Stablecoin Ponzi Risk Is a Consumer-Protection Time Bomb

Input

Modified

Stablecoin yields mimic Ponzi dynamics and amplify run risk Ban interest on payment tokens; regulate platforms that bolt on returns Educators and institutions should teach risks and keep payments separate from investments

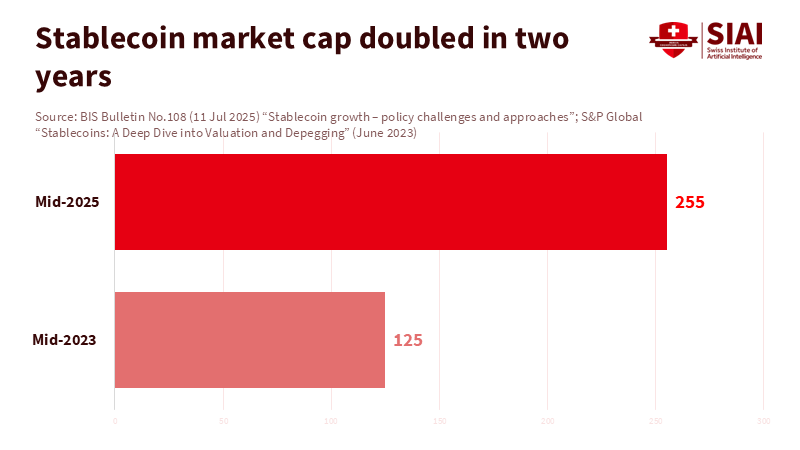

The most revealing number in today's crypto markets is not a coin price; it is the yield advertised on "risk-free" digital dollars that were never meant to pay interest. By September 2025, stablecoins reached roughly $280 billion in circulation. Most payment stablecoins are designed to hold a peg, not to earn income for users. Still, big platforms offer "rewards" on those tokens by re-lending customer balances to traders, moving them into DeFi pools, or paying loyalty bonuses from their own budgets. At the same time, a new type of yield-bearing stablecoin grew from under $1 billion in 2023 to more than $19 billion in 2025. This growth is quick, unclear, and dangerously appealing. When a product that cannot generate real returns is promoted with steady payouts, the stablecoin Ponzi risk becomes more than a metaphor; it becomes an actual policy issue. It can lead to runs, misleading sales, and regulatory loopholes across countries.

Why Stablecoin Ponzi Risk Is Rising Now

The basic design of payment stablecoins is straightforward: keep one token worth one unit of money, backed by cash and safe, short-term assets. Issuers earn interest on those reserves, but in many places, they cannot pass that interest on to retail users. In the European Union, the MiCA framework explicitly bans issuers and service providers from granting interest on e-money tokens or asset-referenced tokens. This ban treats any compensation linked to "time held" as interest. The goal is clear: stablecoins should act like money, not like deposit substitutes with tempting rates that fall outside prudential rules. Yet platforms have added yield anyway, muddying a legal line that was meant to be clear and shifting risk onto users who don't understand the underlying leverage or liquidity risks.

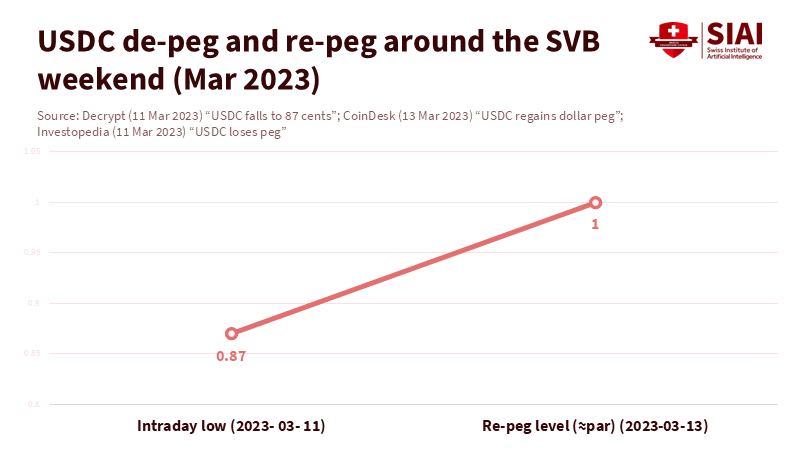

The risk is no longer just a theory. Regulators and central banks have warned that stablecoins perform poorly on key "money tests" such as uniformity and elasticity. They do not settle in central bank money, and they get fragmented by issuer. When stress occurs, they can break the peg and transfer pressure back into banks and money markets. In March 2023, USDC fell as low as $0.87 after its issuer revealed exposure to Silicon Valley Bank. The peg only recovered after public backstops restored confidence. This situation showed how a token promising stability still relies on traditional systems and politics. Suppose we start attaching yield promises to that shaky foundation. In that case, we invite the same run dynamics that brought down shadow banks in previous cycles—only faster, because digital markets operate at machine speed.

