Rethinking US manufacturing productivity: why the “hidden gains” change education policy

Input

Modified

Adjusted deflators reveal hidden gains in US manufacturing productivity The bottleneck is skills, not machines Scale capital-intensive training, stackable credentials, and adult apprenticeships

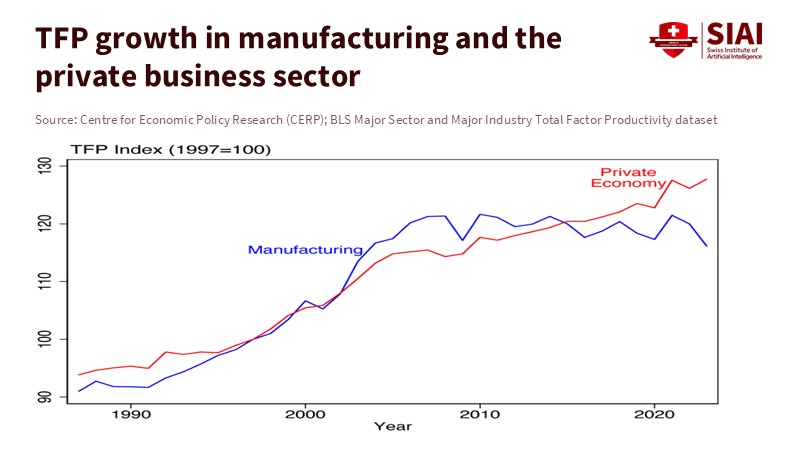

The standard view suggests that US manufacturing productivity has stagnated. However, this argument is becoming harder to support. New estimates suggest that when we adjust the pricing of capital and intermediate goods, the sector’s total factor productivity (TFP) appears much stronger than official figures indicate. Revised estimates roughly double long-run TFP growth in manufacturing to around 1.4% per year since the late 1980s. They also change the narrative of post-2009 stagnation into modest positive growth of about 0.6% annually. This contrasts with an official index that remains below its 2017 level in 2023, contributing to a story of decline. Meanwhile, recent quarterly data reflect positive trends: manufacturing labor productivity increased at a 2.5% annualized rate in Q2 2025 and 1.6% over the year, marking the best four-quarter gain since 2021. Additionally, capital intensity in the sector reaches a record high. If US manufacturing productivity is indeed higher than we realize, then education policy needs to catch up. The bottleneck is now in the pipeline for skills, credentials, and teaching capacity—not in technology. It's crucial that we align our education policies with the evolving needs of the manufacturing sector, and this is where your roles as policymakers and educators become urgent and essential.

US manufacturing productivity is higher than we think

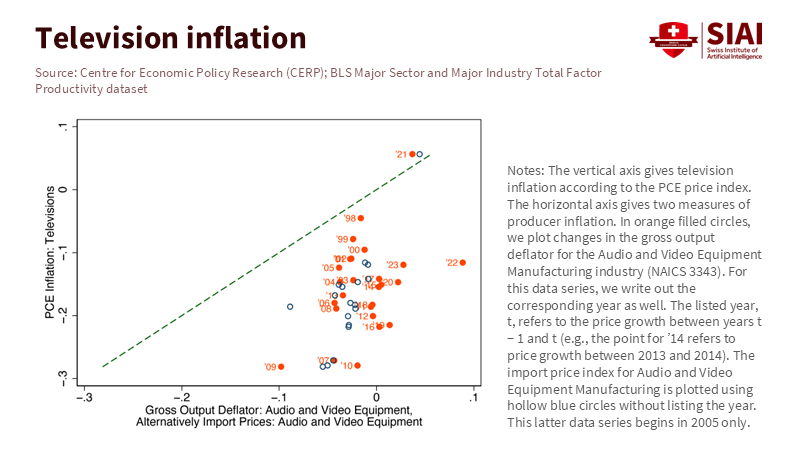

The previous perspective viewed the weak official productivity numbers as evidence that factories had run out of ideas. New evidence instead points to a measurement issue that has policy implications. Official deflators for producer prices have not kept up with rapid quality improvements in capital-heavy and electronics-intensive industries. When we apply alternative price signals that better reflect quality changes, the situation changes. Long-run TFP growth in US manufacturing is closer to 1.4% annually, rather than 0.6%. Consequently, after 2009, the sector did not show signs of stagnation; it actually experienced growth of about 0.6% a year. This effect is particularly significant in computers and electronic products, where adjusted TFP growth is around 10% annually, compared to approximately 4% in official figures. This adjustment does not erase the post-2000 slowdown, but it reframes it. The slowdown appears less severe against a higher base level of efficiency. This higher base necessitates a stronger response from the education sector.

