Sector-Specific AI: Why Finance Isn’t ChatGPT—and Why That Matters

Published

Modified

AI works best when built for each sector’s data and goals Finance needs domain-grounded models and risk-based metrics, not generic chatbots Teach, buy, and regulate using sector-specific measures

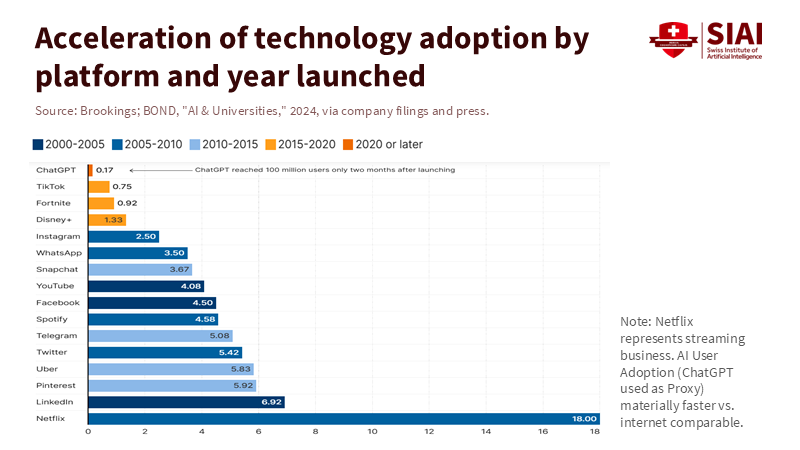

The most crucial figure in today’s AI discussion isn’t a high parameter count. It is a divide. In 2024, only 13.5% of EU firms reported using AI at all. Yet nearly half of information and communications firms had adopted it, while most other sectors were below one in six. This pattern is striking and revealing: adoption occurs where data and tasks match the tools, and stalls where they do not. This divide challenges the idea that "AI equals ChatGPT." Sector-specific AI relies on domain data, error structure, incentives, and key metrics in the field. Photographs and writing benefit from identifying patterns in clean, stable datasets. In contrast, financial time series are challenging due to noise, regime shifts, and the higher costs of making mistakes. Suppose we continue to think of AI as a single entity. In that case, we risk teaching students incorrectly, purchasing the wrong systems, and mismanaging risk. The solution isn’t just more hype; it’s about adopting sector-specific AI tailored to the needs of each sector.

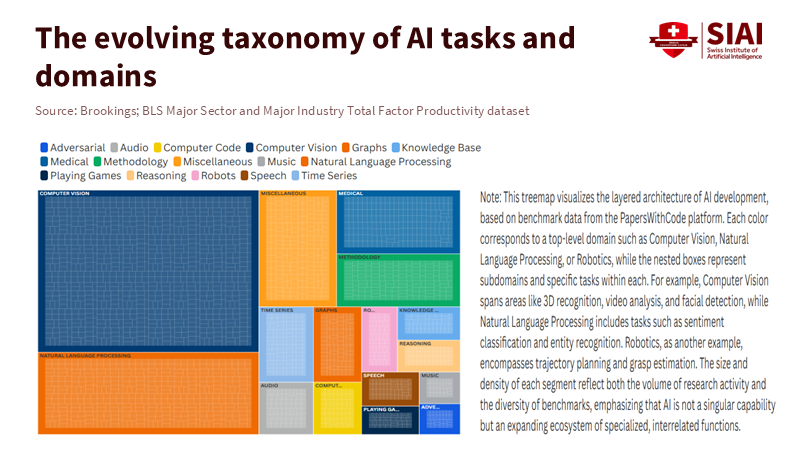

Sector-specific AI is a practice, not a product

Sector-specific AI isn’t just a chatbot dressed up; it’s a group of probabilistic systems tailored to specific contexts. In some areas, these systems already outperform previous top standards. Take weather forecasting. In peer-reviewed studies, DeepMind’s GraphCast beat the leading European physics model on 90% of 1,380 verification targets for forecasts ranging from three to ten days, delivering results in under a minute. This achievement stemmed from training on decades of structured reanalysis data, which had well-understood physical constraints and stable measurement processes. In short, the domain provided the model with valuable signals. This lesson applies broadly: when data are plentiful, consistent, and connected to governing dynamics, the benefits of learning are significant and rapid. That’s the essence of sector-specific AI.

