. Accomplish that, and we can reduce transfer times from hours to seconds and bring fees closer to domestic rates. Students, families, universities, and vendors all benefit. Regulators also gain, receiving traceable and accountable transactions. The market will follow the most reliable, quickest, and lowest-cost route. Our job is to make that route through the banking systems we already trust.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Bank for International Settlements (BIS). (2025, Oct 6). Pricing in fast payments: A practical and theoretical overview (Working Paper No. 1295).

BIS Innovation Hub. (2025, Aug 27). Project Nexus: Enabling instant cross-border payments.

European Central Bank (ECB). (2025, Apr 1). Enhancing cross-border payments in Europe and beyond (speech).

European Central Bank (ECB). (2025, Jun 27). The quest for cheaper and faster cross-border payments (speech by P. Cipollone).

European Central Bank (ECB). (2025). Instant Payments Regulation: Main requirements and timelines.

Financial Stability Board (FSB). (2024, Oct 21). G20 Roadmap for Enhancing Cross-border Payments: Consolidated progress report for 2024.

Reuters. (2025, Oct 9). G20's cross-border payments push set to miss 2027 target.

SWIFT. (n.d.). SWIFT gpi: Nearly 60% of payments credited within 30 minutes.

SWIFT via Financial IT. (2023, Dec 1). SWIFT connects instant payment systems to bring round-the-clock processing across borders.

U.S. Federal Reserve Financial Services. (2025, Jul 16). FedNow Service: Two years of growth and innovation (participants).

U.S. Federal Reserve Financial Services. (2025). FedNow Service: Quarterly volume and value statistics.

World Bank. (2025, Mar). Remittance Prices Worldwide—global average cost highlight.