The 10-Second Bank Run: Why Payment Speed and Portfolio Diversity Must Be Managed Together

Input

Modified

Instant payments and digital banking have made deposit runs faster than ever Portfolio diversity cushions shocks, but uninsured deposits remain a fragile tail risk Stronger backstops and real-time liquidity are essential to match ten-second money

On March 9, 2023, Silicon Valley Bank lost $42 billion of deposits in a single day, with a further $100 billion queued for withdrawal the next morning—an exit equivalent to roughly two-thirds of its funding base inside 48 hours. Those numbers, once unthinkable outside financial history textbooks, tell us something larger than one bank's failure: run dynamics have shifted from queues at branches to taps on phones. Europe is about to compress that runway further. From January and October 2025, euro-area payment service providers must be able to receive and then send instant euro transfers in ten seconds, 24/7/365, at fees no higher than ordinary transfers, with name-matching checks following soon after. A modern run will therefore travel at the speed of regulation, not rumor alone. The policy challenge is not to slow payments or scold depositors; it is to pair this structural speed with structural resilience. The evidence shows that heterogeneity in balance-sheet duration, funding mix, and hedging absorbs shocks and limits contagion—yet a fragile tail remains when uninsured money bolts. The urgency of aligning "ten-second payments" with "ten-second liquidity" is paramount. If we do not achieve this alignment, we will outsource crisis management to the clock.

Digital speed, analog safeguards

The first reframing is temporal: bank runs are no longer "events" but "processes" gated by infrastructure. Mobile banking, instant transfers, and algorithmically amplified narratives accelerate withdrawals; supervisors from the BIS and national authorities now describe 2023 outflows as two to three times faster than prior episodes, with single-day outflows of 20–30% at some institutions. Switzerland's own post-mortems called Credit Suisse's deposit flight "unprecedented," not because panic is new but because pipes are wider and frictions lower. In Europe, this baseline speed becomes policy with the Instant Payments Regulation (IPR): by January 9, 2025, banks must receive instant payments; by October 9, 2025, they must send them; and by October 2025, they must verify payee names (IBAN-name checks) to curb misdirection and fraud. This is good public policy for commerce and inclusion. But liquidity assumptions built for batch payments and business hours cannot survive a ten-second world. Liquidity coverage, collateral mobilization, and intraday funding access need to become genuinely real-time—measured in seconds, not days—without bluntly throttling legitimate payments.

Deposit behavior has also changed. Euro-area non-cash payments climbed to 77.6 billion in the second half of 2024, with cards and credit transfers dominant and e-money growing. Social media can steer these flows; research using comprehensive Twitter data shows that banks with higher social exposure saw larger valuation hits during the SVB period. Against this, new evidence complicates the caricature of "apps cause runs." An ECB working paper (2025) finds that mobile banking availability and online use do not causally raise volatility in normal times; social media matters mainly in idiosyncratic cases—precisely when misinformation can catalyze a sprint. The policy implication is not to ban speed, but to pre-commit to credible backstops and to strengthen information channels. The role of proactive communication and credible backstops in managing rapid outflows is crucial. Instant payments plus disciplined communications beat slow payments plus rumors every time, providing reassurance and confidence in the system.

