Bitcoin's Price Can Be Justified, Just Not the Way We Usually Value Things

Input

Modified

Bitcoin’s value stems from settlement utility, not cash flows Institutional demand and fees support this role It is better seen as a monetary asset than a Ponzi

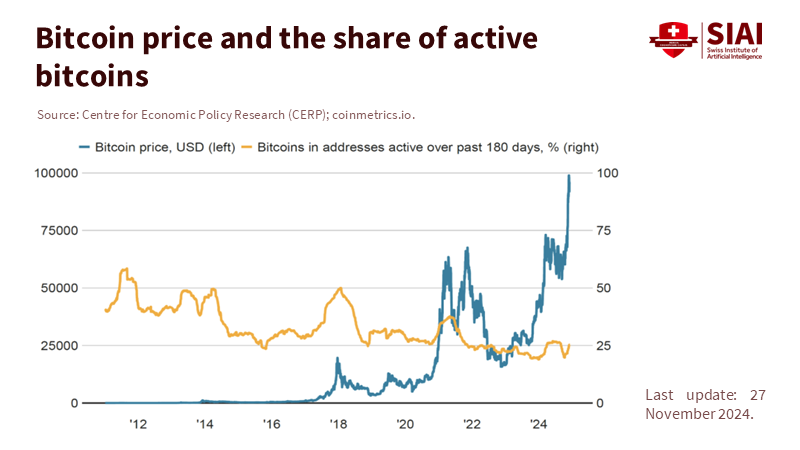

In its first year on the market, U.S. spot bitcoin exchange-traded funds attracted over $36 billion in net inflows. Bitcoin crossed the $100,000 mark in early December and reached new highs shortly after. One of these funds became the fastest U.S. ETF to reach $10 billion in assets. A risky curiosity does not usually break records in the most regulated parts of global finance. These flows reveal something the old debate overlooks: even if daily trading is noisy, a significant share of bitcoin demand is steady. It monetizes a specific kind of utility—permissionless, final settlement on a credible ledger—rather than conventional cash flows. If we insist on valuing bitcoin like a dividend-paying stock, it seems like a bubble. If we treat it as a monetary network with a liquidity premium and institutional access, the price makes sense, even while remaining volatile and prone to speculation.

Rethinking "Transactional Demand"

The transactional demand that counts in 2025 will not appear as buying coffee at the corner store. It will look like high-value settlements across borders on a Saturday, treasury rebalancing at a crypto exchange, custody transfers in and out of regulated ETFs, and movements connecting crypto-native finance with traditional systems. On-chain transfer volume, even after a decline in April, has stayed in the tens of billions of dollars per day this year. This is an activity level that does not fit a purely self-referential game. This volume is an imperfect measure; it includes internal movements and consolidations, reflecting custody architecture as much as end-user commerce. However, as a lower-bound indicator of the willingness to pay for bitcoin's settlement assurances, it is strong and rising over multiple years, particularly as institutional channels expand. Method note: the figure cited is USD-denominated "transfer volume" from a professional on-chain provider. It is change-adjusted but still includes some self-churn, which skews the estimate upward.

A second, complementary signal comes from where new money actually enters the crypto space. Over the last year, bitcoin has remained the main "on-ramp" asset for fiat inflows, outpacing all other tokens by a wide margin, even as stablecoins dominate everyday transactional flows. This split is crucial. Stablecoins manage much of the routine payment activity because they align with the dollar's unit of account. Bitcoin absorbs the monetization premium linked with digital scarcity and censorship-resistant settlement, especially when institutions require regulated wrappers. In Chainalysis' 2025 geography report, Bitcoin is still the leading asset for capital flows. The U.S. and India together account for a large share of that activity, reflecting both ETF channels and retail adoption. Educators and regulators need to recognize this divergence: "payments" and "price formation" now operate on different systems, and bitcoin's role in the latter is growing stronger.

The second-layer landscape tells a more nuanced story. The Lightning Network—a system for low-fee, instant payments—has seen its public capacity decline by about a fifth since late 2023, reaching around 4,000 BTC by August 2025. At first glance, that seems like a setback for payment promises. However, capacity is an imperfect proxy for throughput, and recent engineering changes may reduce how much liquidity must be publicly posted to achieve the same performance. In other words, a drop in visible capacity doesn't necessarily mean a drop in usage; it indicates a maturing design where payment channels can be leaner and more targeted. Method note: capacity figures come from mempool. Space's Lightning explorer and aggregate public channels, private channels, and custodial "LN-inside" services are omitted.

