When Data Finds the Hidden Reasons We Save

Input

Modified

Bequests and risk largely drive why households save and work Factor thinking reduces student signals to cashflow, care, schedules, and family transfers Design aid to smooth risks and protect family reserves with fast, income-based plans

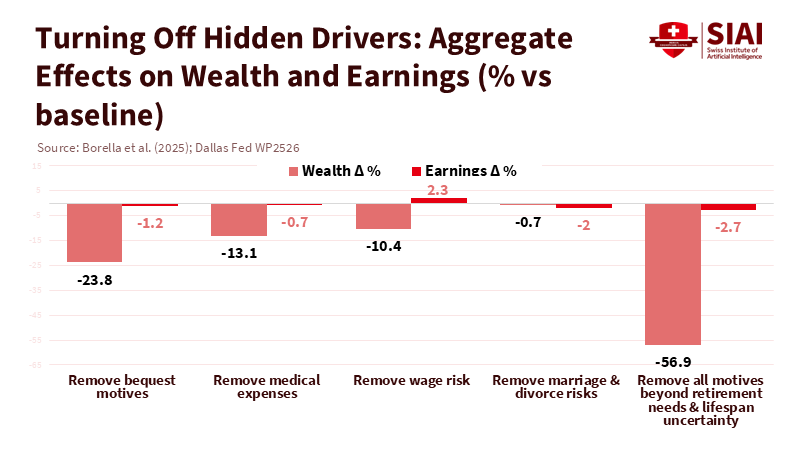

In a recent life-cycle model using US microdata, the removal of households' bequest motives alone results in a staggering 24% reduction in total wealth. It also leads to a 1% decrease in total labor earnings. If we strip away all saving motives except for basic retirement needs and lifespan uncertainty, the wealth drop is a substantial 57%, with earnings decreasing by nearly 3%. These figures, far from being mere speculation, are derived from a model based on actual behavior and counterfactuals that examine risks one at a time, such as wage shocks, medical expenses, marital changes, and the desire to leave an estate. In essence, the hidden factors economists have long suggested—bequests and risk exposure—are significant enough to alter the national balance sheet and influence labor supply. For education leaders working on aid design, scheduling programs for adult learners, or timing tuition bills with family cash flow, these figures are not just numbers. They reveal that underlying motives can be quantified and have a tangible impact. Policies that overlook these motives are likely to miss their objectives.

What Factor Analysis Really Does

Factor analysis is the cornerstone that statisticians rely on when observable variables appear complex, but an underlying narrative is more straightforward. It doesn't predict a specific outcome; instead, it condenses many observed measures into a few underlying dimensions that move in unison. Consider six course grades: math, science, English, Greek, literature, and Latin. We anticipate clusters: the language arts group (English, Greek, literature) will likely correlate; math and science usually track each other; and Latin might connect both areas due to its formal grammar and vocabulary that requires memorization. A typical exploratory factor analysis (EFA) would likely identify two or three hidden factors—let's call them "language mastery," "quantitative reasoning," and perhaps "formal logic"—that explain most of the shared variation in those course grades. The labels are our choice, but the data's covariance structure does the heavy lifting: it shows what moves together and how strongly. This practical application of factor analysis empowers us to interpret complex data in a manageable way.

This same logic applies to social science and policy. Families report many observable outcomes—income, hours worked, net worth, out-of-pocket medical expenses, marriage and divorce histories, and expected inheritances. Many of these outcomes move together due to hidden forces: the risks households face (wages, health, longevity), their preferences (risk aversion, care for heirs), and their limitations (human capital, childcare, access to credit). A pure factor model would summarize the covariance across outcomes using a few hidden dimensions and loadings. In practice, economists often take it a step further. They build structural models—specific life-cycle decision frameworks—so they can run counterfactuals that "switch off" specific shocks or motives. While this isn't textbook factor analysis, it is still a factor-related activity in spirit: we observe behavior, infer the unseen factors influencing that behavior, and measure their impact while controlling for everything else. When done well, this helps us speak in clear policy terms: "If bequest motives disappeared, wealth would drop by about a quarter."

