Asia’s Green Transition: A Pivotal Shift in Energy Dynamics

Input

Modified

China’s scale and prices now drive Asia’s green transition without Western support Japan and Korea provide the standards, finance, and delivery that make projects bankable ASEAN education should pivot to East Asian hardware, codes, and procurement skills

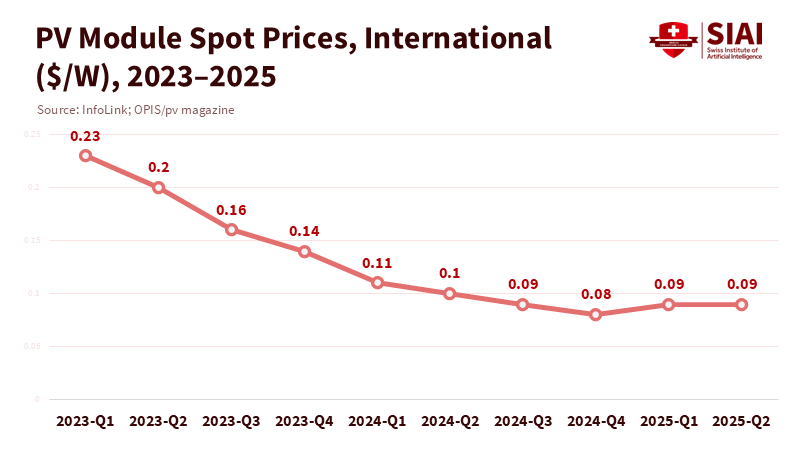

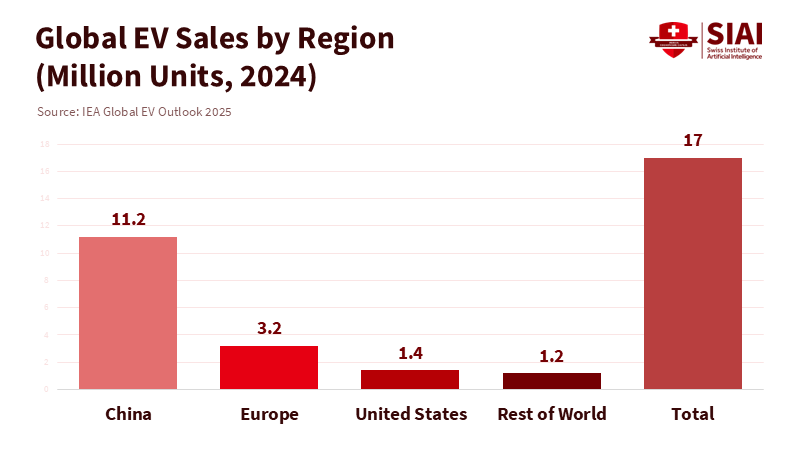

If one statistic shows how significantly the center of gravity has shifted, it is 277 gigawatts. That is the utility-scale solar capacity China added in 2024, which is more than double the entire U.S. utility-scale solar fleet at year-end. This calculation supports the policy. At international spot prices of $0.08 to $0.10 per watt for mainstream modules and pack prices around $115 per kilowatt-hour for lithium-ion batteries, Southeast Asian projects can proceed without Western subsidies or standards. In 2024, the world sold 17 million electric cars; China alone sold over 11 million. This scale reduces battery costs and enhances supplier know-how across the region. Prices are low not because the technology is basic, but because China holds over an 80% share in every link of the photovoltaic (PV) chain and has gained experience by building domestically while exporting internationally. In the Pacific, the United States is reducing its own green support. Europe had the chance to shape the rules three to four years ago, but hesitated and now finds itself on the defensive. The practical outcome is clear: Southeast Asia’s school districts, utilities, and ministries can source the best and most affordable equipment from China, and when they seek reliable standards, safety cases, and commissioning support, Japan and Korea are ready to step in.