Heterogeneity as immunity—and its limits

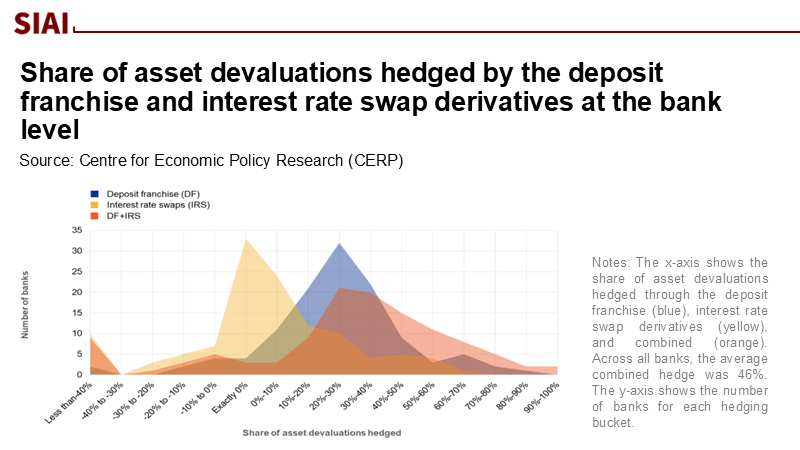

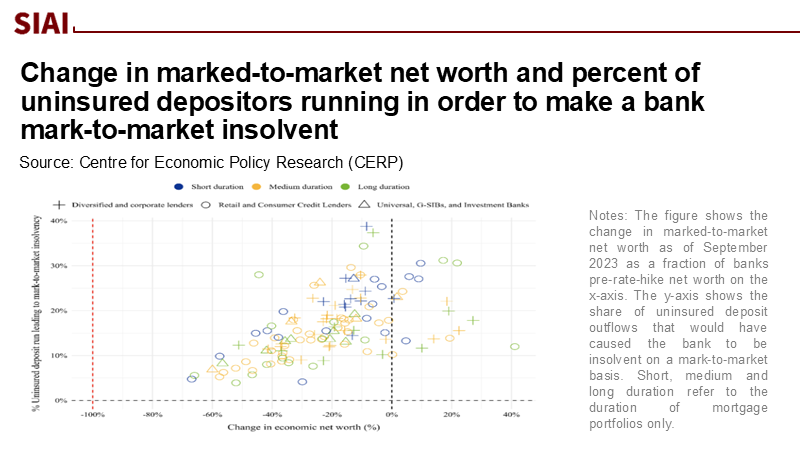

The second reframing is structural. New euro-area evidence from confidential data on 139 banks during the 2022–23 tightening shows the core mechanism: rising rates reduce the market value of long-duration assets, while "deposit franchise" value rises if deposits reprice sluggishly. In the euro area, unrealized losses on loans and bonds held at amortized cost averaged approximately 30% of book equity as of September 2023, with smaller retail lenders being the most exposed due to their long-dated mortgages. Crucially, interest-rate swaps and the deposit franchise offset roughly 46% of those valuation hits on average, and cross-country mortgage heterogeneity meant that some banks' mark-to-market net worth actually improved. Europe's diversity in asset duration, funding mixes, and hedging limited losses and absorbed shocks. That diversity is not a bug; it is a feature. It means one failure is less likely to telegraph another, because balance sheets do not rhyme as tightly.

Yet the same study's run simulations reveal a fragile tail: by September 2023, a 5% outflow of uninsured deposits would have pushed several banks into mark-to-market insolvency; a 10% outflow would have tipped more than two dozen. This is where "ten-second payments" bite: uninsured money can move intraday, before a bank can mobilize collateral or reprice funding. Deposit insurance remains a powerful calm anchor—€100,000 coverage across the EU, with faster payout times—but uninsured and concentrated funding is a cliff. Socially, we should not valorize uninsured deposits as a "sophisticated discipline"; they are a public-good risk amplifier when everyone runs at once. Heterogeneity buys time and dampens contagion; it does not eliminate the need for clear, bright-line liquidity backstops and a standard, credible playbook to distinguish between panic and insolvency in real-time. The need for a standard, credible playbook is crucial to provide clear guidelines and maintain stability in real-time.

The cross-border twist: stablecoins, CBDC, and the education sector's exposure

Digital money does not respect geography. Stablecoins have grown to represent the bulk of crypto transaction volume in parts of Latin America; Chainalysis estimates that by 2024, stablecoins made up roughly 62% of Argentina's crypto transactions amid triple-digit inflation, and Reuters notes fast growth in emerging markets more broadly. Europe's MiCA regime has already brought stablecoin issuers under conduct and reserve rules (phase-in since June 2024). However, in times of stress, cross-border dollar-linked tokens can move faster and further than insured deposits, thereby bypassing domestic payment rails. A future retail CBDC would facilitate transactions at similar speeds, but within the regulatory perimeter. For universities, municipalities, and school systems—the entities that manage payrolls, grants, and student payments within the education sector—these shifts have operational implications. Treasury teams that once watched end-of-day sweeps now face 24/7 liquidity. Vendor and payroll runs can accelerate if rumors circulate about a relationship bank; in a tokenized future, cross-border outflows could be minutes, not days. The policy choice is not to wall off digital money but to equip public and quasi-public treasurers with run-aware liquidity tools, harmonized identity checks, and pre-negotiated intraday credit lines across counterparties.