A Rational Bubble with Monetary Utility

If bitcoin represents a bubble, it is a rational one in the classic sense: a price supported by expectations of resale to future users who value its non-cash-flow utility. In rational-bubble models adapted for cryptocurrencies, the key factor is whether a subset of users values permissionless finality and scarce bearer assets. That value does not need to be expressed as dividends but as a liquidity premium for holding the asset that best enables high-value, censorship-resistant settlement. A recent theoretical framework shows how price can exceed any simple "cost-to-produce" metric without turning into a Ponzi scheme. The main point is clear: what seems like "speculation" from a discounted-cash-flow perspective can be seen as "monetization" from a monetary-network perspective. This reframing does not deny excitement; it explains why prices continue to find support after downturns as the user base for settlement utilities grows through regulated channels.

Several empirical markers support this view. First, the ETF channel has consolidated demand that was previously fragmented. Inflows exceeding $36 billion in the first year are not just a headline; they create a new investor base that values exposure without the friction of self-custody. The speed at which the largest fund crossed $10 billion in assets—and the subsequent inflows and outflows—illustrate bitcoin's normalization in portfolio construction, not a return to novelty. The policy-relevant point is that when an asset lacking cash flows establishes a steady base of regulated access, the appropriate valuation lens shifts toward scarcity, liquidity, and settlement demand, much like gold in earlier times.

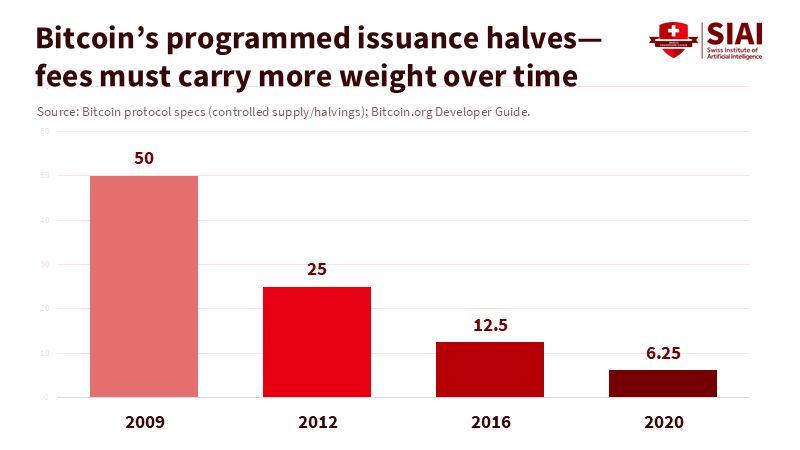

Second, block space is limited, and users sometimes pay high fees for it. After the April 2024 halving, transaction fees briefly surged to record levels due to new protocols competing for on-chain space. Fee spikes do not "prove adoption," but they indicate a willingness to pay for settlement finality when demand meets limited throughput. In monetary terms, that willingness is a shadow price on bitcoin's core service: permissionless, globally verifiable settlement. Over time, as issuance per block decreases, fees must support security. Monitoring the fee market, therefore, provides insight into the sustainability of the monetary network. Educators should view fees as a macro-micro connection: a market price that links protocol economics and user demand.

Third, macro connections matter. In 2025, bitcoin's gains have tracked periods of U.S. dollar softness and portfolio hedging behavior. Correlation does not imply causation, but the pattern aligns with a monetary premium narrative: when the opportunity cost of holding non-yielding assets decreases and macro uncertainty rises, demand for liquid "outside" money goes up. U.S. regulatory bodies often describe bitcoin's main use case as a "store of value." This is a straightforward way of saying the market sees a liquidity premium attached to it—different from a cash-flow "fundamental," but still a fundamental of a monetary kind. In a finance classroom, this is not radical: foreign exchange, gold, and even acceptable art show price behavior linked to liquidity premiums and portfolio hedging rather than discounted dividends. The error is treating Bitcoin as if it must be a stock.

None of this downplays the risks. Retail investors chasing price often lose money, large holders can influence markets, and criminal exploitation remains a serious issue. These facts highlight the need for better data and educational tools, rather than dismissing the asset entirely. A lasting conclusion from central-bank and academic research indicates that rising prices attract new users—a feedback loop that can inflate booms and exacerbate busts—teaching students to measure and critique that loop—using cohort analysis, order-book depth, and on-chain supply dynamics—provides more public value than simply labeling the entire phenomenon a Ponzi scheme. A Ponzi scheme promises yields funded by new entrants, collapsing when flows stop; bitcoin makes no such promise and endures when flows slow because its utility is not contractual income but settlement assurance.