How Stablecoin Yields Work—and Why Incentives Invite Run Dynamics

Stablecoin yields usually do not come from productive activity. They tend to arise from others' needs for leverage or liquidity. Platforms pool customer tokens, re-lend them to market makers, route them to margin funding, or use them as collateral for basis trades (buy spot, short futures) and DeFi loans. During stable periods, those strategies can yield attractive returns. In times of volatility, they can freeze. Contracts often transfer ownership or allow rehypothecation, and in the event of insolvency, customers can be treated as unsecured creditors. That is not a savings account; it is a credit product in disguise. Recent legal actions and bankruptcy outcomes surrounding "earn" programs have highlighted this reality for thousands of retail users.

The stablecoin Ponzi risk arises when promised "dividends" depend on new inflows rather than external cash flows. Research shows that some algorithmic designs can sustain payouts only if new participants keep joining—what economists call a "rational Ponzi game." This dynamic collapses when confidence wavers. We saw pegs wobble even in fiat-backed models when underlying banking ties broke; in algorithmic or synthetic designs, venue and oracle issues can cause sharp drops that appear as de-pegs to users. In every situation, the lesson is the same. If the return offered to holders is not backed by clear, regulated cash generation, the scheme is vulnerable by design. The marketing may claim "stable," but the funding setup says "fragile."

Policy Triage: From Prohibition to Accountability

First, keep the dividing line clear. Where the law already prohibits paying interest on payment stablecoins, regulators should enforce that rule for both issuers and intermediaries. The European regulations are clear, and newer global guidance emphasizes that algorithms are not "stabilization mechanisms" if they depend on expectations rather than solid backing. Yield on top of a payment token is an investment product, not a wallet feature. It should be regulated and sold as such, with disclosures, risk assessments, and suitability checks that align with the real credit, liquidity, and operational risks involved.

Second, extend oversight beyond just the issuer. A recent analysis argues that regulations must also apply to crypto-asset service providers who change non-yielding payment tokens into yield-bearing products. Multifunction platforms that combine exchange, custody, lending, margin, and derivatives create conflicts and interdependencies that regulators do not allow in traditional finance. The solutions are practical: stringent client-asset segregation, limits on rehypothecation, consolidated oversight of groups, real-time reserve attestations, and product intervention powers when retail "yield" claims emerge in payment contexts. These steps do not favor any particular players; they prevent a regulatory loophole that shifts bank-like risks into poorly supervised areas.

Third, separate payments from investments. If investors want yield, tokenized money market funds and short-term bond tokens are available and already governed by fund rules. That differs from a payment stablecoin. The policy message should be clear: no yield on payment tokens; if you want yield, buy a fund share. That distinction prevents platforms from offering "cash-like" returns on instruments that are not cash and cannot be made cash-safe through branding. It also reduces hidden competition with insured deposits, a concern that central banks have raised as stablecoins become more widespread.

What Educators and Administrators Can Do Before the Next Stress Test

An online education journal should engage here, as the first line of defense is education. Students, teachers, and administrators need to learn a simple strategy for identifying stablecoin Ponzi risk. They should ask three questions: Where does the yield come from? Who bears the loss if trades fail? Can I exit at par under stress without relying on the platform's balance sheet? If the answers are "we lend your coins to traders," "you," and "maybe," then the product is not a safe store of value. Numerous cases now exist—pegs that broke, "earn" programs that were halted or legally challenged, and bankruptcy rulings determining that customer coins in yield accounts belong to the estate. These examples should be incorporated into curricula and staff training for bursars, finance offices, and student groups.

