When the Dollar’s Direction Changes on Policy, Not Punditry

Input

Modified

The dollar jumped post-election on expectations of institutional discipline April 2025 tariffs flipped that belief, boosting uncertainty and softening the dollar Education systems should hedge and budget for event-driven FX swings

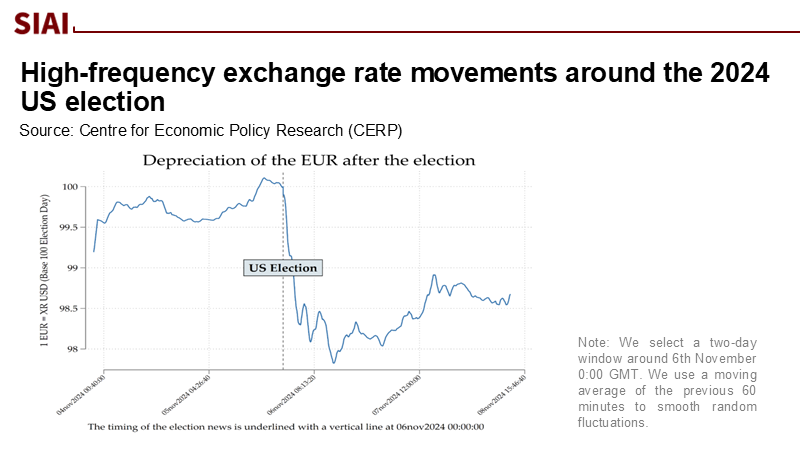

Within minutes of the 2024 US presidential result becoming clear, almost every currency on earth fell against the dollar. The euro alone slid from $1.0936 to $1.0694 in a matter of hours—an abrupt, high-frequency move that reflected a shift in sentiment more than fundamentals. Markets weren’t cheering a personality; they were pricing institutions: the prospect of tighter budgeting, steadier rule-making, and therefore stronger real-yield support for US assets. The same lens also explains the reversal months later. When an across-the-board tariff regime was implemented by executive order in early April 2025, investors marked down the very credibility they had previously rewarded, and the dollar surrendered ground. The lesson for education finance is stark: the dollar strengthens on institutional trust and weakens when policy undermines it—and budgets, scholarships, and procurement cycles are affected by this spread.

Reframing the Post-Election Dollar Move

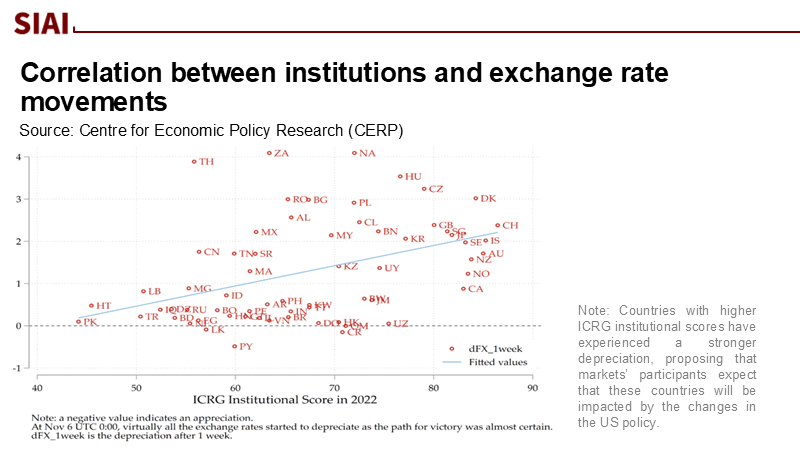

The post-election narrative was sold as “growth optimism,” but the data point to something more precise: a credibility impulse. High-frequency evidence across 73 currencies shows a synchronized depreciation against the dollar in the hours after the outcome was no longer in doubt, with the euro’s two-cent collapse serving as a visual shorthand. That pattern is not about immediate changes in trade or productivity; it is about expected governance. Investors inferred fiscal restraint and more precise policy coordination, which lifted the dollar by raising expected real yields and reinforcing the US safe-asset premium. As an identification strategy, event-study windows around November 6, 2024, isolate that institutional shock: the reaction concentrates in the first trading sessions after the result, then fades, consistent with a belief update rather than new macro data.

