When Money Becomes a Network: Why Token Network Effects Will Decide CBDC Success

Input

Modified

CBDC success depends on token network effects, not cash-back incentives Merchant acceptance and interoperability tip usage Design rails and transparency—not subsidies—win

The most critical fact in payments today is not a rate, a pilot, or a protocol. It is the scale curve that appears when a system reaches a critical mass of users and merchants. India’s UPI handled over 20 billion transactions in August 2025 alone. Brazil’s Pix processes millions of payments daily and sets records on peak days. China’s e-CNY has recorded ¥7 trillion in cumulative transactions across 17 regions. These figures reflect real performance. They show token network effects at work: each new user adds value for the next, and each new merchant reinforces the system. If we evaluate central bank digital currency (CBDC) concepts in environments that limit these effects, we will develop misguided policy. The key question is no longer “Will people switch without strong incentives?” It is “How do we reach a tipping point so the network supports the switch for us?” The solution lies in design, not giveaways. Design means creating for networks from the start.

Rethinking Adoption: Token Network Effects Beat One-off Incentives

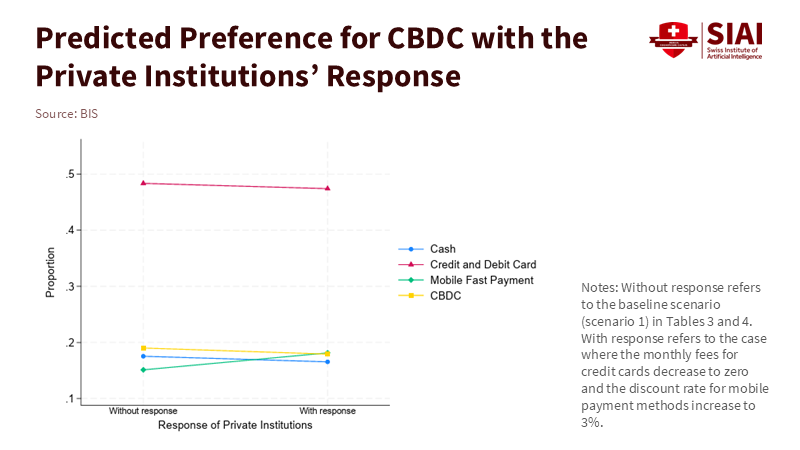

CBDC pilots often ask people to compare a new payment method to cards, cash, or mobile apps. While that seems straightforward, it separates the economy into isolated choices. Payments operate in two-sided markets. What we “prefer” often depends on who else accepts the method and what they are charged. The classic theory is straightforward: in two-sided platforms, the structure of prices and participation on both sides drives adoption more than the price levels by themselves. A small incentive for users doesn’t provide much insight into whether merchants are missing or if acceptance is inconsistent. As acceptance improves, even fees can rise while usage continues to increase because the alternatives become less appealing. This is precisely what happened with cards. Merchants bear most of the economic burden. Yet cards prevail at the point of sale because network participation resolved the chicken-and-egg problem first. CBDC trials that keep one side weak—such as having a limited number of merchants, short time frames, or little interoperability—will underestimate future demand at scale.

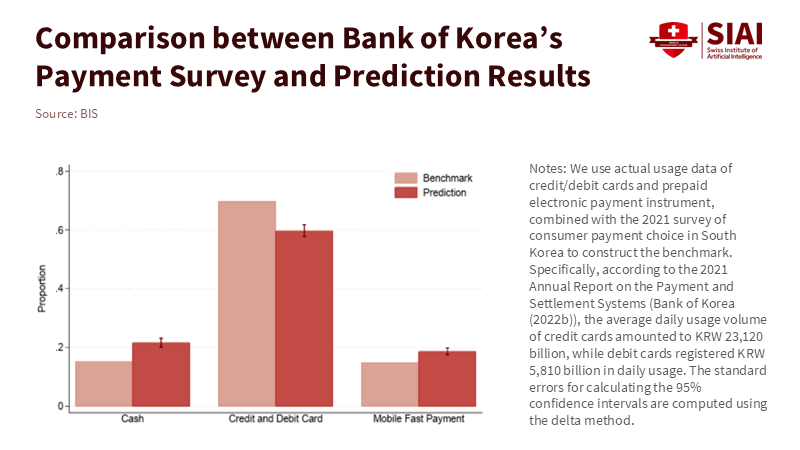

Korea illustrates this trap. Surveys show that cards still lead, with credit cards accounting for about 46% of transactions, cash around 16%, and mobile cards roughly 13%. This might lead us to assume a token form of public money would lag behind cards without significant incentives. However, the real preference in Korea’s market is different: cash usage at point-of-sale dropped to about 7% in 2024, mobile wallets are widely used, and real-time infrastructure has existed for decades. A well-designed token that integrates with the same merchant systems, enables instant settlement, and reduces reversal risk does not compete against a vague fondness for plastic. It competes against the established habits of networks that rely on plastic. The answer is not to incentivize users. It is to create a network that feels “always on” for both sides and then let the positive effects multiply.