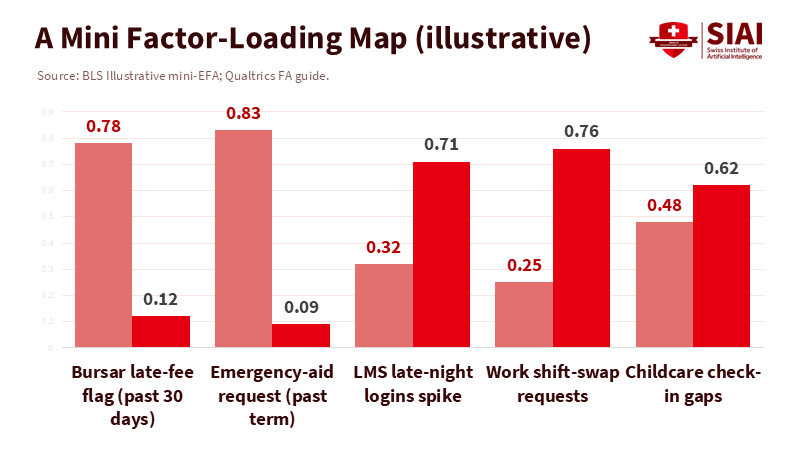

For educators and administrators, the benefits should be clear. Factor analysis helps us interpret scattered indicators—attendance drops around specific dates, unpaid bills, shifts to part-time status, increases in emergency aid requests—into a manageable set of actionable factors: cash flow risk, caregiving challenges, unstable work schedules, and expectations about family support. You don't need to conduct a maximum-likelihood EFA in-house to adopt this mindset. We simply need to ask: Which hidden pressures are clustering behind the symptoms we see, and what straightforward measures would alleviate those pressures? That bridges the gap from statistics to scheduling and connects the dots to real students.

What the New Evidence Reveals—and Why It Matters Now

The latest research presents two pertinent claims for education policy. First, the motives we learned about in theory are not just empty concepts; they show up as significant in the data. In a 2025 working paper and related presentations, Borella, De Nardi, Yang, and Torres Chain analyze a comprehensive life-cycle model based on US data and conduct counterfactuals. When they remove bequest motives, total wealth drops by 23.8% and total earnings decrease by 1.2%. When they remove the risk of medical expenses, wealth falls 13.1% and earnings decline 0.7%. When they remove wage risk, wealth drops 10.4%, but earnings increase by 2.3% because more stable wages lead people to save less and change their work patterns. Turning off marriage and divorce dynamics produces varying effects by group, but roughly balances out as a whole. These are hidden drivers that help explain how people save and work at different ages and in various family situations. This evidence sheds light on the real-world implications of these hidden motives, offering a deeper understanding of economic behavior.

Second, bequest motives are not just a relic of past debates—they remain essential in contemporary data. Other evidence using changes in health news shows that bequest intentions are strong enough to influence transfers for many individuals; when mortality risk becomes apparent, planned bequests and gifts adjust in ways that simple consumption smoothing cannot explain. In European data, the reluctance to deplete wealth in retirement appears tied to bequests rather than just precaution, echoing older findings with improved measurement. Furthermore, new studies suggest that expectations of receiving an inheritance lead to reduced current savings, indicating that family transfers influence behavior well before retirement. For higher education, this means many students—and especially adult learners—come with not only income constraints but with expectations of family support that affect their willingness to borrow and how they respond to tuition timing.

What should education systems do with this understanding? First, recognize that risk is not evenly distributed among students, and the relevant risks align with those affecting household finances: wage volatility, medical expenses, and relationship changes. A nursing assistant who loses hours when census numbers drop does not just face a minor issue; their wage risk presents a significant challenge to their financial stability for the semester. An emergency surgery can quickly turn a stable plan into debt. A breakup can dismantle a two-income plan overnight. The macro evidence showing that eliminating wage risk raises earnings by about two percentage points in an imagined scenario highlights that smoothing risk—even slightly—can change schooling and work choices broadly. In practical terms, this suggests predictable payment plans, quick access to emergency funds within 48 hours, and automatic grace periods to accommodate fluctuations in clinical or seasonal work. These initiatives are not handouts; they serve as risk insurance, and the life-cycle models suggest they should improve student persistence with minimal fiscal impact.

Bequest motives add complexity to the situation in beneficial ways. Families that prioritize leaving an estate often want to avoid selling assets or taking on new debt, even when doing so might make financial sense. In the overall model, removing bequest motives reduces wealth by about a quarter, indicating that many households intentionally carry assets forward. For aid design, this warns against policies that assume liquid wealth suggests the ability to pay. A home equity line is not a neutral tool for a family focused on leaving bequests; using it to pay tuition might be resisted more strongly than relying on current cash flow. Aid offices should therefore distinguish between liquidity and wealth and tailor their offers—with options like deferred tuition for students with steady but seasonal incomes, or plans that favor income-based payments over asset liquidation.