The adoption rates illustrate the same story. Across the European Union, information and communications firms led AI use at 48.7% in 2024, followed by professional, scientific, and technical services at 30.5%. Adoption rates were lower in other sectors, highlighting differences in how well tasks match available data. UK business surveys present a similar picture: about 15% of firms reported using AI in late 2024, with adoption increasing alongside firm size and digital readiness. Global executive surveys show another layer: many organizations claim to be "using AI" somewhere, but the actual use is primarily in IT and sales/marketing, not in the complex, data-scarce areas of each sector. Sector-specific AI doesn’t spread like a single product; it expands where data, incentives, and measurement are aligned.

Why financial time series breaks the hype

Finance is where the idea that “AI = ChatGPT” causes the most damage. Equity and foreign exchange returns exhibit heavy tails, clustered volatility, and frequent regime changes—factors that render simple pattern-finding unreliable. The signal-to-noise ratio is low, labels change because of market perceptions (prices move because others believe they will), and feedback loops can reverse correlations. Recent studies clarify this issue: careful analyses find that language-model features generally do not beat strong, purpose-built time-series baselines. In many cases, simpler attention models or traditional structures perform just as well or better at a much lower cost. This isn’t a critique of AI; it’s a reminder that sector-specific AI for markets must begin with the data-generating process, not the latest general-purpose model.

What works in weather or image recognition doesn’t translate directly to forecasting returns. Weather models benefit from physics-consistent data with dense, continuous coverage. Corporate earnings, yields, and prices fluctuate due to policy changes, accounting adjustments, liquidity pressures, and narratives that affect risk pricing. Advanced models in finance can assist by nowcasting macroeconomic series from mixed data, classifying the tone of news, and identifying structural breaks, but the objectives differ. A trading desk cares less about root mean square error on tomorrow’s price and more about drawdowns, turnover, and tail risk during stress periods. This requires sector-specific AI that combines causal structure, reliable features, and stringent controls for backtesting and live deployment. If the benchmark is whether it surpasses a well-tuned seasonal naive or a hedged factor model after costs, many flashy systems fall short. That isn’t a failure of AI; it reflects the nature of finance.

Sector-specific AI needs local metrics, not generic demos

The quickest benefits from sector-specific AI come when evaluations align with the job to be done. In meteorology, the goal is timely, location-specific forecasts on variables that impact operations; benchmarks reward physical consistency and accuracy across different times. That’s why the GraphCast work—and hybrid systems that combine it with ensemble methods—are significant to grid planners and disaster response teams, not just to machine learning experts. The technique, data, and impact metric all align. In health imaging, sensitivity and specificity, depending on the condition and scanner type, matter more than polished fluency. In manufacturing, defects per million and scrap rates determine success, not flashy presentations. Sectors that establish these local metrics see real compounding benefits from AI.

Financial markets require an even stricter approach. A credible sector-specific AI roadmap starts with governance: controlled data pipelines, baseline econometrics, and pre-registered backtesting protocols that penalize overfitting. It then focuses evaluations on finance-specific outcomes: probability of failure under stress, realized Sharpe ratio after fees and slip, turnover-adjusted alpha, and worst-case liquidity scenarios. This viewpoint explains the gap between firms stating "we use AI somewhere" and those saying "we trust an AI signal in real time." Business surveys show widespread experimentation—78% of firms reported AI use in at least one function in 2025—but not widespread transformation. In finance, trust will increase when developers acknowledge the noise and start with the right benchmarks. Sector-specific AI works when it optimizes for the metrics that the sector already uses.

What educators, administrators, and policymakers should do next

Educators should teach sector-specific AI as a skill grounded in domain data. This begins with projects that use real sector datasets and metrics. A finance capstone should connect students with anonymized tick or macro datasets, run competitions against seasonal naïve, ARIMA-GARCH, and transformer models, and assess based on out-of-sample risk and costs, rather than classroom-friendly accuracy. A public-sector project should simulate casework prioritization or fraud detection, focusing on fairness, false-positive costs, and auditability from the start. An energy systems project should optimize fleet dispatch based on weather forecasts and price volatility. The core message is clear: the sector defines the loss function, and the model adapts accordingly. OECD analysis indicates that sectoral AI dynamics differ significantly; curricula should reflect that reality, rather than compress it into a single "AI course."