Implications for Educators and Policymakers

Education programs should shift from asking students to choose between "currency or bubble" to teaching how monetary assets gain and maintain a premium. This involves combining monetary theory modules on liquidity and network effects with practical labs using professional datasets. A proper sequence would begin by measuring on-chain transfer volume and fees, then comparing that data with ETF flows to analyze how settlement and portfolio demands interact. Students should explore why stablecoins dominate payments while bitcoin leads in on-ramps and hedging, and why these roles can coexist. Assignments should include brief method notes—what a metric captures, what it misses, and how to triangulate with alternative data. When students understand why "change-adjusted transfer volume" overstates economic activity or why Lightning capacity doesn't equal throughput, they start thinking like analysts instead of advocates.

Administrators and curriculum committees can take it a step further by incorporating digital asset analytics into finance, data science, and public policy tracks, rather than limiting them to electives. The goal is not to promote a specific viewpoint; it is to ensure fluency in the language. Students should be able to read a fee chart, interpret an ETF flow table, and build a basic model linking macro variables to bitcoin returns—all while acknowledging the limitations of each step. Case studies can ground this work. For example, the mixed results from El Salvador: while legal-tender status did not lead to widespread retail use or a significant share of remittances, the experiment still offers a real-world example of wallet design, incentives, and financial inclusion claims. A data-skilled group will evaluate both the promise and the failures without resorting to stereotypes.

Policymakers should distinguish consumer protection issues from fundamental value concerns. The first requires action—clear disclosures, custody standards, incident reporting, and consistent treatment of ETF risks alongside other commodity-like funds. The second involves humility and measurement. Regulated ETFs have already changed the market's structure; the appropriate response is to observe how these channels affect volatility, liquidity, and holder composition across cycles. Monitor the fee market as a signal for security budgets; watch Lightning and other second-layer tools as indicators of payment costs; and track on-ramp flows to gauge monetization. A curriculum that prepares students to compute and critique these indicators will, over time, improve the quality of public discourse.

The most challenging question remains: if this demand is "real," why do adoption experiments falter? The answer is that monetary assets seldom succeed by taking over every payment; they succeed by earning a premium for a few vital roles. For bitcoin, those roles include high-value settlement, collateral in crypto-native markets, and a macro hedge with 24/7 liquidity. This profile can support a high price without offering a coupon. In turn, the price, bolstered by regulated access, attracts new groups, some of whom may misuse, misunderstand, or overpay for exposure. Education helps reduce the harm. Policy minimizes the adverse effects. Neither requires pretending the asset lacks underlying utility.

The record growth of spot ETFs and the scale of net inflows are not evidence that bitcoin is "fairly valued." They demonstrate that a large and increasingly regulated group is willing to pay for the monetary utility the network provides. This utility is not a stream of dividends; it is settlement assurance under credible scarcity, accompanied by ever-easier access. Prices will overshoot, retail investors will face losses in cycles, and policies will continue to tighten. Yet, the correct analytical perspective reveals why the price continues to find support: there is a base of users—exchanges, funds, market makers, and cross-border transactors—who view bitcoin as a monetary asset with a liquidity premium. The aim for educators is to teach that perspective without idealism; the objective for policymakers is to regulate the channels without stifling the essential signals. If we achieve this, the debate can evolve beyond "Ponzi or payment" toward a more honest evaluation of what is being monetized and why a network without cash flows can still hold value.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Americas Quarterly. (2025, March 17). In El Salvador, Bitcoin’s retreat left valuable lessons.

Bank for International Settlements. (2022). Auer, R., et al. Crypto trading and Bitcoin prices: Evidence from a new database (BIS Working Papers No. 1049).

Bank for International Settlements. (2025). Results of the 2024 BIS survey on central bank digital currencies and crypto (BIS Papers No. 159).

BlackRock. (2025). iShares Bitcoin Trust ETF (IBIT) overview.

CoinDesk. (2025, September 6). Bitcoin and stablecoins dominate as India, U.S. top 2025 crypto adoption index.

Financial Times. (2024, March 13). Bitcoin rally pushes BlackRock ETF over $10bn in record time.

International Monetary Fund. (2025). El Salvador: 2025 Article IV Consultation and Program—Staff Report.

Kaiko Research. (2025, April 22). Bitcoin’s halving anniversary: This time was different.

Kaiko Research. (2025). How BTC ETFs reshaped crypto.

mempool.space. (2025). Lightning Explorer: Network capacity and nodes.

U.S. Department of the Treasury, Treasury Borrowing Advisory Committee. (2024, November). Digital Assets and the Treasury Market.

VanEck. (2025, April 25). Mid-April 2025 Bitcoin chaincheck.

VoxEU/CEPR. (2024, December 7). Bitcoin valuation: Transactional demand versus speculative bubble.

Federal Reserve Bank of Philadelphia. (2024). Chernoff, A., & co-authors. The hidden effect of crypto “whales”.

Comment