The Solow lens provides insight into why this matters. In a simple model, output increases with labor, capital, and a residual known as TFP. If we overstate capital input growth due to underreporting quality-adjusted price declines in equipment and intermediate goods, we also underestimate the residual. This is what new research has discovered. The official TFP index for US manufacturing stood at 97.8 in 2023 (2017=100). Many interpreted this as evidence of decline. Yet in 2025, we also observe cyclical improvement in labor productivity. In Q2, manufacturing output per hour increased at a 2.5% annualized rate, marking the most substantial four-quarter change since 2021. This conveys a straightforward message for education: firms are not struggling to advance the technology curve; they may be progressing faster than we assume. Our human-capital systems must not lag behind the capital deepening that we now measure more accurately.

Translating US manufacturing productivity into education choices

If US manufacturing productivity is understated, the real economy is more capital-intensive than our data suggest. Capital-intensive workplaces require workers who can operate, maintain, and enhance complex systems. This shifts what classrooms and labs must deliver. Community colleges and technical institutes are already moving in this direction. National Student Clearinghouse data reveal total postsecondary enrollment rising by 3.2% in spring 2025 compared to spring 2024, with community colleges up 5.4% and vocational-focused public two-year institutions up nearly 20% since spring 2020. This recovery is not a side issue; it forms the backbone of a skills strategy that aligns with modern factory equipment. Programs in mechatronics, industrial automation, CNC, robotics, and quality systems must expand, because the additional worker now adds value by increasing machine uptime, yield, and energy efficiency, rather than replacing machines. Your investment in technical education and apprenticeships is crucial and will significantly contribute to the growth and development of the manufacturing sector.

Apprenticeships are also on the rise. The United States had around 680,000 active registered apprentices in FY2024, more than double the number from a decade ago, with completers up 143% over the same period. These figures should be part of manufacturing policy and are not limited to the building trades. The average apprentice is no longer a teenager; mid-career professionals are turning to paid training to enter high-demand roles. Colleges and employers should strengthen pathways so that a Level 2 apprenticeship in industrial maintenance leads directly into an associate degree and recognized micro-credentials. State systems can facilitate this through credit guarantees for national standards, waivers for lab fees tied to progress, and instructor externships at advanced plants. These strategies minimize obstacles and help US manufacturing productivity gains translate into improvements in wages, safety, and company viability, rather than just surface-level data.

A policy playbook for US manufacturing productivity

The first step is to align funding with the actual costs of capital-intensive instruction. Fields such as mechatronics, process control, and advanced machining require costly equipment and materials. Standard per-student funding formulas often fall short. States should establish equipment and maintenance funds designated for high-cost manufacturing programs, connecting them to utilization and industry collaboration. Instructors need time off for machine setup and curriculum updates. Without this support, programs lag behind the production standards. Additionally, since new productivity often centers on software, labs must treat software as capital. This includes needing budgets for licensing software related to PLC programming, digital twins, SPC tools, and AI-assisted quality. BEA accounts indicate continued growth in investment in intellectual property through 2024–2025. Programs that teach skills related to this growth will help students enter higher-paying jobs quickly.

Next, focus on credentials that address bottleneck areas. Employers identify specific needs: line integration, maintenance technicians who can read P&IDs and troubleshoot ladder logic, quality leads who can create Gage R&R plans, and technicians who can fine-tune robots and vision systems. Colleges should offer manageable, stackable lesson sets that last weeks rather than semesters, are credit-bearing, and are linked to paid work. States can enhance funding for manufacturing programs that successfully place graduates in jobs within six months by using automation, energy management, and digital quality. Workforce boards should reserve apprenticeship incentives for employers who give opportunities to career changers and rural learners, not just recent high-school graduates. None of these mandates a reliance on a single technology; it requires investing in demand for workers who can increase throughput, reduce waste, and keep machines operating smoothly. If the new measures hold, that demand is likely to be consistent.