Evidence in the Wild: Token Network Effects at Scale (UPI, Pix, e-CNY)

If token network effects were just a theory, we should proceed with caution. They are not theoretical. UPI is the clearest example. It is a neutral protocol that allows any licensed provider to connect. Banks, wallets, and apps came together to unify the QR and alias space, enabling network growth to feed on itself. By August 2025, UPI reached 20 billion transactions in just one month, with 688 active banks. Once that growth curve took off, further adoption required reliability, a simple user experience, and interoperable identifiers, rather than subsidies. Two years ago, many wondered if users would abandon cards. They did when the network expanded to reach stalls and small shops everywhere. This shift was not ideological; it was a matter of accessibility.

Pix in Brazil followed a similar path. The central bank established standards, fraud prevention tools, and alias directories. Acceptance surged in retail, peer-to-peer, and bill payments. Daily transactions now typically reach nine figures, with peaks much higher. The key takeaway is not that Brazil is unique. A public network with low latency and wide acceptance can significantly change usage patterns in under five years when it serves as the main product. Countries that hesitate to scale the network while waiting for perfect features miss valuable opportunities.

China’s e-CNY teaches a second lesson. Tokenized public money can only succeed if it utilizes existing acceptance networks. The pilot includes municipal services, transportation, tourist venues, and educational payments. This is not a simple “coupon.” It is a way to increase merchant-side density. By June 2024, cumulative e-CNY transactions reached ¥7 trillion. This figure is less important than the mix of transactions: many occur in everyday, high-frequency settings where users prioritize speed and acceptance over branding. Network effects thrive in the mundane routines of daily life, and that is where CBDC must thrive as well.

Building CBDC for Ignition: How to Engineer Token Network Effects

The design task is to shorten the path to critical mass. Start with merchant systems. Most pilots focus too much on consumer wallets. Merchants provide the necessary surface area for network effects. The public network should ensure simple and open acceptance: a single QR standard, a unified alias layer, and apparent, tiered compliance. If three QR codes sit on a counter, none will dominate the network. Merchant onboarding must happen “same-day,” with settlement rules that eliminate reconciliation issues. History shows that merchants will invest if the network generates sales and predictability. A token rail should flip that: offer predictable settlement, lower dispute costs, and instant funds. This shift will change the conversation around fees from resistance to trade-offs.

Second, anchor the system in interoperability. Users do not care whether a payment was made using “CBDC” or account money. They just want it to work. This is why India’s UPI and Brazil’s Pix scaled effectively. Open APIs allow various contributors to compete on the same level playing field. For CBDC, this means creating a tokenized platform where central bank liabilities, commercial bank money, and government securities can coexist. By treating programmability as policy hooks—not passing trends—new use cases can arise without fracturing the base. The BIS's 2025 blueprint emphasizes this: maintain reserves, deposits, and bonds at the core of a tokenized platform to support both “old” and “new” markets. It is not merely a coin. It is a network framework.

Third, leverage acceptance mandates in the public sector to speed up density. When public services like transit, utilities, taxes, and school fees adopt the token rail, the network shifts from peripheral to primary. China’s e-CNY pilot followed this strategy, as did earlier card networks that gained traction when large billers and public services signed on. While you do not have to mandate retail acceptance, you should target the most frequent and reliable payment channels and allow habits to form from there. Once the top 10 everyday categories embrace it, the positive effects will carry over to others.

Finally, establish guardrails. Fraud is a reality in any growing network. Pix’s surge led to an increase in scams, so Brazil’s central bank introduced refund protocols and improved alias management. The goal is not to expect zero fraud but to equip the network for fast and transparent recovery while publicizing results. This builds trust as the network scales. Trust itself becomes a network effect, growing each time the system resolves an issue in hours rather than weeks.

Anticipating Critiques—and the Evidence

“Cards already solved this. Why add a token?” Because cards are built on a closed set of bilateral contracts, this leads to high dispute and interchange costs. The economic burden falls on merchants, who fund rewards and risk. This approach only worked after the cards established their own network. Even then, regulators took years to eliminate restrictions like no-surcharge rules. A public token rail can ensure consumer protection while simplifying and reducing the dispute risks for merchants. This is a welfare gain, not just a duplication.