Administrators should also invest in sector metrics. In universities and research hospitals, purchases should require direct validation based on outcomes important to the unit—such as critical sensitivity and workload effects in radiology —rather than broad natural language processing benchmarks. In business schools and engineering programs, computing resources should connect to reproducible methods and solid baselines, rather than just parameter counts. In finance labs, live-trading environments should be separated from model development and subject to strict change controls. For many institutions, the first step is straightforward: improve the data management. UK and EU business surveys show that AI adoption increases with digital maturity; companies with good data management and security gain more tangible benefits from AI than those that skip the basics. Sector-specific AI relies on clean data.

Policymakers should create regulations based on sector needs, not a one-size-fits-all approach. Generic rules regarding "AI systems" overlook the actual risk landscape. Financial markets require model-risk management, record-keeping, and post-trade auditing. Health care needs documentation of training groups, site-to-site testing, and commitments to real-world performance. Critical infrastructure needs stress tests for rare events. International organizations are starting to recognize these differences as they assess sectoral AI use in manufacturing, finance, and government; the most effective frameworks relate controls to impacts and error costs rather than vague capability labels. In short, regulate the interface between model errors and human welfare where it occurs.

The counterargument is familiar: if models improve continuously, won’t ChatGPT-like systems soon handle everything? Progress is real, and overlaps will occur. However, the immediate path to impact relies on aligning with sector needs. Even in areas with significant breakthroughs, improvements stem from tailoring architecture and data to the task. Weather AI’s success wasn’t about chatbots; it was about domain knowledge. Finance will eventually reach its own breakthroughs, but they will involve effective risk management and improved hedging, rather than a general model extracting alpha from random noise. Since incentives vary by sector, the adoption curve will also differ. The right approach is not to wait for a single, universal solution; it’s to build according to the unique needs of each domain now.

The 13.5% overall adoption compared to nearly half in information and communications was never just a number. It illustrates how sector-specific AI spreads. When data are organized, outcomes are clear, and metrics are relevant, AI evolves quickly. In contrast, when data are chaotic, outcomes are uneven, and metrics are flawed, it stalls or even fails. Finance serves as a warning: time series are complex, rich in feedback, and resistant to pattern-finding that lacks a foundation in risk economics. The takeaway isn’t to lower expectations. It’s to teach, invest, build, and regulate as if AI encompasses many things—because it does. Suppose educators prepare builders who start with the data-generating process. In that case, administrators invest based on sector metrics, and policymakers regulate the impact of errors on people and capital. This approach will achieve the desired benefits alongside the necessary safeguards. This is the route out of the "AI = ChatGPT" trap and toward effective sector-specific AI based on the needs of each field.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

DeepMind (2023). GraphCast: AI model for faster and more accurate global weather forecasting. Retrieved November 14, 2023, from DeepMind blog; see also Lam, R., et al. “Learning skillful medium-range global weather forecasting,” Science, 382(6673), eadi2336.

Eurostat (2025). Use of artificial intelligence in enterprises—Statistics Explained (data extracted January 2025). European Commission.

McKinsey & Company (2024). The state of AI in early 2024: Gen AI adoption. McKinsey Global Survey.

McKinsey & Company (2025). The State of AI: Global survey. (March 12, 2025).

OECD (2025). “How do different sectors engage with AI?” OECD Blog, February 13, 2025.

OECD (2025). Governing with Artificial Intelligence: The State of Play and Way Forward in Core Government Functions (Media advisory and report). September 18, 2025.

Office for National Statistics—UK (2024). Business insights and impact on the UK economy, October 3 2024 (PDF).

Office for National Statistics—UK (2025). Management practices and the adoption of technology and artificial intelligence in UK firms, 2023, March 24, 2025.

Tan, M., Merrill, M. A., Gupta, V., Althoff, T., & Hartvigsen, T. (2024). “Are Language Models Actually Useful for Time Series Forecasting?” NeurIPS 2024 (conference paper and arXiv).

Xu, D. J., & Kim, D. J. (2025). “Modeling Stylized Facts in FX Markets with FINGAN-BiLSTM.” Entropy, 27(6), 635 (discussion of volatility clustering).

Yan, Z., et al. (2025). “Evaluation of precipitation forecasting based on GraphCast.” Scientific Reports (Nature).