The Role of Price Signals in Shaping Policy

The idea that Asia’s rise is just a temporary “dumping” misses the underlying structure. Over the past decade, China has invested over $50 billion to centralize polysilicon, ingot, wafer, cell, and module production, claiming an 80% share at every stage. This concentration shortens learning curves and keeps prices down even as technology shifts from p-type to n-type TOPCon and HJT modules. In 2024, China installed approximately 277 GW of solar and 79 GW of wind, marking an industrial achievement that solidifies its cost advantages and fills regional supply chains with skilled labor, testing equipment, and balance of system (BOS) expertise. Because modules trade internationally at $0.08 to $0.10 per watt, engineering, procurement, and construction (EPC) firms in Vietnam, Thailand, Malaysia, and the Philippines can over-size direct current (DC) fields, accept clipping, and still have lower costs than imported coal or liquefied natural gas (LNG). This economic model supports the wave of Chinese-owned factories and ASEAN assembly lines that serve both local projects and exports. Even in the ongoing price war, Beijing is now eliminating energy-inefficient polysilicon lines, a quality-focused consolidation that stabilizes but doesn’t erase Asia’s pricing advantage.

The United States’ policy withdrawal changes the landscape but not the results. As Washington cuts or pauses parts of its subsidy program and retreats as a standards-setter in the Pacific, the policy race across Asia has sped up rather than slowed down. In 2024, renewables accounted for 92% of global net capacity additions, and governments throughout the Indo-Pacific doubled their investments in green industries to enhance energy security and competitiveness. The outcome: ASEAN buyers are not waiting for U.S. regulations or European factories. They are acquiring Chinese equipment and integrating it into Japanese and Korean project finance and standards systems. This shift makes the key question in education and training not whether to “catch up” to Western standards, but how to prepare students for the procurement, commissioning, and operations and maintenance (O&M) realities they will face in ASEAN job sites from 2025 to 2030.

Europe’s chance to set the rules mostly closed when it failed to establish manufacturing in time. Leading companies like Meyer Burger shut down or reduced their German operations, and Brussels’ tariff actions against Chinese EVs may provide temporary political cover, but do not restore scale in cells or modules. For Southeast Asian planners, the message is clear: Europe will be relevant for trade and disclosure but will not provide most of the equipment or the know-how needed for microgrids, distribution enhancements, or utility-scale PV systems.

Standards and finance now flow from Tokyo and Seoul

Hardware leadership is just part of the equation. Standards and financial viability complete the picture. Korea’s APR-1400 program successfully delivered a four-unit nuclear plant at Barakah, expected to begin commercial operations by September 2024. This provides ASEAN planners with a clear delivery benchmark for complex baseload projects. That track record supports KHNP’s feasibility work on reviving the Bataan plant in the Philippines and influences emerging nuclear policy discussions across the region.

Meanwhile, Japan has launched the Asia Zero Emission Community (AZEC) as a platform for memorandums of understanding (MOUs) and technical standards covering grid interconnection, hydrogen and ammonia demonstrations, and financing. Trials by JERA and IHI on 20% ammonia co-firing at Hekinan have yielded positive operational and emissions outcomes, showing how Japanese utilities translate pilot projects into standards and procurement templates. Even with critics warning about risks of dependency, these developments address a question left unanswered by U.S. withdrawal: who defines the acceptance tests, trains the technicians, and packages the export credit support that proves projects can secure funding? Increasingly, Japan and Korea are working alongside Chinese hardware.

Finance is following the standards. Japan’s JBIC has positioned AZEC as a driving force in decarbonization and is co-financing regional infrastructure. Korean policy banks are expanding transition lending. On the manufacturing side, Chinese clean-tech companies have announced numerous overseas projects since 2022 to establish a foothold inside tariff barriers and get closer to markets. This ranges from BYD’s Thai EV plant to a wave of battery and module facilities across ASEAN, embedding supply chains and service networks where projects are constructed. For a university rector or a director of technical vocational education and training (TVET) in the region, this is not about geopolitics; it is about creating a curriculum that aligns with the region's promising future in the energy sector.