That credibility impulse translated quickly into education-sector realities. A stronger dollar raises the local-currency cost of imported educational goods, from lab equipment to journal subscriptions, and increases debt service for universities with dollar-denominated liabilities. Development finance analysts flagged this risk within weeks, warning EMDE systems that a “Trump 2.0” strong dollar would transmit to higher borrowing costs and tighter global conditions if US yields remained elevated. The point is not that the dollar always rallies after Republican victories; instead, in this instance, institutional expectations—tighter budgets and predictable rules—were the mechanism of transmission. For education policymakers setting 2025 procurement calendars in late 2024, the practical takeaway was to hedge their bets earlier and budget more broadly.

Tariffs, Institutions, and the Dollar’s Sign Flip

The April 2025 tariff turn, a significant event in the global economic landscape, put the interpretation of the dollar's value to the test. On April 2, the White House declared a national emergency. It imposed a universal 10% tariff, set to take effect April 5, alongside “reciprocal” higher rates from April 9 for dozens of partners—later revised and modified again in late July. Markets did not treat this as abstract protectionism. On April 3, the dollar fell to multi-month lows against its major peers as investors factored in the risk of recession, potential retaliation, and litigation. In the following week, even a partial, temporary tariff pause produced whiplash relief in equities without restoring a stable dollar bid. These are not the footprints of a market convinced tariffs would narrow the trade deficit and strengthen the currency. They are the signs of rising uncertainty about the rules that make the dollar a haven.

Three channels explain the sign flip. First, the inflation-expectations channel: broad tariffs are a one-time tax on imports that lift prices, complicating the Federal Reserve’s reaction function and eroding the real-yield advantage that had supported the dollar. Second, the credibility channel: tariff revenues are volatile and subject to legal challenges, while repeated executive rewrites, pauses, and exceptions undermine fiscal planning, thereby downgrading the dollar’s “credibility premium.” Third, the institutional-quality channel: just as stronger foreign institutions amplified their post-election depreciations in the VoxEU study, a sudden US institutional shock (contested emergency powers; conflicting court rulings) reverberates in reverse—denting the dollar’s status as the rule-of-law anchor of global portfolios. By mid-August 2025, markets were assigning high odds to a Fed rate cut and the broad dollar index had eased from its spring highs—consistent with a world pricing less certainty about policy and, therefore, less certainty about the dollar’s path.

For education leaders, the difference between a “credible-dollar quarter” and a “tariff-shock year” is not academic. Ministries budgeting in local currency must procure dollar-priced inputs on timetables that policy can scramble overnight. A scholarship program pegged to a dollar tuition can find itself underfunded by five to ten percent simply because the exchange rate fluctuates within a given time frame. CSIS assessments in April estimated non-trivial GDP losses from the tariff package for both the US and its trading partners, implying tighter public budgets precisely when import costs rise. That combination—dearer inputs, weaker fiscal space—magnifies the education sector’s exposure to policy-driven currency volatility.

What Education Systems Should Do Now

The correct response is not to predict the dollar but to operationalize institutional risk. Start with a transparent, replicable method that any ministry or university CFO can run on a desktop: use the nominal broad US dollar index (DTWEXBGS) as the exposure proxy, compute rolling 60-day 5th–95th percentile bands from January 2023 onward, and mark two event clusters—(i) November 6–8, 2024, when the election result crystallized; (ii) April 2–12, 2025, spanning the initial tariff orders, effective dates, and partial pause headlines. Treat the bandwidth in those windows as the “tail elasticities” that should be baked into procurement budgets. As a rule of thumb, a 7–10% adverse swing over a quarter is a defensible contingency in tariff-headline months; for a $50 million import program, that translates to a $3.5–$5 million buffer or equivalent hedges. This is not forecasting; it is governance—allocating risk capital to the institutional shocks the data say recur.

Hedging should match the academic calendar, not just the fiscal year. Scholarship programs can embed “FX-fairness” clauses that automatically adjust stipends if exchange rates breach pre-set bands on offer-accept dates, with caps to protect aggregate budgets. Universities with significant foreign-student tuition exposure can forward-hedge receivables at admission-deposit milestones. Systems of small colleges can pool exposure to obtain forward quotes they cannot achieve alone, coordinated by a central procurement unit. Where derivatives are constrained, a cash-buffer rule based on the broad dollar’s percentile bands is a practical substitute. The operational aim is to prevent exchange-rate surprises from turning into cancelled lab orders or shortened study-abroad windows. This flexible approach to risk management will ensure you can adapt to any currency volatility.