Answering the skeptics on US manufacturing productivity

One criticism is that the recent productivity gains are merely cyclical fluctuations. The data do reveal some variability from quarter to quarter. However, the four-quarter increase in manufacturing productivity through Q2 2025 is the strongest since 2021. While this does not confirm a new trend, it contradicts the idea of persistent stagnation. Another critique suggests that the “hidden gains” stem from simply switching from consumer to producer price indexes. Although this concern is valid, the evidence is thorough. The correction compares price measures across similar product categories and adjusts for import content using the BEA input-output tables. The discrepancies are most significant in areas experiencing rapid quality changes, like computers and electronics. When the correction is applied, long-run manufacturing TFP roughly doubles, and the post-2009 period shifts from slightly negative to clearly positive. Although the slowdown persists, the overall level is higher. This is crucial for planning programs and capacity.

A third concern is that computers and electronics represent a small fraction of the manufacturing sector, so their rapid changes shouldn’t dictate policy for the entire field. Two points counter this argument. First, linkages are real. Electronics and software have become integral across machinery, vehicles, medical devices, and process industries. Gains in one area spread through supply chains via components, controls, and methods. Second, even outside electronics, official producer deflators often overlook quality improvements in specialized capital and intermediate goods. Research from the New York Fed shows that measured labor-productivity growth in manufacturing averaged -0.5% annually from 2010 to 2022, a significant slowdown that has puzzled analysts. The “hidden gains” research helps clarify part of that puzzle by adjusting the level where quality corrections are most necessary. It does not claim to have solved the problem; it suggests we should stop designing education for a sector that we think is stagnant. Instead, we should develop it for one that is evolving.

Some also argue that pushing more students into manufacturing programs is risky because the sector “no longer creates good jobs.” This perspective is outdated. Apprenticeship positions and completions have increased significantly. Vocational-focused two-year colleges have led the enrollment rebound since the pandemic, with double-digit growth since 2020. Employers continue to seek candidates for maintenance, automation, and quality roles that remain vacant, even when starting wages surpass local market levels. Students are making their choices clear. In well-equipped and well-taught programs, placement rates remain strong. The appropriate response is not to deter learners away. Instead, it is to expand program capacity, align offerings with plant technology, and reduce the time and financial burdens of re-skilling for adults. This is the only way to convert measured productivity into broader opportunities.

Finally, some fear that emphasizing US manufacturing productivity in education policy will limit other priorities. It should not. The agenda is practical and local: better equipment budgets, smarter credentials, closer ties with employers, and meaningful credit for apprenticeship learning. These investments enhance student completion and earnings, even if graduates transition into energy, logistics, or healthcare manufacturing supply chains instead of traditional factory roles. They also prepare teachers to instruct on systems that drive improvements across various sectors: sensors, controls, data, and safety. When we invest in these capabilities, we also increase the chances that federal and state industrial policies lead to local human capital improvements rather than lost opportunities. This is a wise choice for any economy, and it becomes critical if the data indicate the sector’s efficiency is better than we thought.

We built a policy narrative on a weak foundation: that US manufacturing productivity was stagnant. The revised perspective reveals hidden gains. Corrected TFP grows faster over decades and remains positive after 2009. Quarterly data shows immediate progress. Capital intensity has reached a record high. This should change how we invest in people. The objective is not to chase every new machine. Instead, we need to expand the programs that enable workers to improve uptime, decrease waste, and safely operate digital and automated lines. This requires dedicated funding for equipment, stackable and credit-bearing credentials, more paid apprenticeships for adults, and faculty who split their time between labs and factories. If we accomplish this, the “hidden” productivity will manifest in increased earnings, safety, and regional resilience—not just updated charts. We can treat the new evidence as a mere statistical note or use it to create faster, fairer pathways into the jobs produced by a capital-intensive sector. The latter option is the superior choice, and now is the time to make it.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Atalay, E., Hortaçsu, A., Kimmel, N., & Syverson, C. (2025). Hidden growth in US manufacturing productivity. VoxEU, 13 October 2025.

Atalay, E., Hortaçsu, A., Kimmel, N., & Syverson, C. (2025). Why Is Manufacturing Productivity Growth So Low? Becker Friedman Institute Working Paper 2025-127.

BLS. (2025). Productivity and Costs, Second Quarter 2025, Revised (USDL 25-1343).

BLS via FRED. (2025). Manufacturing Sector: Capital Intensity (MPU9900082).

BLS via FRED. (2025). Manufacturing Sector: Total Factor Productivity (MFGPROD).

National Student Clearinghouse Research Center. (2025). Current Term Enrollment Estimates, Spring 2025.

National Student Clearinghouse (News). (2025). Vocational-focused public two-years lead enrollment rise.

New York Fed, Liberty Street Economics. (2024). The mysterious slowdown in US manufacturing productivity.

US Community College Daily. (2025). New stats on registered apprenticeships

Comment