What about quality? Evidence suggests that the frontier of quality has shifted eastward, in tandem with costs. China’s latest mainstream modules are high-efficiency n-type platforms; battery costs dropped to $115 per kilowatt-hour in 2024 due to scale, changes in technology, and lower material prices. The adoption of EVs has also accelerated to levels where supplier knowledge is now enhancing grid storage and power electronics. Even the narrative of “oversupply” in the solar market is evolving. Regulatory pressure is now focused on reducing energy-wasting polysilicon capacity and improving average line efficiency, consistent with an industry that aims for sustainability, not a fire sale.

What's Next for ASEAN Education Systems?

First, teach procurement realities rather than politics. Coursework for electrical and energy-systems programs should focus on the actual bills of materials students will encounter: Chinese n-type modules, inverters, and lithium iron phosphate (LFP) battery racks paired with Japanese and Korean grid codes and commissioning protocols. This requires bilingual or trilingual documentation (Chinese, Japanese, and Korean alongside English) and assessment criteria aligned with the acceptance standards used by AZEC partners and regional EPCs. The benefits are significant: fewer commissioning delays, reduced performance issues, and quicker troubleshooting because graduates will understand the firmware menus, testing methods, and warranty terms in their original language.

Second, teach the new economics. A campus microgrid has different parameters when modules cost $0.08 to $0.10 per watt and storage approaches $115 per kilowatt-hour. DC to AC ratios can increase; clipping can be used deliberately to lower BOS costs; and hybrid PV, storage, and diesel systems for remote provinces can be optimized for fuel savings rather than capacity limitations. Methodology: use BNEF’s 2024 battery price survey as a starting point, then adapt it with PV-trade trackers like InfoLink and pv magazine/OPIS to establish module price ranges within ±$0.02 per watt. Teach students to develop sensitivity ranges instead of fixed estimates.

Third, engage manufacturers in designing clinical placements. The IEA’s EV Outlook confirms that 2024 was a pivotal year: 17 million EVs sold globally, over 11 million in China. This creates a spillover demand for power electronics, battery logistics, and grid upgrades throughout the ASEAN region. Ministries should arrange cohort placements with JA Solar, Trina, LONGi, BYD, CATL, Samsung SDI, and regional EPCs, enabling final-year students to gain experience on actual production lines and active grid projects. Maintain vendor-neutral curricula while keeping internships vendor-specific.

Fourth, enhance nuclear knowledge. The topic is back on the agenda in Manila and Hanoi, and the region now has credible reference cases. Barakah demonstrates the successful delivery of four APR-1400 units; the work at Bataan signals a transparent decision-making process; and the stance of Japanese regulators, along with the scope of AZEC, normalizes nuclear as a skill set rather than a contentious issue. Universities should include topics on probabilistic risk assessment, grid integration of stable low-carbon power in high-variable renewable energy systems, and vendor-neutral procurement law.

Fifth, treat finance as a technical subject. With AZEC’s MOUs and the involvement of JBIC and Korean policy banks, plus Chinese firms operating within tariff boundaries, the specifics of a power purchase agreement (PPA), an O&M bond, or an escrow clause for inverter firmware can determine whether a school district can move to solar energy or not. Students need to graduate with a solid understanding of both inverters and legal agreements, grasping how European and U.S. trade measures influence prices and why Southeast Asian factories have become crucial for Chinese suppliers.

Anticipated critiques—and the evidence. The first critique is that dependency on Chinese equipment represents a strategic risk. This can be managed with dual qualification of suppliers, secure storage of firmware source code, and acceptance standards that exclude low-quality or substandard components. China is tightening its standards and shutting down inefficient polysilicon plants, which bolsters quality control. The second critique concerns Japan’s ammonia co-firing, possibly reinforcing coal use. While this is a valid concern, the policy response should focus on clearly transitional projects while prioritizing interconnection, storage, and demand-side flexibility within AZEC’s framework. The third critique suggests that Europe or the United States might soon re-enter the market with better offers. That may be true, but educators cannot base curricula on speculation. They must align programs with the current equipment base and existing projects. If Western policy does return, graduates who understand the technology already in use will remain valuable.