Policy clarity multiplies the benefits of these micro-tools. When the legal basis of trade actions is transparent and time-bounded, when fiscal plans are published with realistic costing of tariff revenues, and when central-bank independence is reaffirmed, the dollar’s safe-asset premium rests on sturdier ground. Conversely, when the tariff authority relies on contested emergency statutes and lower courts issue divergent rulings while appeals are pending, risk premia widen. That is reflected in the dollar as path uncertainty rather than a stable level, and it is evident on campus through unplanned mid-year budget revisions. The recent litigation arc on the International Emergency Economic Powers Act, coupled with executive-branch modifications to reciprocal rates in July, underscores that the currency’s direction is being graded in real time by institutional homework.

Skeptics will counter that tariffs should strengthen the currency by compressing imports and improving the trade balance. In a static model, in markets priced to policy credibility, not so fast. April’s tape told a different story: the dollar fell alongside equities on the announcement, then remained jumpy through the partial pause, with havens like the Swiss franc gaining and gold touching records as recession odds climbed. By late summer, with rate-cut expectations firming, the dollar’s broad measure had eased, consistent with a world in which higher inflation variance, lower real yields, and legal uncertainty dilute the currency’s appeal. That does not mean a weak-dollar future is assured. It implies the sign on the dollar is now a function of whether policy buttresses or blurs the institutional anchors that investors reward.

The education research community can raise the baseline by mainstreaming policy-event risk into sector finance models. We should teach budget officers to monitor a simple triad of forward-looking indicators—Fed-cut probabilities, court calendars on trade actions, and executive-order pipelines—because these three indicators have been closely correlated with currency volatility since late 2024. The method note is intentionally spare: pull the broad dollar and implied-policy series, set event windows, compute percentile-band breaches, and convert them into hedge sizes and cash buffers. The contribution of scholarship is to document, over multiple cycles, the extent to which these rules would have saved in procurement and preserved in program delivery. That moves us from post-hoc explanations to ex-ante resilience.

Credibility as the Currency Educators Can’t Ignore

The opening statistic—the euro’s plunge from $1.0936 to $1.0694 within hours—was an X-ray of belief. It captured a market betting that institutions would constrain policy and steady the budget, and it rewarded the dollar accordingly. The tariff sequence flipped that belief: contested authority, shifting exemptions, and litigation converted certainty into variance, and the dollar handed back ground. Education systems cannot steer Washington, but they can read what the dollar is grading: credibility earns the premium that keeps imported learning affordable; ambiguity taxes classrooms through exchange rates first. The correct call is not to guess the dollar’s direction but to refuse to be surprised by either one—by hard-coding event-risk bands into budgets, aligning hedges with academic calendars, and demanding clear, time-bounded policy frameworks. If we do that, the next swing in the dollar will be a headline, not a tuition hike.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Aizenman, J., & Saadaoui, J. (2025). How institutions interact with exchange rates after the 2024 US presidential election. VoxEU/CEPR.

Bini Smaghi, L. (2025, April 18). A crisis of confidence in the dollar threatens global financial stability.

BNP Paribas Economic Research. (2025, January 21). Could Trump drive down the dollar?

CSIS. (2025, April 3). “Liberation Day” tariffs explained.

CSIS. (2025, April 16). Economic consequences of “Liberation Day” tariffs.

Finnfund. (2024, December 11). Stronger US dollar under Trump 2.0 – What are the impacts on emerging and developing markets?

Federal Reserve Bank of St. Louis. (2025). Nominal Broad US Dollar Index (DTWEXBGS). FRED.

Reuters. (2025, April 3). US stocks post biggest drop since 2020, dollar falls as tariffs fuel recession fears.

Reuters. (2025, April 3). Dollar sinks as investors grapple with tariff aftermath.

Reuters. (2025, April 10). US stocks, dollar drop on lingering tariff worries after temporary pause.

Reuters. (2025, August 15). Dollar hits lowest since end-July ahead of US jobs data.

The White House. (2025, April 2). Fact sheet: President Trump declares national emergency and imposes a 10% baseline tariff.

The White House. (2025, April 2). Executive Order: Regulating imports with a reciprocal tariff…

The White House. (2025, July 31). Fact sheet: President Trump further modifies reciprocal tariff rates.

US Appeals and District Courts (coverage via Reuters). (2025, August 28). US courts weigh Trump’s tariff powers under IEEPA.

Comment