Administrators should also tighten procurement and treasury policies. Ban the use of yield-bearing stablecoin products for tuition, payroll, endowments, or student-group funds. Any crypto exposure should be required to exist within regulated vehicles with daily liquidity and audited assets. Demand clear risk statements that explain, in 200 words or fewer, how returns are generated and what happens in insolvency. When working with industry partners or donors, insist on "no yield on payments" clauses. Educational institutions help set norms; if they refuse to blur the lines between savings and speculation, they will help protect retail users. The benefit is practical. The more users recognize that "5% on a dollar token" signals hidden leverage, the fewer victims there will be when problems arise, and the easier it will be to handle any fallout.

Anticipating and Answering the Counter-Case

Some argue that banning interest on payment stablecoins is overly protective and that competition for deposits will improve services. Others note that yield-bearing designs tied to short-term government debt seem safer than uninsured bank deposits. There is some truth in both arguments. Tokenized funds can be transparent, and competition can benefit users. However, the actual record since 2023 suggests one outcome: payment stablecoins are fragile precisely when yield promises matter most. USDC's de-pegging during the SVB weekend quickly showed how fast a "safe" token can falter when its banking support is questioned. Central banks have warned that stablecoins fail necessary money tests and may hurt monetary control as they grow. When the underlying foundation is not real money, adding a yield layer adds risk. The right approach is not to endorse yield on money-like instruments; it is to channel risk into regulated investment products and keep the payment system simple, stable, and secure.

A stricter approach will not stifle innovation; it will redirect it. The Financial Stability Board's recommendations and recent supervisory briefings outline a path that encourages tokenized deposits and regulated fund tokens while isolating shadow banking. This agenda leaves ample space for faster cross-border payments, programmable escrow, and atomic settlement. What it removes is the incentive to dress up leverage as a "savings feature." For users, the choice is straightforward: choose between cash-like tokens with zero yield and investment tokens with yield and clear risks. For platforms, the message is even clearer: if you want to offer yield, get a license and comply with fund rules.

Stop Marketing Yield on Money-Like Tokens

The issue began with a number. The call to action is simple: stop marketing yield on money-like tokens. The market capitalization of stablecoins has surged, along with the Ponzi risk associated with products that offer steady rewards without a consistent, regulated cash source. We have seen pegs falter, "earn" programs collapse, and courts remind users that terms of service matter more than social media claims. The policy solution is straightforward. Enforce existing interest-ban rules on payment tokens, extend oversight to platforms that attach yield to them, and direct savers seeking returns into investment products subject to real securities rules. At the same time, educators and administrators should treat "yield on stablecoins" as a red-flag term and teach students to question the origins of that yield. If we act now, we can halt this dangerous trend before it escalates. If we wait, the fallout will be faster, broader, and more complex to manage than the last time we confused money with catchy marketing.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

American Bankers Association (2025). Stablecoins fail as "sound money," BIS finds. ABA Banking Journal.

Bank for International Settlements (2025a). Annual Report 2025, Chapter III: The next-generation monetary and financial system. BIS.

Bank for International Settlements, Financial Stability Institute (2025b). Garcia Ocampo, D. Stablecoin-related yields: some regulatory approaches. FSI Briefs No. 27.

Decrypt (2023). USDC falls to 87 cents after SVB exposure disclosed.

European Union (2023). Regulation (EU) 2023/1114 on Markets in Crypto-Assets (MiCA). EUR-Lex. (See Article on prohibition of granting interest).

Financial Stability Board (2023). High-level Recommendations for the Regulation, Supervision and Oversight of Global Stablecoin Arrangements: Final Report.

Fu, S., Wang, Q., Yu, J., & Chen, S. (2024). Leveraging Ponzi-like designs in stablecoins. International Journal of Network Management, 34(4), e2277.

Morgan Lewis (2025). E-Money Tokens: EBA clarifies PSD2–MiCA interplay. Client update, 16 June 2025.

Reuters (2025). Central bank body BIS delivers stark stablecoin warning. 24 June 2025.

SEC (2023). SEC charges Genesis and Gemini for unregistered offer and sale of securities through Gemini Earn. Press Release 2023-7.

SEC (2024). Genesis to pay $21 million penalty to settle SEC charges related to Gemini Earn. Press Release 2024-37.

Sidley Austin (2023). Celsius bankruptcy court confirms Earn assets are property of the estate. 18 January 2023.

CoinDesk (2023). USDC regains dollar peg after SVB-induced chaos. 13 March 2023.