Method notes. Where prices vary by market or trade terms, I report ranges backed by current trackers: InfoLink and pv magazine/OPIS for modules, BNEF for batteries. Where volume figures differ among sources, I cross-reference between the U.S. EIA, PV-Tech, S&P Global, and the IEA, selecting the most conservative estimates. For nuclear developments, I rely on records from the World Nuclear Association and World Nuclear News. For economic policy analysis and U.S. withdrawal, I follow dated assessments from the East Asia Forum.

From thesis to timetable

What to do this academic year. Ministries should instruct national TVET and engineering programs to adopt vendor-neutral, East Asia-aligned standards and bilingual assessments where appropriate; require at least 30% of final-year hours to take place in manufacturer or EPC placements tied to active projects; and launch a joint ASEAN micro-credential in “Clean Energy Procurement and Commissioning,” which can stack into national diplomas and be co-taught with AZEC partners. None of this requires Western permission or funding. It needs coordination and a clear understanding of where the hardware, finance, and standards actually originate.

The statistic that began this piece—277 GW in a single year—was not an anomaly; it was a statement. China’s manufacturing capabilities now dictate global prices and timelines. Japan and Korea translate those economics into standards, guarantees, and fundable projects. Europe will remain necessary for trade and disclosure, but the equipment that ASEAN students will work with, install, and maintain will predominantly come from East Asia. The job for educators and policymakers is to adapt to this new reality. Adjust curricula to reflect module and storage price ranges that make PV-plus-storage the standard for school campuses. Normalize nuclear knowledge as a viable option with real reference plants. Teach procurement as a part of engineering. If we do this, Southeast Asia will not just purchase its transition from abroad; it will manage, implement, and export it—on its own terms, with its own tools, at its own prices. This is not a retreat from global standards; it is leadership based on the current facts.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

BloombergNEF. (2024, Dec. 10). Lithium-ion battery pack prices see largest drop since 2017, falling to $115/kWh. Retrieved from BloombergNEF Insights.

East Asia Forum. (2025, Sept. 18). Green industrial policy race in Asia quickens despite US retreat.

IEA. (2025, May 14). Global EV Outlook 2025. (Global sales reached 17 million in 2024; China >11 million).

IEA. (2023). Solar PV Global Supply Chains: Executive Summary. (China’s >80% share; >$50 billion invested).

InfoLink Consulting. (2025). PV spot price tracker. (Weekly module price updates).

Japan Ministry of Economy, Trade and Industry (METI). (2025, Jun. 26). AZEC Senior Officials Meeting and promotion at Energy Asia.

Japan Times. (2024, Oct. 22). What happens when China becomes the green tech superpower?

JERA/IHI. (2024, Jun. 26). Ammonia co-firing trial results at Hekinan. (News coverage).

PV-Magazine. (2025, Apr. 9). International PV module pricing may rise to $0.11/W by year end. (Current international levels $0.08–$0.10/W).

PV-Tech. (2025, Jan. 22). China hits another record high with 277.17 GW of new PV in 2024.

Reuters. (2024, Apr. 15). Losing hope of rescue, some European solar firms head to U.S. (Meyer Burger context).

Reuters. (2024, Oct. 29). EU slaps tariffs on Chinese EVs, up to 45.3%.

Reuters. (2025, Sept. 17). China threatens to shut down polysilicon plants if new energy standards can’t be met.

S&P Global Commodity Insights. (2025, Jan. 24). China added 277 GW of solar and 79 GW of wind in 2024 (infographic).

U.S. Energy Information Administration. (2025, Apr. 22). China’s utility-scale solar reached 880 GW; 277 GW added in 2024. Today in Energy.

World Nuclear Association. (2025, Jul. 23). Nuclear power in the United Arab Emirates. (Barakah Unit 4 commercial operation in Sept. 2024).

World Nuclear News. (2024, Oct. 7). Korea to assess rehabilitation of Philippine Bataan plant.

World Nuclear News. (2024, Sept. 5). Barakah 4 landmark: commercial operation announced.