The impact of marital transitions is equally actionable. The model's counterfactuals indicate that removing marriage and divorce dynamics results in significant, offsetting changes by group: singles tend to save and work more in a world without marriage, while couples save and work slightly less. This suggests that relationship expectations influence education as well. Programs offering modular credentials, options to pause without penalty, and re-entry pathways make sense if we recognize that households plan education around partnership risks. Advising should normalize the idea that taking a semester off after a divorce filing or following a move for a partner is not a failure; it is a rational response to a hidden challenge that the data indicate is common.

Skeptics might say that structural models depend on calibration choices, and the results can vary widely. This critique has merit in general, but it is less convincing here for two reasons. First, the trends and general figures in the 2025 results align with external evidence: bequests appear in quasi-experimental research and in European retirement studies; wage and medical risks dominate every serious analysis of saving behavior. Second, the counterfactual approach gives policymakers the clarity they need. A factor-related question like "how much of observed wealth can be explained by bequest motives?" is distinct from "what is the specific coefficient on risk aversion?" and more helpful in designing programs. If switching off one motive causes wealth to shrink by a quarter, we should plan as though many families will resist strategies that undermine that motive.

Another argument is that college finance focuses on young people, while bequests matter later in life. The evidence disputes that idea. First, the 2025 model spans the entire life cycle, not just retirement, and shows that risks related to old age and bequests influence how working-age individuals save and work. Second, expectations of receiving an inheritance influence current saving behaviors, including those of young adults and mid-career professionals. Finally, many students are not just 18-year-olds; they are parents, caregivers, and workers who fit into the model's risk categories. This is why emergency aid, flexible scheduling, and income-based payment plans are practical—they address the same hidden factors that guide household decisions in the larger economy.

From Evidence to Action: Designing Risk-Smart Education Policy

We can also learn a practical lesson from the measurement strategy itself. Institutions should create simple "factor dashboards" using the data they already collect: flags for unpaid bills, LMS logins, swipes at childcare centers, requests for schedule changes, and self-reported health issues. The goal is not surveillance; it is efficient inference. Three or four composite indicators—cash flow challenges, care challenges, schedule fluctuations, and expected family support—will explain a surprising proportion of at-risk behavior, just as three academic factors can summarize six course grades. The statistician's trick is to keep the factors stable and clear, then design interventions around them: pre-approved micro-loans that repay from earnings, leave options near clinics, advising scripts that discuss family transfers in an understanding way, and communication that aligns with the preferences of families focused on bequests.

A final point concerns how we communicate with donors and policymakers. For years, we have promoted emergency aid as a moral obligation. It is also economically sensible. When wage and health risks are the main hidden threats, small, quick cash resources greatly enhance persistence because they protect the exact margins highlighted by macro evidence. Similarly, discussions about "intergenerational mobility" should acknowledge that intergenerational transfers play a significant role in household finances. Ignoring bequest motives leads to fragile designs; recognizing them invites choices that respect family goals while keeping students enrolled. This isn't just yielding to emotions; it is aligning policies with the factors the data reveal are essential.

We started with a statistic—a roughly 24% decline in total wealth when bequest motives are removed—that seems like a thought experiment but is actually a data-driven breakdown of household behavior. The broader analysis, taking away risks and motives one at a time, conveys a consistent message: hidden drivers are significant, measurable, and actionable. For education, this is straightforward. If wage, health, and family risks influence saving and work, then tuition schedules, emergency aid, and program design must respond to, not amplify, those shocks. If bequest motives influence how families view liquid assets, aid should focus more on income than on tapping equity, and it should respect households that want to maintain a reserve. The proper test for our policies is similar to the one economists applied to the data: isolate one driver and see what changes. If the result is "retention increases, borrowing anxiety decreases, and schedules stabilize," then we are nudging the system's hidden factors in the right direction. That is what it looks like when statistics turn into strategic action.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Belloc, I., & Molina, J. A. (2025). How inheritance expectations impact household savings (IZA Discussion Paper No. 17695). IZA Institute of Labor Economics.

Borella, M., De Nardi, M., Yang, F., & Torres Chain, J. P. (2025). Why do households save and work? (NBER Working Paper No. 33874). National Bureau of Economic Research.

Borella, M., De Nardi, M., Yang, F., & Torres Chain, J. P. (2025). Why do households save and work? (Dallas Fed Working Paper 2526). Federal Reserve Bank of Dallas.

CEPR. (2025). DP20323: Why do households save and work? Centre for Economic Policy Research.

Kværner, J. S. (2023). How large are bequest motives? Estimates based on health shocks. Review of Financial Studies, 36(8), 3382–3422.

Qualtrics. (2023). Factor analysis and how it simplifies research findings.

VoxEU/CEPR. (2022). The wealth dynamics of retirees in Europe: The importance of bequest motives and precautionary savings.

Comment