This argues for a concrete playbook that matches speed with structure. First, make "instant-era" liquidity operational: supervisors should require resolvable firms to prove they can raise secured funding and move collateral within minutes, not hours, including outside business hours, and test that capability under surprise drills. The Single Resolution Board's latest readiness reports and the FSB's lessons from 2023 both point toward higher-frequency liquidity data, entity-level monitoring, and friction-tested resolution options for small and mid-sized banks. This very segment often anchors local education budgets. Second, codify the communications ladder: banks and authorities should agree in advance on when and how to communicate rumor control, discount-window usage (or its European equivalents), and guarantees—because in a ten-second run, ambiguity is the accelerant. Third, embed "heterogeneity by design": avoid herding into identical long-duration assets by treating deposit-franchise reliance and duration risk as a combined exposure in supervision; reward diversified terming, robust swap programs with monitored counterparty concentrations, and deposit bases that are retail-heavy and less flight-prone.

There is a final frontier: distinguishing panic from solvency in real time. Central banks' lender-of-last-resort mandates were designed for liquidity failures at solvent institutions; the 2023 turmoil exposed frictions in stigma, collateral mobility, and the speed of operationalizing support. The U.S. introduced an emergency facility to lend against par, easing fire-sale pressures; Europe relies on central bank credit operations and national frameworks, but the principle is the same: credible, time-bound liquidity backstops must be ready to fire before social feeds do. Evidence from the euro area suggests that deposit franchise and hedging absorb nearly half of valuation shocks, buying the system time. The question is whether public backstops can cross the gap in seconds to prevent a solvent bank's deposit franchise from evaporating mid-rumor. With instant payments, the answer must increasingly be yes—paired with transparent resolution for truly insolvent cases.

The core statistic bears repeating: $42 billion gone in a day, $100 billion more queued at daybreak. Europe is about to normalize the speed that made that possible, for good reasons—commerce, competition, and inclusion. The correct response is not to fear speed but to engineer around it. Heterogeneity—of asset duration, funding, and hedging—already functions as a form of network immunity, and new EU reforms promise a cleaner path to resolve smaller banks without sparking panic. Yet the fragile tail exposed by uninsured money will not disappear. Education budgets, municipal payrolls, and student services are just as dependent on predictable banking as exporters or manufacturers. The policy bargain is therefore straightforward: let money move in ten seconds; require liquidity and information to move just as fast. Make deposit-franchise reliance and duration risk a joint focus of supervisory attention. Pre-commit credible, time-bounded backstops for digital-era runs, and drill them. And teach institutional treasurers—across universities and school networks—to manage cash in a world where the difference between rumor and rescue is measured in taps, not days. Speed is here to stay. The system will be safer if we choose to match it.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Bank for International Settlements (BIS) & Basel Committee on Banking Supervision. The 2023 banking turmoil and liquidity risk: a progress report, Oct. 2024.

Banque de France. "Digitalisation—a potential factor in accelerating bank runs?" Eco Notepad, December 26, 2024.

Cookson, J. A., Fox, C., Gil-Bazo, J., Imbet, J. F., & Schiller, C. "Social Media as a Bank Run Catalyst," April 2023.

European Central Bank (ECB). Payments statistics: H1 2024 and H2 2024 press releases.

European Central Bank. "Instant Payments Regulation," and related Q&A on Regulation (EU) 2024/886; European Payments Council notes on implementation timelines.

European Central Bank. Wildmann, N., Mind the App: do European deposits react to digitalisation? Working Paper No. 3092, Aug. 2025.

European Commission. "Deposit Guarantee Schemes—€100,000 coverage and repayment timelines."

Financial Stability Board (FSB). "Depositor Behaviour and Interest Rate and Liquidity Risks," 2023; and 2024 Resolution Report: From Lessons to Action.

Guerrini, G. M., & Rice, J. "Interest rate and deposit run risk: New evidence from euro area banks in the 2022–2023 tightening cycle," VoxEU/CEPR, August 22, 2025.

IMF, Krogstrup, S., Sangill, T., & von Sicard, M. "Containing Technology-Driven Bank Runs," Finance & Development, March 2024.

Markets in Crypto-Assets Regulation (MiCA): Phase-in for ARTs and EMTs effective June 30, 2024 (overview by ESMA and legal analyses).

Reuters. Coverage of stablecoin adoption and Tether developments in emerging markets; reporting on Credit Suisse post-crisis vulnerabilities.

Silicon Valley Bank post-mortems: FDIC and Federal Reserve OIG reports on outflow magnitudes.

Swiss National Bank (SNB). Financial Stability Report 2023 and 2023 Annual Report materials on Credit Suisse outflow speed and liquidity lines.

Chainalysis. "Latin America's Search for Economic Stability: The Rise of Stablecoins" (2024); "Stablecoins 101" (MiCA dates).

Comment