“Users won’t switch without cash-backs.” Perhaps in the short term. However, networks can change habits over time. In the United States, cards gained dominance because acceptance reached near universality, not merely because every card offered more than cash. Federal Reserve surveys show cards leading by transaction share, while money has dropped to about 14% in 2024. Once a payment method is everywhere, people will use it—even without rewards—because the costs of searching and cognitive load decrease. With CBDC, the aim is not to outbid rewards schemes. It is to outperform in connectivity.

“Scale is risky; fraud will increase.” Yes, scale does attract fraudsters. But network design can mitigate this risk. Brazil’s central bank has expanded special refund mechanisms and strengthened alias checks as Pix has grown. The fraud share in the US card system decreased even as transaction volumes rose in 2024, thanks in part to changes in network rules. The lesson is clear: prepare for abuse from the start, share metrics transparently, and respond quickly. Network effects in security are real; as more participants monitor and respond, the baseline improves.

What to Do Now: A Network-First Policy Playbook

The policy shift is to design CBDC as a network good from the beginning, not as an isolated product. This starts with acceptance. Government ministries should transition regular public payments—such as transportation, fees, benefits distribution, and small-value purchases—to the token rail under clear consumer protection rules. This will create high-frequency anchors that normalize the system. Regulators should mandate open QR and alias interoperability among banks and wallets, supported by visible certifications and penalties for closed systems. A national acceptance fund should subsidize onboarding and compliance tools for small merchants, rather than offering cash-backs to end users; the latter wastes money without developing rails, while the former increases the value of each new user for the next.

Supervisors need to publish quarterly data on adoption, latency, failure rates, fraud incidents, and refund timelines. UPI and Pix grew because users trusted that the system would perform. In CBDC, trust will depend more on substantial operational data than on speeches. Finally, central banks should expand on the tokenized platform concept by establishing shared standards so that deposits, CBDC, and tokenized government bills can move seamlessly. This enables programmable settlement for payroll, education vouchers, and municipal procurement—high-frequency, routine scenarios that strengthen the network without speculative hype.

For educators and administrators, the implications are clear. Schools should be among the first public entities to adopt the token rail for fees and disbursements, as they handle thousands of small, predictable payments and refunds. This will encourage families to maintain an active wallet and provide the rail with a steady source of daily volume. Procurement for school meals and local services can follow, with instant settlement reducing the financial burden for small vendors. In parallel, education ministries can test conditional, programmable grants for schools that only settle when specified conditions are met, easing reconciliation burdens while maintaining oversight. The goal isn’t a “smart contract” revolution, but a more efficient back office that draws users into the network through straightforward, practical tasks.

For payment providers, the focus should be on service and security rather than fragmentation. The successful players on public token rails will be those that help merchants reconcile more quickly, resolve disputes effectively, and simplify compliance. This is how two-sided markets succeed. For policymakers, guardrails must remain a top priority. Fraud prevention mechanisms, clear redress timelines, and public metrics are essential, not optional. They are the foundation that holds the network together as adoption increases. The faster we demonstrate that losses are infrequent, recoveries are swift, and errors are easy to address, the more users will engage.

Token network effects transformed UPI from a promising concept into 20 billion monthly transactions. Pix evolved from an experiment to a national habit. The e-CNY surpassed ¥7 trillion in total volume by gaining strong support from public-sector institutions. These systems did not succeed because one offered users better rewards than another. They succeeded because the network made each subsequent payment cheaper and more reliable. This is the path for CBDC. Create a payment system that integrates with existing transactions. Make it easy for merchants to accept payments with one tap. Share the numbers that prove the system is reliable and can resolve issues. Let the natural benefits take care of what subsidies cannot. If we focus on the network, public digital money will not have to compete for attention. It will be the choice people naturally make because everyone else has—and because, when it's widely used, it simply works better.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Atlantic Council. (2024). CBDC Tracker (e-CNY cumulative transactions).

Bank for International Settlements (BIS). (2025a). Predicting the payment preference for CBDC: a discrete choice experiment (Working Paper No. 1296).

Bank for International Settlements (BIS), CPMI. (2025b). And so we pay: more digital and faster, with cash still in play (Commentary on Red Book stats).

BIS Annual Economic Report. (2025). The next-generation monetary and financial system: tokenised platforms with central bank money at the core.

Evans, D. S., & Schmalensee, R. (2007). The Industrial Organization of Markets with Two-Sided Platforms. Competition Policy International.

Federal Reserve Bank of Atlanta. (2025). 2024 Survey and Diary of Consumer Payment Choice.

Korea Times. (2025). Credit cards No. 1 payment tool among consumers in 2024, says BOK poll (March 25).

Payments Council & Market Intelligence (PCMI). (2025). South Korea 2025: Payments and